You’ve heard friends and family say it, and you may have said it yourself.

“Oh, I’m going to sell!”

It’s said casually, without a real commitment or timeline, with blame placed on politics, taxes, traffic, etc.

With home prices this high, it’s a real temptation because virtually every homeowner can cash out with six or seven figures and leave California for good – which I encourage!

We know you aren’t desperate, you don’t need the money, and you’re not going to give it away. We’ve covered that – heck, I even have a t-shirt!

If making a move is getting to be more than just a temptation, then what should a casual seller focus on?

Know where you are going to move.

Without knowing for sure where they are going to go, people just never get around to selling.

Let me help you – check out my collection here, and take a road trip:

http://bubbleinfo.s020.wptstaging.space/general-information/where-to-move/

Once you know where, then the next question is when – and look what’s coming in 2020.

We sold houses during Clinton, Bush, Obama, and a couple of years of Trump, so the real estate market won’t come to a halt. But this election cycle is shaping up to be an all-timer!

As we get closer to the election, more people will decide to wait, causing fewer buyers and sellers.

Let’s work it backwards.

Election Day is November 3, 2020, so we should just take October off, and focus on the World Series…..which should include the Padres.

September won’t be any better, and August and July could slow down too, so It would probably be smart to move by May/June – or wait until Selling Season 2021.

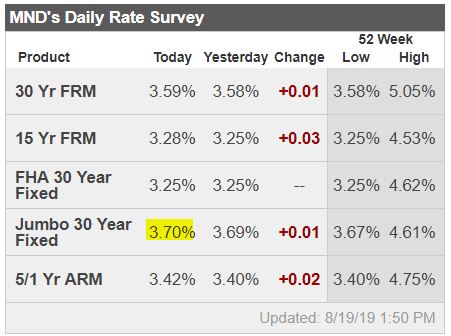

Or just get cracking now, while rates are in the mid-3s!

Get Good Help!

My now classic t-shirt from bubbleinfo.com (and from) a decade ago (thank you) says something different.

I’m beginning to suspect there’s a thing closely resembling “ongoing cost basis” that serves as an internal meter for buyers on the cusp. “Can I stretch and get this and then grow my situation so that it isn’t such a stretch?

It kills me as a cynic but despite all the price rises and fear of sharp reversal, it isn’t bubbly. It doesn’t even seem bubbly anytime soon.

Speaking of a decade ago….

Today’s 30-yr fixed rate (3.50%) is lower than the teaser start rates on the old neg-am loans (3.99%).

Listening to Robert Shiller this morning and thinking about his animal spirits…..the chance of animal spirits turning negative and upsetting the current housing momentum seems remote too. And if prices went down, sellers just wouldn’t sell.

The game is rigged. TPTB can change the rules at their discretion to maintain the status quo. They will not let housing crash because it puts their power in jeopardy. Banks can hold properties indefinitely. Programs exist(ed) to pay your mortgage if you went unemployed. The rich with assets don’t want the status quo to change.