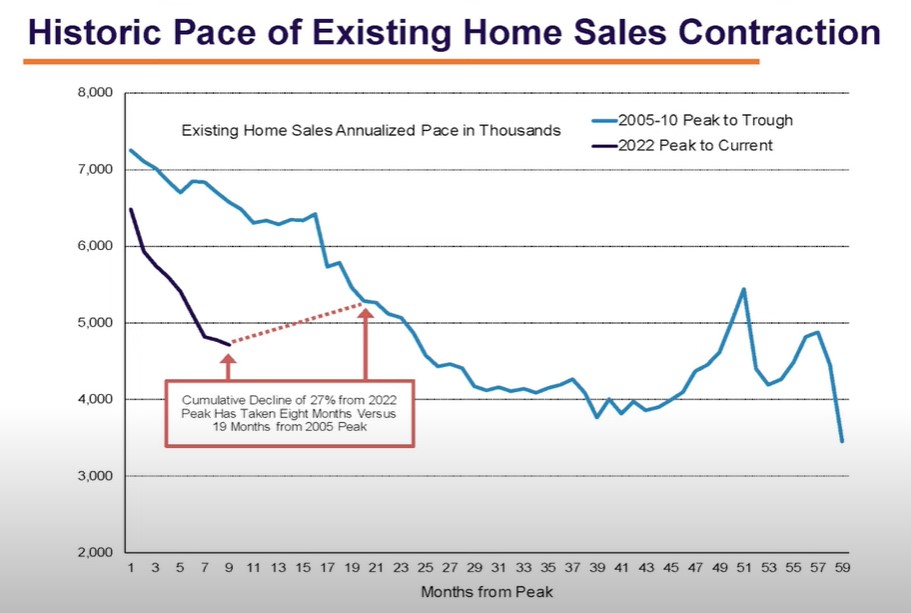

Ivy covers all the topics in this recent interview. The most interesting was her graph above that shows how much quicker sales have declined this year, compared to the last downturn.

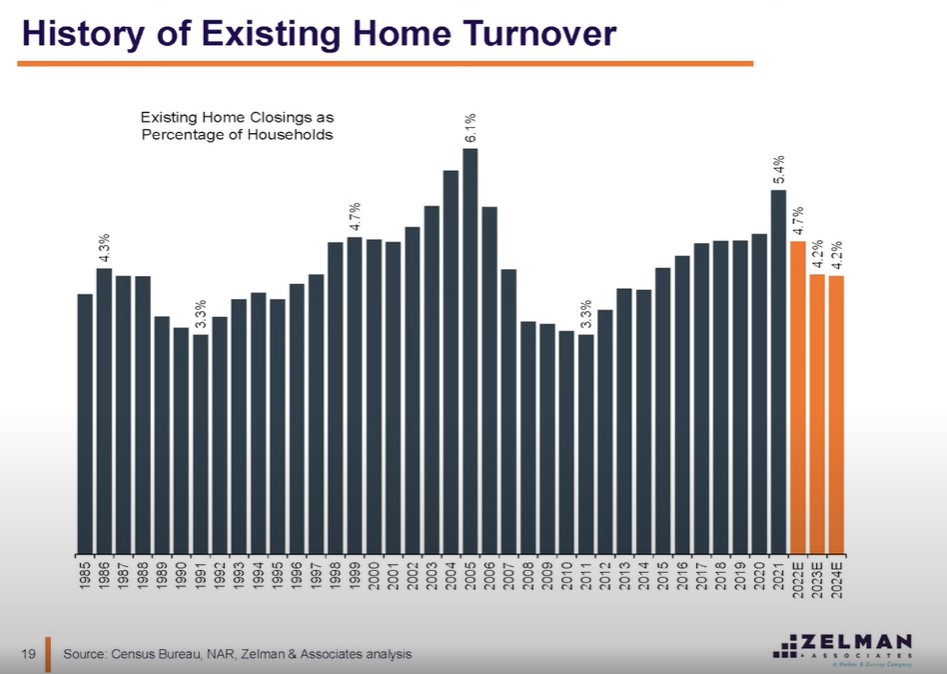

She is expecting -12% in national pricing, and -20% in sales next year.

The different topics are identified in the red line at the bottom of the YouTube, and I started at Pricing:

Hard to see any sub 3.5% mortgages from the past 3 years ever being paid off early. Either inherited or becoming rentals, etc. Turnover as far as arms length handovers will fall far lower. Some of us are really freakin’ old. We remember parents/neighbors in the late 1960s early 1970s having mortgage burning parties.

We remember parents/neighbors in the late 1960s early 1970s having mortgage burning parties.

And AITDs!

“And AITDs!”

Please translate, JtR, for those of us not fully awake yet.

Hi Susie! AITDs haven’t been seen for 40 years and not likely to make a comeback. But for creative sellers who don’t mind taking a chance on a buyer who can’t get a regular mortgage for some reason, it might be worth considering. The buyers would be expected to pay over value for the favor, probably +10% or more.

AITD = All-Inclusive-Trust-Deed.

The AITD is a sort of seller-carryback – the seller collects a monthly payment from the buyer, and then pays his old mortgage payment out of it. The mortgage doesn’t get formally assumed by the buyer.

Example:

$1,000,000 sales price

$100,000 down payment

$600,000 existing loan at 3% fixed ($2,530/mo)

$200,000 seller carryback at 8% interest-only ($1333.33/mo)

Total monthly payments: $3,863.33

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

$1,000,000 sales price

$900,000 new mortgage at 6% fixed are $5,396/mo.

$5,396 – $3,363.33 = $1,532.67 savings per month.

But the seller is still responsible for the $600,000 debt officially, even though ownership has transferred officially. But the buyer gets in with low down payments and cheaper monthlies than with a regular mortgage. If the buyer quit making the payments, the seller would have foreclose AND cover the payments while not living in the house.

A better solution for the sellers is to do a lease-option because there wouldn’t be official ownership-transfer documents filed with the county.

We have said previously that a lender who is willing to take a 90% chance on a buyer might as well go to 100%. The 10% down payment by itself isn’t enough to keep them in a house that has other dire circumstances.

If the buyer had an 800+ credit score, solid job history, and stable everything else might be a decent option for a seller who won’t concede that his $1,000,000 house is really only worth $900,000 – that’s why there were no other offers. But what if the AITD buyer was willing to go higher?

$1,100,000 sales price

0 down payment

$600,000 exiting loan @ 3% ($2,530/mo)

$500,000 seller carry @10% ($4,166/mo)

Buyer’s monthly payment = $6,696/mo

Regular 90% mortgage at 6% = $5,936.

The AITD payment is only $760 per month higher than regular, and there will be buyers who would be happy to pay it in exchange for no down payment. If it all goes well and the buyer refinances in five years, the seller would have sold his house for $200,000 over value and made an extra $250,000 in interest.

If he would have sold it straight away for $900,000 to a regular-loan buyer, he would have netted around $240,000. If he sold to the $1.1M AITD buyer and waited the five years, his take rises to $425,000 + $250,000 = $700,000.

From JB:

In early December, 75% of nationally surveyed home builders confirmed they are buying down buyers’ mortgage rates to make payments more affordable.

Our survey indicates 32% of builders are buying down the full 30-year term and another 30% of builders are temporarily reducing the rate for the first two years of the mortgage.

The remaining 13% of builders identified other less common buydowns. Builders pay these costs up front, effectively reducing monthly payments by prepaying for some of the buyers’ interest on the loan. Few resale sellers are offering these savings to prospective buyers.

Two popular strategies involve builders lowering the mortgage rate for the buyer:

30-year rate buydown: Builders are contributing 5%–6% of the home purchase price up front to lower the 30-year mortgage rate by 1%–2% typically. For example, builders may reduce the rate from 6.5% to 5.0% using last week’s Freddie Mac mortgage rate.

2-1 temporary rate buydown: Builders are contributing 2% of the home purchase price up front, which lowers the first-year mortgage rate by 2%, and the second-year mortgage rate by 1%. Using last week’s 6.5% rate, a buyer’s rate would be 4.5% in year one, 5.5% in year two, and 6.5% thereafter. Borrowers still have to qualify at the 6.5% rate to benefit from a reduced payment in the first few years, giving them some breathing room to perhaps spend money on furniture or other needed items.

Because buyers have to qualify at the highest rate that will occur during the 30-year term, builders using the 2-1 temporary buydown tell us some buyers still cannot qualify. By shifting to a 30-year rate buydown, builders can lower the rate and monthly payment used to qualify struggling buyers.