by Jim the Realtor | Dec 29, 2023 | 2024, North County Coastal

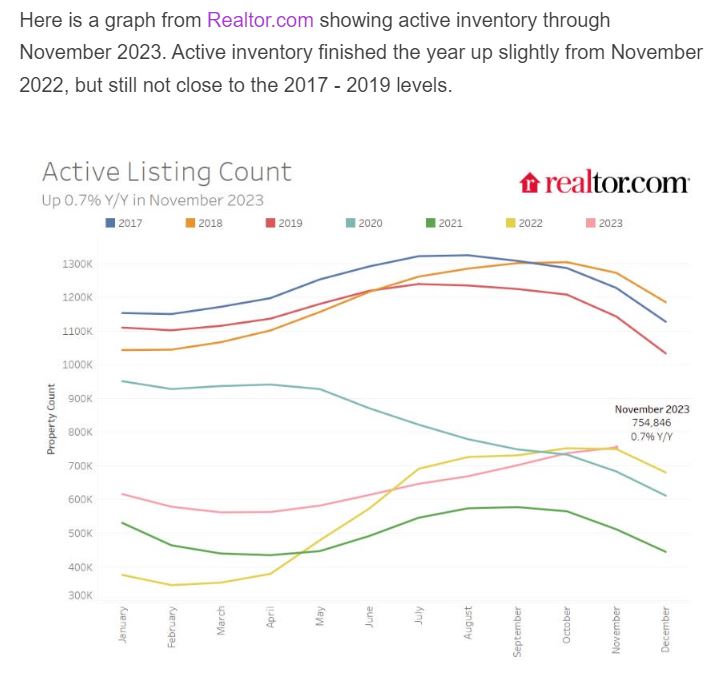

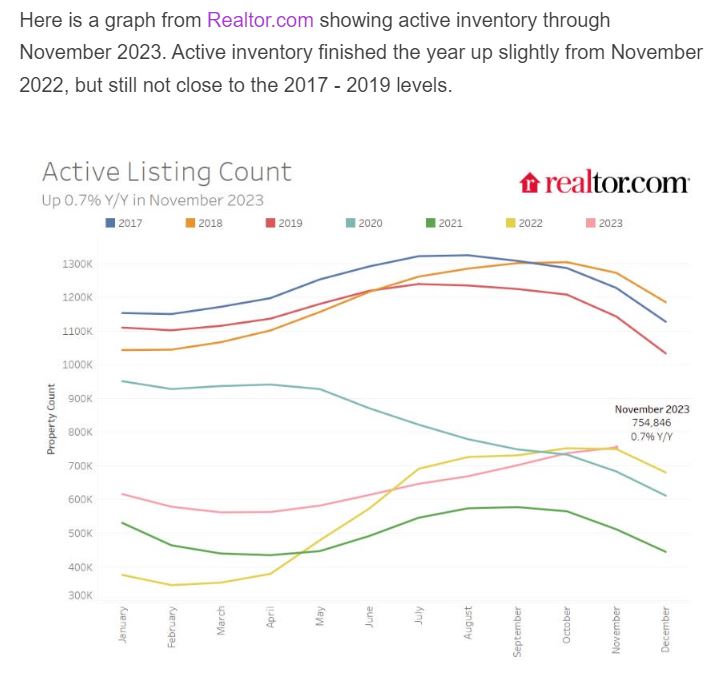

I’m guessing that our local NSDCC inventory has to be at least 10% higher in 2024 than it was this year. Heck, it would need to grow +20% just to get back to the same number of houses for sale in 2022!

Bill agrees that we should see more listings in 2024:

Somewhat lower mortgage rates – and time – will likely lead to more new listings in 2024. Still, mortgage rates will remain well above the pandemic lows, and therefore new listings will be depressed again in 2024.

The bottom line is inventory will probably increase year-over-year in 2024. However, it seems unlikely that inventory will be back up to the 2019 levels. Inventory is always something to watch!

So far, there have only been 73 NSDCC closings this month, which is well under the 110 sales last December. The median sales price is 11% higher, but with such low volume we can’t make much of that statistic. The current inventory is so picked over that it’s impressive there are that many sales.

Read Bill’s Ten Questions for 2024:

https://www.calculatedriskblog.com/2023/12/ten-economic-questions-for-2024.html

by Jim the Realtor | Dec 26, 2023 | 2024, Inventory |

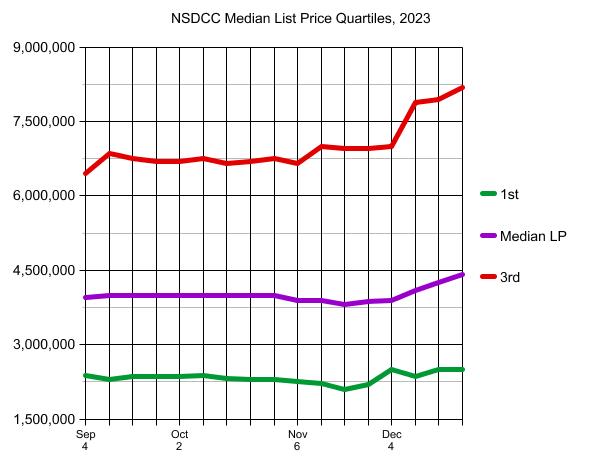

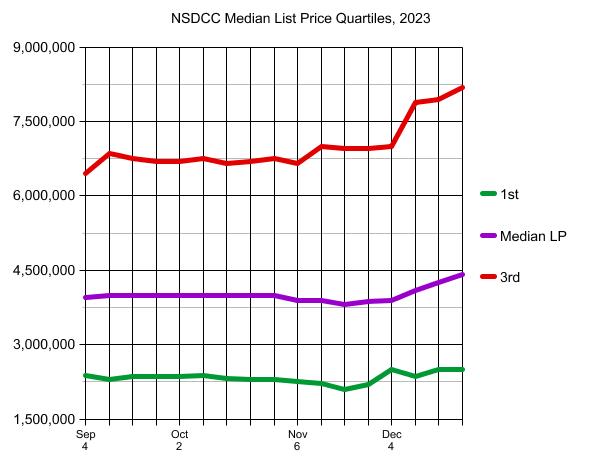

It’s been impressive how strong the pricing has looked towards the end of the year. But if we’re looking at the median list prices, then all we know is that these are the medians of what’s not working…..but at least they aren’t going the other way!

The limited inventory has helped to keep the market stabilized. The total number of NSDCC houses for sale in 2023 was only 2,531 for the year, which was 17% lower than last year and 47% lower than 2019. Yet sales were only down 15% from 2022, and -38% from 2019.

Next year should be equally exciting, either because the inventory stays ultra-low and we gawk at the fight over too few goods, or because there is a 10% to 20% surge in listings that will bring out more demand!

Plus lower rates – wow, it’s going to be one heck of a year. I could not be more optimistic!

(more…)

by Jim the Realtor | Dec 22, 2023 | 2024, Commission Lawsuit, Realtor, Realtor Post-Frenzy Playbook, The Future, Why You Should List With Jim, Zillow |

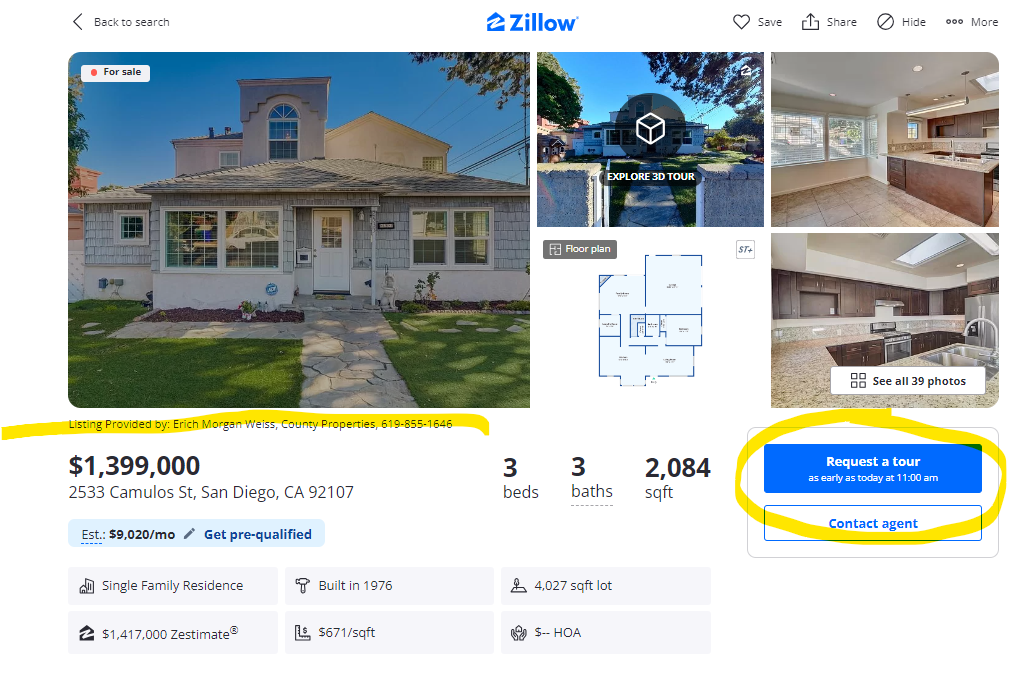

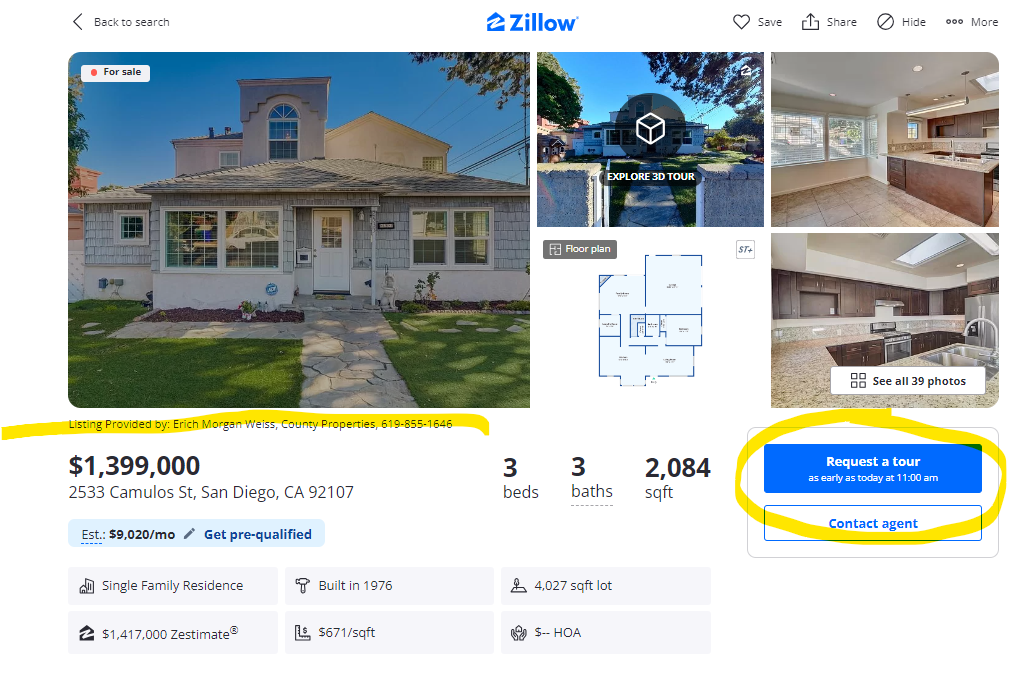

The gradual phasing out of buyer-agents is underway, and it shouldn’t be long now.

Zillow’s new format features the listing agent’s phone number under the main photo!

The three-headed agent display was removed and now when a reader clicks on the right side for Request a tour or Contact agent, they are linked to the Zillow call center instead. There they get processed/qualified on the phone by Zillow employees, sent to Zillow Mortgage, and then get assigned to an agent who is paying big money to Zillow for the privledge.

Buyers will figure it out pretty quick. By clicking on the right side, you get a 3rd party agent who isn’t the listing agent and has never been to the home. With the listing agent’s phone number now prominently displayed, it is inevitable that buyers will call the listing agent next time.

If they need a prompt, they will get one when they start clicking on the photos – which every viewer does immediately. This is what they will see now:

Yep – the listing agent is in the upper-left corner of every photo!

https://www.zillow.com/homedetails/2533-Camulos-St-San-Diego-CA-92107/16966353_zpid/

With the threat of buyers having to pay a buyer-agent a hefty commission out of pocket, it will be irresistible for them to contact the listing agent to see what they have to offer – in hopes of avoiding a separate payment due to a buyer-agent. The listing agents will be happy to oblige because they will already have their full fee packed into the listing side.

By the time the realtor lawsuits get resolved, it will be too late – there won’t be any need for a buyer-agent.

Zillow is offering a full marketing package to listing agents too.

Package Includes:

-

- Listing Placement Boost on Zillow

- HD Photography

- Aerial Photography

- Social Media Reel

- 3D Tour

- “NEW” AI Generated Interactive Floor Plan

- Listing Website

- Enhanced Listing Agent Branding

- Capture New Leads From Your Zillow Profile

The Listing Placement Boost on Zillow?

Listing agents who purchase a marketing package will have their new listings displayed first in the home’s area for seven days – a very nice feature for agents looking to capture buyers for their listings.

While the rest of the industry was grumbling about lawsuits over the last few months, Zillow created a new format that will solve everything. But nobody knows what fee the listing agent charges because it is never disclosed to anyone but the seller – the person who just wants to hurry up and get their money.

by Jim the Realtor | Dec 20, 2023 | 2024, Compass, Market Conditions

by Jim the Realtor | Dec 19, 2023 | 2024, North County Coastal, Over List

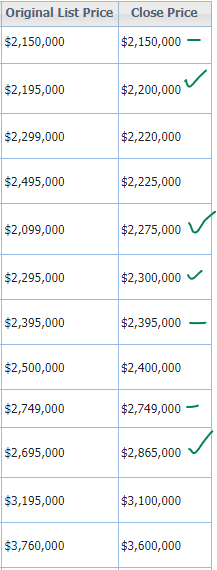

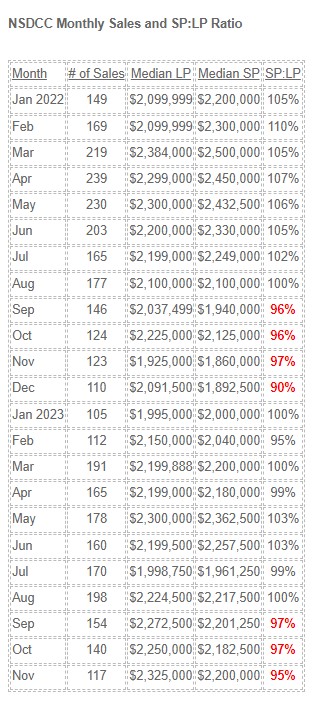

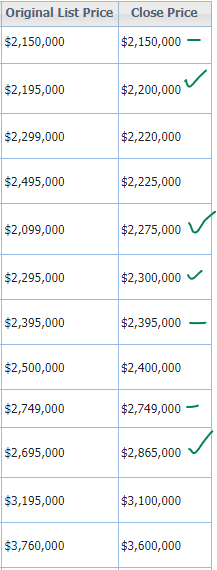

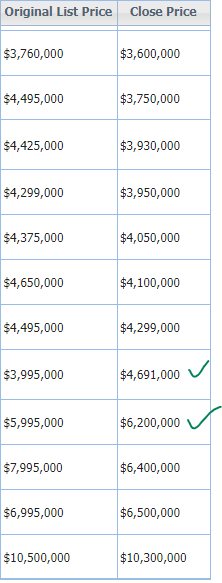

If there was going to be a time when the local market might soften up a bit, it would be around November/December, wouldn’t it? If the majority of the recent sales closed at 10% discounts or more, then it would be nervous time, but most buyers are still paying fairly close to list – or higher.

We’ve had 47 closed sales in December so far, and pricing is holding up. Next year probably will too!

by Jim the Realtor | Dec 18, 2023 | 2024, Inventory |

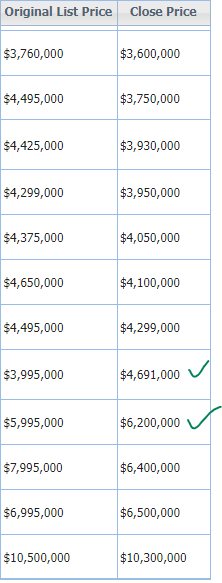

As the real estate market continues to ‘normalize’ and we get used to a perpetually low-inventory environment, these are factors that will greet the players in 2024:

- The NSDCC median list price today is $4,250,000, the highest ever.

- There are 19 homes for sale under $1,500,000 between La Jolla and Carlsbad.

- The current inventory of 314 NSDCC houses for sale couldn’t be more picked over.

- Yet, the currently unsold inventory will be a significant factor in creating the new list prices in 2024.

- Bidding wars on attractively-priced homes for sale.

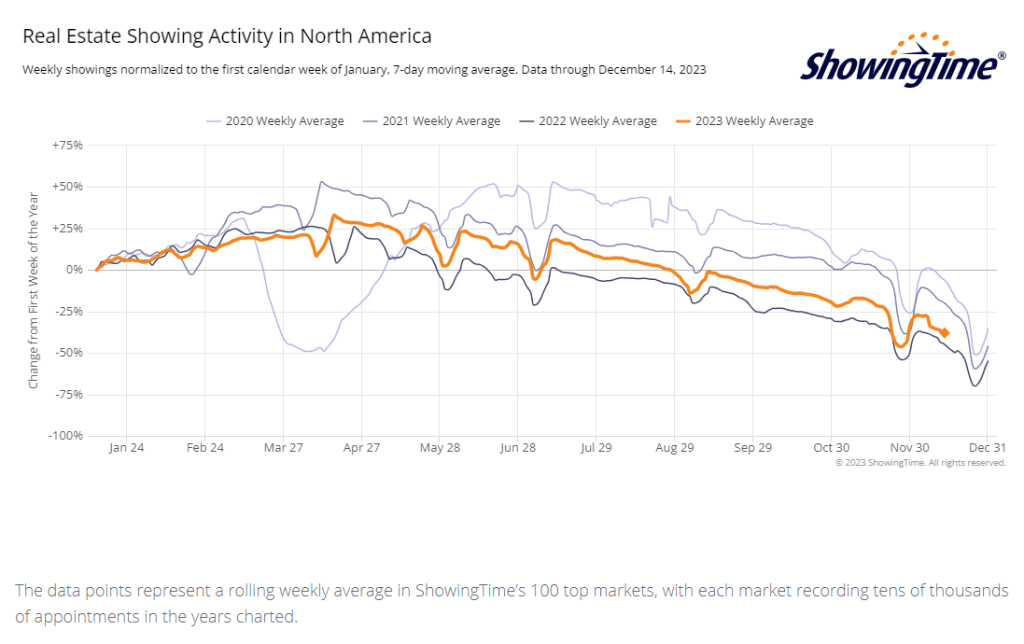

In the graph above, it looks like the national market gets off to a similar start every year. Over the last three years, the showings peaked in early-April, and then dwindled down.

The market intensity should be red hot in the first quarter of 2024! But will the pricing cause sales?

The reasonable sellers in early 2024 should be greatly rewarded.

(more…)

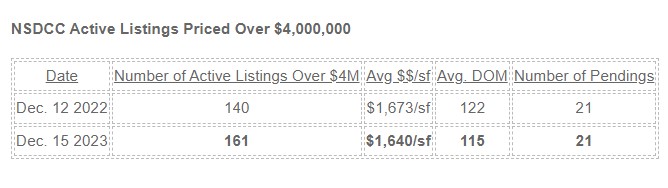

by Jim the Realtor | Dec 15, 2023 | 2024, Jim's Take on the Market

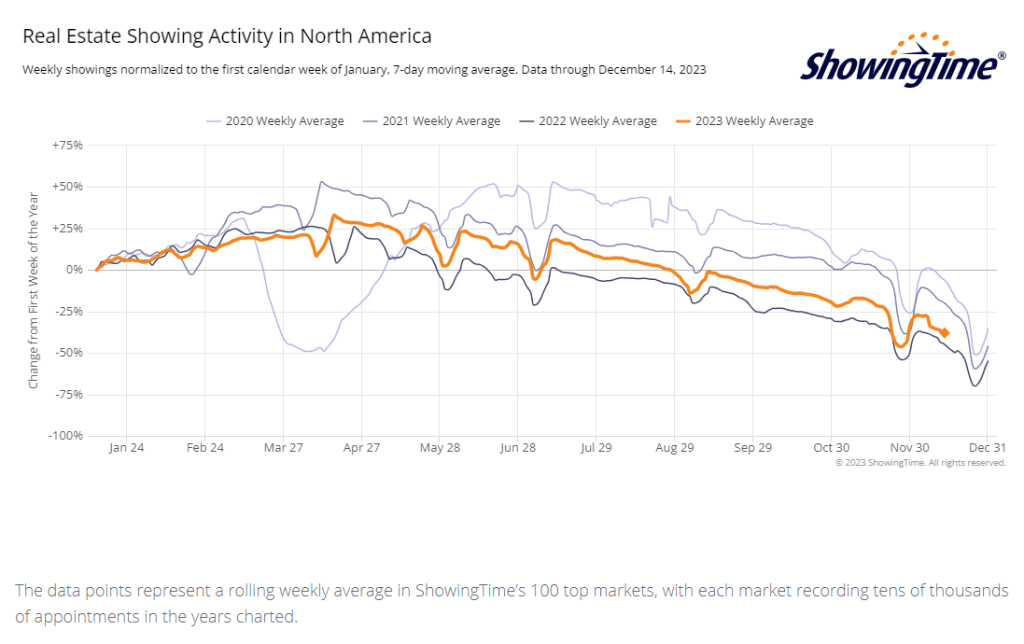

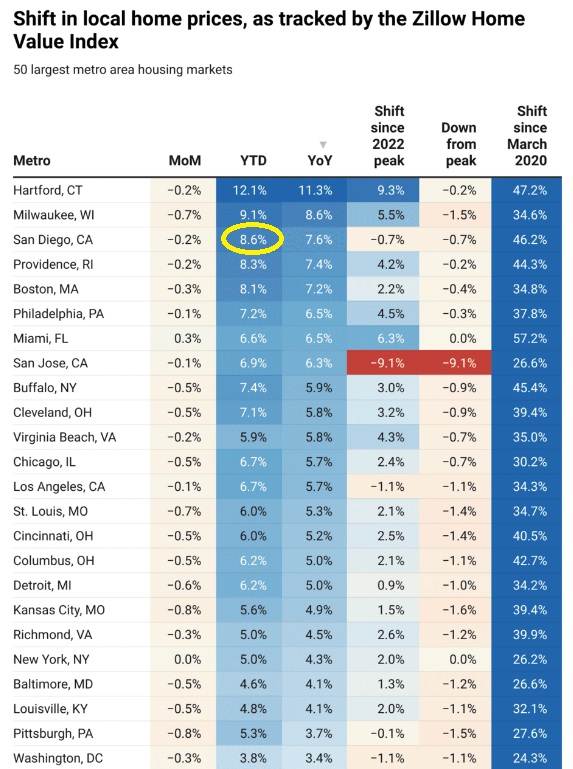

The big difference between last year and now is that the 2023 pricing has been on a slow steady climb, instead of the tumult caused last year by the sudden upward shift in mortgage rates.

San Diego is leading all the higher-end luxury markets for YTD pricing!

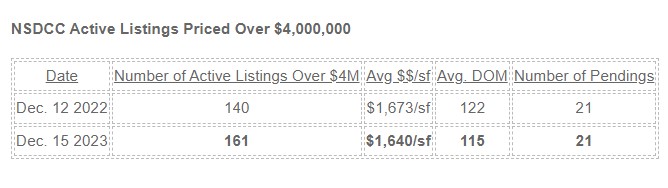

Another comparison where it counts – on the higher-end, where active (unsold) listings are sure to pile up quickly in a soft market. But not yet, and if we’ve made it through this stretch, then the future market with lower rates should survive ok too:

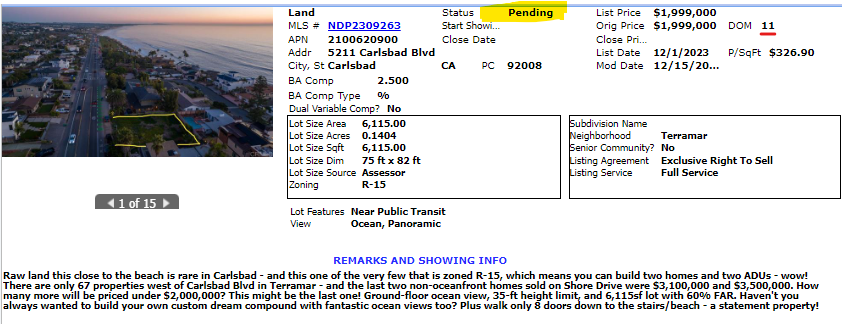

Our vacant-land listing went pending today too!

by Jim the Realtor | Dec 11, 2023 | 2024, Bubble Talk, Forecasts, Frenzy, Sales and Price Check

A former federal regulator who served when the 2006 housing bubble burst is concerned that today’s housing market is on an unsustainable path.

The housing market’s affordability is worse than it’s been in decades as mortgage rates toy with 8%. The median price of a U.S. home was $322,500 in the second quarter of 2019. Then the pandemic housing rush hit, and prices across the nation shot up. High mortgage rates sent sales spiraling, but home prices only experienced a minor correction before heading back up. In the second quarter of this year, the median price was $416,100, according to the Federal Reserve Bank of St. Louis.

“Talk about a bubble. That’s a classic supply-demand imbalance,” Sheila Bair recently told CNN.

Bair, who served as a federal regulator when the mid-2000s housing bubble popped, nearly taking down the entire financial system, said home prices today are “bubbly” following years of low mortgage rates.

A housing bubble can form when prices rise to unsustainable levels. This can be caused by speculative buying, as was the case during the sub-prime mortgage crisis when people who could not make the monthly payments on their mortgages were buying homes with very little money down. The bubble popped when home prices dropped and many people owed more on their home than it was worth.

A bubble can also be caused by irrational exuberance, in which a surge in prices leads to a buying frenzy.

“When rates were cheaper, a lot of people wanted to buy. You ended up with really frothy price increases. That was pretty predictable,” said Bair, who led the Federal Deposit Insurance Corp. from July 2006 until July 2011.

Although Bair said home prices need to correct downward, she’s not confident that will happen anytime soon because there’s still a shortage of homes on the market and she doesn’t expect the bubble to violently burst.

“If supply remains constrained, this could go on for some time,” said Bair, who last week released a new children’s book about bubbles called “Daisy Bubble: A Price Crash on Galapagos.”

There were just 1.1 million existing unsold homes on the market as of the end of August, down 14.1% from the year before, according to the NAR. “Letting that bubble deflate a bit would probably be a good thing,” said Bair. “People who already own their home – and I’m one of them – don’t want to hear that. But for those who want to own, I hope home prices do come down.”

Over the past year, the median home price has increased by 23.8% in Los Angeles, 18.2% in San Diego, 15% in Richmond and 14.6% in Cincinnati, according to Realtor.com.

The good news is Bair does not see a repeat of the bursting of the mid-2000s housing bubble, which set the stage for the Great Recession. That’s in part because a typical homeowner today has more equity in their homes than a homeowner during that time. Only 1.1 million homes, or 2% of all mortgaged properties, owed more on their mortgage than their home was worth in September, according to CoreLogic. That is a small number compared with the share of properties underwater during the sub-prime mortgage crisis, which topped out at 26% in the fourth quarter of 2009, according to CoreLogic’s equity analysis, which began in the third quarter of 2009.

In addition, mortgage lending standards are significantly tougher today, meaning fewer people are borrowing more than they can afford.

“I see much less speculation in the housing market today, thank goodness,” said Bair.

And unlike in the mid-2000s, homeowners today have built up a significant cushion of equity. That means they shouldn’t find themselves in a situation like during the subprime meltdown where many owed more than their homes were worth.

“Even if home prices adjust a bit, people should not be under water,” said Bair.

Legendary investor Jeremy Grantham shares Bair’s concern about a housing bubble. He has been warning of an eventual plunge in home prices around the world.

“Real estate is a global bubble,” Grantham said on The Compound and Friends podcast last month. “Home prices will come down…30% would be a pretty good guess.”

Yet others on Wall Street are confident home prices will continue rising.

Despite high mortgage rates, Goldman Sachs expects US home prices will increase by 1.8% this year and then accelerate to 3.5% growth in 2024. Similarly, CoreLogic forecasts that home prices will increase by 4.3% from June 2023 to June 2024.

Although UBS acknowledges home prices have spiked to “dizzying heights” in recent years, the bank only sees two cities around the world at risk of being in a bubble: Zurich and Tokyo. That’s down from nine cities a year ago. Miami, Los Angeles, Toronto and Vancouver are among the cities that UBS says are in “overvalued” territory.

Fannie Mae CEO Priscilla Almodovar said it’s “unusual” that home prices have not taken more of a hit from high mortgage rates. “What has surprised us the most is the stickiness of home prices,” Almodovar told CNN in a recent interview. “Supply is the issue. There is no place to go. There is a lack of inventory.”

That’s the main reason Lawrence Yun, chief economist at the National Association of Realtors, says homebuyers shouldn’t hold their breath waiting for a drop in home prices.

“There is not going to be a home price crash,” Yun told CNN. “When you have a housing shortage, home prices simply cannot decline in any measurable way.”

While a temporary dip in prices is possible, Yun said a “prolonged” drop of 10% to 15% “cannot happen in this tight supply market.”

Yun noted that many assumed London was in the midst of a housing bubble years ago – only to see prices continue to rise, albeit with fewer people participating.

“It became only a playground for the wealthy. I hope America doesn’t go in that direction,” he said.

In many ways, today’s housing market is the polar opposite of the one that preceded the Great Recession.

Back then, reckless mortgage lending helped create a situation where demand became artificially strong. Eventually, it collapsed and the market was left with way too many homes.

“Today, we have an imbalance the other way. Too much demand, not enough supply,” said Yun.

The NAR has estimated the supply of homes needs to basically double to moderate home prices.

“It’s creating social inequity. The only way out of this situation is we have to induce more supply,” said Yun.

https://www.cnn.com/2023/10/11/economy/housing-market-bubble-sheila-bair/index.html

by Jim the Realtor | Dec 10, 2023 | 2024, Market Buzz, Market Conditions, Spring Kick |

Mortgage rates have come down 1% in the last few weeks, and the casual observers are hoping it means that the Big Turnaround will commence in the Spring of 2024.

But for a full-fledged frenzy to break out, home prices would have to drop too.

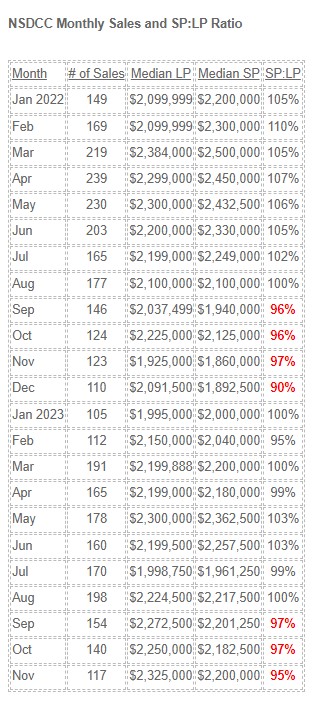

We’ll never learn much from the median sales prices by themselves. But the SP:LP ratios demonstrate the off-season trend of buyers driving harder bargains, which is the solution for lower prices too.

We’re probably not going to see the whole market drop in price (i.e., big dips in the median sales prices) because the superior properties should hold their value better with the impatient buyers.

But those who don’t need the perfect house will likely have better luck next year with getting a deal. We only flirted with an over-list frenzy briefly this year, and in 2024 we not see many, if any, 100% months.

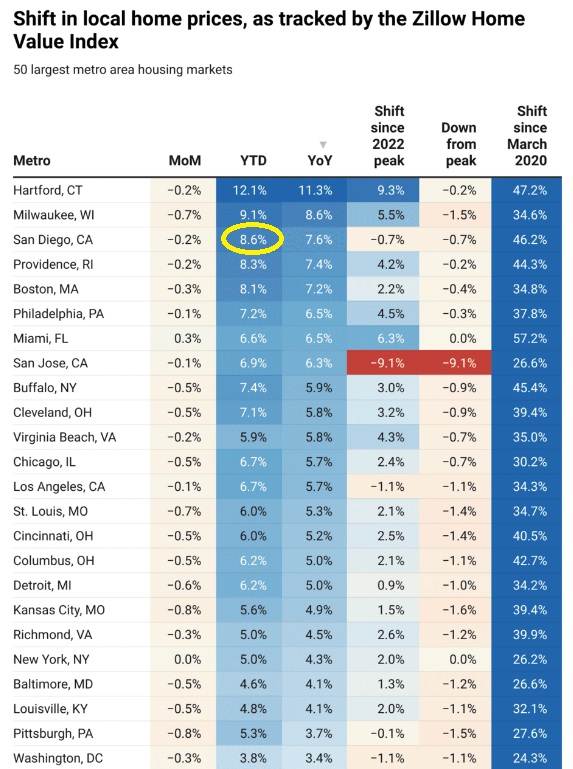

by Jim the Realtor | Dec 6, 2023 | 2024, Forecasts, Jim's Take on the Market |

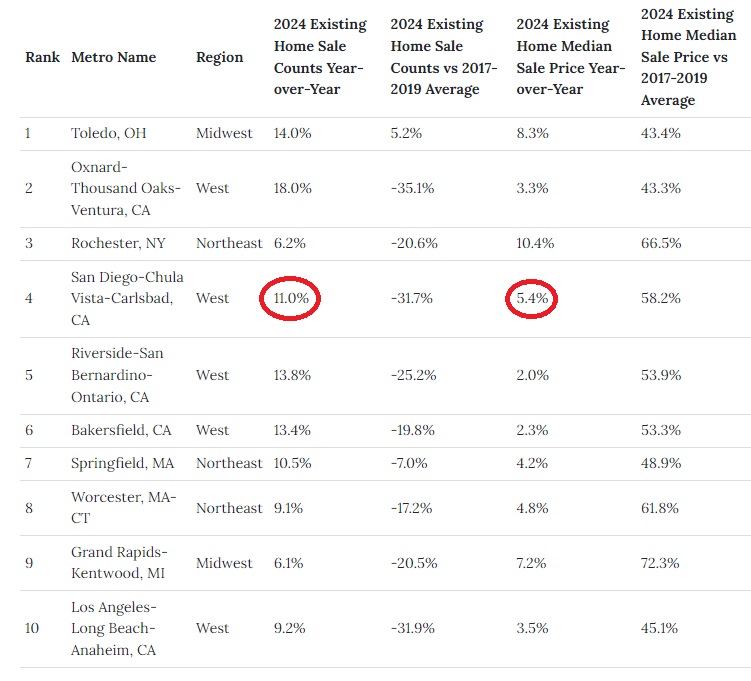

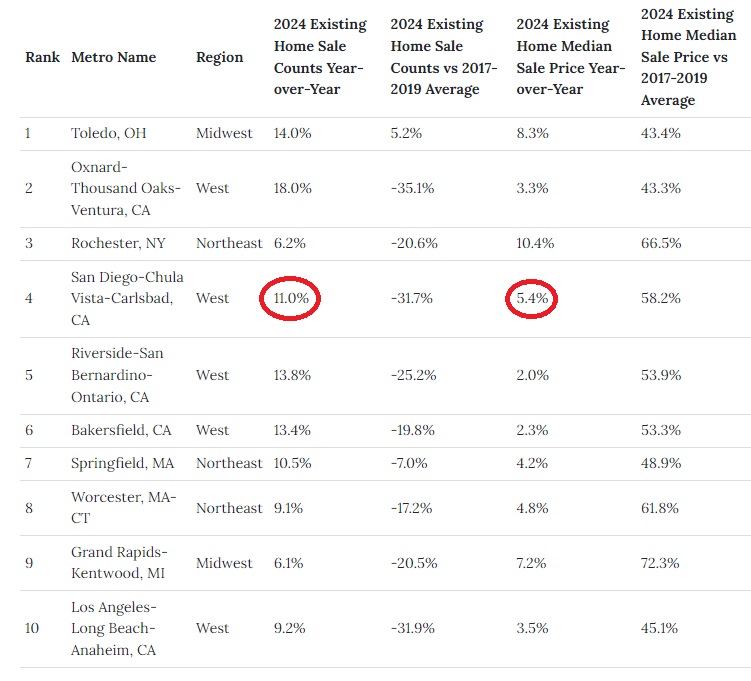

We’re in the forecasting time of year!

The chart above is from Realtor.com. We are used to the ivory-tower types who don’t bother to get out of their office or even pick up a phone. They just shine up their previous guess with some current events, like lower mortgage rates, and tell everyone we’re going to be fine.

But their guess that sales will be up 11% in San Diego is preposterious, and giving credit to lower rates doesn’t address the ultra-low inventory that is so likely to persist:

For sales to increase by 11% means that inventory will have to increase by the same or higher amount. While an 11% to 20% increase in the number of homes for sale would be fantastic for the market, there is virtually no evidence to support that idea – other than I have three listings booked already.

https://www.realtor.com/research/top-housing-markets-2024/

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

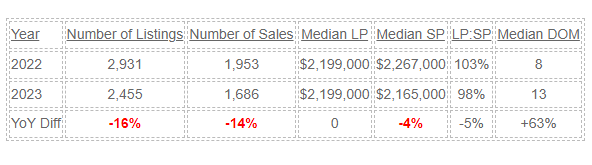

If you’d like to make your own predictions, here is some local data (La Jolla to Carlsbad):

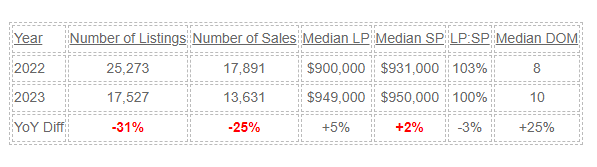

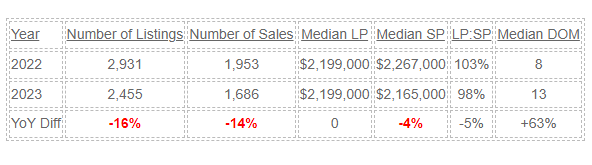

NSDCC Detached-Home Listings & Sales, Jan 1 to Nov 30

I’m guessing that sales will be flat/same in 2024, and the median sales price will be +4%.

Why? Because I think we’ll see mortgage rates in the sixes, which will help to energize the demand. The number of listings may grow slightly but not up by more than +10% and many will be wronger on price, which will cause the number of sales to be about the same as they were in 2023.

We know it will be hot during the selling season, it’s what happens in the second half of the year that will drag down the median sales price.

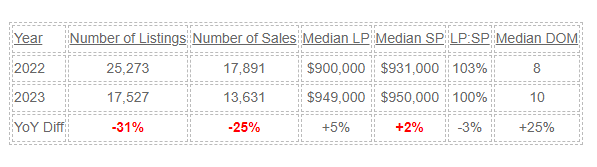

Here’s what I thought last December:

San Diego County Detached-Home Listings & Sales, Jan 1 to Nov 30: