by Jim the Realtor | Mar 5, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market, Tips, Advice & Links |

This can be overwhelming, and everyone puts it off as long as possible. Start early, and heave at will – note the last paragraph below.

8 Tips for Home Unfurnishing

What else can you do to avoid finding yourself forlorn in your late parents’ home, broken up about the breakfront that’s going begging? Some suggestions:

1. Start mobilizing while your parents are around. “Every single person, if their parents are still alive, needs to go back and collect the stories of their stuff,” says Kylen. “That will help sell the stuff.” Or it might help you decide to hold onto it. One of Kylen’s clients inherited a set of beautiful gold-trimmed teacups, saucers and plates. Her mother had told her she’d received them as a gift from the DuPonts because she had nursed for the legendary wealthy family. Turns out, the plates were made for the DuPonts. The client decided to keep them due to the fantastic story.

2. Give yourself plenty of time to find takers, if you can. “We tell people: The longer you have to sell something, the more money you’re going to make,” says Fultz. Of course, this could mean cluttering up your basement, attic or living room with tables, lamps and the like until you finally locate interested parties.

3. Do an online search to see whether there’s a market for your parents’ art, furniture, china or crystal. If there is, see if an auction house might be interested in trying to sell things for you on consignment. “It’s a little bit of a wing and a prayer,” says Buysse.

That’s true. But you might get lucky. I did. My sister and I were pleasantly surprised — no, flabbergasted — when the auctioneer we hired sold our parents’ enormous, turn-of-the-20th-century portrait of an unknown woman by an obscure painter to a Florida art dealer for a tidy sum. (We expected to get a dim sum, if anything.) Apparently, the Newcomb-Macklin frame was part of the attraction. Go figure. Our parents’ tabletop marble bust went bust at the auction, however, and now sits in my den, owing to the kindness of my wife.

4. Get the jewelry appraised. It’s possible that a necklace, ring or brooch has value and could be sold.

5. Look for a nearby consignment shop that might take some items. Or, perhaps, a liquidation firm.

6. See if someone locally could use what you inherited. “My dad had some tools that looked interesting. I live in Amish country and a farmer gave me $25 for them,” says Kylen. She also picked out five shelters and gave them a list of all the kitchen items she wound up with. “By the fifth one, everything was gone. That kind of thing makes your heart feel good,” Kylen says.

7. Download the free Rightsizing and Relocation Guide from the National Association of Senior Move Managers. This helpful booklet is on the group’s site.

8. But perhaps the best advice is: Prepare for disappointment. “For the first time in history of the world, two generations are downsizing simultaneously,” says Buysse, talking about the boomers’ parents (sometimes, the final downsizing) and the boomers themselves. “I have a 90-year-old parent who wants to give me stuff or, if she passes away, my siblings and I will have to clean up the house. And my siblings and I are 60 to 70 and we’re downsizing.”

This, it seems, is 21st-century life — and death. “I don’t think there is a future” for the possessions of our parents’ generation, says Eppel. “It’s a different world.”

http://www.nextavenue.org/nobody-wants-parents-stuff/

by Jim the Realtor | Feb 6, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market, One-Story, Thinking of Buying?, Thinking of Selling? |

There are already people who have decided to buy and/or sell this year, and to those folks I’ll say in advance – congratulations, and I’d like to help you!

I’d like to reach out those who are thinking of putting off the move for another month or year.

Here are reasons why you should re-consider:

- The actual moving is mentally and physically taxing. Even if you have plenty of family to help sort through the junk and pack everything up, you will want to have a say in many of the decisions.

- Moving to a new home almost always means getting accustomed to a new home, area, amenities, and basic things to live. You want to be on top of your game to endure that many changes.

- People are buying one-story homes in advance because of the lack of supply and the pressure on pricing – demand is heavy, and supply is light!

- The current administration could mess with the tax law, and tweak the $500,000 tax-free profit you have coming from your home sale.

- The move is very likely to be more difficult than you think!

Recently, I had a widow move to a retirement facility after her husband had passed away (she was younger). We lamented that if they would have moved together, he would have loved the new place, and she would have had a network of friends already built by the time he passed.

If you are getting up in years, and know that you have at least one more move in you before you’re done, don’t wait too long. Seventy years old is about the latest anyone should move, and 60 years old is recommended. You want to enjoy a few years at the new spot!

Don’t wait too long!

Save

by Jim the Realtor | Jan 31, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market |

The baby boomer generation is huge, roughly 78 million Americans born between the years of 1946 and 1964. The oldest are just turning 70 and the youngest are just 52 (and usually denying that they are even baby boomers.) It’s a big spread. But one thing they all have in common is that they are getting older, and that their lives are changing.

It’s an issue that we have covered before, quoting Jane Gould’s book “Aging in Suburbia,” which I described as “a fascinating and troubling book that covers so many of the issues we will be facing down the cul-de-sac.” She notes that boomers “have not considered, at a personal level, what they will do when their homes are too large, their incomes shrink, and their mobility needs are in flux.”

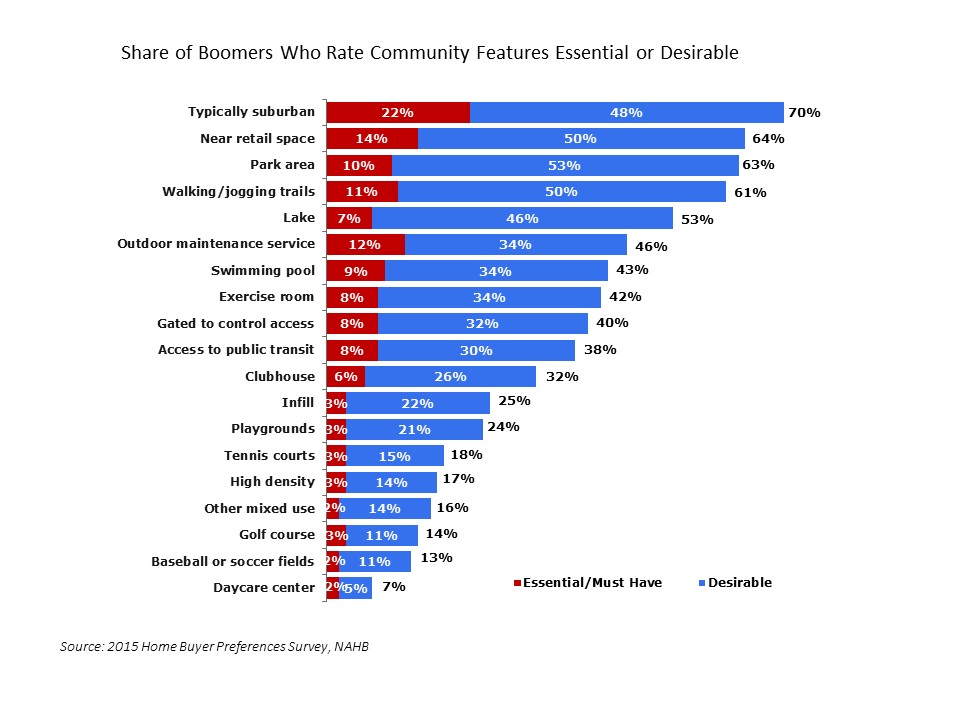

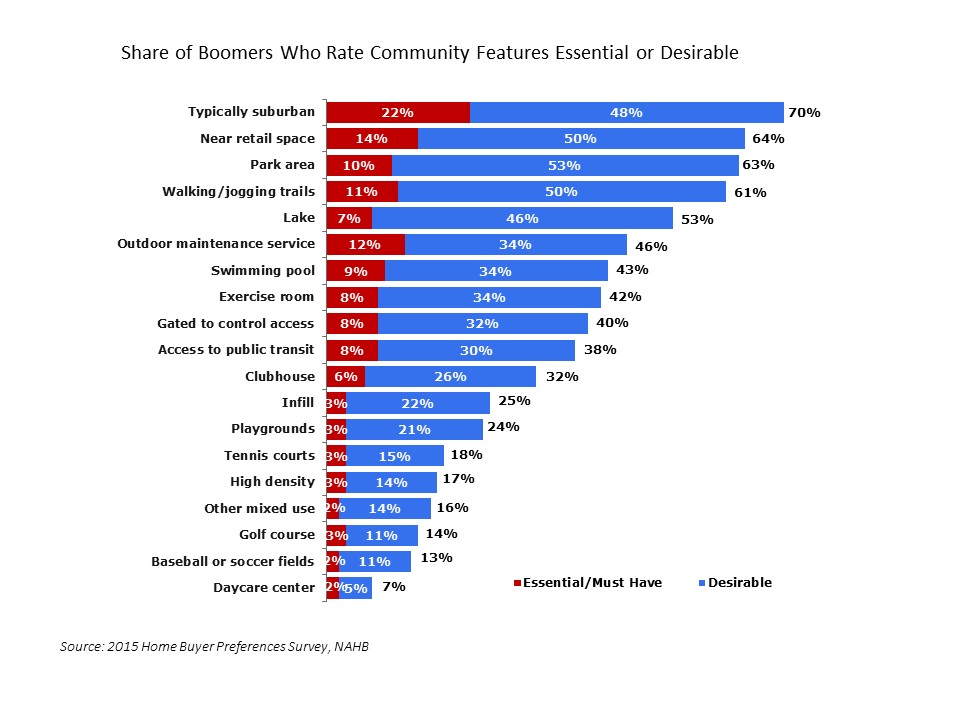

That’s why a new study looking at the housing preferences of the baby boomer generation from the NAHB, the National Association of Home Builders, is so scary. Because when they were surveyed, it appears that what boomers want are big suburban houses on winding culs-de-sac. It proves that Gould was dead on, that the boomers are simply not considering what’s down that long and winding road.

It’s bizarre. 78 percent actively prefer a cul-de-sac to a connected street. They want double car garages. They want 2,000 square feet on one level. They want three bedrooms. And they really, really don’t like the city.

Only 7 percent of boomers prefer a central city location. About two-thirds prefer a home in the suburbs (close or outlying) and just over a quarter prefer a rural area. Only 8 percent thought being near public transit was essential. Because of course, they’re going to be driving forever.

Yet the main reason they might consider a move is the worry about “changes in health or increased physical limitations. And “the leading two reasons that would motivate boomers to take on a potential move are finding greater peace of mind and a fuller life.”

Not high on any boomer’s list is the environment. Only 13 percent are willing to pay more out of concern for it. However they will pay more if they’ll get lower utility bills, up to $10,000 to save $1,000 per year, which is pretty hard to do.

Read full article here:

http://www.mnn.com/your-home/remodeling-design/blogs/new-study-confirms-boomers-are-clueless

by Jim the Realtor | Jan 7, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market |

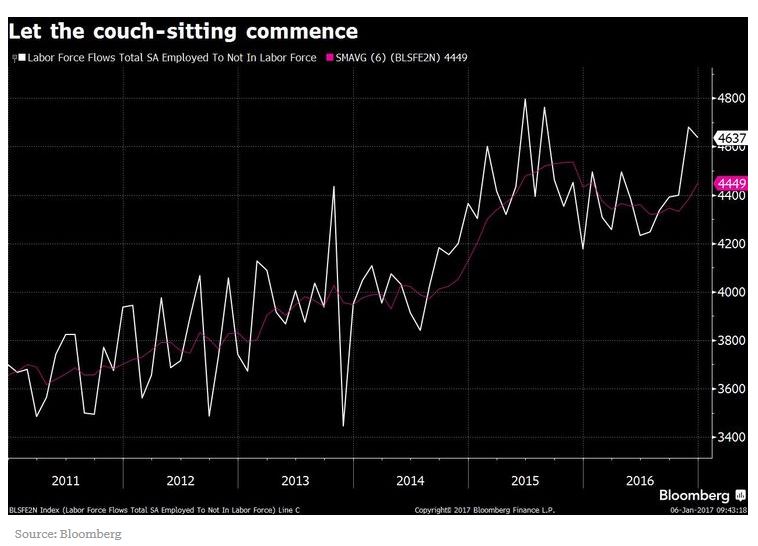

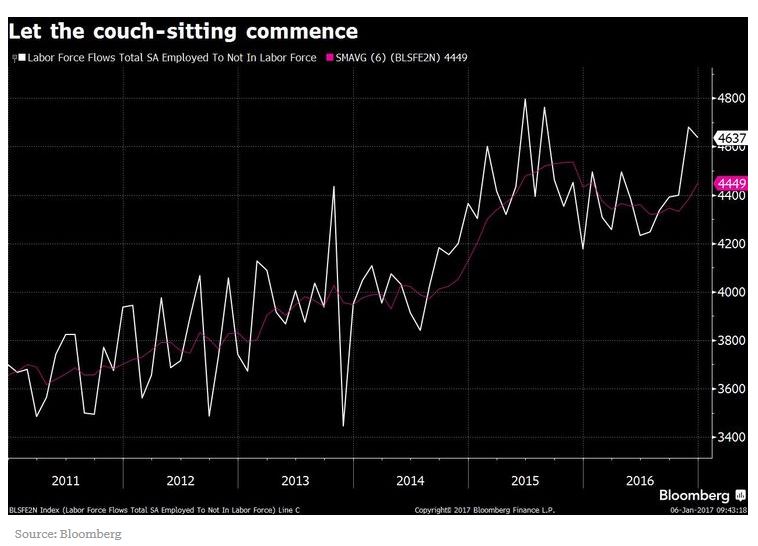

It’s inevitable that as more boomers retire, the more we’ll see those lightly-maintained-and-home-depot-upgraded houses hitting the market.

Hattip to daytrip for sending this in:

https://www.bloomberg.com/news/articles/2017-01-06/older-americans-are-retiring-in-droves

An excerpt:

Whether a larger share of senior citizens had previously been incented to remain in their jobs by higher wages or by a need to keep working in order to rebuild their nest eggs after the financial crisis is still an open question. But the recent non-farm payroll reports affirm that the secular trend of rising retirements can only be delayed for so long.

Boomers – would you move if you just had a place to go? Start here:

http://bubbleinfo.s020.wptstaging.space/general-information/where-to-move/

by Jim the Realtor | Jan 4, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Conditions, North County Coastal |

For those looking for a more binary view of market conditions (hot/cold, good/bad), let’s compare San Diego County detached-home sales for 2016 to the previous years.

San Diego County Annual Detached-Home Sales

| Year |

No. of Sales |

Median Sales Price |

Avg. Days on Market |

| 2012 |

25,023 |

$383,000 |

76 |

| 2013 |

24,910 |

$455,000 |

50 |

| 2014 |

22,101 |

$495,000 |

47 |

| 2015 |

23,732 |

$529,000 |

42 |

| 2016 |

23,802 |

$560,000 |

37 |

The median sales price has gone up 46%, yet the number of sales were only 5% lower in 2016 than in 2012. Last year, sales were higher than the last two years, and the average days on the market are half what they used to be

Those are fantastic market conditions!

Could the momentum keep going? Will it?

There were good reasons that the real estate market has tanked previously. In 1981, mortgage rates hit 18%, when just four years prior they were in the 8s – that is sticker shock! In the early-1990s, we had the Savings & Loan crisis when they gave away all the foreclosed houses. Of course, in 2006-2008 we had the Mozilo Crisis, where exotic mortgages caused a panic.

It would take a catastrophic event to topple our market now. Sales and prices may bounce around, but the baby-boomer wealth distribution program will juice the market for decades. The final gift of boomers will be to make sure their children all have houses, and even Trump won’t screw that up. If anything, the hysteria will cause more boomers to worry about their kids!

Here are the NSDCC annual sales, broken down into North and South:

La Jolla-Del Mar-SB-RSF-Carmel Valley Detached-Home Sales

| Year |

No. of Sales |

Median Sales Price |

Avg. Days on Market |

| 2012 |

1,364 |

$1,175,000 |

93 |

| 2013 |

1,462 |

$1,350,000 |

61 |

| 2014 |

1,285 |

$1,445,000 |

63 |

| 2015 |

1,301 |

$1,500,000 |

63 |

| 2016 |

1,369 |

$1,520,000 |

58 |

Carlsbad-Cardiff-Encinitas Annual Detached-Home Sales

| Year |

No. of Sales |

Median Sales Price |

Avg. Days on Market |

| 2012 |

1,790 |

$684,042 |

70 |

| 2013 |

1,756 |

$770,500 |

41 |

| 2014 |

1,564 |

$815,000 |

41 |

| 2015 |

1,723 |

$870,000 |

37 |

| 2016 |

1,639 |

$919,000 |

34 |

What could cause the market to tank, besides a catastrophic event? We’d have to run out of buyers. But if there is any place in the good ol’ USA that people will keep coming, it’s San Diego!

by Jim the Realtor | Dec 28, 2016 | Boomer Liquidations, Boomers, Jim's Take on the Market |

Newly widowed, Kay McCowen quit her job, sold her house, applied for Social Security and retired to Mexico. It was a move she and her husband, Mel, had discussed before he passed away in 2012.

“I wanted to find a place where I could afford to live off my Social Security,” she said. “The weather here is so perfect, and it’s a beautiful place.”

She is among a growing number of Americans who are retiring outside the United States. The number grew 17 percent between 2010 and 2015 and is expected to increase over the next 10 years as more baby boomers retire.

Just under 400,000 American retirees are now living abroad, according to the Social Security Administration. The countries they have chosen most often: Canada, Japan, Mexico, Germany and the United Kingdom.

Retirees most often cite the cost of living as the reason for moving elsewhere said Olivia S. Mitchell, director of the Pension Research Council at the University of Pennsylvania’s Wharton School.

“I think that many people retire when they are in good health and they are interested in stretching their dollars and seeing the world,” Mitchell said.

Read full article here:

http://www.csmonitor.com/USA/Society/2016/1227/Why-are-more-Americans-retiring-abroad

by Jim the Realtor | Dec 13, 2016 | Boomer Liquidations, Boomers, Jim's Take on the Market, North County Coastal

Who is selling?

This is the fourth reading – this time I checked the last 112 detached-home sales between La Jolla and Carlsbad.

Here are the categories of when the sellers purchased the home they sold:

| Year Purchased |

12/12/15 |

3/19/16 |

6/18/16 |

12/13/16 |

| 0 – 2003 |

41% |

42% |

39% |

57% |

| 2004 – 2008 |

23% |

29% |

24% |

19% |

| 2009 – 2011 |

15% |

11% |

13% |

6% |

| 2012 – 2016 |

18% |

18% |

19% |

13% |

| New Homes |

2% |

1% |

5% |

4% |

It has been consistent all year – the majority of sellers are long-time owners, which almost always means buyers are getting a project to some degree. No matter how much work the sellers have done to their house, buyers can plan on spending plenty to bring it into this era, and modify to their tastes.

Buyers should get comfortable with the idea of remodeling just to expand the inventory. It is helpful if you or your realtor can properly assess the repair costs before offering, and know that it’s rare to get a dollar-for-dollar discount.

More stats:

| Other Categories |

12/12/15 |

3/19/16 |

6/18/16 |

12/13/16 |

| Number of Sales |

125 |

114 |

144 |

112 |

| Avg. $$/sf |

$505/sf |

$552/sf |

$550/sf |

$529/sf |

| Median SP |

$1,080,000 |

$1,129,000 |

$1,291,500 |

$1,274,500 |

| Avg DOM |

60 |

38 |

42 |

54 |

| Sold in First 10 Days |

24% |

32% |

35% |

28% |

| Lost $$ |

11 |

3 |

7 |

7 |

| 0 DOM |

5 |

8 |

7 |

2 |

Today’s stats are fairly similar to the first reading last December, with the exception being the median sales price up 18% – which isn’t the appreciation rate for every house. It means more of the higher-priced homes are selling.

by Jim the Realtor | Sep 20, 2016 | Boomer Liquidations, Boomers, Jim's Take on the Market, Thinking of Selling?, Tips, Advice & Links |

OK, OK, Jim, it does sound like a good time to us to sell and move.

But where would we go????

Check out my lists of ideas here (also found in right-hand column):

http://bubbleinfo.s020.wptstaging.space/general-information/where-to-move/

P.S. Never put a bandstand on the infield!

Save

Save

by Jim the Realtor | Sep 19, 2016 | Boomer Liquidations, Boomers, Inventory, Jim's Take on the Market |

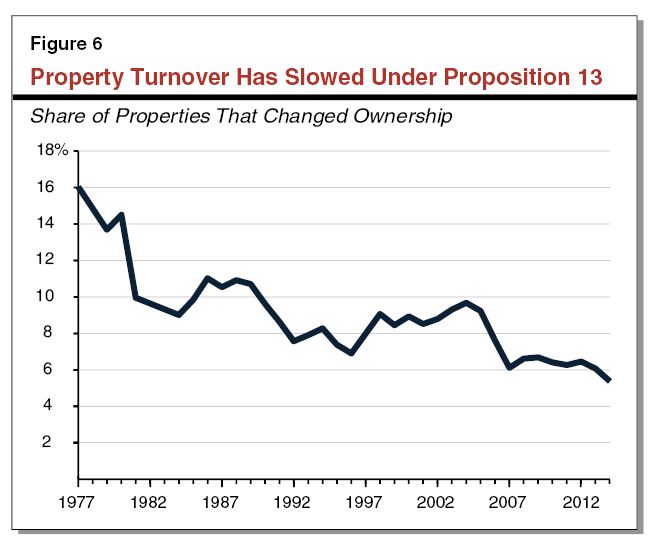

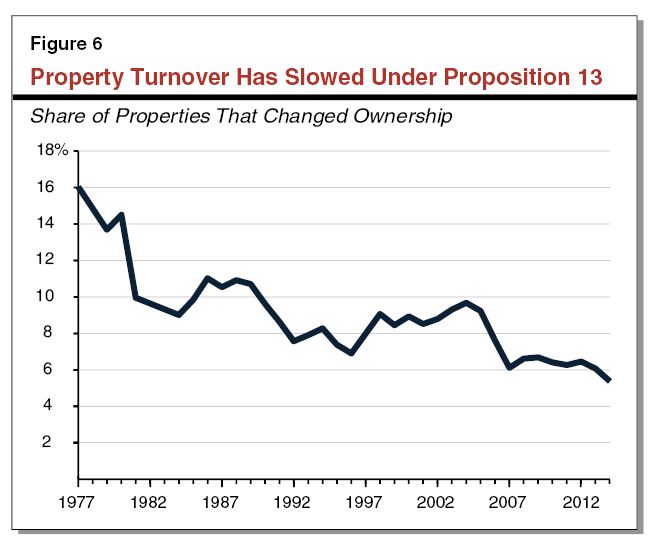

The low-inventory conditions have several contributing factors, one of which is the Prop 13 cap on property taxes. The long-time owners sure don’t want to pay what would be much-higher taxes if they move up, thus the turnover has slowed considerably:

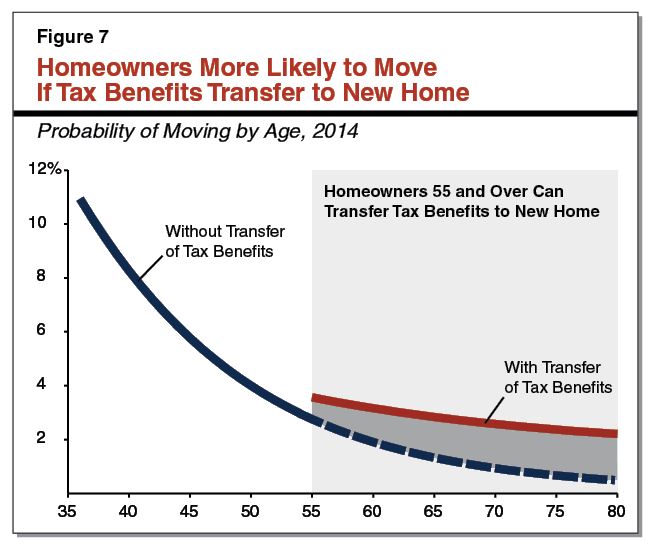

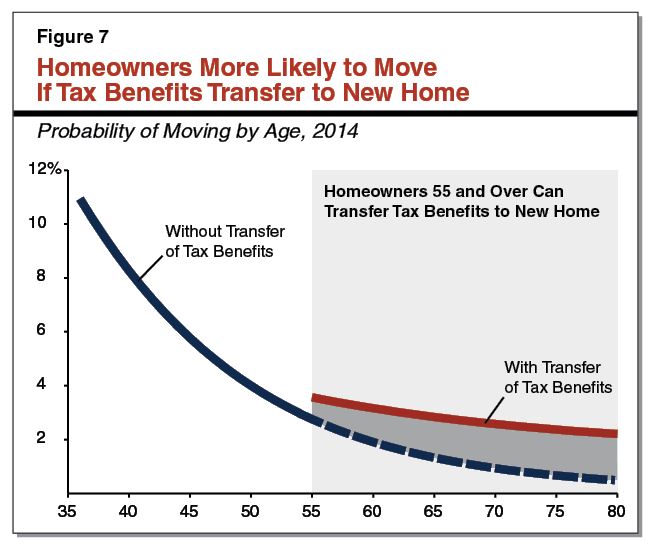

Moving down, price-wise, to keep your old tax basis isn’t easy either. Though this graph shows that twice as many people would move if they could take their tax benefits with them, it’s not enough to get older people to sell. By the time you are 65, the chance of you selling is less than 4%, and that’s with the tax benefits transferring:

Move before you get old!

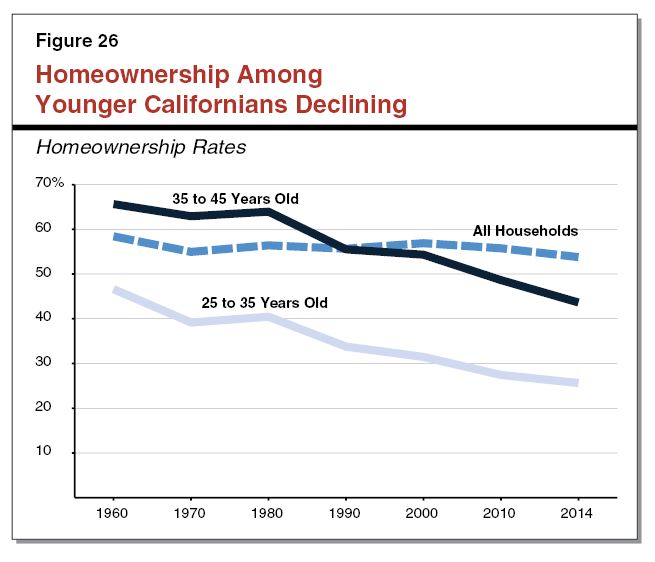

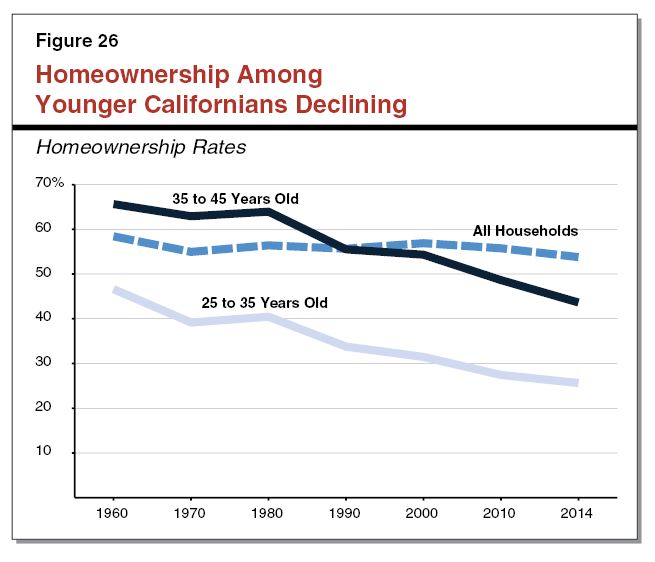

Here is the big concern – how many younger folks are coming up that are ready, willing, and able to buy your house for what you think it is worth today?

Your house comes with a stifling property-tax bill, and fewer are going for it:

The residual effects of prop 13, combined with the high federal and state income taxes paid on the profit above $500,000 will cause fewer and fewer long-timers to want to sell. Eventually, it means the inventory will be stocked with estate sales and sellers who NEED to sell.

The full report on Prop 13 is here:

http://lao.ca.gov/Publications/Report/3497

Save

by Jim the Realtor | Sep 13, 2016 | Boomer Liquidations, Boomers, Jim's Take on the Market |

Our local market has been solid as a rock, and we know that banks have quit foreclosing. Could we ever have another distress sale – a seller who doesn’t hold out for their price, but instead takes less in order to cash-out and go?

Can we predict who might take a quick and easy deal?

90 year-olds and up – Those who die intestate will have the public administrator sell their house the right way via an open auction with no reserve and a reasonable opening bid. Many will leave enough meat on the bone for flippers to tack on another 10% to 20%. Nothing to fear there. Or their kids will sell for retail or move in.

70-90 years old – They too own their house outright, and hopefully have family assisting them with decisions. If they had any mortgage balance left, it would be far below the retail value, so these folks are ideal candidates for a reverse mortgage. Because our tax laws favor selling the home after death, these will have their kids quietly put the house on the market once vacant and take a simple deal that is close to list.

50-70 years old – This is the category at risk, and could be the new ‘distressed’ sale for those who still have a loan. If you have 10-29 years left on your mortgage, and your health/job/spouse gives out on you, that monthly payment becomes more of a burden. If nearby home prices have flat-lined or are bouncing around, the allure of cashing out becomes more tempting. If you had to take 5% to 10% under comps, you’d still be selling for a boatload of money, price-wise, and in 30-45 days be on your way to an easier life.

This could happen to folks who have money. If your health/job/spouse gives out on you, it’s a game-changer, and the discomfort with the debt/payment could cause a rash decision.

30-50 years old – You bought in the last ten years, and are in it for the long haul – and the kids aren’t that old. Few sellers in this category.

Under-30 – No sellers this young, and anyone under 30 should buy anything they can get their hands on!

It’s unrealistic to expect a massive outbreak of cheap-and-easy sales that would torpedo a whole market. But it’s possible to see skirmishes in areas where homes were sold 10-20 years ago. If they refinanced in the last 5-10 years, they still have 20+ years left on that mortgage – and that’s a long time for people who are over 60 years old and uncomfortable being in debt.

Debt is a funny thing. As people get older, debt gets more uncomfortable, just because of the calendar – they know time is running out.

Think about it. If you have already considered moving to a less-expensive area, and thought you had $300,000 equity, but then saw two quick-sale comps nearby bring down your equity to $250,000. Your wife splits or you lose your job and you decide to sell.

But the best you could do was $225,000 equity (minus costs).

Do you sell for the discounted price?

Yes, because the outside factors tend to be more important.

Save