by Jim the Realtor | Jul 25, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market |

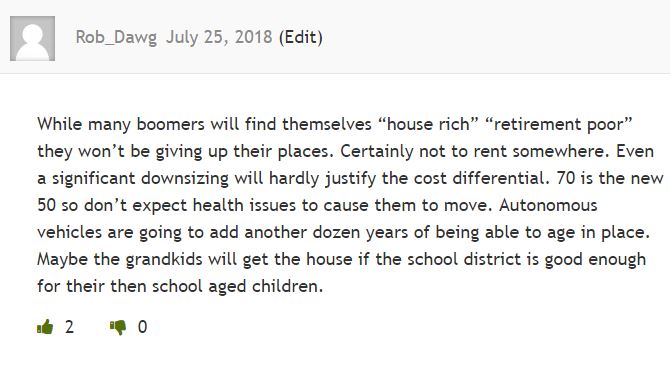

Rob Dawg is skeptical (as I have become) that boomers will be fleeing their long-time residences any time soon:

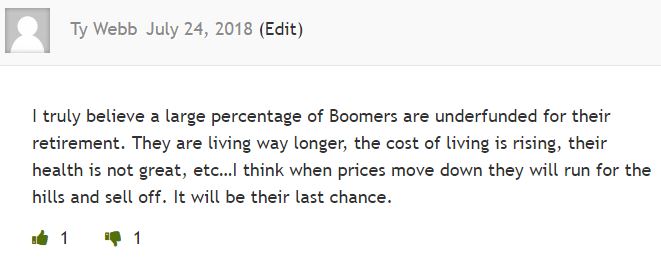

Reader Ty Webb isn’t so sure though:

For the most part, boomers own the houses, so besides the usual Big 3 reasons for selling (death, divorce, and job transfer), the boomers will be making the real estate market for the foreseeable future. If boomers don’t sell, the inventory will remain tight.

I’ll lay off the incessant boomer drivel here after this – for at least a few days! But first, here are excerpts from a post written by people who have real estate licenses, but I’m not sure that’s enough to be so confident about the boomer direction – so take this with a grain of salt:

http://journal.firsttuesday.us/boomers-retire-and-california-trembles2/8531/

Retirees move real estate

At about the age of 65, most Californians stop working full time and begin capitalizing on the benefits of social security, Medicare and their years of saving. The decision to retire is often swiftly followed by a series of lifestyle changes as retirees take advantage of their newly-increased liberty and accumulated financial power.

One of the most significant changes is the sale of the retiree’s current home and the corresponding move to a new, more compact and centralized residence with a better year-round climate or in closer proximity to family. As California’s population continues to age, senior citizens will exert increasing influence over both the housing market and every other aspect of the California economy.

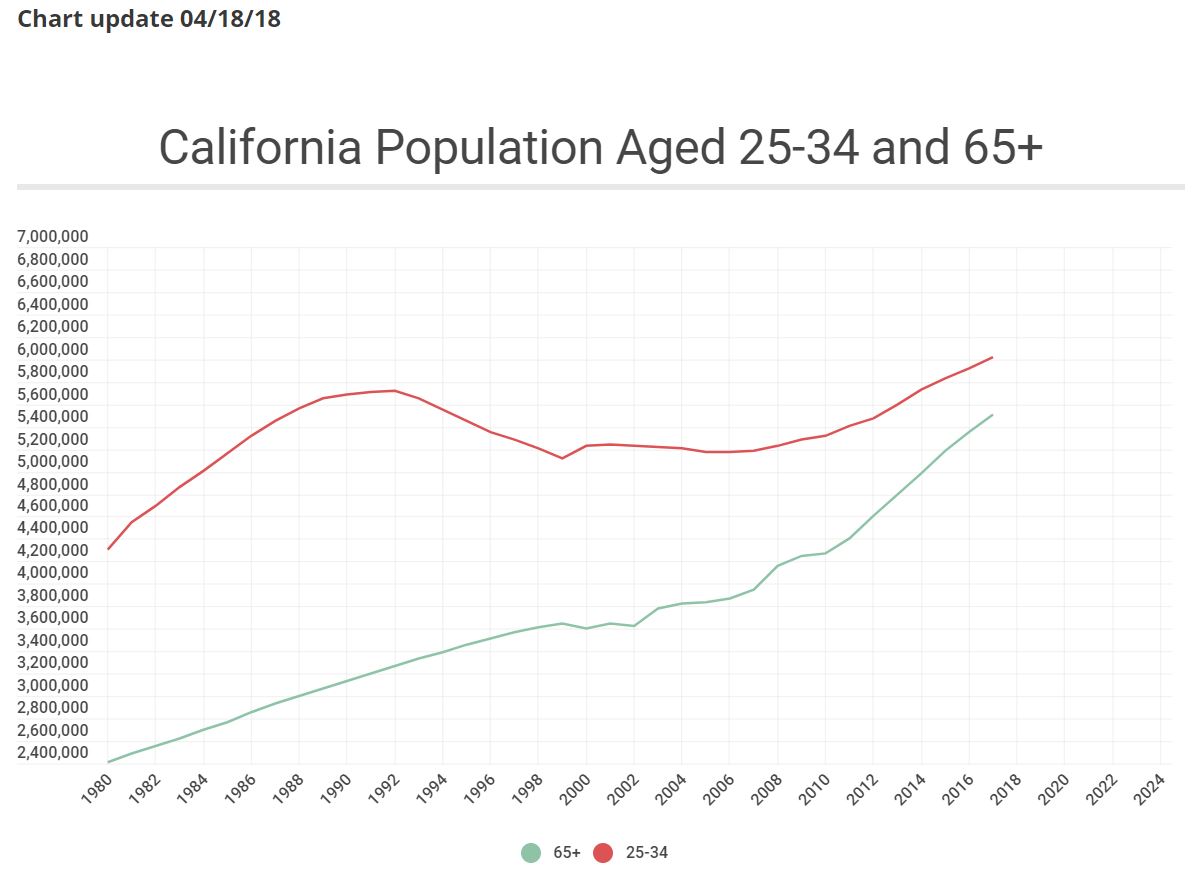

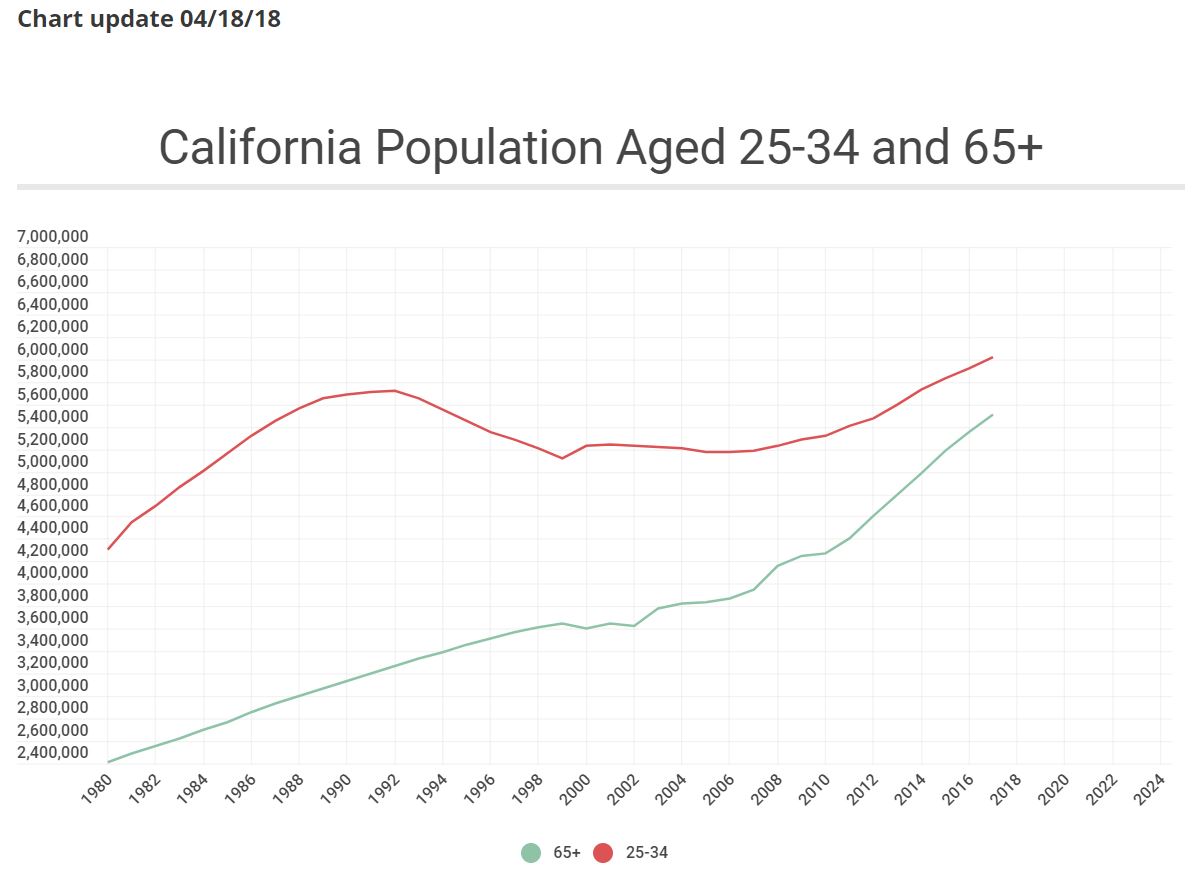

Over the past twenty years, retirees have exerted minimal influence in real estate transactions, as the age group of citizens over 65 was comparatively small. The generations born between 1915 and 1935 – during the Great Depression and World War II – did not have the numbers necessary to remold the housing market in their own image. That is about to change dramatically, as the above population chart demonstrates.

The shadow inventory of retiree homes for sale will thus manifest itself sooner rather than later. Those homes will be key factors in the elimination of the current rigor mortis in the housing industry. Retirees generally want to sell and relocate, and most will buy new SFRs; likely more than 70% will acquire a smaller (though not necessarily less expensive) residence than the one they have left.

Historical trends in Boomer conduct will also prove true now as retirees sell their current homes, looking to find replacement properties and live freer lives. The first Boomers to retire, those on the cusp of the population boom, have somewhat higher average earnings and savings than those who will follow. Consequently, the retirees of 2008-2018 will have the most money to spend, and will often have a second or third home to live in or sell.

Those retiring after 2018 will (generally) have somewhat less money, and thus less purchasing power upon their retirement. Those who retire later will also have a greater disadvantage due to the competition from other retirees in their generation. The homes they sell will fetch lower prices, the urban condos and retirement-community dwellings will be full before they arrive and prices will be rising.

The price reduction of large suburban SFRs caused by Boomer home sales will be further aggravated by a corresponding rise in the values of the more desirable replacement homes in near urban centers. While we cannot predict with certainty which properties will be involved or just where they will be, historical and current trends give us some hints.

Homeownership is a well-entrenched habit among the Boomer generation; a fact not likely to change because of increased age. However, this does not mean retirees remain stationary.

Sooner or later they decide to move to a new location that has a better climate or is closer to other family members. With their collective savings and equity, most will have the resources to do so with ease.

Retirees have traditionally moved to smaller, more conveniently-located properties that are closer to urban centers. The U.S. Census Bureau reported in 2014 that approximately 12% of the population in California’s metropolitan areas is 65 or older.

To complicate Boomer relocation, the younger generation is better educated and more mobile, migrating with increasing frequency to the cities. Their parents are likely to follow. They will be attracted by the increased access to public transportation, the proximity to cultural and artistic institutions and (not least important) the closeness of their children and grandchildren.

Read full article here:

Link to Article

by Jim the Realtor | Jul 24, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Buzz |

It’s just a matter of whether it will be a trickle or a flood:

The preference for baby boomers to age in place has been blamed in part for lower homeownership rates among millennials, who have been forced to compete for a smaller slice of available properties on the market. But now experts warn that even just a slight change in older homeowners’ attitudes could lead to a mass sell-off that would flood certain markets.

Focusing solely on the Washington, D.C. metropolitan area, researchers at George Mason University’s Stephen S. Fuller Institute point to the significant amount of empty-nesters living in properties that might be too large for their current needs. Using Census Bureau data, the team looked at the proportion of homeowners with “extra bedrooms” around the nation’s capital, defined as the number of bedrooms in excess of people who live at each property.

Even under the researchers’ “conservative” classifications — in which a married couple in a home with three bedrooms would be considered to have one extra, despite the likelihood that two of the three were unused — the results were striking. More than a quarter of all homeowners between 2014 and 2016 were in properties that had two extra bedrooms, which works out to more than 270,000 households with at least one resident aged 50 or older.

Though the George Mason team acknowledges that older Americans in the baby boom generation typically prefer to stay put in retirement instead of downsizing, they note that it wouldn’t take much of a mindset adjustment for the cohort to create a seismic effect in certain markets.

“The significant number of older homeowners in larger homes means that even a modest shift in preferences could have an outsized impact on the housing market,” the team wrote in their report, released earlier this month. “If even three percent of homeowners aged 50+ with two or more extra bedrooms decided to sell, an additional 8,210 homes would be put on the market — the equivalent of 12.4% of all the homes sold in the Near-In Washington region in 2017.”

That works out to a 5% to 10% increase in the available homes for sale in that particular area, which includes the District itself and surrounding suburban counties in Maryland and Virginia — an effect that could potentially depress home values.

Still, the researchers note that in the hot Washington, D.C. market, there’s a significant pool of eager buyers: George Mason found nearly 70,000 rental households where the head resident was younger than 50 and took in at least $150,000 per year, along with a significant crop of homeowners with no extra bedrooms who may be looking to expand into bigger properties.

“As a result, the near-term housing market has the potential to be more dynamic than in past years,” the team concludes. “Some longtime owners who wish to sell may have difficulty attaining the price gains they witnessed in their neighborhoods during recent years, when inventory was limited — especially if their neighborhood has a large number of longtime owners who put their homes on the market at once.”

Link to Article

by Jim the Realtor | Jun 22, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Conditions |

It looks like the low-inventory era will be here for a while….

The statistics about the waves of baby boomers turning 65 each day are old news to anyone who works in a senior-focused industry.

But a new report from Harvard University adds a new twist to measuring the coming wave of American seniors: In 2035, households with members aged 65 and older will account for a full third of the homes in the country.

That’s one of the conclusions from a new report published by the Joint Center for Housing Studies (JCHS) at Harvard, which releases an annual look at the complexion of the U.S. housing market. And this year, the researchers specifically pointed out the ways elders will dominate the market for decades to come.

At present, 65-and-olders represent about one in four U.S. households, up from one in five just 10 years ago — thanks to a gain of 7 million senior households over that span. And in a little over 15 years, that number will grow to one in three.

“The aging of the U.S. population has also boosted the number of older households because the baby-boom generation is so much larger than the preceding generation,” the JCHS observed.

Homes headed by those 65 and older were also the only age group that had a higher rate of homeownership in 2017 than they did in 1987.

That growth is coming at the expense of the younger millennial generation, which despite reaching the age that their predecessors were when they began buying homes and starting families, still lags behind.

“In fact, household headship rates among young adults are still declining, albeit more slowly than after the recession,” the JCHS wrote in its report. “Indeed, 26% of adults aged 25-34 were living with parents or other relatives in 2017, while 9% were doubling up with non-family members — both shares all-time highs.”

In addition, adults of all ages are far less likely to move than in years past. While the greatest declines in household mobility have been concentrated among the young, the 65-and-older set has also become increasingly more entrenched in their existing properties.

“Many of the growing number of older households are staying in their homes longer than previous generations at their ages, rather than downsizing or moving to rentals,” the JCHS observed.

Demographic shifts also play a role: Even though the move rate for Americans aged 65 and older dropped by just a percentage point, the sheer volume of aging baby boomers means that change represents “significantly fewer residential moves.”

“There is no doubt that the number of older adults will reach an unprecedented high over the next two decades,” the Harvard team concluded. “With this growth will come different demands, challenges, and stresses on the housing stock.”

Link to Article

by Jim the Realtor | Jun 21, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Conditions, Where to Move |

This story is about the same as Carlsbad folks moving to San Jacinto, where you can buy brand-new houses in the $300,000s. But boomers want to stay within range of their kids and grandkids, so any boomer-flight could be muted.

Link to Full Article

If you’re touring a model home this weekend in Sacramento, chances are the other couple over there, the ones checking out the quartz counters and sizing up the master closet, are not locals.

Emigres from the San Francisco Bay Area will comprise one-third of house hunters in the capital region this summer, real estate analysts predict.

Call it the coastal wave. It started a year ago, and it may be about to peak.

Bay Area residents are inundating Sacramento home developer websites, clicking through floor plans, watching promotional videos and signing up for email blasts, according to Kevin Carson of the New Home Company. His firm is building in El Dorado Hills, downtown Sacramento and Davis.

“I believe this summer, when the kids get out of school, we are going to see a real increase in Bay Area sales,” he said. “We haven’t really seen the wave hit yet.”

Michael Strech, head of the North State Building Industry Association, said he’s checked with other builders and guesses the one-third figure may be conservative at some new subdivisions.

The reasons are obvious: The median price of a Bay Area home hit $850,000 in April, according to CoreLogic, a real estate data company. That’s a $100,000 increase in one year.

In San Francisco, the median price hit $1.3 million. That often buys no more than a 1,600-square-foot house.

In contrast, the April median sales price for a resale home in Sacramento County was $357,000. And the median for a new home was $433,000.

In an eye-opening Bay Area Council survey this month, 46 percent of Bay Area residents said they want to move out of the region within the next few years. They cite the high cost of living, high housing costs, traffic congestion and homelessness.

By comparison, Sacramento’s sparkling new hillside subdivisions and moderately priced midtown condos are hot properties.

Retiree Marie Diaz, 59, of San Jose is among the emigres. She and her former spouse are selling their home for $2 million after a divorce.

Diaz said she found she can’t afford another Bay Area house with her portion of the proceeds.

“Prices here are outrageous,” she said. “I can’t afford to live in this area. I’d be in an apartment.”

She bought a home under construction in El Dorado Hills for $525,000. It has the same square footage as her old home, with an outdoor “California room” and a nearby community clubhouse where she will play bingo and bunco and do yoga.

(more…)

by Jim the Realtor | Jun 8, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market |

Two good reasons why boomers aren’t selling: They are working longer, and kids still live at home (or might return):

Link to Article

Thanks to their sheer numbers, the baby boomers have shaped society, driving social change and the economic expansion since the 1970s. But now they’re influencing society in a new way — by holding on to their homes.

The oldest baby boomers are now in their early 70s, an age that in previous generations signaled a desire to downsize into condos and apartments. But economists are finding that boomers aren’t yet downsizing, at least not in the numbers that some of them had predicted.

That may be adding to the ongoing inventory crunch facing homebuyers, said Zillow senior economist Aaron Terrazas. Boomers are healthier and working longer than previous generations, which means they aren’t yet ready to sell their homes and strike out for retirement developments. And some may not want to sell their homes because they then must jump into the homebuyers’ market, which is suffering from low inventory and high prices.

“Several years ago there was an expectation that as baby boomers move into retirement, there wold be a surge of homes hitting the market,” Terrazas said. “That really hasn’t materialized.”

(more…)

by Jim the Realtor | Jun 1, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Conditions |

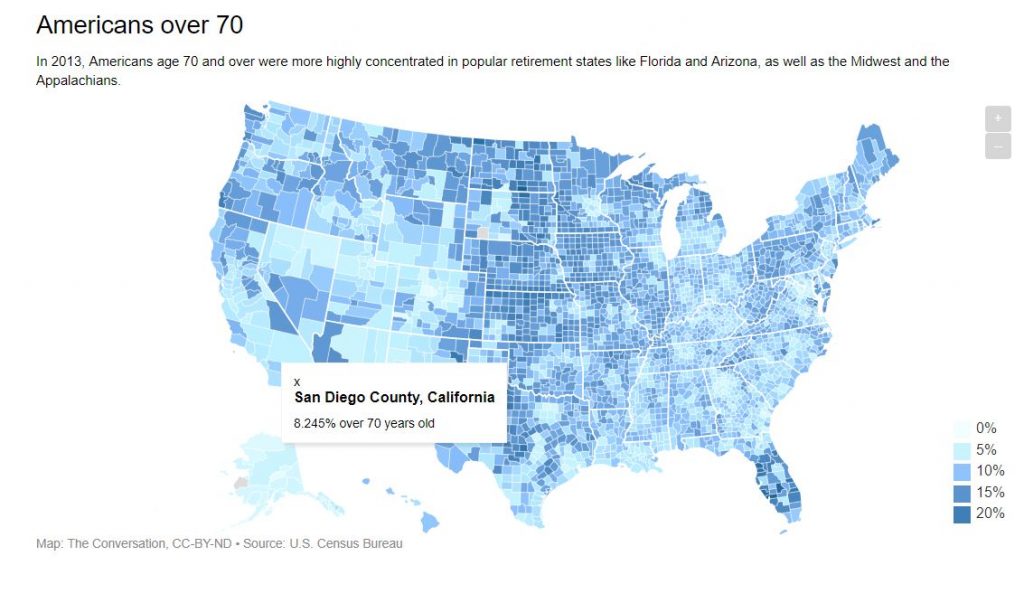

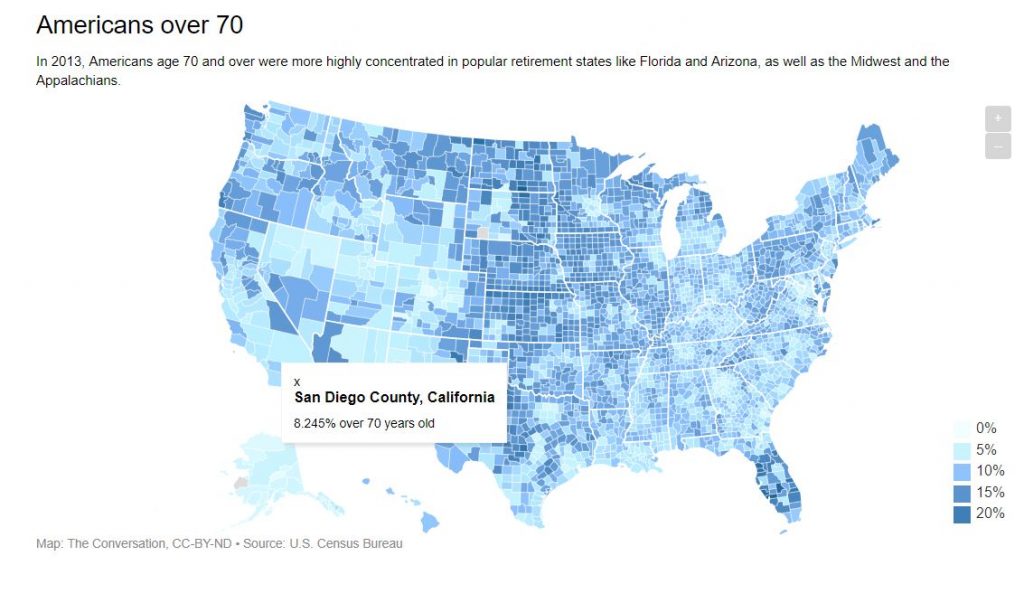

Five years ago, San Diego County had the second-highest number of people over 70 years old in Southern California (Riverside is higher), but other areas have many more. There are counties in Florida with over 25%!

Maybe those boomer liquidations might occur later than expected?

Thanks daytrip:

Link to Article

by Jim the Realtor | May 18, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market |

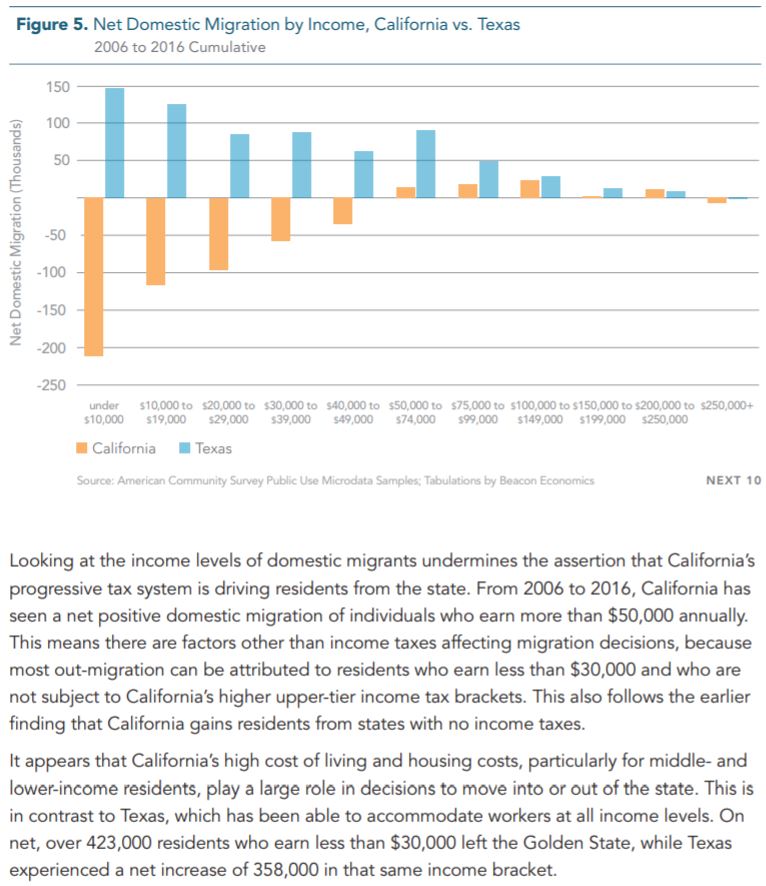

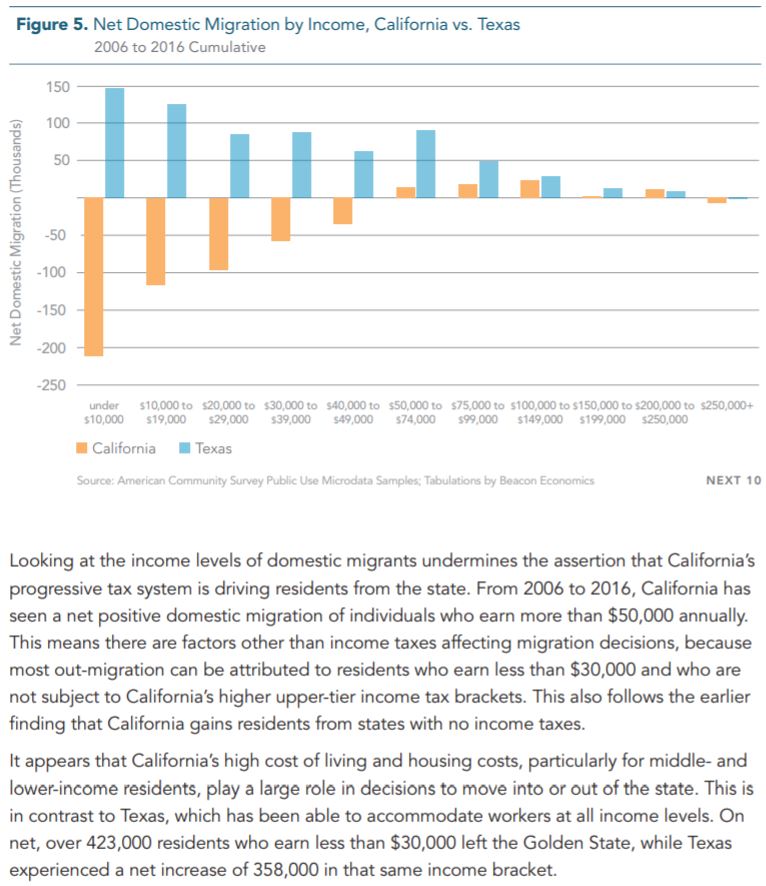

Another study that shows lower-income people leaving California, and rich people moving in. But what’s not examined is whether those leaving were long-time homeowners who sold their home and took a truckload of money with them to Texas:

http://next10.org/sites/default/files/California-Migration-Final2.pdf

by Jim the Realtor | May 16, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market |

Will the day come when boomers need to sell their house to survive? The reverse mortgages have offered a solution for some, but they are expensive and loan limits have been cut back recently. The general real estate market may not feel the impact of boomers running out of money, but you could see flare-ups of more inventory in older areas.

Link to Article

The grim outlook for many Americans approaching retirement age has some new stark statistics: One-third of respondents in a recent survey said they’d saved less than $5,000 for retirement.

Among baby boomers, one third said they had $25,000 or less in retirement cash available, according to a new data release from life insurance provider Northwestern Mutual.

Looking at the wider pool of Americans in general, 21% reported that they had zero retirement savings, while exactly three quarters agreed that Social Security is unlikely to exist in its current form when they eventually retire. And just about half said they’d done nothing at all to prepare for a future in which they outlived their retirement savings — despite the fact that two-thirds said that scenario was at least somewhat likely.

“As financial implications of retirement become increasingly complex, inertia just isn’t an option,” Northwestern Mutual vice president of planning Rebekah Barsch said in a statement announcing the results. “The good news is that it’s rarely too late to start.”

The survey also revealed that many Americans have resigned themselves to the idea of working longer before retiring, a strategy that’s increasingly preached even by financial planners. Nearly 40% of respondents in the Northwestern Mutual poll said they would work until at least age 70, more than the 33% who said they were targeting a retirement date sometime between 65 and 69.

In addition, the desire for more disposable income slightly outweighed professional satisfaction when respondents were asked why they planned to work past 65. That’s a shift from 2015, when the same study determined that 66% of Americans simply wanted to continue working for the fulfillment of it — as opposed to 60% who cited income as a concern.

“Continuing to work later in life should be a personal choice and not a mandatory requirement for survival,” Barsch said. “Proactive financial planning can be the difference between a desired and a default retirement lifestyle.”

by Jim the Realtor | Nov 7, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market, Local Government, Market Buzz, Market Conditions, Tax Reform |

In September, I touched on the Big Stagnation:

http://bubbleinfo.s020.wptstaging.space/2017/09/02/the-big-stagnation/

Just talking about the GOP tax changes could slow down the market. Because the N.A.R. and others are suggesting publicly that home values could drop 5% to 10%, won’t potential home buyers wait to see if it happens?

The demand will still be there; it will just be more picky than it is today.

The move-up market is where we could see real impact from the proposed tax changes. If potential move-uppers don’t move, they would keep their mortgage-interest deduction and lower property taxes. If they do move and get a loan over $500,000, they’ll enjoy paying on a new mortgage for 30 years with no MID, and pay higher property taxes.

They won’t calculate the exact cost of losing the MID (it’s not that much) – and instead, it will be the last straw and they will just quit thinking about moving because they’re disgusted with politicians.

We will also lose a few who need to stick around longer to qualify for the tax-free gain on the sale of their house, due to the change of having to own/occupy the house for five out of the last eight years to qualify.

End result: Fewer people willing to move up, which would have a significant impact on the higher end market. True, the move-up buyers won’t be listing their lower-priced house for sale either, which would create a net-zero change, and potentially make the inventory tighter, which would be better for the remaining sellers.

But there hasn’t been a shortage of homes for sale listed over $1,000,000 (there are 1,395 homes for sale today in San Diego County priced over $1,000,000, and 327 sold in October).

Higher-end sellers will have to wait even longer for the trickle of buyers to reach them. Plus, if a neighboring seller or two dumps on price to unload theirs, the lower comps could add another six months to the selling timeline, or longer. The sellers who claim to be in no rush will be tested!

The environment will be compounded by the lack of experience in dealing with this type of market by everyone involved. For the last seven years, if you wanted to buy a house, you had to pay the sellers’ price….or more. Will that continue? Yes, for those selling a perfect house at the perfect price. But it will be too easy for buyers to pass on the clunkers or OPTs.

S-t-a-g-n-a-n-t C-i-t-y.

The lower end should stay red hot, but it won’t be trickling up as much.

And that’s not considering the possibilities of higher interest rates, earthquake or other natural disaster, nuclear war, or recession!

by Jim the Realtor | Oct 26, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Buzz, Market Conditions, The Future, Thinking of Buying?, Thinking of Selling?, This Is America |

These responses point to a massive downsizing trend!

From realtor.com:

LINK

It’s all about millennials these days. Everything seems to center around these special snowflakes. But what about the original “me” generation? We’re talking about baby boomers, of course. What do these roughly 76 million Americans want when it comes to housing?

Well, they want multicar garages, for one thing. According to a recent survey by national homebuilder PulteGroup, they were the top feature boomers were looking for in a new home, followed by open decks or patios; eat-in kitchens; and a private yard.

About 38% of boomers plan to buy a home within the next three years, according to the report. About 11% expect to purchase a residence within the year.

The survey was of 1,043 folks between the ages of 50 and 65 who plan to buy a home in the next decade.

“Retirement marks a new phase in a baby boomer’s life, and it only seems natural to relocate or move to a new home when transitioning away from their primary career, or from the day-to-day rearing of school-aged children,” Jay Mason, vice president of market intelligence for PulteGroup, said in a statement. “It’s not surprising that the 55+ buyer wants a variety of options and choices in their homes.”

According to the survey, 39% of respondents said the main reason they’re moving is because they want to retire, 33% want to downsize, and 30% want to move to a more desirable location.

“One thing we know about boomers is they are not done yet,” says Amy Lynch, president of Generational Edge, a Nashville, TN–based company that consults with companies on generational differences in employees. “As a group, they are starting encore careers and also going back to school. And they often move to be near their millennial kids, who are having kids.” They also start new families of their own, through divorce or remarriage.

All of these situations may require a move. About 26% of boomers plan to stay in their current cities, but just move to a different home, while 34% want to remain in the state, but in a different city or town. Also, 38% hope to cross state lines.

Their top retirement destination? You guessed it: Florida. It seems you just can’t beat all of that year-round sunshine. The state was followed by fellow warm-weather states Arizona, North Carolina, and South Carolina. The cost of living is lower in these states than on the pricier West Coast or in the Northeast.

About 82% of boomers wanted to be someplace affordable, and 74% want to be close to their preferred health care programs.

But boomers don’t want to just pack up and leave their grandchildren. Being close to kids was their top consideration when choosing a new community. They also want to be near the water and park or other green space.

“We are in a period in this country where family life and family connections are very strong,” says Lynch. “There’s a lot of regret among boomers because they worked so many long hours when their kids were young. With grandkids, there’s a chance to make up for that.”