by Jim the Realtor | Oct 14, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market, Thinking of Selling? |

Coming to a neighborhood near you….some day! From cnbc.com:

LINK

Jeff Swaney is worried about selling his 5,600-square-foot home one day.

In his neighborhood south of Atlanta, demand and prices for large ranch houses like his have declined over the last decade, as more young professionals move to smaller abodes in hipper areas. He doesn’t expect that to change anytime soon.

The 51-year-old real estate investor and owner of Swaney Consulting Group has personal reasons to hold on, at least for now. He may eventually move to a condo at the beach, but wants his future grandchildren to enjoy his pool, yard and basement. For these amenities, he spends about $18,000 annually in lawn maintenance, taxes, insurance and utilities alone.

The housing market, on the rebound since the Great Recession, is increasingly being driven by millennials and first-time homebuyers who “are hungry for starter homes and efficient layouts,” said Javier Vivas, manager of economic research for realtor.com.

The trend may leave some older homeowners in a lurch if they want to retire, downsize and cash in their nest egg.

Large single family homes — defined as the largest 25 percent of all listings on realtor.com and about 2,900 square feet to 4,000 square feet — receive 12 percent to 45 percent less views on realtor.com than the typical home in each market.

This year so far, large, single family homes are selling up to 73 percent (or 50 days) slower on average than the typical home in each market.

The often hefty price tags for bigger homes contribute to their lengthier sale times because there is a smaller pool of buyers who can afford them, said Artur Miller, founder and CEO of Miami-based AMLUXE Realty.

Even Swaney, whose 1994 home appraised for $350,000, thinks he may have a tough time selling.

“The McMansions that soon-to-retire people purchased in the 80s and 90s are a very difficult sell right now,” said Melissa Rubenstein, a former real estate attorney who now sells luxury properties with Re/Max HomeTowne Realty in Bergen County, New Jersey. Many are outdated and may not include a first floor bedroom and bath suite for aging in place or in-laws.

Listings of large homes are also up two percent from last year, suggesting owners are dumping them faster, while listings of all homes are down 10 percent from last year, according to the realtor.com data.

“We’re finding these homes are an albatross for clients,” said Michael E. Chadwick, a financial planner and owner of Chadwick Financial Advisors in Unionville, Connecticut.

“We’ve got several right now who have been trying to sell them and move south, and they’ve cut the asking price by over 30 percent each and they’re still not going anywhere fast,” he said.

(more…)

by Jim the Realtor | Sep 20, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market |

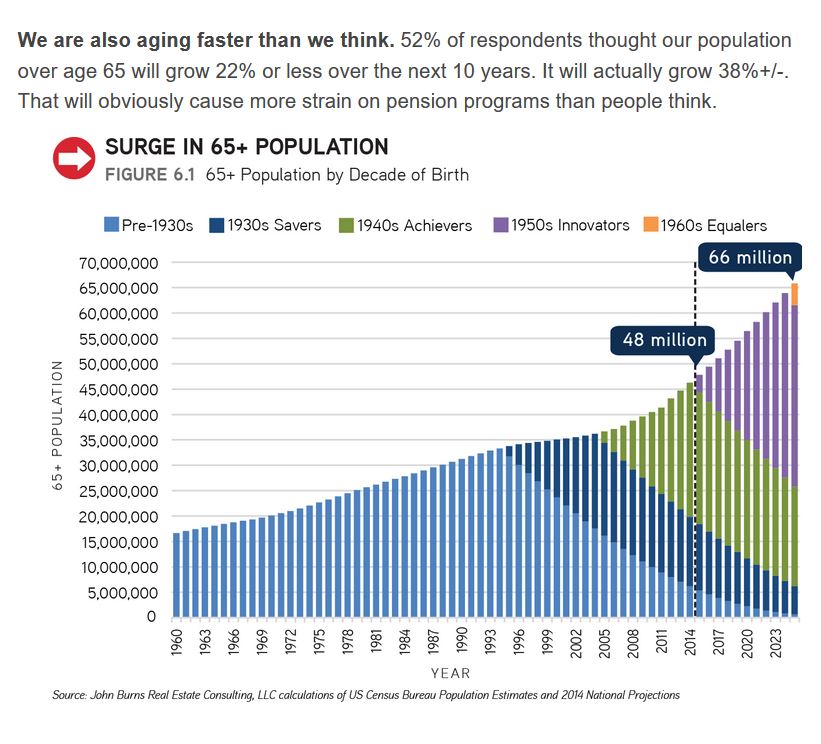

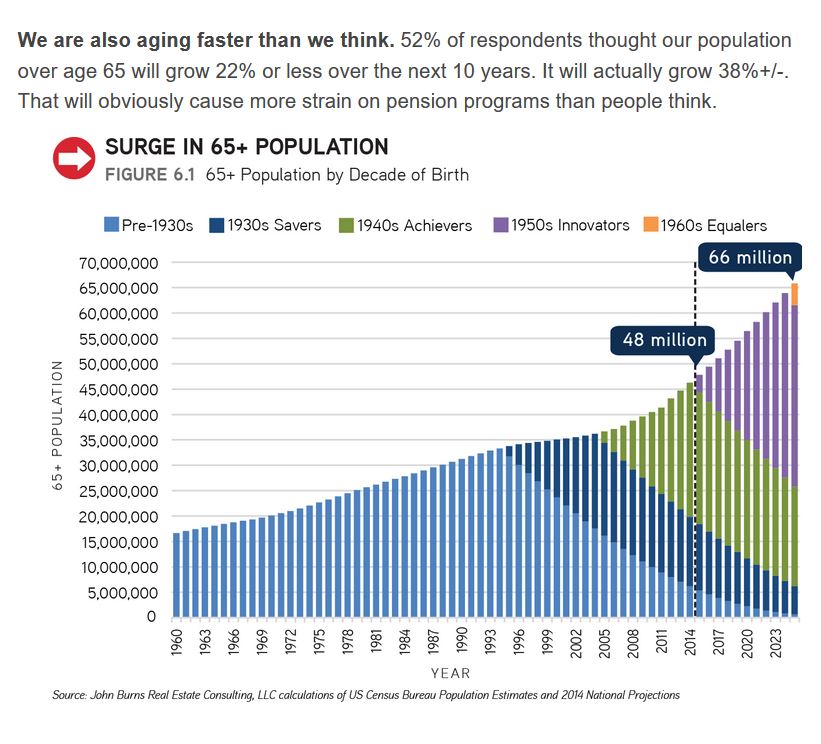

A surge in the 65+ population will probably prolong the market conditions we’ve seen lately – those are the people who got in first, and are probably settled enough that they won’t be moving.

But those who are relying on pensions might get a surprise, and it would take an unusual monetary need like that to cause them to sell their house – or get a reverse mortgage. An interesting note – the number of HUD reverse mortgages funded in the 2017 fiscal year was the lowest since 2005.

Read full article here – thanks JB!

https://www.realestateconsulting.com/correcting-demographic-misperceptions/

by Jim the Realtor | Aug 9, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market, Listing Agent Practices |

Hat tip to daytrip for sending this in!

LINK

An excerpt:

People 55 and older own 53 percent of U.S. owner-occupied houses, the biggest share since the government started collecting data in 1900, according to real estate website Trulia. That’s up from 43 percent a decade ago. Those ages 18 to 34 possess just 11 percent. When they were that age, baby boomers had homes at almost twice that level.

Public policy contributes to the generational standoff. Property-tax exemptions for longtime residents keep older Americans from moving. Zoning rules make it harder to build affordable apartments attractive to senior citizens.

“The system is gridlocked,” says Dowell Myers, a professor of urban planning and demography at the University of Southern California. “The seniors aren’t turning over homes as fast as they used to, so there are very few existing homes coming online. To turn it over, they’ll have to have a landing place.”

Read full article here:

https://www.bloomberg.com/news/articles/2017-08-08/baby-boomers-who-won-t-sell-are-dominating-the-housing-market

by Jim the Realtor | Aug 6, 2017 | Boomer Liquidations, Boomers, CA Homeowners Bill of Rights, Foreclosure Count, Jim's Take on the Market, No-Foreclosure as Banking Policy |

The real estate market in our neighboring Orange County has performed much like San Diego’s. Here, Jon outlines the 12 differences between the bubble days of 2007, and now:

http://www.ocregister.com/2017/08/06/orange-countys-housing-bubble-10-years-later/

These stats show how the game has changed forever – there is no down side if banks are so reluctant to foreclose:

10. Distressed property: Too much debt and too many layoffs pushed many homeowners to the financial brink. Owners rushed to sell as bankers hit the market with their repossessed properties. In June 2007, 13 percent of homes sales were either short sales — banks agreeing to take less than owed — or sales of foreclosed properties. That distressed share of selling would become roughly half of the market during the next five years. But by June 2017, that share settled back to just 7 percent. Fortunately, it’s only a history lesson today. The supply of foreclosures to buy has shrunk from 463 in late June a decade ago to only 27 as this year’s summer began.

11: Warning signs: Nothing screams “danger” more than owners skipping house payments. Ponder what lenders were doing in June 2007 vs. this past June. Default notices, a first step in foreclosure: 1,144 then, 310 today. Auction notices, the official threat to sell: 598 then, 213 today. Actual foreclosures: 281 then (and 1,084 in June 2008) vs. 21 today.

For the bubble to ‘pop’, and prices decline, we would need more than a trickle of distressed sellers who need to sell at whatever price the market would bear. A rash of boomer liquidations might happen, but with reverse mortgages being available, they have other options too.

All ahead full!

by Jim the Realtor | Jul 25, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market |

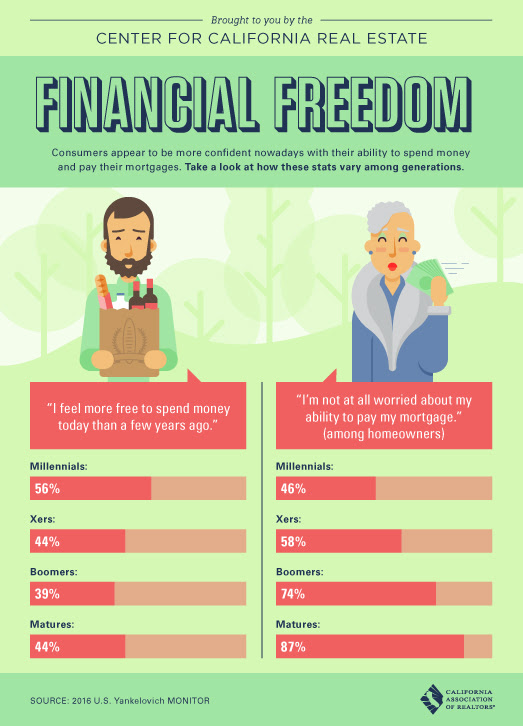

Will we see boomer liquidation sales, where baby-boomers sell their home because they and/or their family need the money to live? There isn’t any conclusive research, just speculation.

See bottom left though – how many people are getting by on social security, and any single life event could change everything?

by Jim the Realtor | Jul 10, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market, Prop 13, Property Tax Re-Assessment, The Future

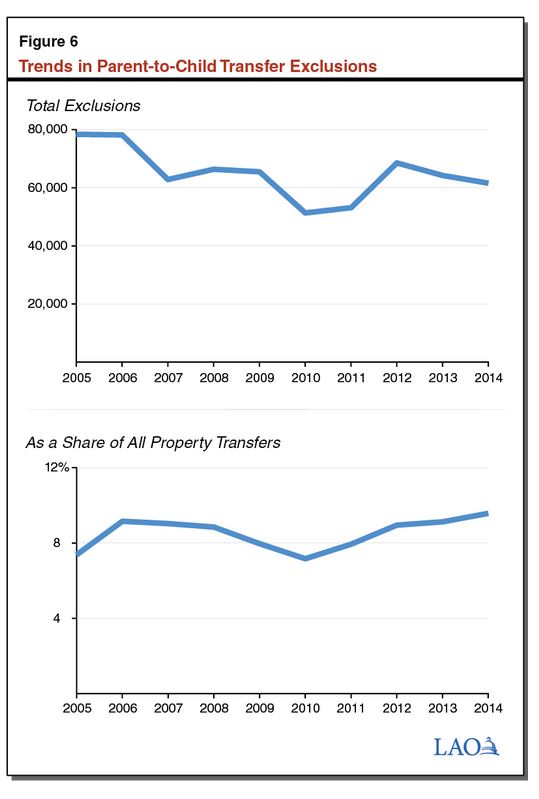

Daytrip sent in this article (link below) on baby boomer sales, and how the transfer of homes from parents to children are likely to dampen the supply of homes for sale – and somewhat limit the property-tax receipts:

LATimes.com

But then I went to the actual report for more info and graphs:

http://www.lao.ca.gov/Publications/Report/3693

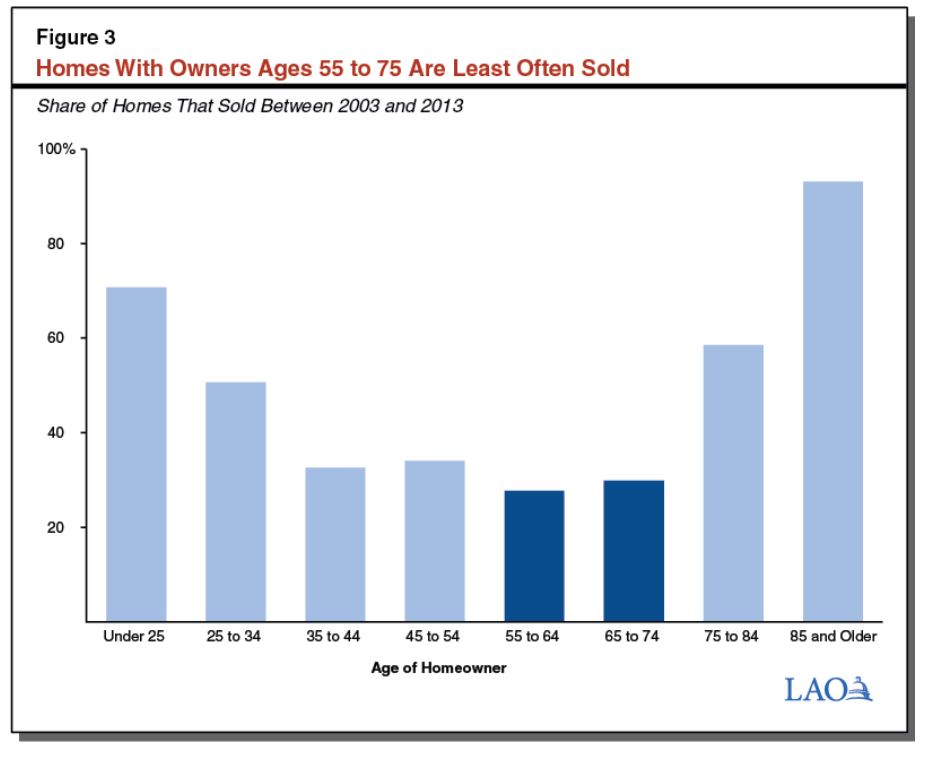

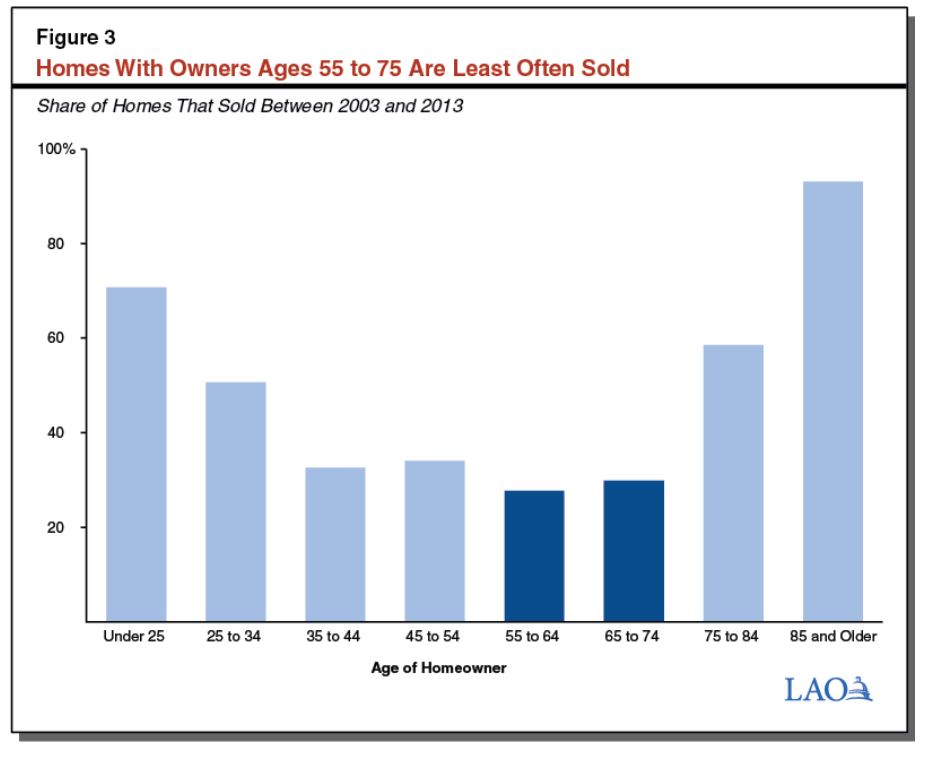

They do expect more boomer sales – it looks like a growing trend as more boomers get into their mid-70s:

Home Sales Likely to Pick Up as Homeowners Get Older. Although the aging of California’s homeowners has depressed home sales in past years, this pattern is likely to reverse in the future.

As California’s homeowners continue to age—transitioning from the 55 to 75 age group to the over 75 age group—more and more will begin to downsize, move into assisted living or with family, or die. When this occurs, home sales are likely to rise.

Between 2003 and 2013, over two-thirds of homes in California with owners 75 or older were sold to a new owner, compared to less than one-third of homes with owners ages 55 to 75.

Different Rules Apply to Homes Passed From Parents to Children. In general, when a home is transferred to a new owner, its taxable value is reset to its purchase price.

California voters, however, passed Proposition 58 in 1986, which amended the California Constitution to exempt transfers between parents and children (and later grandparents and grandchildren under certain circumstances under Proposition 193 [1996]) from revaluation. This allows a child to inherit their parent’s lower taxable property value.

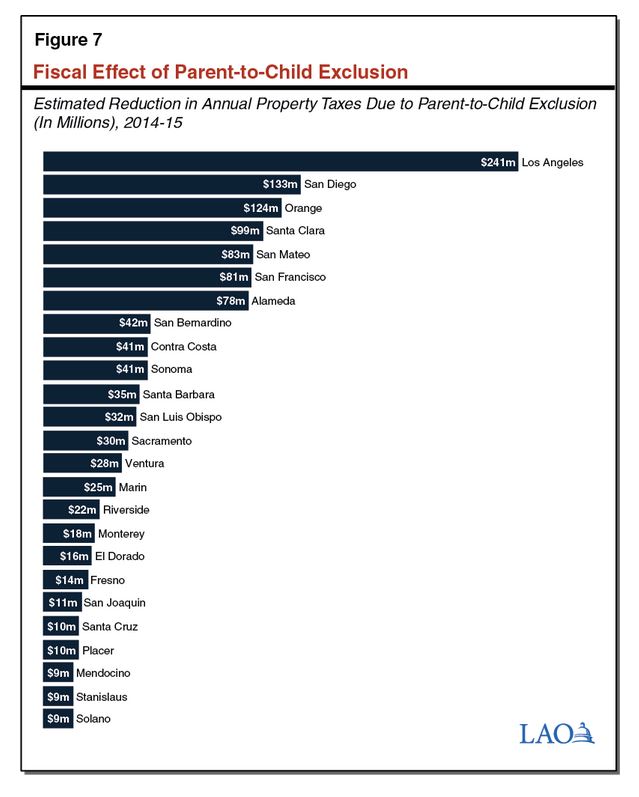

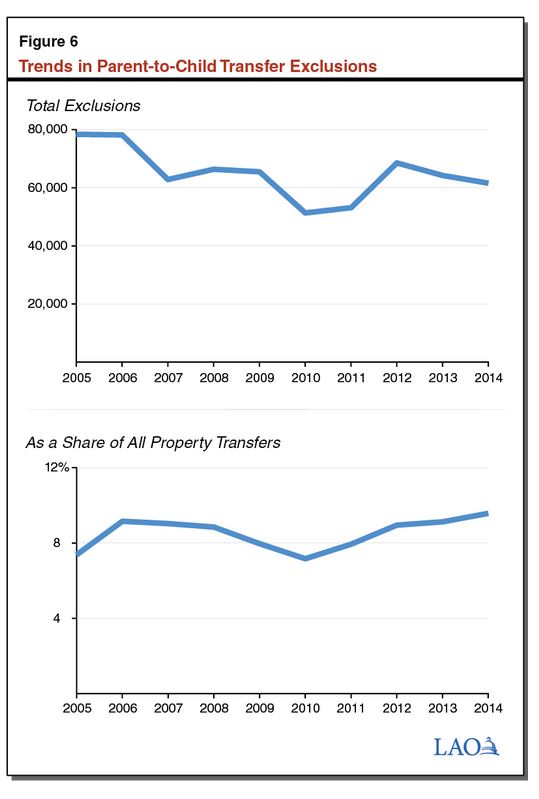

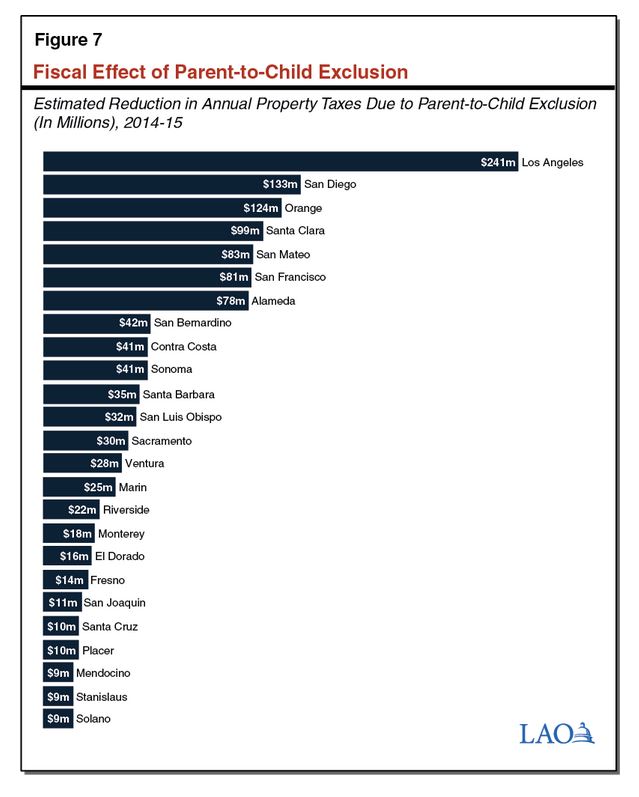

The report shows the parent-to-child transfers to be around 10% over the total homes sales over the last decade, but it should be going higher, especially in the higher-cost coastal counties!

Parent-to-Child Exclusions Have Had a Notable Impact on Revenues. Over the past decade, around 10 percent of property transfers have taken advantage of the parent-to-child exclusion to prevent an increase in property tax payments. Figure 6 shows how many of these exclusions have been used each year during the past decade.

JtR:

San Diego County is the second most populated county in the state, so no surprise we’re #2 on list at $133,000,000 in estimated reduced taxes. Those are a substantial number of homes being transferred within the family!

If the average tax savings was $10,000 per house sold, it would mean 13,300 homes transferred from parent to child – and this is from 2014-2015. We had 35,382 homes sold on the MLS in the same period. Add the FSBOs and new-home sales and we might have had 40,000 to 45,000 total homes transferred in fiscal 2014-2015.

The parent-to-child transfers could be as many as 25% of the homes moved! (40,000+13,300 = 53,300. 13,300/53,300 = 25%)

Their $133,000,000 estimate could be a tad off, but we probably have 10% to 20% of the potential supply of homes for sale being transferred within the family. No wonder the public supply is so limited.

It is a trend that probably started to increase in 2013 as prices took off. Parents realized that with the low tax basis, a child would be better off moving into the family homestead, rather than buying a resale home and paying full boat on the property taxes!

Save

by Jim the Realtor | Jun 30, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market |

Who is selling?

The last column below is regarding the 99 NSDCC houses sold between June 13-22 – these are the years when the sellers purchased the home they sold:

| Year Purchased |

12/12/15 |

3/19/16 |

6/18/16 |

12/13/16 |

4/3/17 |

6/30/17 |

| 0 – 2003 |

41% |

42% |

39% |

57% |

48% |

32% |

| 2004 – 2008 |

23% |

29% |

24% |

19% |

15% |

12% |

| 2009 – 2011 |

15% |

11% |

13% |

6% |

7% |

14% |

| 2012 – 2017 |

18% |

18% |

19% |

13% |

25% |

34% |

| New Homes |

2% |

1% |

5% |

4% |

4% |

7% |

This year we’ve had an increase of recent purchasers selling!

Are they moving up, or cashing out?

I’ve been having more thoughts about the older boomers selling. Though the long-timers here still make up a large group of sellers, they may not all be as old as I imagined. With a third of sellers being recent buyers, it suggests that there could be more mobility – buyers may not be buying their forever home.

Are more people making one last move-up?

Or are they making a quick buck and cashing out?

The younger boomers:

- Probably moved up a couple of times, not sitting on family homestead.

- Are used to moving more.

- Are more physically capable of moving.

- Have a little less connection to the neighborhood.

- Still have some adventure left in them.

But younger boomers:

- Are more likely to still be working.

- Are more likely to still have kids at home.

- Are more capable of modifying their home.

- Don’t need assisted living.

There weren’t many pure flippers in the 2012-2017 group, so we’ll see if the trend continues. It could be an anomaly.

More stats:

| Other |

12/12/15 |

3/19/16 |

6/18/16 |

12/13/16 |

4/3/17 |

6/30/17 |

| # of Sales |

125 |

114 |

144 |

112 |

99 |

99 |

| Avg. $$/sf |

$505/sf |

$552/sf |

$550/sf |

$529/sf |

$481/sf |

$532/sf |

| Median SP |

$1.08M |

$1.129M |

$1.291M |

$1.274M |

$1.11M |

$1.25M |

| Avg DOM |

60 |

38 |

42 |

54 |

43 |

52 |

| 0-10 DOM |

24% |

32% |

35% |

28% |

45% |

42% |

| Lost $$ |

11 |

3 |

7 |

7 |

0 |

1 |

| DOM = 0 |

5 |

8 |

7 |

2 |

4 |

3 |

Other notable items:

- Of the 99 sales, 35 sold at or above list price.

- The median days-on-market was 18 days.

- We have duplicate listings now that we are semi-merged with CRMLS, which will alter up the average and median data.

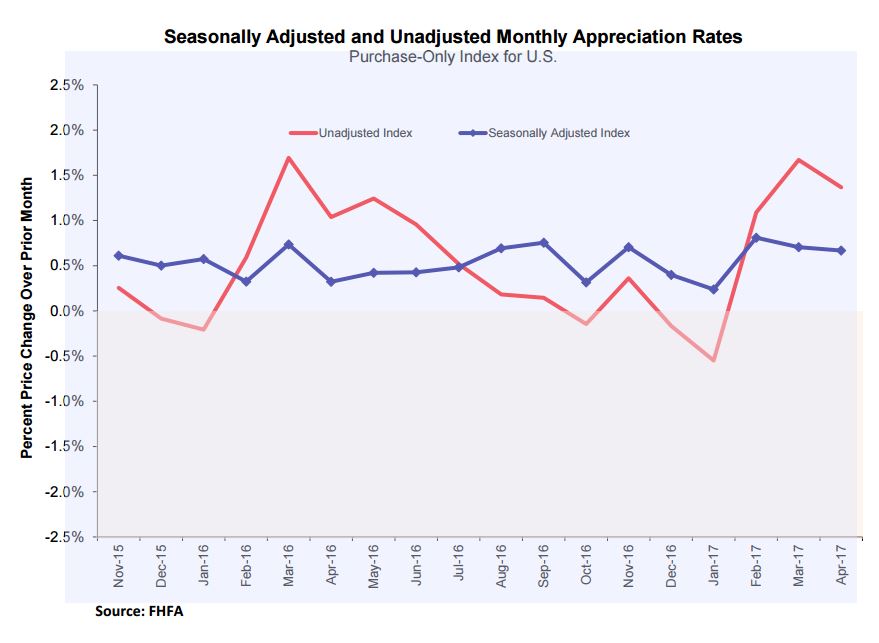

by Jim the Realtor | Jun 22, 2017 | Boomer Liquidations, Boomers, How Hot?, Jim's Take on the Market, Market Conditions

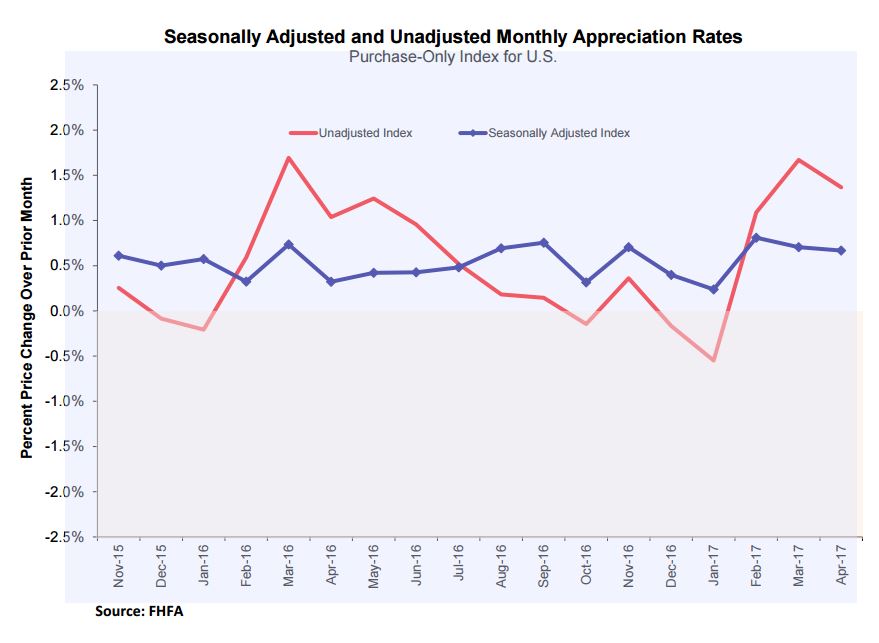

The N.A.R. Chief Economist Lawrence Yun was befuddled in his previous press release, and now this:

“Home prices keep chugging along at a pace that is not sustainable in the long run,” Yun said. “Current demand levels indicate sales should be stronger, but it’s clear some would-be buyers are having to delay or postpone their home search because low supply is leading to worsening affordability conditions.”

Yunnie is an old-fashioned guy who relies on historical norms. But more people are probably thinking the same – this run-up in pricing isn’t sustainable.

Or is it?

We are in an environment where we are peppered with lottery ads daily. People dream about getting rich quick, and selling your house is about the closest most people get – and it’s not enough just to sell your house for an all-time record price. Instead, every seller wants more than the last guy got.

Unless that mentality changes, prices will keep going up.

Won’t there be a point where we run out of ready, willing, and able buyers? Yes, but unless a seller NEEDS to move, they aren’t going to budge. They aren’t going to lower their price until they are absolutely convinced that they must – and it’s more likely that sellers will withdraw their listing and try again later.

If sellers do need a solution, there are more alternatives than ever:

- Reverse mortgages.

- HELOCs

- Share with family.

- Share with others. (H/T daytrip)

- Loan mods.

Once we reach the point where the market stalls, it will stagnate for years until sellers and realtors realize they must adjust their price to sell. Realtors themselves struggle to accept the rules of supply and demand – they just keep hanging onto their listing until the market catches up.

Rising rates, economic downturns, political drama, world calamities – none will be as influential as a seller’s ego when it comes to adjusting on price.

Watch the number of sales – they are the precursor. If/when sales start to decline, all it means is that fewer sellers are willing to adjust enough on price.

Will their reason for moving be powerful enough to not seek an alternative, and sell for what the market will bear? It’s doubtful, and as a result, a market that is this hot will take time to re-calibrate – if it does at all.

Save

by Jim the Realtor | Jun 9, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market, The Future, Thinking of Buying?, Thinking of Selling? |

A great article from realtor.com. Excerpts:

As baby boomers look to downsize out of their suburban McMansions, a generational showdown is looming: Millennials might be coming into their own as the nation’s biggest group of first-time home buyers, but they aren’t exactly lining up with bids in hand for those large, expensive homes in the sleepier suburbs. Instead, they’re looking for a different kind of home—the same ones, in fact, that the empty nesters are looking to buy.

It’s a battle of the millennials vs. baby boomers playing out in the nation’s suburban housing markets.

Younger and older generations alike are gravitating toward smaller dwellings in more urban, walkable suburbs and cities, with restaurants and coffee shops around the corner. It’s leading to a real estate traffic jam: Increasingly, boomers are getting stuck, because most can’t buy the home of their dreams until they unload their current ones. And many millennials have neither the desire nor the means to help them out.

“What you have is everyone chasing the same type of home,” says Rick Palacios, director of research at John Burns Real Estate Consulting. “More and more buyers of all ages want to avoid having to deal with a huge yard and all the upkeep and the costs to maintain [a larger] home.”

It’s creating an odd imbalance in a real estate market—a disruption to what has long been considered the traditional generational housing life cycle. And it’s leaving many would-be buyers out in the cold.

When they do make that move to the suburbs, millennials often seek more walkable towns that have many of the urban amenities they’re used to, like bike lanes, social events, and lots of shops and restaurants.

“What’s really attracting millennials are the communities that are bringing the urban flavor out to nonurban towns,” Palacios says. “They don’t want the traditional massive homes and big yards. They want smaller homes and cool things to do.”

“It’s more important to have proximity to the lifestyle they want,” says Jason Dorsey, president and researcher at the Center for Generational Kinetics, focused on millennials and Generation Z. “Their living room is actually the park outside the condo.”

It’s not just the size of boomers’ homes that is a turnoff; it’s also the style. Times and tastes have changed, and today both boomers and millennials are attracted to modern, open floor plans—which aren’t common in the older homes that boomers are hoping to unload. Boomers like the flexibility of these spaces for aging in place, and millennials like the clean design.

And while they’re willing to compromise on size, millennials are less willing to bite the bullet on amenities. Weened on HGTV, they want high-end finishes, nice countertops, upscale appliances, and luxurious bathrooms.

“They’ll buy a smaller house with fancier amenities, close to town, rather than chase square footage,” Dorsey says.

As for Generation X, having weathered the Great Recession during what should have been their prime earning years, they now have to save for their kids’ college expenses, their retirement, and caring for their aging parents. So they’re not likely to trade up from their starter homes. And if they do, many prefer an easier-to-maintain smaller home in a community with activities they enjoy—just like those millennials and boomers, Dorsey says.

Meanwhile, since the boomers see their home as their nest egg, they’re not all willing to reduce their asking price and shortchange their retirement accounts, says Dorsey. So more of them end up staying put.

“There certainly was a lot of speculation about what would happen if the boomers tried to sell their houses en masse, and whether that would flood the market with a supply of large homes that the younger population didn’t want—or couldn’t afford—to buy,” Porter says. But “the boomers do seem to be moving less and aging in place more.”

Read full article HERE.

by Jim the Realtor | Jun 3, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market, The Future |

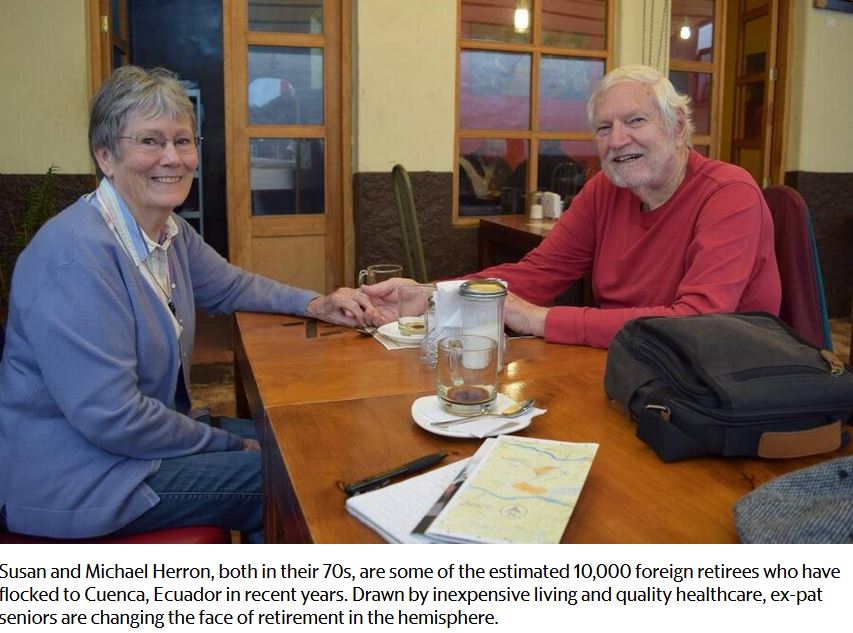

Could this be one of the growing trends that might add more reasonably-priced homes to our inventory? Thanks Daytrip for sending in!

http://www.charlotteobserver.com/news/nation-world/world/article154209369.html

To casual visitors, this colonial town in southern Ecuador looks like it was torn from the pages of history. With its cobbled streets, soaring cathedrals and bustling markets, it exudes a lazy, old world charm.

But Cuenca is also on the cutting edge of a very modern trend: providing a safe haven for U.S. retirees who have found themselves unwilling — or unable — to live out their golden years at home.

The growing wave of ex-pat seniors is not only upending notions about retirement in the hemisphere but reshaping the face of communities throughout the Americas. And the trend is expected to grow as waves of baby boomers exit the workforce ill-prepared for retirement.

There’s no accurate way to measure the phenomenon, but the Social Security Administration was sending payments to 380,000 retired U.S. workers living abroad in 2014 — up 50 percent from a decade ago.

In the Americas, records show that seniors are flocking to Canada, Mexico, Colombia, the Dominican Republic and Ecuador.

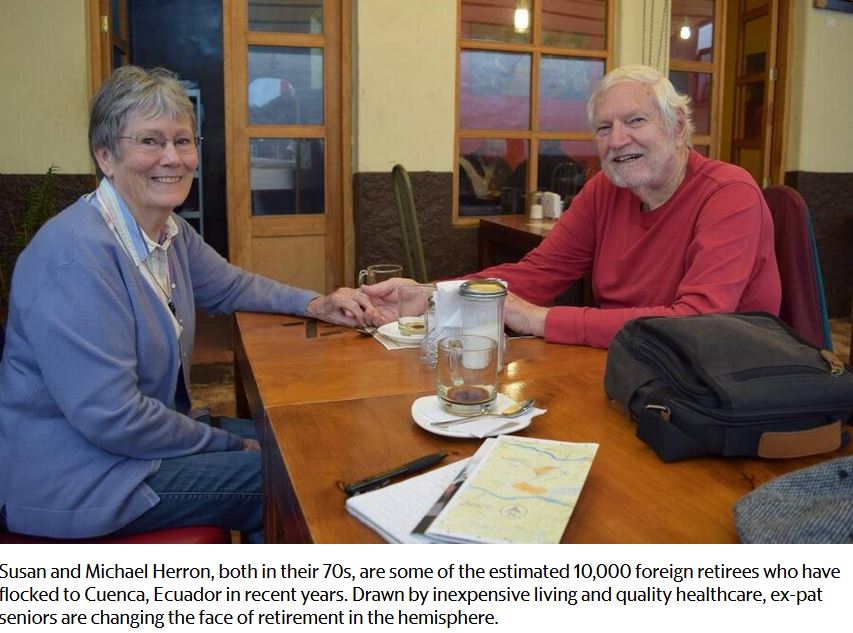

On a recent weekday, Susan and Michael Herron were having a long, lazy breakfast by the side of the Tomebamba River that cuts through the city. Both in their 70s, they have the lean look of people whose principal mode of transportation is walking — and a sense of adventure usually found in people half their age.

They had previously “retired” in Central Florida, Georgia, Alaska, South Carolina and Panama before finally settling on Ecuador — because it was beautiful and cheap.

“We could have survived [financially] in the United States if we had moved to a more rural area,” said Susan, 71, a semi-retired property manager. “But we wanted to take this chance while we were still healthy enough to be able to do it.”

In Cuenca, a city of about 350,000 people, they’ve found robust public transportation, an extensive museum network, solid healthcare and markets bursting with fresh fruits and produce. It’s a place where their two-bedroom, two-and-a-half bath apartment costs less than $400 a month. They’ve found that for about $1,500 a month, they can live a solidly upper-class lifestyle, dining out frequently and traveling.

“In the United States, we couldn’t afford to go anywhere,” Susan explained. “We were having to stay home.”

If there is a real driving force for retirees, it’s healthcare. Although the Trump administration has said it will leave Medicare untouched, its desire to scrap the Affordable Care Act amid rising premiums has created anxiety among seniors, said Prescher with International Living.

“Look at what retirees [in the U.S.] are facing,” he said. “They have a fixed income, maybe their investments haven’t been doing that well and now nobody knows what public healthcare will look like in the United States.”

“In the face of that … if you can live in a place where you can cut your cost of living in half while getting access to high quality healthcare, you have to think seriously about it,” he added.

James Skalski, a 74-year-old semi-retired architect and builder from Minneapolis, credits the city’s quality but quirky medical establishment for turning his life around. When he arrived here three years ago, he was 20 pounds overweight, had high blood pressure and was running from a family history of heart disease.

“In the United States, all they would do for you is give you drugs,” he said. Here, a holistic doctor worked with him for six months, using a regimen of nutrition, chelation therapy and meditation that Sakalski said reversed all that. Price tag: $1,600.

“Just last month, I had to go to the dentist for inflamed gums, and the dentist was using state-of-the-art X-ray equipment made in Germany,” he said. The X-ray, antibiotics and dentist visit ran him less than $30. He encouraged a friend to travel from Alaska for dental work. With flights and all, it was still cheaper.

“It was a real eye opener,” he said. “For a guy like me who’s not a millionaire, this all makes sense.”

Cuenca’s survey of retirees found that most were either paying for healthcare out-of-pocket or had private healthcare. But some are reliant on Ecuador’s public healthcare system. Foreigners only need to pay into the system for three months before they have access to full benefits.

Because Medicare doesn’t cover most costs abroad, the Herrons, for example, were paying $84 a month to belong to the public healthcare system. When Michael, a 76-year-old retired IT worker-turned-novelist, recently ended up in the emergency room for a cardiac issue, the total bill was $133. In the past, the same procedure in the United States had been billed to his insurance company at $186,000.

Crespo, the city official, said the retirees are pumping money into the economy, but there are growing concerns over how they might be affecting the healthcare system.

“We’ve heard about cases where someone night need brain or heart surgery that might cost $300,000 in the United States and they have the operation here for $300 because they had paid into the system for three months,” she said. “The price differences are abysmal.”

The Herrons say they’ve tried to isolate themselves from the U.S. political news by not having a television. And while they say they have no desire to return to the United States, they’re open to continuing their retirement adventure in some other country.

But for the moment, they’re still enjoying the little details of laid-back Latin American living.

“We keep pinching ourselves,” Susan said. “We can have a two hour lunch and not be rushed out of the restaurant.”

Save