by Jim the Realtor | Aug 29, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market, The Future

Will the current turbulence in the real estate market make boomers drop everything and list their home for sale in the coming months, or just scoot a little closer to the exits?

How many were already counting on every dollar of equity based on their lofty estimates of value that are now in question? Do they pack it up and wait for a few more years? Or sell now while they can?

The pressure is coming from many angles too – if it was just up to boomers having to survive on their own, they’d be fine, even if they had to cut back on the current lifestyle. It’s their parents needing the expensive assisted-living and the kids trying to get ahead that puts the additional strain on boomers, and could make them sell their house.

It’s a curious topic for those around housing – how will it all play out?

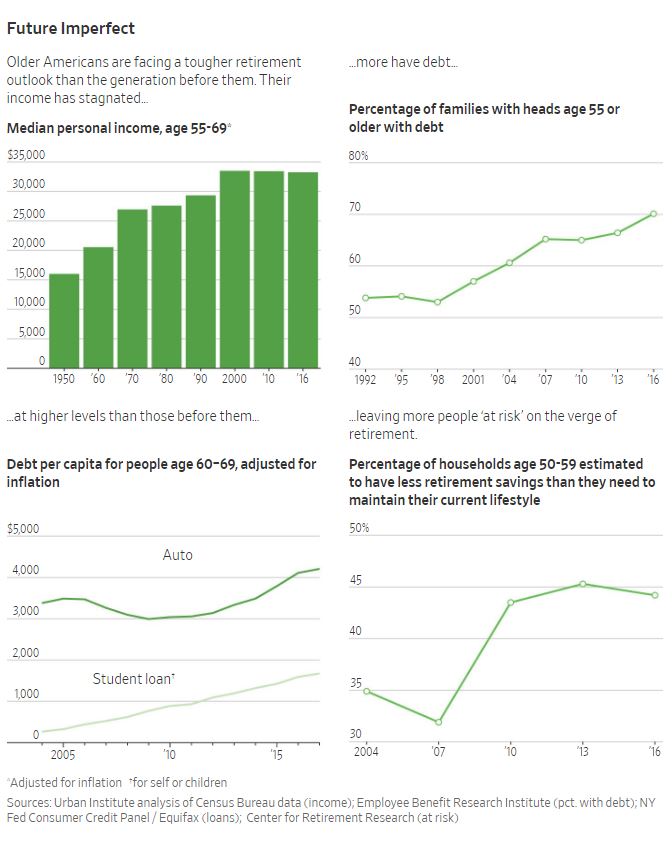

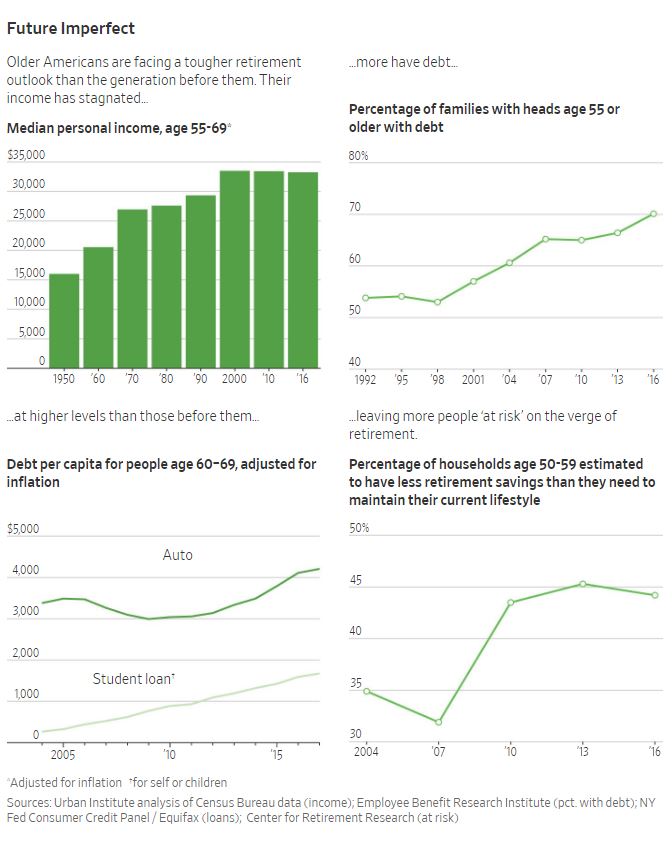

These charts and graphs are from this story in the WSJ:

https://www.wsj.com/articles/a-generation-of-americans-is-entering-old-age-the-least-prepared-in-decades-1529676033

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

•The percentage of families with any debt headed by people 55 or older has risen steadily for more than two decades, to 68% in 2016 from 54% in 1992, according to the Employee Benefit Research Institute, a nonpartisan public-policy research nonprofit.

•Americans aged 60 through 69 had about $2 trillion in debt in 2017, an 11% increase per capita from 2004, according to New York Federal Reserve data adjusted for inflation. They had $168 billion in outstanding car loans in 2017, 25% more per capita than in 2004. They had more than six times as much student-loan debt in 2017 than they did in 2004, Fed data show.

A combination of economic and demographic forces have left older Americans with bigger bills and less money to pay them.

Tempted by a prolonged era of low interest rates, boomers piled on debt to cope with rising home, health-care and college costs. Interest-rate declines hurt their security blankets. Lower earnings on bonds prompted many insurance firms to increase premiums for the universal-life and long-term-care insurance many Americans bought to help pay expenses. Some public-sector workers are living with uncertainty as cash-strapped governments consider pension cuts.

Gains in life expectancy, combined with the soaring price of education, have left people in their 50s and 60s supporting adult children and older relatives. Some are likely to have to rely on professional caregivers, who are in short supply and are more expensive than informal arrangements of the past.

Read full article here:

Link to WSJ Full Article

by Jim the Realtor | Aug 25, 2018 | Boomers, Graphs of Market Indicators, Jim's Take on the Market |

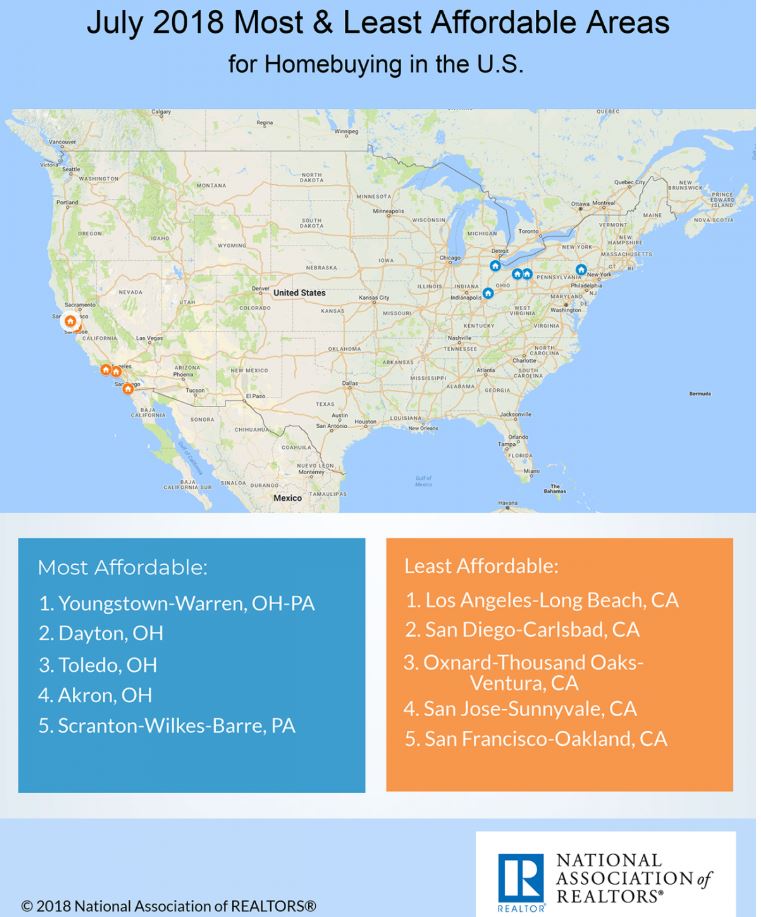

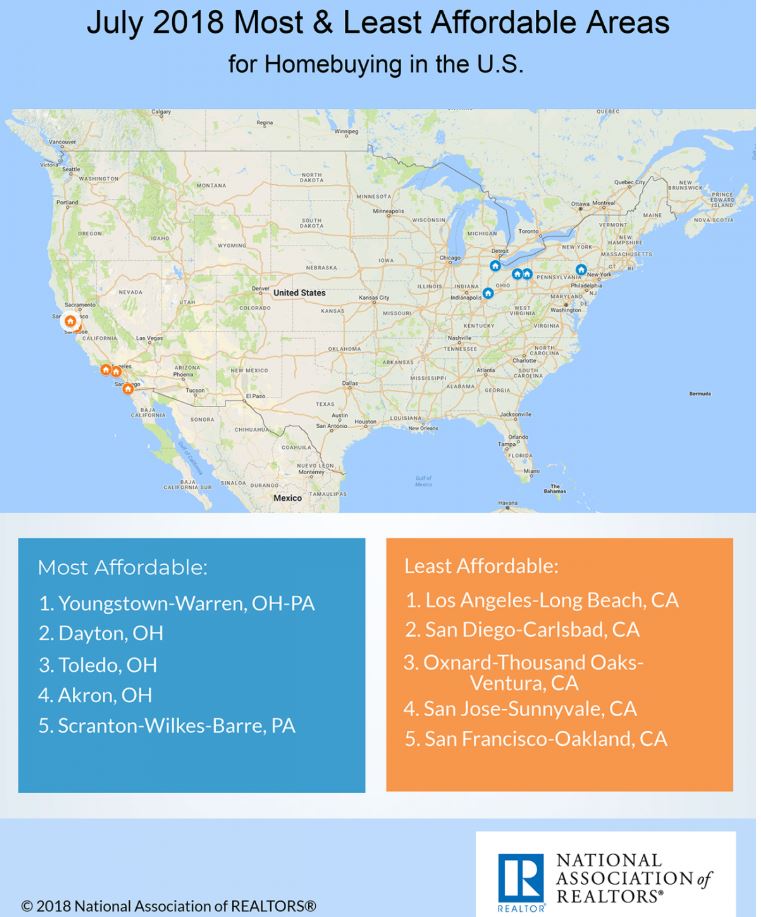

We have dispatched the lightweights around the Bay Area and have now passed those pesky VenCo guys, so only one more town in our way – Los Angeles!

We can do this! Keep being less-affordable San Diego!

The NAR didn’t list the criteria they used to create this graphic, so I’m not sure what we need to do to win, except tell your friends and family to move to Ohio or Scranton, PA?

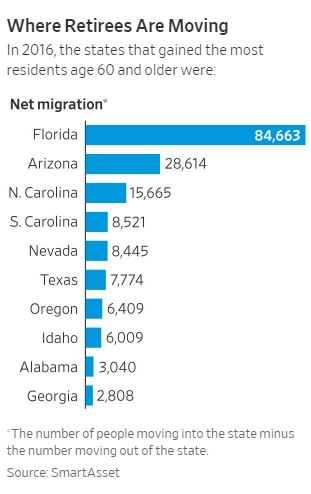

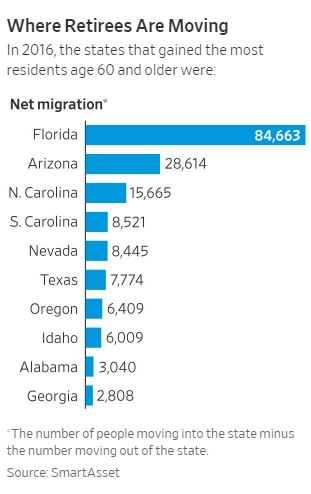

But seriously. We’re America’s Finest City (though New York City is in the running – wow!). Shouldn’t more rich people be moving here to retire? And fewer retirees be willing to leave?

In a downturn, our housing market could survive better than other cities just because of the retiree influence.

by Jim the Realtor | Aug 17, 2018 | Boomer Liquidations, Boomers, Forecasts, Jim's Take on the Market, Market Buzz |

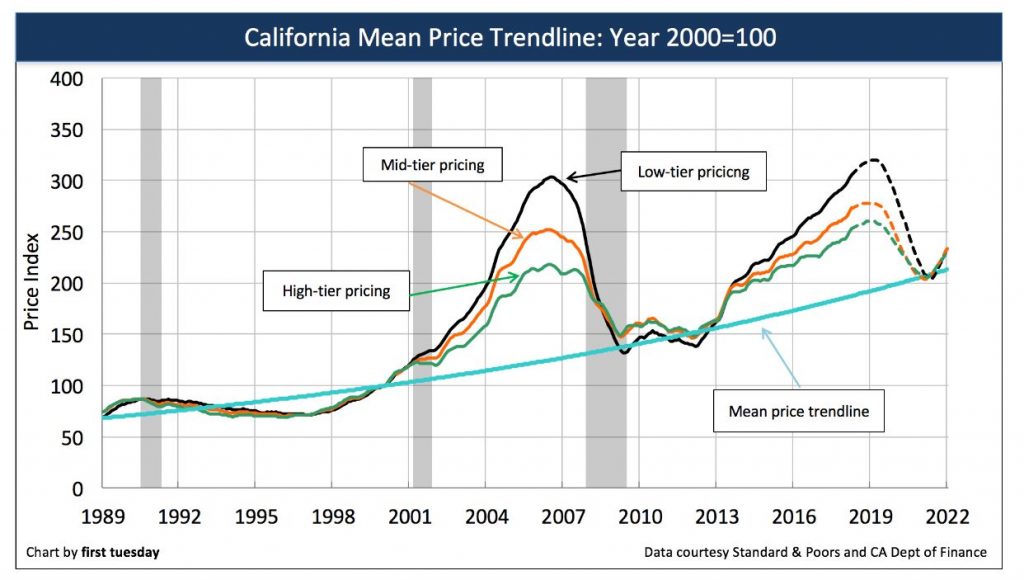

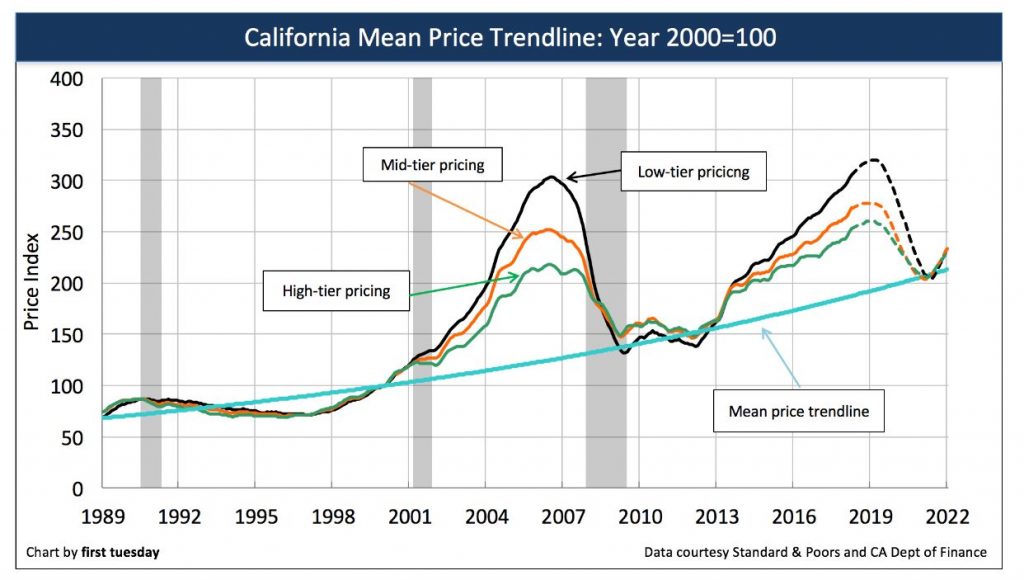

We’re going to be fed a solid diet of ivory-tower analyses from now on, because when you look at the history, it sure seems like home prices are due to come down. What these authors fail to consider is how the Bank of Mom and Dad has made the current pseudo-bubble possible, and will continue to do so. Plus, for prices to go down, you must have sellers who are willing to dump on price. None have been that motivated, at least not yet.

This article can’t even get the facts straight – the last bust was caused by exotic neg-am financing exploding in our faces, and ill-informed homeowners bailing out. In addition, you can draw the trendline anywhere you want, and these authors drew it where it would produce the most drama – see above – yet their worst-case scenario is only back to 2013 prices. We’d survive that.

http://journal.firsttuesday.us/home-prices-run-away-from-incomes-for-now/64911/

This most recent cycle we are emerging from in 2018 has its roots in the early 2000s, when home values began outpacing incomes at a rapid pace.

In 2006, home prices peaked in step with the Millennium Boom. By that time, home sales volume was already falling as buyers sensed prices were too high to continue during the inevitable recession, which arrived in 2008. From 2006 to 2007, prices dropped 16%, followed by a further 26% in the following year.

All in all, California home prices fell 44% from their 2006 peak to their bottom in 2009.

In some ways, this steep fall was a correction to all the excess experienced in the housing market during the early- and mid-2000s. In another sense, the fall was simply the market’s way of bringing home prices back in line with incomes.

There is a name for this reliable force that pulls home prices toward incomes: the mean price trendline.

Through the volatility of housing booms and busts, price increases continue to return to the same rate of annual income change, related to the consumer price inflation (CPI), which is typically 2%-3% per year. In California, this mean price change is closer to 3.5% annually over the past several decades.

How does income impact home prices?

Quite simply, home values can only go as high as incomes allow.

Homebuyers reliant on financing are limited to a maximum mortgage payment of 31% of their monthly income. This translates to the ability to purchase a home costing roughly five times their annual income.

Still, there is some wiggle room in the equation. After incomes, interest rates have the next biggest impact on home prices. When interest rates are falling — as occurred in the 2000s — buyer purchasing power is extended, as homebuyers’ mortgage payments go further. When interest rates rise — as is occurring in 2018 — buyer purchasing power falls and homebuyers are limited to paying less with the same income.

During housing bubbles, home prices become temporarily untethered from this rule and the mean price trendline. During the bust that follows the boom, prices fall, returning once again to the trendline.

2018 is primed for the next downturn

Here’s how the situation stands in mid-2018:

- home prices are roughly 9% above a year earlier;

- home sales volume is 1% above a year earlier (basically flat);

- interest rates are nearly a full percentage point higher than a year earlier, translating to a 7% reduction in purchasing power for the average California homebuyer.

Further, the Federal Reserve (the Fed) plans to continue their efforts to increase interest rates in an effort to cool down the economy and induce a moderate business recession by 2020. Not only do higher interest rates discourage potential homebuyers from entering the market, but they cause homebuyers to offer less when they make an offer to purchase.

In response, first tuesday expects home prices to fall by mid-2019, bottoming once they hit the mean price trendline around 2020. Meanwhile, incomes will continue along at their current measured pace, pausing briefly in 2020-2021 in response to the recession.

Link to Article

by Jim the Realtor | Aug 7, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market, Where to Move |

Hat tip to daytrip for sending in this article, though it somewhat contradicts what I believe – I think you should move somewhere!

Yes, many retirees are looking for a version of Mayberry, the fictional North Carolina town that actor Andy Griffith called home in his 1960s TV show. But even the best Mayberrys, like most communities, have drawbacks.

So, before you pull up stakes, here are some cautionary tales about small towns that retirees have shared with us through the years:

• “I’m here! Hello?” The ideal town is easy enough to envision: a cozy, safe and picturesque spot with—perhaps most essential—a sense of community. It’s important, though, to be realistic about your chances of fitting in with your new surroundings. While you certainly could become part of the inner circle, many transplants find themselves instead joining the ranks of other retirees in the area.

Consider, for instance, this bumper sticker seen in Florida: “We don’t care how you did it up North.” You get the idea.

• Character traits. Along these same lines, and at the risk of overgeneralizing, retirees who relocate often are more assertive, more aggressive and more likely to have been managers or decision makers than those who stay put. (After all, starting a new life in a distant locale isn’t for the faint of heart.) But a strong personality that might have been a big help in the business world might not work as well in an unhurried environment.

In short, ask yourself if the temperament of a possible retirement destination—and, in particular, a small town—is comparable to your own. “I think new arrivals are more concerned about immediate productivity and less patient than those who have been retired 10 or 20 years,” Ms. Carlson says.

• Small—but for how long? Unfortunately, the chances of any small, attractive community staying that way are increasingly slim, as word about such places gets around much faster than before. (Indeed, Ms. Carlson asked us not to identify her new home.) If you do find your Mayberry, the best place to settle—even if you find yourself paying a premium—could be in a historic district, where future development likely will be kept to a minimum.

• Health care. Here’s what Ms. Carlson told us about relocating to a small town: “We were assured, primarily by our real-estate agent, that medical care was excellent. What we weren’t told was that there was a yearlong waiting list for an appointment with most internists. We discovered that there’s an unfavorable ratio of physicians to residents because many younger doctors aren’t interested in an area with limited opportunities for working spouses and a small school system.”

In hindsight, she says, she would have done more digging about health care, as well as asking about emergency care. “Had we asked some questions at the visitor center, instead of just picking up maps and using the restrooms, we might have received more-accurate information,” she says.

“Once we arrived and discovered how hard it is to get into a [medical] practice, I asked at the local fire district: ‘What happens if I have to call the medics?’ I was told that patients with heart problems who must be hospitalized are sent two counties over from us, and that other problems requiring hospital care mean a trip 15 or 20 miles west of here.”

• Transportation. Again, some digging is needed here. A small town is likely to have fewer public-transportation options than a larger community. And remember: You could be living in your new home for a long time. With all that in mind, what happens if you’re forced to cut back, or eliminate, your time behind the wheel? Do volunteer organizations or local government agencies offer transportation programs for older adults?

Says Ms. Carlson of her new town: “Our county has some door-to-door bus service for the disabled, but there appear to be long waits to be returned home. A carwash/gas station operates a single cab. There’s no Uber and no car-sharing rentals.”

And be aware, she adds, “that many small businesses—I’m thinking, in this case, about our local dairy that sells composted manure for gardens and yards—don’t deliver, and may not be able to refer you to delivery services.”

Link to Article

by Jim the Realtor | Aug 6, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Buzz, North County Coastal

Who is selling?

Over the last few years we’ve seen that most home sellers are the long-time owners, and that trend is continuing.

On the left are the years when the sellers purchased the home they sold between July 26 and August 3rd of this year:

| Year Purchased |

12/12/15 |

3/19/16 |

6/18/16 |

12/13/16 |

4/3/17 |

6/30/17 |

8/5/18 |

| 0 – 2003 |

41% |

42% |

39% |

57% |

48% |

32% |

42% |

| 2004 – 2008 |

23% |

29% |

24% |

19% |

15% |

12% |

14% |

| 2009 – 2011 |

15% |

11% |

13% |

6% |

7% |

14% |

12% |

| 2012 – 2018 |

18% |

18% |

19% |

13% |

25% |

34% |

29% |

| New Homes |

2% |

1% |

5% |

4% |

4% |

7% |

5% |

The increasing trend of recent purchasers selling might just be from the additional years in the last category. It was 2012-2015 when this graph began, and now it covers seven years – almost twice as many.

Are those sellers moving up or down? Or cashing out?

The younger boomers:

- Probably moved up a couple of times, not sitting on family homestead.

- Are used to moving more.

- Are more physically capable of moving.

- Have a little less connection to the neighborhood.

- Still have some adventure left in them.

But the younger boomers:

- Are more likely to still be working.

- Are more likely to still have kids at home.

- Are more capable of modifying their home.

- Don’t need assisted living.

With long-time owners providing the bulk of the inventory, we should expect older homes for sale that need fixing, or at least some updating. Yet the current trend is for buyers getting more picky, not less.

More stats:

| Other |

12/12/15 |

3/19/16 |

6/18/16 |

12/13/16 |

4/3/17 |

6/30/17 |

8/5/18 |

| # Sales |

125 |

114 |

144 |

112 |

99 |

99 |

102 |

| Avg. $/sf |

$505/sf |

$552/sf |

$550/sf |

$529/sf |

$481/sf |

$532/sf |

$558/sf |

| Median SP |

$1.08M |

$1.129M |

$1.291M |

$1.274M |

$1.11M |

$1.25M |

$1.34M |

| Avg DOM |

60 |

38 |

42 |

54 |

43 |

52 |

36 |

| 0-10 DOM |

24% |

32% |

35% |

28% |

45% |

42% |

31% |

| Lost $$ |

11 |

3 |

7 |

7 |

0 |

1 |

2 |

| DOM = 0 |

5 |

8 |

7 |

2 |

4 |

3 |

8 |

by Jim the Realtor | Aug 1, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market |

Another analysis from the ivory tower. I’d love to see them survey baby boomers and/or realtors, instead of just guess at what might happen.

Baby Boomers, the largest generation of Americans in history until the Millennials came along, have influenced the country since their birth and have created what could be described as a pig in a python in homeownership rates.

They are ageing, the leading edge of the group is now in their 70s, but still, according to Fannie Mae, inhabit 46 million owner-occupied homes with an estimated $13.5 trillion. What happens to the housing market when that generation, voluntarily or not, exit homeownership? Will the four generations following behind the Boomers step up and assume the mantle of homeownership?

While it doesn’t address the results of this inevitable generational shift, research by the University of Southern California and Fannie Mae’s Economic & Strategic Research Group attempts to determine its timing and how precipitously it might occur by analyzing earlier generations of homeowners. The results are reported on Fannie Mae’s Housing Insights blog in an article by the company’s Patrick Simmons and Dowell Myers representing USC.

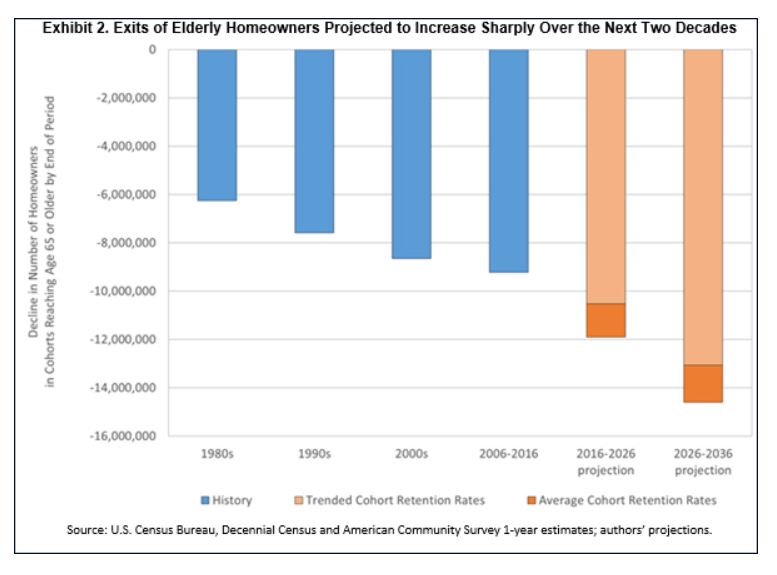

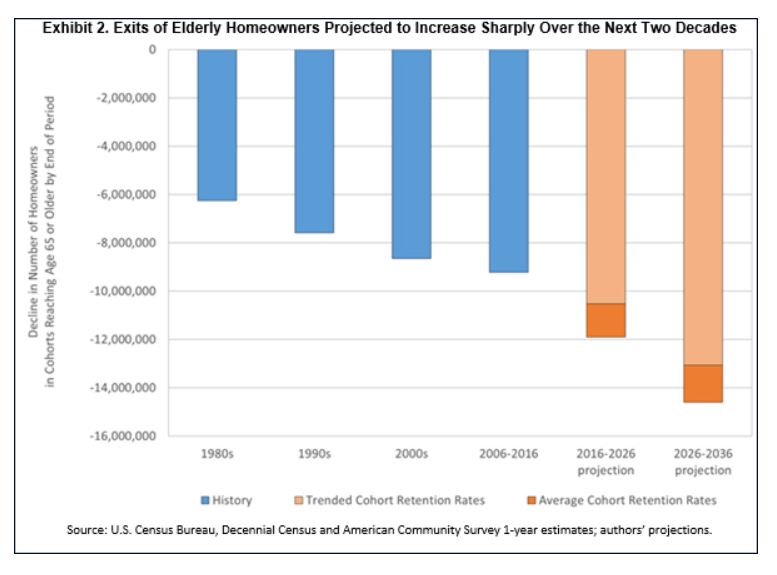

Under all scenarios the authors predict substantial increases in the number of older adults who will exit homeownership over the next two decades.

In the ten years ending in 2016, homeowners who had aged to at least 65 declined by 9.2 million. Over the next ten years, the authors say that number will be 10.5 to 11.9 million depending on the scenarios. Going out ten years more, 2026 to 2036, the 65+ cohorts are projected to shrink by 13.1 to 14.6 million homeowners, a loss at least 42 percent greater than registered during the most recent decade.

The reason these exit numbers increase is, of course, the large number of homeowner adults involved in the relevant cohorts and how each age cohort swells with homeowners as Boomers enter into it. In 2006, when the oldest Baby Boomers were only age 60, the 65-74 age group contained 9.3 million homeowners. By 2016, when the oldest Boomers had reached age 70, that number had swollen to 13.6 million. By 2026, when the youngest Boomers will be age 62 and the oldest age 80, the number of owner-occupants age 65-74 is projected to jump again to about 16.4 million, putting an even greater number of older owners on the precipice of aging-related homeownership attrition.

It will be aging Boomers who will trigger this potential mass exodus, but efforts on the part of industry and government will need to cross generations. One such effort might be to extend the period during which the elderly can remain homeowners such as providing financing for home improvements or community-based support services either of which might allow homeowners to age in place.

At the demand end of the potential problem would be the provision of sustainable home purchase finance options to allow the younger generations to absorb the large number of Boomer homes likely to flood the market. Because immigrants contribute substantially to homeownership demand growth, immigration policy will also likely play a role in determining the adequacy of replacement demand for the homes vacated by Boomers.

The authors conclude that, regardless of the shape such efforts take, “fostering a smooth intergenerational handoff of housing assets will likely require approaches that span the age spectrum and that seek to forge a bond of mutual housing market interests between old and young.”

Link to Full Article

by Jim the Realtor | Jul 25, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market |

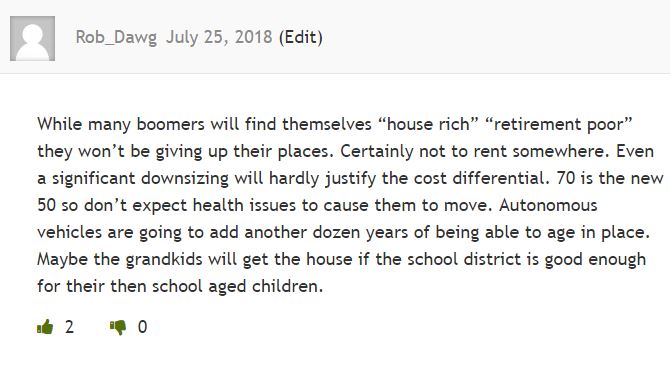

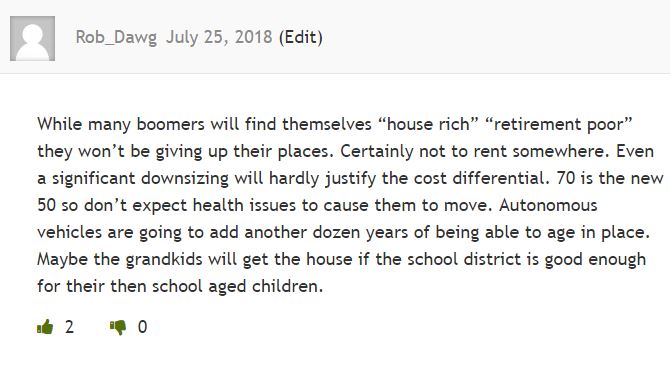

Rob Dawg is skeptical (as I have become) that boomers will be fleeing their long-time residences any time soon:

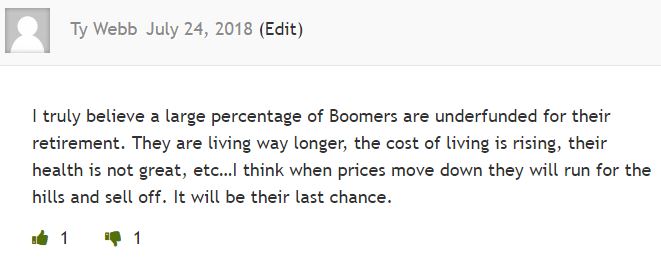

Reader Ty Webb isn’t so sure though:

For the most part, boomers own the houses, so besides the usual Big 3 reasons for selling (death, divorce, and job transfer), the boomers will be making the real estate market for the foreseeable future. If boomers don’t sell, the inventory will remain tight.

I’ll lay off the incessant boomer drivel here after this – for at least a few days! But first, here are excerpts from a post written by people who have real estate licenses, but I’m not sure that’s enough to be so confident about the boomer direction – so take this with a grain of salt:

http://journal.firsttuesday.us/boomers-retire-and-california-trembles2/8531/

Retirees move real estate

At about the age of 65, most Californians stop working full time and begin capitalizing on the benefits of social security, Medicare and their years of saving. The decision to retire is often swiftly followed by a series of lifestyle changes as retirees take advantage of their newly-increased liberty and accumulated financial power.

One of the most significant changes is the sale of the retiree’s current home and the corresponding move to a new, more compact and centralized residence with a better year-round climate or in closer proximity to family. As California’s population continues to age, senior citizens will exert increasing influence over both the housing market and every other aspect of the California economy.

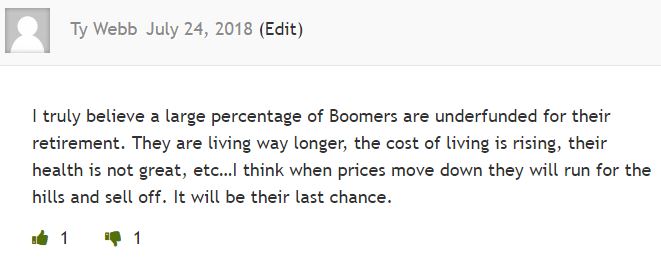

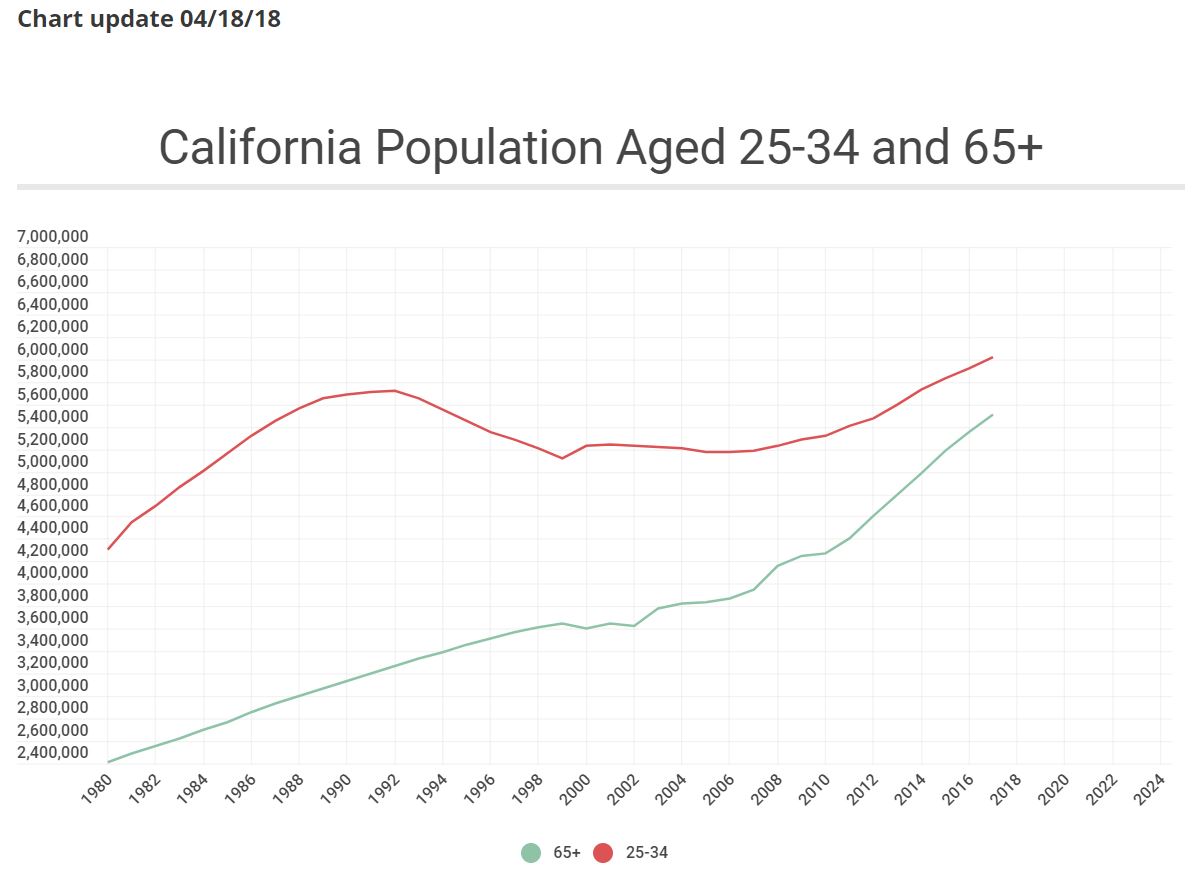

Over the past twenty years, retirees have exerted minimal influence in real estate transactions, as the age group of citizens over 65 was comparatively small. The generations born between 1915 and 1935 – during the Great Depression and World War II – did not have the numbers necessary to remold the housing market in their own image. That is about to change dramatically, as the above population chart demonstrates.

The shadow inventory of retiree homes for sale will thus manifest itself sooner rather than later. Those homes will be key factors in the elimination of the current rigor mortis in the housing industry. Retirees generally want to sell and relocate, and most will buy new SFRs; likely more than 70% will acquire a smaller (though not necessarily less expensive) residence than the one they have left.

Historical trends in Boomer conduct will also prove true now as retirees sell their current homes, looking to find replacement properties and live freer lives. The first Boomers to retire, those on the cusp of the population boom, have somewhat higher average earnings and savings than those who will follow. Consequently, the retirees of 2008-2018 will have the most money to spend, and will often have a second or third home to live in or sell.

Those retiring after 2018 will (generally) have somewhat less money, and thus less purchasing power upon their retirement. Those who retire later will also have a greater disadvantage due to the competition from other retirees in their generation. The homes they sell will fetch lower prices, the urban condos and retirement-community dwellings will be full before they arrive and prices will be rising.

The price reduction of large suburban SFRs caused by Boomer home sales will be further aggravated by a corresponding rise in the values of the more desirable replacement homes in near urban centers. While we cannot predict with certainty which properties will be involved or just where they will be, historical and current trends give us some hints.

Homeownership is a well-entrenched habit among the Boomer generation; a fact not likely to change because of increased age. However, this does not mean retirees remain stationary.

Sooner or later they decide to move to a new location that has a better climate or is closer to other family members. With their collective savings and equity, most will have the resources to do so with ease.

Retirees have traditionally moved to smaller, more conveniently-located properties that are closer to urban centers. The U.S. Census Bureau reported in 2014 that approximately 12% of the population in California’s metropolitan areas is 65 or older.

To complicate Boomer relocation, the younger generation is better educated and more mobile, migrating with increasing frequency to the cities. Their parents are likely to follow. They will be attracted by the increased access to public transportation, the proximity to cultural and artistic institutions and (not least important) the closeness of their children and grandchildren.

Read full article here:

Link to Article

by Jim the Realtor | Jul 24, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Buzz |

It’s just a matter of whether it will be a trickle or a flood:

The preference for baby boomers to age in place has been blamed in part for lower homeownership rates among millennials, who have been forced to compete for a smaller slice of available properties on the market. But now experts warn that even just a slight change in older homeowners’ attitudes could lead to a mass sell-off that would flood certain markets.

Focusing solely on the Washington, D.C. metropolitan area, researchers at George Mason University’s Stephen S. Fuller Institute point to the significant amount of empty-nesters living in properties that might be too large for their current needs. Using Census Bureau data, the team looked at the proportion of homeowners with “extra bedrooms” around the nation’s capital, defined as the number of bedrooms in excess of people who live at each property.

Even under the researchers’ “conservative” classifications — in which a married couple in a home with three bedrooms would be considered to have one extra, despite the likelihood that two of the three were unused — the results were striking. More than a quarter of all homeowners between 2014 and 2016 were in properties that had two extra bedrooms, which works out to more than 270,000 households with at least one resident aged 50 or older.

Though the George Mason team acknowledges that older Americans in the baby boom generation typically prefer to stay put in retirement instead of downsizing, they note that it wouldn’t take much of a mindset adjustment for the cohort to create a seismic effect in certain markets.

“The significant number of older homeowners in larger homes means that even a modest shift in preferences could have an outsized impact on the housing market,” the team wrote in their report, released earlier this month. “If even three percent of homeowners aged 50+ with two or more extra bedrooms decided to sell, an additional 8,210 homes would be put on the market — the equivalent of 12.4% of all the homes sold in the Near-In Washington region in 2017.”

That works out to a 5% to 10% increase in the available homes for sale in that particular area, which includes the District itself and surrounding suburban counties in Maryland and Virginia — an effect that could potentially depress home values.

Still, the researchers note that in the hot Washington, D.C. market, there’s a significant pool of eager buyers: George Mason found nearly 70,000 rental households where the head resident was younger than 50 and took in at least $150,000 per year, along with a significant crop of homeowners with no extra bedrooms who may be looking to expand into bigger properties.

“As a result, the near-term housing market has the potential to be more dynamic than in past years,” the team concludes. “Some longtime owners who wish to sell may have difficulty attaining the price gains they witnessed in their neighborhoods during recent years, when inventory was limited — especially if their neighborhood has a large number of longtime owners who put their homes on the market at once.”

Link to Article

by Jim the Realtor | Jun 22, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Conditions |

It looks like the low-inventory era will be here for a while….

The statistics about the waves of baby boomers turning 65 each day are old news to anyone who works in a senior-focused industry.

But a new report from Harvard University adds a new twist to measuring the coming wave of American seniors: In 2035, households with members aged 65 and older will account for a full third of the homes in the country.

That’s one of the conclusions from a new report published by the Joint Center for Housing Studies (JCHS) at Harvard, which releases an annual look at the complexion of the U.S. housing market. And this year, the researchers specifically pointed out the ways elders will dominate the market for decades to come.

At present, 65-and-olders represent about one in four U.S. households, up from one in five just 10 years ago — thanks to a gain of 7 million senior households over that span. And in a little over 15 years, that number will grow to one in three.

“The aging of the U.S. population has also boosted the number of older households because the baby-boom generation is so much larger than the preceding generation,” the JCHS observed.

Homes headed by those 65 and older were also the only age group that had a higher rate of homeownership in 2017 than they did in 1987.

That growth is coming at the expense of the younger millennial generation, which despite reaching the age that their predecessors were when they began buying homes and starting families, still lags behind.

“In fact, household headship rates among young adults are still declining, albeit more slowly than after the recession,” the JCHS wrote in its report. “Indeed, 26% of adults aged 25-34 were living with parents or other relatives in 2017, while 9% were doubling up with non-family members — both shares all-time highs.”

In addition, adults of all ages are far less likely to move than in years past. While the greatest declines in household mobility have been concentrated among the young, the 65-and-older set has also become increasingly more entrenched in their existing properties.

“Many of the growing number of older households are staying in their homes longer than previous generations at their ages, rather than downsizing or moving to rentals,” the JCHS observed.

Demographic shifts also play a role: Even though the move rate for Americans aged 65 and older dropped by just a percentage point, the sheer volume of aging baby boomers means that change represents “significantly fewer residential moves.”

“There is no doubt that the number of older adults will reach an unprecedented high over the next two decades,” the Harvard team concluded. “With this growth will come different demands, challenges, and stresses on the housing stock.”

Link to Article

by Jim the Realtor | Jun 21, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Conditions, Where to Move |

This story is about the same as Carlsbad folks moving to San Jacinto, where you can buy brand-new houses in the $300,000s. But boomers want to stay within range of their kids and grandkids, so any boomer-flight could be muted.

Link to Full Article

If you’re touring a model home this weekend in Sacramento, chances are the other couple over there, the ones checking out the quartz counters and sizing up the master closet, are not locals.

Emigres from the San Francisco Bay Area will comprise one-third of house hunters in the capital region this summer, real estate analysts predict.

Call it the coastal wave. It started a year ago, and it may be about to peak.

Bay Area residents are inundating Sacramento home developer websites, clicking through floor plans, watching promotional videos and signing up for email blasts, according to Kevin Carson of the New Home Company. His firm is building in El Dorado Hills, downtown Sacramento and Davis.

“I believe this summer, when the kids get out of school, we are going to see a real increase in Bay Area sales,” he said. “We haven’t really seen the wave hit yet.”

Michael Strech, head of the North State Building Industry Association, said he’s checked with other builders and guesses the one-third figure may be conservative at some new subdivisions.

The reasons are obvious: The median price of a Bay Area home hit $850,000 in April, according to CoreLogic, a real estate data company. That’s a $100,000 increase in one year.

In San Francisco, the median price hit $1.3 million. That often buys no more than a 1,600-square-foot house.

In contrast, the April median sales price for a resale home in Sacramento County was $357,000. And the median for a new home was $433,000.

In an eye-opening Bay Area Council survey this month, 46 percent of Bay Area residents said they want to move out of the region within the next few years. They cite the high cost of living, high housing costs, traffic congestion and homelessness.

By comparison, Sacramento’s sparkling new hillside subdivisions and moderately priced midtown condos are hot properties.

Retiree Marie Diaz, 59, of San Jose is among the emigres. She and her former spouse are selling their home for $2 million after a divorce.

Diaz said she found she can’t afford another Bay Area house with her portion of the proceeds.

“Prices here are outrageous,” she said. “I can’t afford to live in this area. I’d be in an apartment.”

She bought a home under construction in El Dorado Hills for $525,000. It has the same square footage as her old home, with an outdoor “California room” and a nearby community clubhouse where she will play bingo and bunco and do yoga.

(more…)