by Jim the Realtor | Apr 28, 2021 | 2021, Boomers, Frenzy, Sales and Price Check

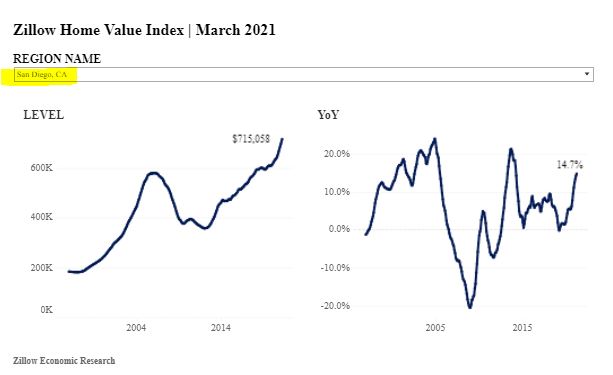

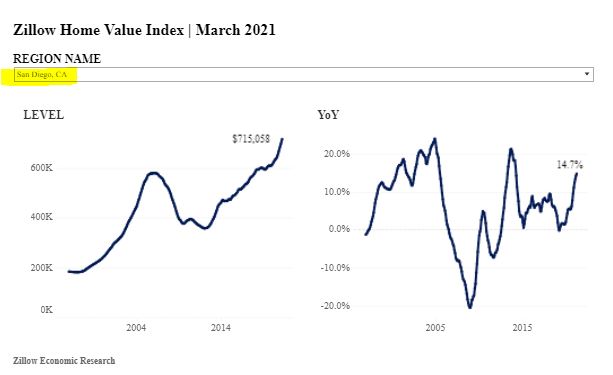

Zillow is optimistic that we will see more homes being listed for sale:

In prior years, inventory has generally increased in March, and the return to some seasonal normality is a positive sign that the market is reaching a more steady state and could see inventory rise more steadily going forward. With home values skyrocketing, vaccination rates rising, and employees getting long-term guidance on where they can work, we expect an increasing number of homeowners to enter the market and list in coming months. That will come as welcome news to home shoppers enmeshed in bidding wars and watching homes get plucked off the market weeks faster than usual.

But their graph shows an interesting trend. Our inventory had already been dropping since the middle of 2019, and is probably why the beginning of 2020 felt hotter than usual:

If we are nearing two years’ worth of declining inventory, than it wasn’t just a Covid-related event – which means the low-inventory environment will persist after Covid is gone.

If baby-boomers control our destiny and continue to age in place, then it may last for years to come.

But does it impact sales?

Here’s how this month’s numbers compare to the full month of April, 2019:

NSDCC Listings and Sales in April

| Year |

Number of Listings |

Number of Detached-Home Sales |

| 2019 |

494 |

265 |

| 2021 |

293 |

268 |

We have already exceeded the number of sales for all of April, 2019 with a few days left to go!

These are the optimal frenzy ingredients of all-time!

If we do see more homes coming on the market, they should all get gobbled up and cause even crazier market conditions as buyers could have a new listing to consider every week, instead of every month. It might even put a dent in the pricing trend that has been going straight up:

https://www.zillow.com/research/march-2021-market-report-29350/

by Jim the Realtor | Apr 21, 2021 | Boomers, Market Conditions, The Future |

The author first explored this topic in 2015, and this follow-up article was published in February:

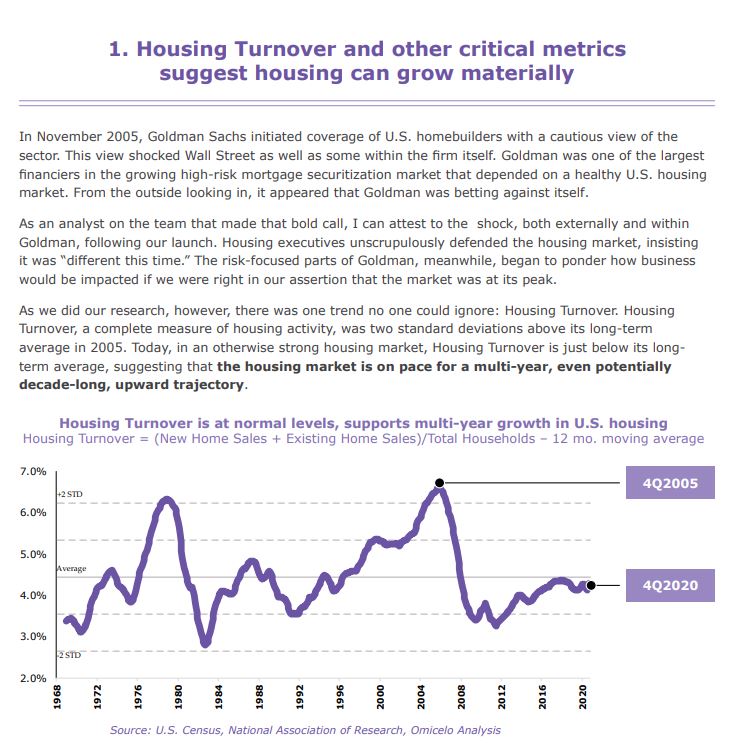

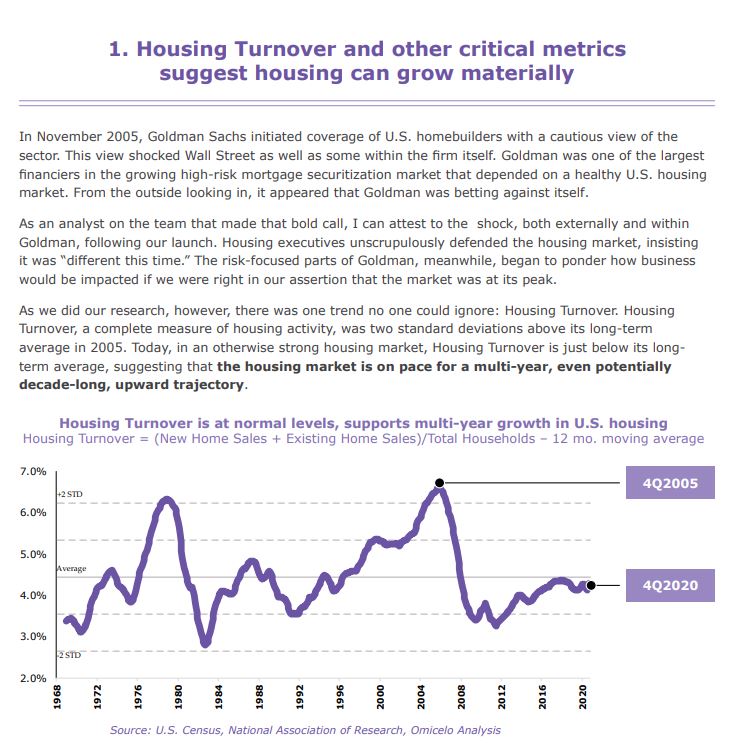

Welcome to the Brave New Housing Cycle: Factors indicate that an extended housing boom is underway.

A new long-term housing boom is upon us. And COVID-19 is the main reason why.

Both housing and economic cycles used to last five to seven years, but the economy has shifted to longer cycles, due to factors such as technology and monetary policy. The housing market has followed suit and the result is what I have defined as the Brave New Housing Cycle, which is poised to last seven to 10 years.

The current Brave New Housing Cycle actually started last year.

Read full article here:

https://www.forbes.com/sites/joshuapollard/2021/02/03/the-housing-market-just-began-a-new-10-year-upward-move/

by Jim the Realtor | Apr 13, 2021 | 2021, Boomers, Downsizing |

The multi-gen home will be a very popular choice for many. From cnbc.com – an excerpt:

Things have changed in the last few years, however, and a new trend has emerged. Rather than downsizing or right-sizing, retirees are starting to upsize. They are moving to bigger homes in their golden years.

According to a recent Merrill Lynch/Age Wave study of more than 3,600 respondents, 49% of retirees didn’t downsize in their last move, and 30% actually ended up moving into larger homes.

And they are doing it for all sorts of reasons — from finding a home that better suits them to buying a home with room for a live-in parent or visiting family members.

According to a recent Del Webb survey conducted among 50- to 60-year-olds, 22% are looking to move to bigger homes. The study also found that 43% want to remain in their existing home or move to a new location with comparable space.

This change marks the first time such a significant majority of retirees have gone against real estate norms.

Let’s take a look at the reasons behind this culture shift and the financial considerations that come into play if you intend to upsize your home.

Read full article here:

Link to CNBC Article

by Jim the Realtor | Mar 16, 2021 | Boomers, The Last Move, Thinking of Buying?

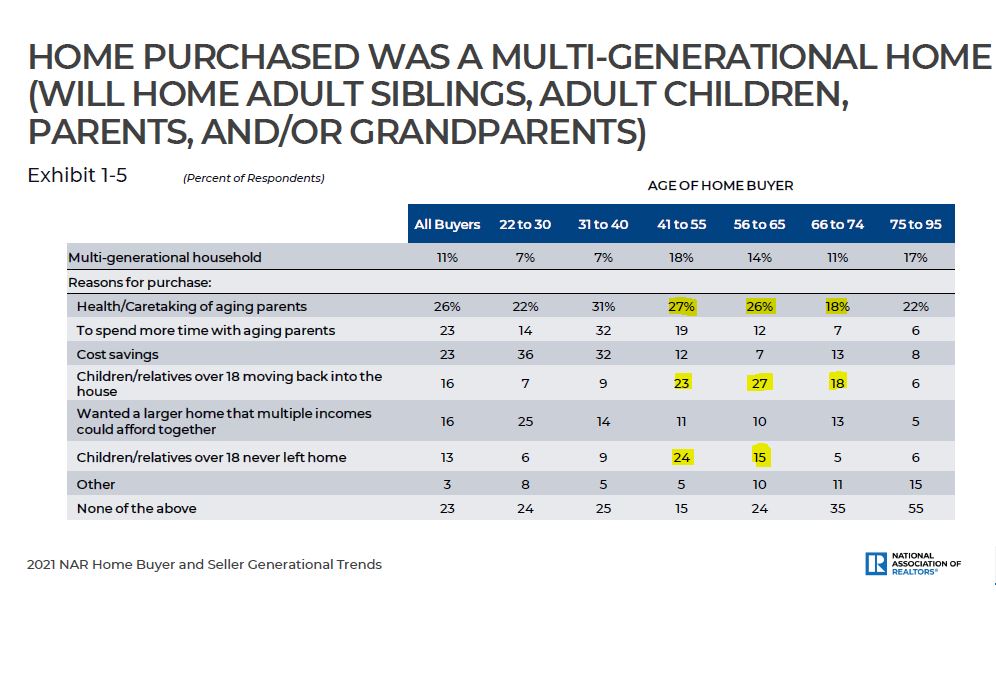

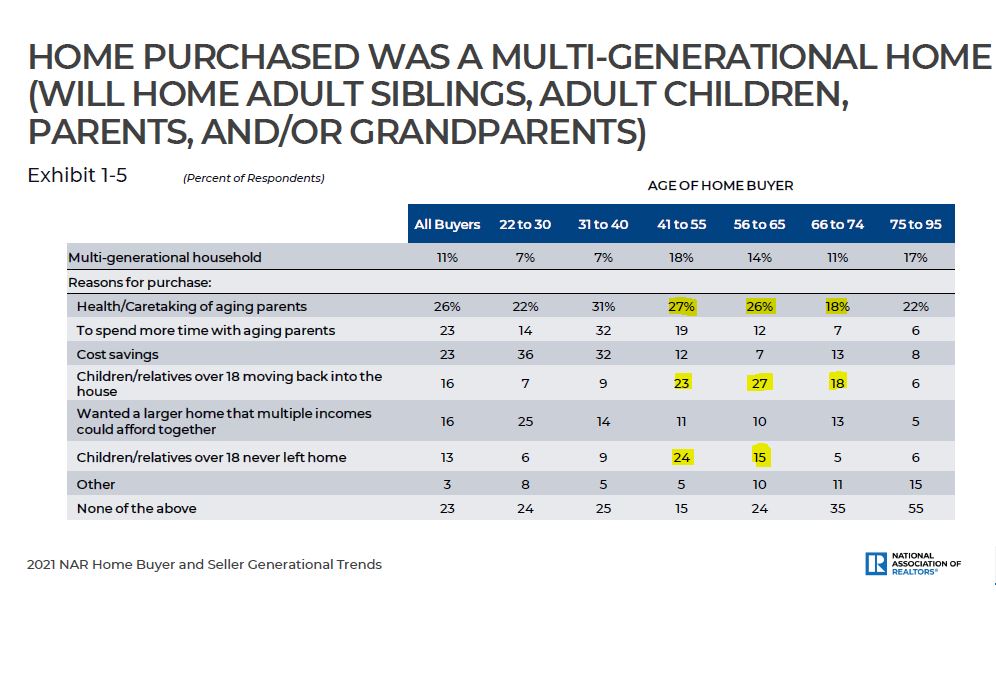

The new NAR report on the characteristics of homebuyers was released today.

Let’s note how many homes were bought to accommodate kids moving back home – or who never left. Past generations never had to worry about kids moving out when everybody could afford a home.

As the prices go sky high, more kids will be faced with either having to move far away if they want/need to buy an affordable home, or live with their parents for the duration – yikes!

One more variable to add to the Reasons-To-Move theories, and help explain why demand is exploding!

by Jim the Realtor | Dec 1, 2020 | Boomers, Jim's Take on the Market, Market Buzz, Market Surge, Sales and Price Check, What's Hot, Why You Should List With Jim |

Remember when it seemed to make sense that because home prices were escalating, people would be buying smaller homes? Boy, did Covid-19 change that – now the larger homes are driving the market, which suggests that the move-up market has come alive:

(To keep a healthy sample size, let’s combine October and November)

NSDCC Sales and Pricing Over/Under 3,000sf

| Oct + Nov |

# of Sales Under 3,000sf |

Median SP |

# of Sales Over 3,000sf |

Median SP |

| 2019 |

265 |

$1,135,000 |

204 |

$1,800,000 |

| 2020 |

362 |

$1,255,444 |

320 |

$2,150,000 |

| % Diff |

+37% |

+11% |

+57% |

+19% |

Rapidly-increasing prices aren’t slowing down sales….and may be speeding them up!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Could the increase in larger-home sales be due to more inventory?

No – actually we have had fewer Over-3,000sf homes listed this year than in 2019:

NSDCC Total Listings between Jan-Nov

| Jan-Nov |

# of Listings Under 3,000sf |

# of Listings Over 3,000sf |

| 2019 |

2,454 |

2,307 |

| 2020 |

2,273 |

2,127 |

| % Diff |

-7% |

-8% |

The larger-home sales were already benefiting from multi-gen buyers needing a place for Mom. Add to that demand the move-uppers who may not need a place for Mom yet, but if they sense it might be coming in the near future, then might as well buy bigger now – and maybe get granny to throw in some of her dough!

by Jim the Realtor | Nov 21, 2020 | 2021, Boomer Liquidations, Boomers, Local Government, The Last Move, Thinking of Buying?, Thinking of Selling? |

The U-T asked their twelve real estate experts about the effects of Prop 19:

Q: Will Prop. 19 substantially increase home inventory in California?

Of the local experts, 11 out of 12 said NO, and the justification for the one YES answer could have been just as easily been reasons to say NO. Gary’s answer above was the best and most-accurate. See the rest here:

Link to Article

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

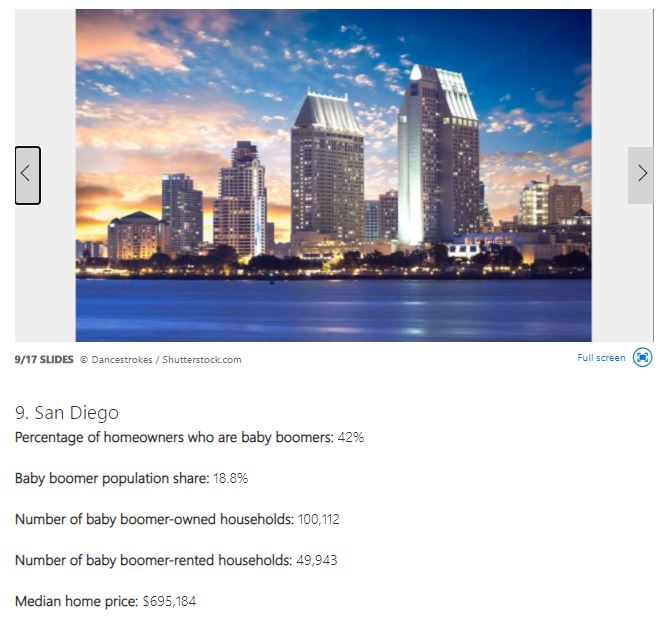

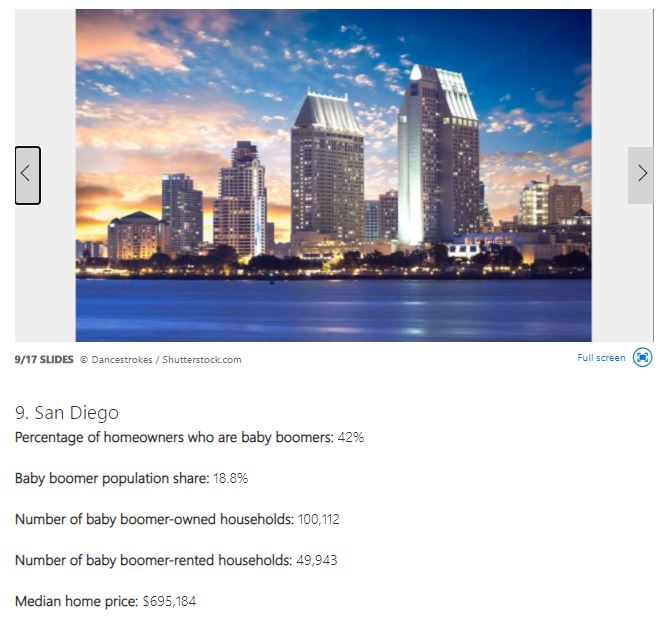

by Jim the Realtor | Oct 30, 2020 | Boomer Liquidations, Boomers, Jim's Take on the Market, Local Flavor |

The boomer sales spree is inevitable, it’s just a matter of when. But if it’s a slow methodical process over the next two decades, will we even notice? Let’s say the 100,112 homes turn over in the next 25 years (and only 1/3 are inherited by the kids), we’d average 223 more sales per month. There were 3,827 residential sales in the county in September. Results may vary!

Homeownership has long been considered part of the American dream. But first-time homebuyers — especially millennials and Gen Xers — are facing an uphill battle when it comes to house hunting.

This is in part because of a growing trend in which baby boomers, the generation that owns the largest share of American homes, are planning to stay put. In fact, a 2018 survey conducted by AARP found that 76 percent of Americans over the age of 50 would prefer to remain in their current home — rather than move in with family, to a nursing home, or to an assisted living facility. That is leading to less inventory for new buyers.

According to the U.S. Census Bureau, the share of homeowners over the age of 55 has been steadily increasing. In 2008, at the onset of the Great Recession, Americans over the age of 55 owned 44.3 percent of homes. By 2019, that percentage had increased to 53.8 percent. While the share of homeowners under the age of 35 remained fairly steady within the same time span, the share of homeowners between the ages of 35 and 54 decreased from 42.3 percent to 34.1 percent.

While baby boomers — defined here as Americans between the ages of 55 and 74 — comprise just over 22 percent of the U.S. population, they account for nearly 42 percent of homeowners nationwide.

Link to Full List

by Jim the Realtor | Sep 29, 2020 | Boomer Liquidations, Boomers, Builders, Jim's Take on the Market, Market Buzz |

My friend Ken Perlman at JBREC consults with new-home builders primarily, but these thoughts apply to the resale market too – notably, the 65+ generation growing by 17 million people in the next ten years!

With the national housing market surging, active adults have decided it is time to participate again. As discretionary buyers, they’ve had time to “restart” their purchasing process, and many of our developer and builder clients report that with proper health precautions in place, they’ve been willing to do so. In many age-qualified communities across the nation, home sales were particularly strong in August and September.

The pandemic hasn’t changed the size of the active adult population or its motivations. The active adult buyers are a key component of housing demand, as the 65+ population will grow by a net 17 million people over the next ten years. We know one of the highest priorities for this buyer set is being close to children and grandchildren. This means that as the Great American Move takes place in hot markets from Phoenix to Southern California’s Inland Empire to Sarasota, Florida, active adult buyers are following.

They are wealthy with large homes they can sell. Our active adult developer and builder clients told us one of the biggest fears their buyers had heading into the pandemic was the negative impact on their stock portfolios and on the homes they had to sell. Those fears have largely subsided with a rising stock market where the S&P 500 is up 10% year over year (YOY) and existing home Google searches up 30% YOY, as well as the Burns Home Value Index (BHVI) up 5.5% YOY.

4 Keys to Success

Active adult buyers are ready to buy now, so make sure you have inventory. Builders we spoke with in the active adult space told us standing inventory numbers are low, and some are tripling the number of standing inventory homes they produce to satisfy demand. Some are also simplifying what they offer in their homes, a process that streamlines housing production and keeps new home prices more attainable. Despite their wealth, these buyers are still prudent about how they spend their money.

Design elements that appeal to primary buyers also appeal to active adults. Per JBREC’s Consumer Products and Insights survey, more than 70% of new home shoppers between the ages of 55 and 69 included a member who worked at least part time. Work-from-home spaces were always critical to this buyer and are even more so today. Indoor/outdoor spaces are top of mind for active adult buyers, particularly those who live in warmer climates. Opportunities to live in the “healthy” outside while still maintaining cover is a big reason why open corner sliders and outdoor living rooms are immensely popular among this buyer set.

A strong virtual presence is essential. Active adult buyers are not afraid to use technology to search for a home; they rely on it. Active adult developers and builders around the country reinforce that their buyers are doing extensive research online before ever coming to the sales office, and we’ve heard reports of conversion rates among prospects in this space tripling post-pandemic. With travel more restricted and the market expanding rapidly, some active adult buyers are tying up their lots and homes efficiently via builder websites before ever visiting the neighborhood. Empire Communities in Atlanta told us, “We leveraged our virtual platforms, created new virtual platforms, optimized our online campaigns and online sales consultant initiatives, coached the sales teams to get out of their comfort zones, and shifted into a ‘we got this’ attitude.”

Active adult buyers still want to visit sales offices before they buy. While technology is helping buyers become educated, developers were universal in their opinion that this buyer cohort still want to make its final purchase in person. This means that an on-site sales office, decorated models, and well-organized system for coordinating appointments are still critical for selling homes to this buyer profile. Our clients across the country told us that with proper safety precautions in place, active adult buyers prefer visiting sales offices or models in person.

While the first-time and move-up buyers have clearly been the headlines of the housing market resurgence, the active adult buyer is starting to reemerge. We are assessing active adult housing across the country and watching product trends and buyer preferences. Let us know how we can be a resource for you. kperlman@realestateconsulting.com

by Jim the Realtor | Sep 28, 2020 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Buzz, Virus |

Who is selling? The chart below tracks when the home was purchased by the sellers. Today’s numbers are from those sales closed between Aug 21-31 of this year:

| Year Purchased |

12/13/16 |

4/3/17 |

6/30/17 |

12/4/17 |

2/16/20 |

9/28/20 |

| 0 – 2003 |

57% |

48% |

32% |

47% |

34% |

29% |

| 2004 – 2008 |

19% |

15% |

12% |

15% |

18% |

15% |

| 2009 – 2011 |

6% |

7% |

14% |

10% |

4% |

9% |

| 2012 – 2020 |

13% |

25% |

34% |

24% |

35% |

44% |

| New Home |

4% |

4% |

7% |

4% |

9% |

3% |

So much for my theory about boomers leaving town! Today’s percentage of long-time owners sellers was the lowest yet…..but we know that over 50% of boomers delayed selling their home due to covid.

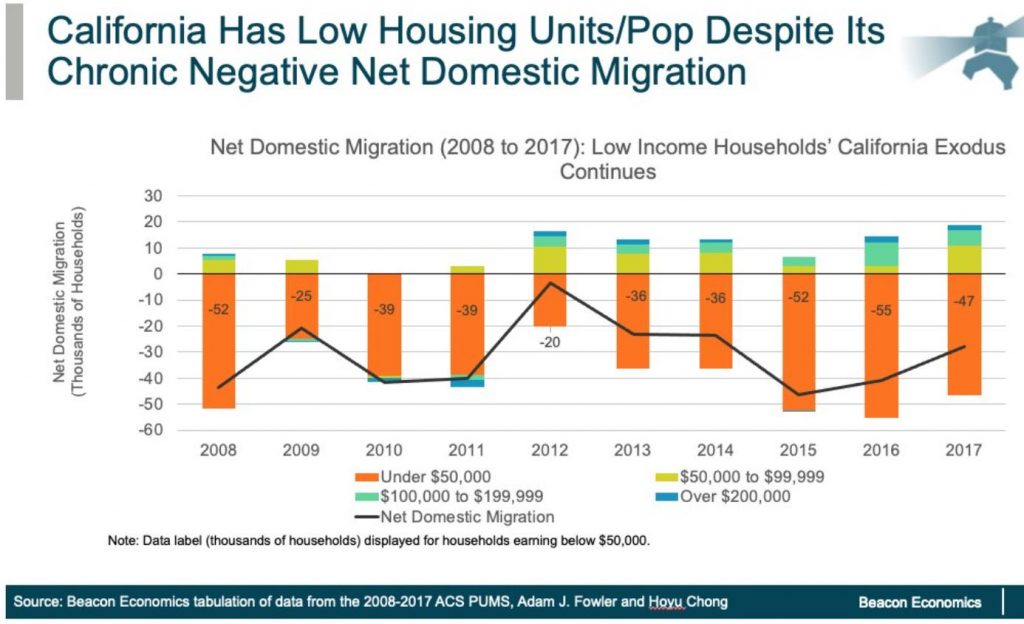

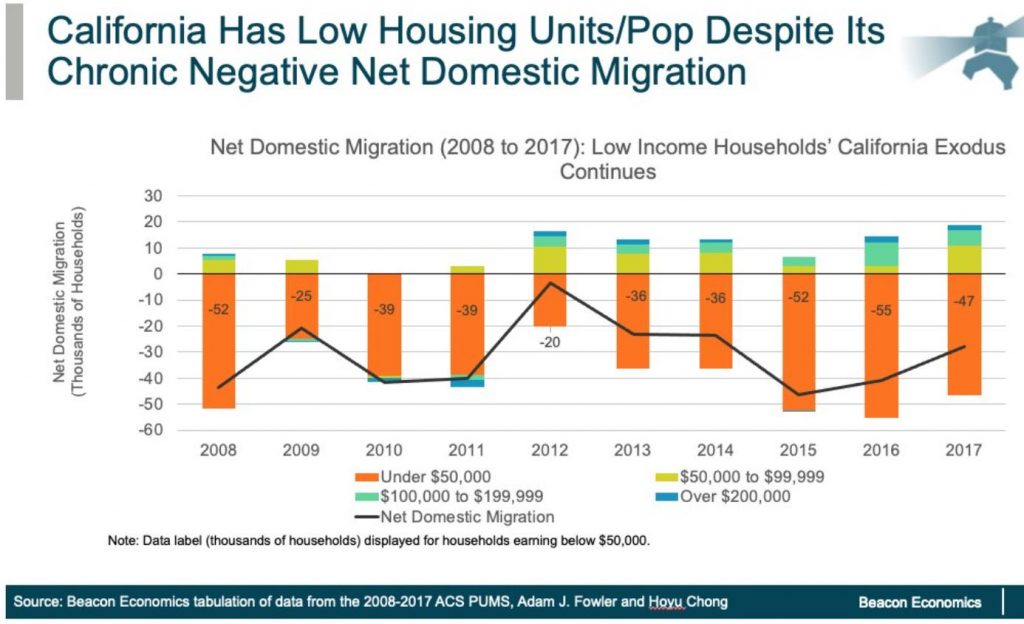

The chart at the top (click to enlarge) shows the California migration, and it’s a money thing.

People who leave the state find it too expensive here, and can do better elsewhere – and are willing to go for it! Younger people are probably more inclined to leave, at least at first. Grandparents to follow!

Of course, even the recent purchasers have no problem selling for a decent-to-huge gain, and more of them have been taking their profits – and hopefully buying another home, either here or elsewhere. Though the 2012-2020 group is the only one that grows just because we’re adding years over time.

More stats:

| Other |

12/13/16 |

4/3/17 |

6/30/17 |

12/4/17 |

2/16/20 |

9/28/20 |

| # of Sales |

144 |

112 |

99 |

99 |

116 |

130 |

| Avg. $$/sf |

$550/sf |

$529/sf |

$481/sf |

$532/sf |

$523/sf |

$612/sf |

| Median SP |

$1.291M |

$1.274M |

$1.11M |

$1.25M |

$1.18M |

$1.46M |

| Avg DOM |

42 |

54 |

43 |

52 |

47 |

39 |

| 0-10 DOM |

35% |

28% |

45% |

42% |

28% |

45% |

| Lost $$ |

7 |

7 |

0 |

1 |

2 |

0 |

| DOM = 0 |

7 |

2 |

4 |

3 |

4 |

2 |

There were four flippers in today’s group, same as last time.

by Jim the Realtor | Sep 10, 2020 | 2021, Boomer Liquidations, Boomers, Jim's Take on the Market, Tax Reform, Thinking of Selling? |

Proposition 19 is on the ballot, and the California Association of Realtors wants you to believe that if it passes, there will be a surge of new inventory from seniors finally being able to sell their homes and take their ultra-low property-tax basis with them to a new home in a county not previously available.

They have deftly orchestrated a campaign that touches on all the hot buttons too. Just look at the title – who doesn’t want to protect the homes of seniors, severely-disabled, families, and victims of wildfire or natural disasters?

But they ignore that seniors have been able to sell and take their ultra-low property-tax basis with them for years – but only if they move to one of the 10 counties in California (out of 58) who have previously approved the benefit.

The ten counties are the major population centers; Alameda, Los Angeles, Orange, Riverside, San Bernardino, San Diego, San Mateo, Santa Clara, Tuolumne, and Ventura. So they want us to believe that seniors have always wanted to move to the sticks – and if passed, the taking of their property-tax basis is the game-changer that gets them to finally move?

Other thoughts:

- How much do seniors need to spend on a replacement home in the sticks? Half a million should do it, so without Prop 19, the regular tax basis would be around $5,000 per year. If a senior pays less than $2,000 annually on their old home….the actual savings isn’t a large amount ($1,000 to $3,000 annually) but yes, every little bit helps.

- Did the grandkids already move to the same town? Probably a more-important ingredient than saving $1,000 to $3,000 per year.

- It only benefits seniors leaving the big cities for small towns. Are they going to live without their modern conveniences like doctors (a big issue), shopping, entertainment, and a way of life to which they’ve become accustomed to for decades, just to save $1,000 to $3,000 per year?

- Prop 19 protects the ability of kids and grandkids to inherit the ultra-low tax basis from the parents and grandparents. How does that create more homes on the market?

But the Association is throwing their full weight behind Prop 19, have gotten the firefighters on board in order to play the wildfire card, and they are advertising on TV:

To me, the thought of Prop 19 creating “tens of thousands of housing opportunities” is preposterous. But seniors are overdue, and maybe it will be the final reason that gets them to move. For that reason, let’s add the passing of Prop 19 to our list of reasons why the 2021 selling season will be like no other!

Check out their impressive website:

https://www.carhomecoalition.com/