by Jim the Realtor | Dec 14, 2018 | Boomers, Jim's Take on the Market, Remodel Projects, Repairs/Improvements, Tips, Advice & Links

Earlier this week the grays were on their way out, but it may take a while. Can you believe that 34% are removing the bathtub? From Houzz:

Anticipating Aging Needs: The majority of baby boomers (ages 55 or older) are addressing current or future needs of aging household members during master bathroom renovations (56%). One-third of boomers are addressing current aging needs (35%), while nearly a quarter are planning ahead for future needs (21%).

Curbless Enthusiasm: Nearly half of boomers change the bathroom layout and one-third remove the bathtub (47% and 34%, respectively). Other upgrades include installing accessibility features such as seats, low curbs, grab bars and nonslip floors in upgraded showers and bathtubs.

The Suite Life: Homeowners are focusing on the master suite as a whole, with nearly half of master bathroom projects accompanied by master bedroom renovations (46%). Master bathrooms command the second-highest median spend ($7,000) in home remodels, behind kitchens ($11,000), while master bedroom spend rivals that of living rooms ($2,000 versus $3,000, respectively).

Premium Features Galore: A surprising one in 10 master bathrooms is the same size or larger than the master bedroom (11%). Beyond size, premium features in master bathrooms are on the rise, with dual showers, one-piece toilets, vessel sinks and built-in vanities showing significant increases in demand in the last three years.

Bathed in Gray: Gray palettes continue to lead in walls and flooring and are increasingly popular in cabinets. Newcomer styles continue to overtake contemporary style, with farmhouse more than doubling in popularity, from 3% in 2016 to 7% in 2018. Matte nickel and polished chrome are the most common metal finishes.

Link to Article

by Jim the Realtor | Dec 9, 2018 | Bailout, Boomers, Jim's Take on the Market, The Future, Thinking of Buying? |

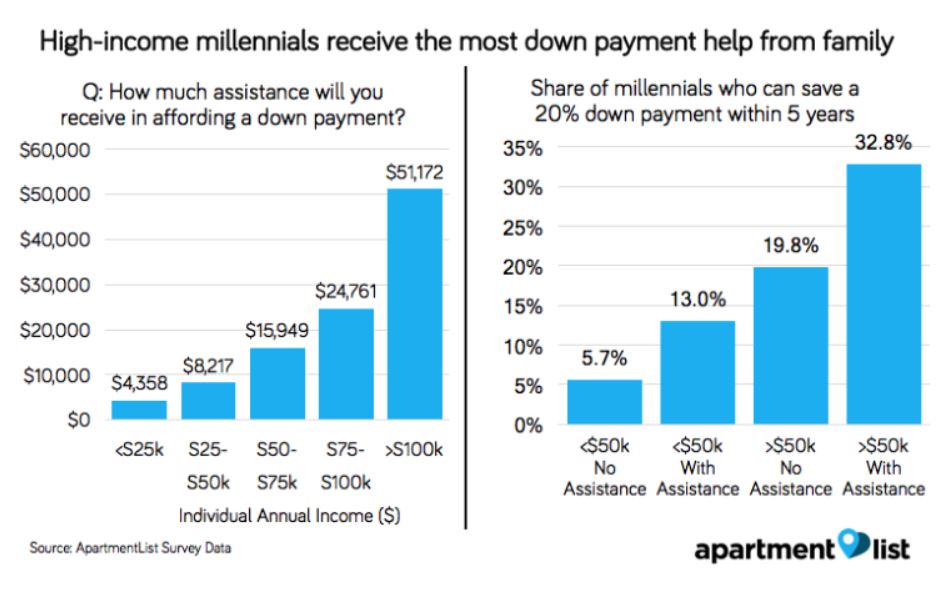

How can the market keep going? Generational wealth distribution!

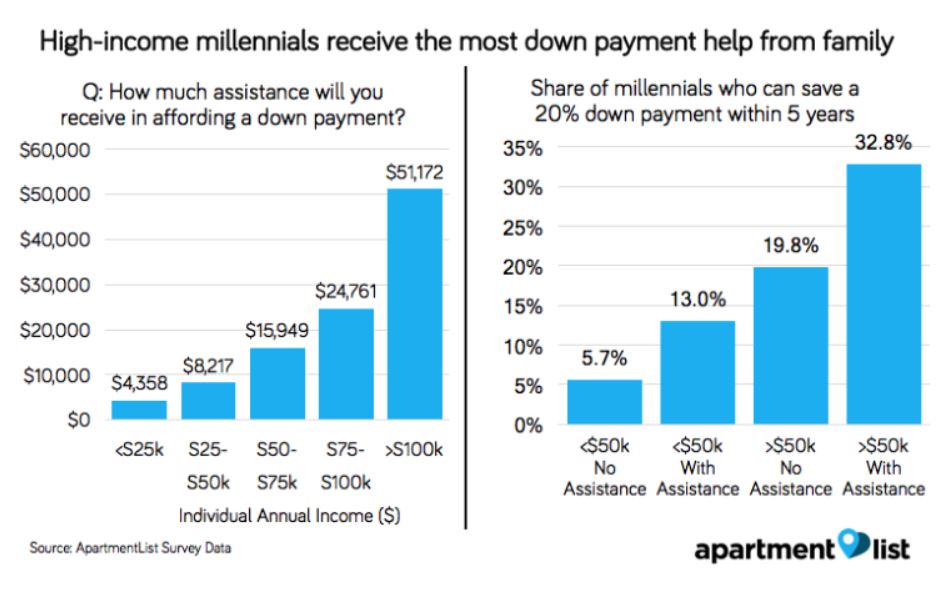

Among respondents with an annual income over $100,000 who anticipate familial help with a down payment, the average expected level of support is over $50,000, enough for a 20 percent down payment on the national median condo price.

This is more than twice the expected down payment assistance of those making between $50,000 and 75,000, and over ten times that of those making less than $25,000, who expect to receive $4,358 on average.

This finding highlights the chronic nature of wealth inequality — not only do lower-income millennials have less purchasing power themselves, but their families have less support to offer.

We find that when it is available, familial down payment assistance can put homeownership much closer in reach.

Among millennials earning more than $50,000 and expecting help with a down payment, we estimate that 32.8 percent will be able to acquire a 20 percent down payment within the next five years, compared to 19.8 of those with similar earnings but no expected down payment assistance.

Among those earning less than $50,000, the prospects are notably worse, but those who expect down payment help still see a significant step up compared to those expecting no help. While help from family can make homeownership a more attainable goal, this option is available to a minority of millennials, with the largest benefits accruing to those earning the highest incomes.

Link to Article

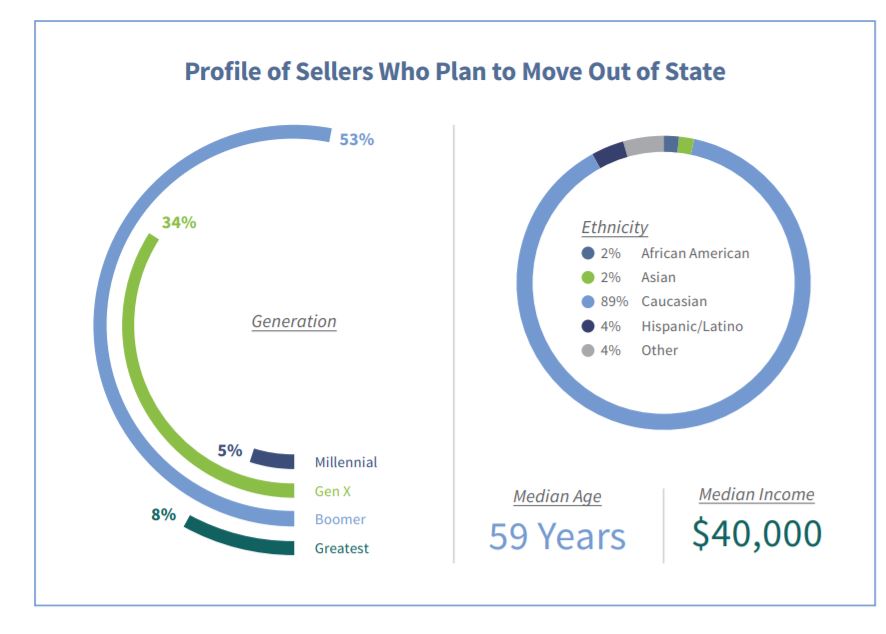

by Jim the Realtor | Dec 8, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market

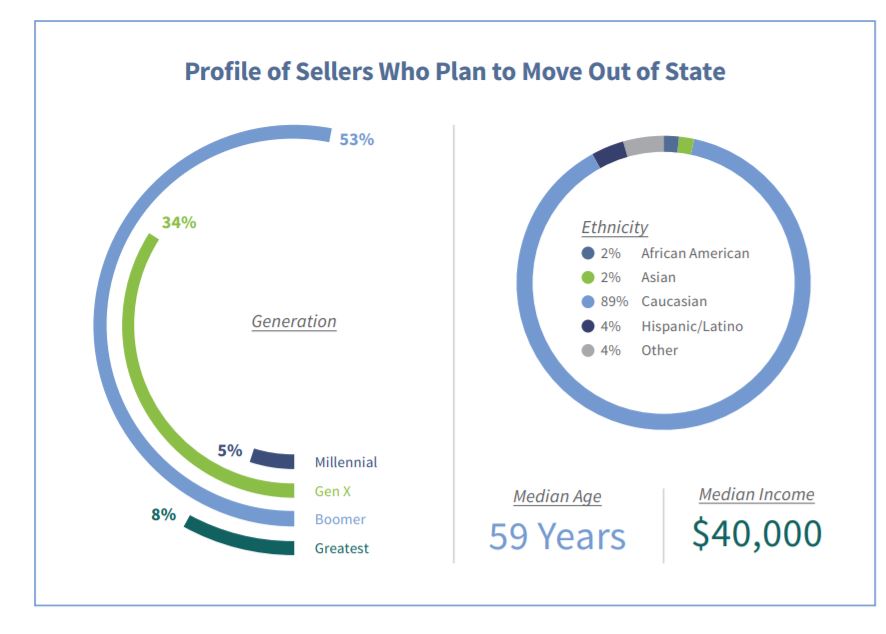

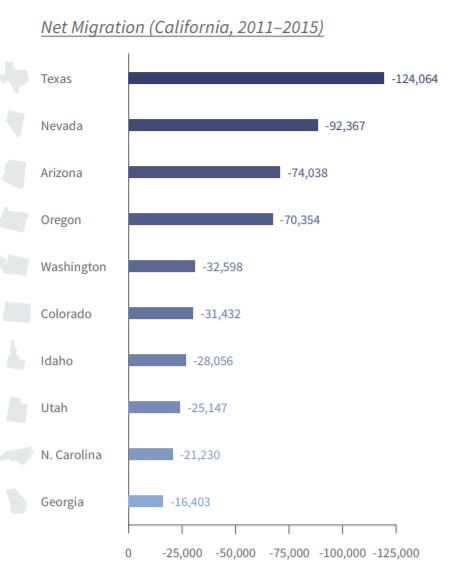

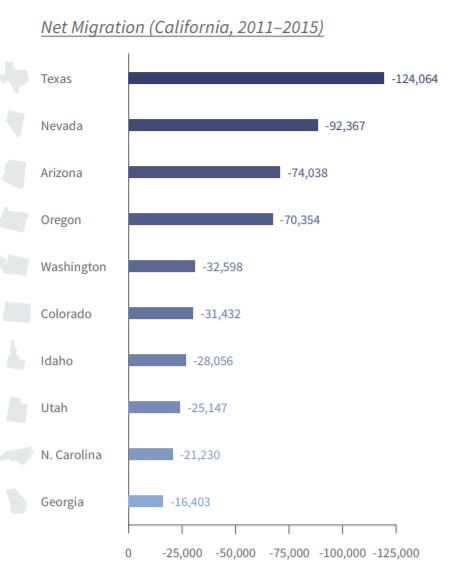

Here’s a visual that sums it up pretty well.

Where are they going?

https://www.car.org/marketdata/surveys/ahs

by Jim the Realtor | Dec 4, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market

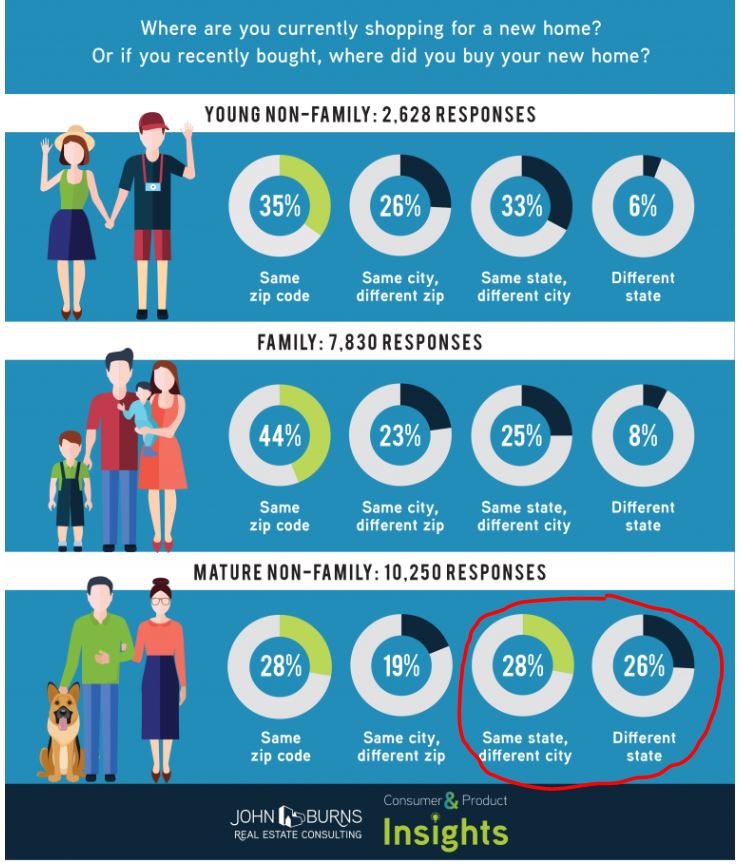

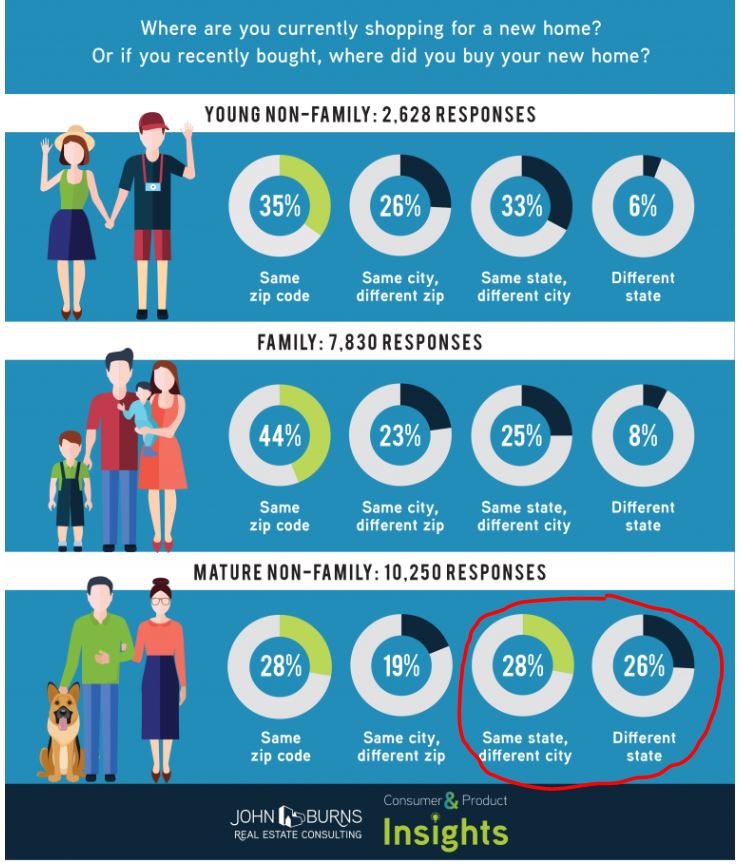

When moving, younger singles, couples, and families tend to stay in their same area, while seniors are more likely to be leaving town.

From our friends at JBREC:

Link to Article

by Jim the Realtor | Dec 1, 2018 | ADU, Boomer Liquidations, Boomers, Homeless Cure, Jim's Take on the Market, Modular Homes, Real Estate Investing, Remodel Projects |

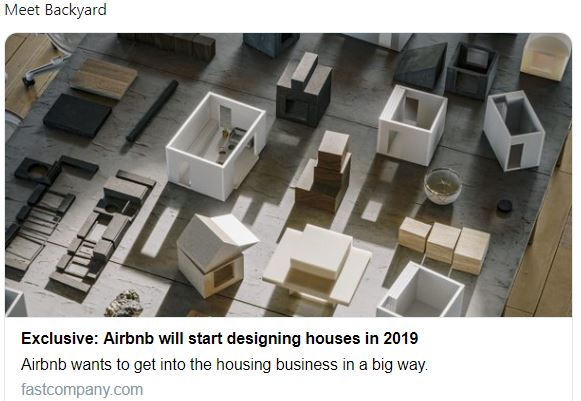

If baby boomers have to sell their home because they need the money, this will be a great alternative – and could help to dry up the housing inventory, especially if you can build an ADU for less than $50,000. Homes with bigger yards would be more valuable too.

Link to Article

Today, Samara is announcing a new initiative called Backyard, “an endeavor to design and prototype new ways of building and sharing homes,” according to a press statement, with the first wave of test units going public in 2019.

It means Airbnb is planning to distribute prototype buildings next year.

The name “Backyard” might imply that Airbnb just wants to build Accessory Dwelling Units (ADUs), those small cottages that sit behind large suburban houses and are often rented on Airbnb. Gebbia clarifies that is not the case. “The project was born in a studio near Airbnb headquarters,” he says in an interview over email. “We always felt as if we were in Airbnb’s backyard–physically and conceptually–and started referring to the project as such.”

Backyard is poised to be much larger than ADUs, in Gebbia’s telling. Yes, small prefabricated dwellings could be in the roadmap, but so are green building materials, standalone houses, and multi-unit complexes. Think of Backyard as both a producer and a marketplace for selling major aspects of the home, in any shape it might come in.

(more…)

by Jim the Realtor | Oct 26, 2018 | Auctions, Boomer Liquidations, Boomers, Estate Sales, Jim's Take on the Market

This idea is ingenious!

Maxsold has a team of staff people in San Diego County to come to your house, photograph all your stuff, and then sell it online for you!

Check out this video:

Get started here:

https://infl.tv/eLwm

by Jim the Realtor | Oct 8, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Conditions

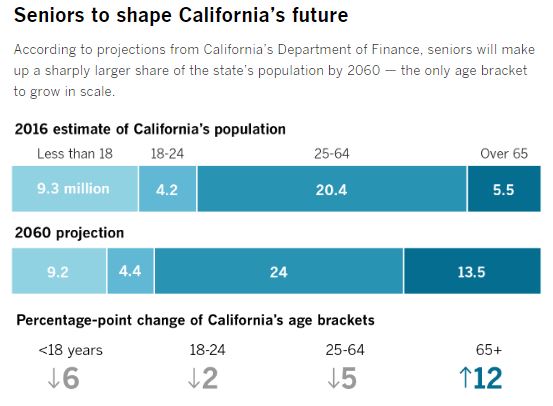

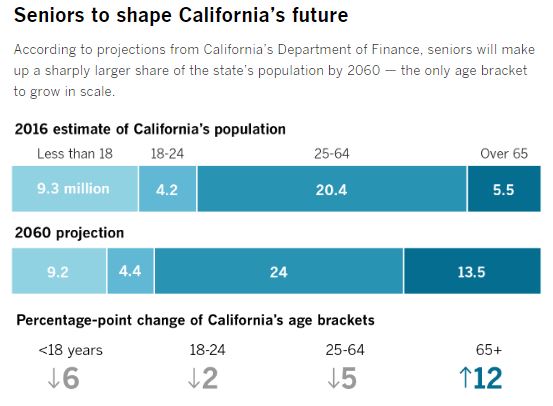

In the last post we saw how expensive kids can be, and taking care of the growing number of seniors is another strain on the Bank of Mom and Dad. Thanks daytrip for sending this in from the latimes.com – an excerpt:

“We are exquisitely unprepared for that [oldest] age demographic pushing through,” said Dr. Bruce Chernof, president of the SCAN Foundation, an aging advocacy group.

By many measures, California is not ready to meet the demand for long-term care. Just under 2% of residents are insured for it, according to the state Department of Insurance.

A 2014 poll found that just 3 in 10 Californians over age 40 felt very confident about their ability to pay for future care. And the Employment Development Department projects that the state will need 250,000 more personal care aides by 2026, a growth rate of 40%.

Nancy McPherson, the California state director for AARP, said long-term care is the No. 1 issue for the retiree advocacy group.

“It’s not enough to have service delivery,” McPherson said. “You need to have a coordinated system, and you need to have a means for middle-income Californians to get the support they need.”

Though wealthy Californians can rely on long-term care insurance or ample savings and the poorest can qualify for safety-net programs, the middle class is especially vulnerable when it comes to paying for care.

The out-of-pocket costs can be staggering, and Medicare, the federal healthcare program for seniors, does not cover long-term care. A 2017 survey by Genworth, a long-term insurance company, found the average yearly cost for a home healthcare aide was $57,200. The median cost for a private room in a nursing home was more than $116,000.

“You are depleting generational wealth, ensuring it is not passed down,” said Kristina Bas Hamilton, legislative director of United Domestic Workers, a union of home care providers. “You are essentially demolishing the American dream of the kids doing better than the parents.”

Read full article here:

http://www.latimes.com/projects/la-pol-ca-next-california-demographics/

by Jim the Realtor | Oct 7, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Conditions |

Factor in the cost of raising children into the future housing demand – how much farther can the Bank of Mom and Dad go? Hat tip daytrip:

The average cost of raising a child until age 18 today is more than $230,000— but that number only gets higher when children leave the nest. In fact, many parents consider it to be the most expensive stage of parenting, according to Merrill Lynch’s new “The Financial Journey of Modern Parenting: Joy, Complexity, and Sacrifice”report.

The bank surveyed more than 2,500 American parents and found that 79% of parents continue to provide financial support to their adult children — contributing to an estimated $500 billion annually. That’s twice the amount they save for retirement — $250 billion annually — according to the report. There are 173 million parents in the US, according to Merrill Lynch.

“When emotions and money become intertwined, parents risk making financial decisions that can compromise their financial futures,” states the report.

Seventy-two percent of parents revealed they put their children’s interests ahead of their own need to save for retirement. On top of that, 63% of parents reported sacrificing their own financial security for their children’s sake. Specifically, Asian, Latino, and African American parents are more likely to give up financial security for their children, the report found.

So what exactly are parents paying for? The answer is both big and small, with parents covering necessities, like rent or mortgage, as well as luxuries, like vacations.

Of the $500 billion total amount parents are spending on adult children, college education comprises about one-fourth, according to the report; groceries and food cost $54 billion annually and cell phone service costs $18 billion, with many parents covering the full cost, not just handing over a few dollars.

But that total doesn’t count big-ticket items — about 60% of parents help pay for their adult child’s wedding and 25% help pay for their child’s first home.

Link to Full Article

by Jim the Realtor | Sep 28, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market, Market Buzz

Here’s the interesting excerpt from this article – the other alternatives that older adults might consider:

Communities become a source of support and engagement for residents, particularly for older adults, who have an even stronger desire to age in place. The AARP survey finds many adults age 50 and older are willing to consider alternatives such as home sharing (32%), building an accessory dwelling unit (31%) and villages that provide services that enable aging in place (56%).

Link to Article

by Jim the Realtor | Sep 8, 2018 | Boomer Liquidations, Boomers, Jim's Take on the Market |

A study released Thursday by Trulia examined the housing situations of homeowners 65 and older and compared it with a decade ago. It uncovered a 3.4% jump in the number of seniors working in 2016 compared with 2005, and a 1.7% increase in the number living with younger generations.

It also showed that seniors appear to be holding off on downsizing just the same as they were 10 years prior.

Only 5.5% of seniors moved, according to Trulia, and of those who did, the split was pretty even between single-family and multifamily residences.

But Trulia analyst Alexandra Lee points out that while the percentage of downsizers hasn’t changed, the number of those moving actually has.

“Because the Boomer generation is so much larger than previous generations, that 5.5% moving rate translates into very different raw numbers across the years,” Lee wrote. “There were about 7 million more senior households in 2016 than 2005, meaning 386,000 more senior households moved in 2016.”

The age at which seniors decide to downsize has also shifted. The survey revealed that in 2005, seniors were moving into multifamily residences by age 75. By 2016, this had moved to 80.

Link to Article