Carmel Valley

I don’t know the exact location of the new tract coming soon, but it will be a gated community off RSF Farms Rd.

I don’t know the exact location of the new tract coming soon, but it will be a gated community off RSF Farms Rd.

If this sort of good news holds up, look forward to the Fed bumping their rate again. Mortgage rates have come down since the last Fed hike!

From MND:

http://www.mortgagenewsdaily.com/05242016_new_home_sales.asp

New home sales surged in April after a disappointing report in March. The Census Bureau and the Department of Housing and Urban Development said today that sales were at a seasonally adjusted annual rate of 619,000, an increase of 16.6 percent from the previous month and 23.8 percent higher than in April 2015. That said, it should be noted that this report has a notoriously high margin of error, with this month’s ringing in at 15.4 percent.

Sales in March were also higher than earlier reported. Last month’s report had those sales down from February by 1.5 percent to a seasonally an annual rate of 511,000. That number

On a non-seasonally adjusted basis there were 61,000 newly adjusted homes sold during the month. In March sales totaled 50,000.

At the end of the reporting period there were an estimated 243,000 new homes for sale nationwide. This is estimated at a 4.7-month supply at the current rate of sales, down from 5.5-months in March.

The median price of a new home sold in April was $321,100 compared to $292,700 a year earlier. The average sales price was $379,800 compared to $334,700 in April 2015.

The Mortgage Bankers Association, based on the numbers of applications submitted to the mortgage subsidiaries of new home builders, had predicted sales to decline 11 percent from March. On a non-seasonally adjusted basis they had projected sales at 48,000 units, down from 54,000 units in March.

Sales in the Northeast were up 52.8 percent from March and an astounding 323.1 percent from the previous year. Sales in the Midwest declined by 4.8 percent and 9.1 percent from the two earlier periods.

Sales of new homes in the South rose 15.8 percent from March and 18.1 percent year-over-year. The West saw sales increase by 18.8 percent month-over-month and 23.6 percent for the year.

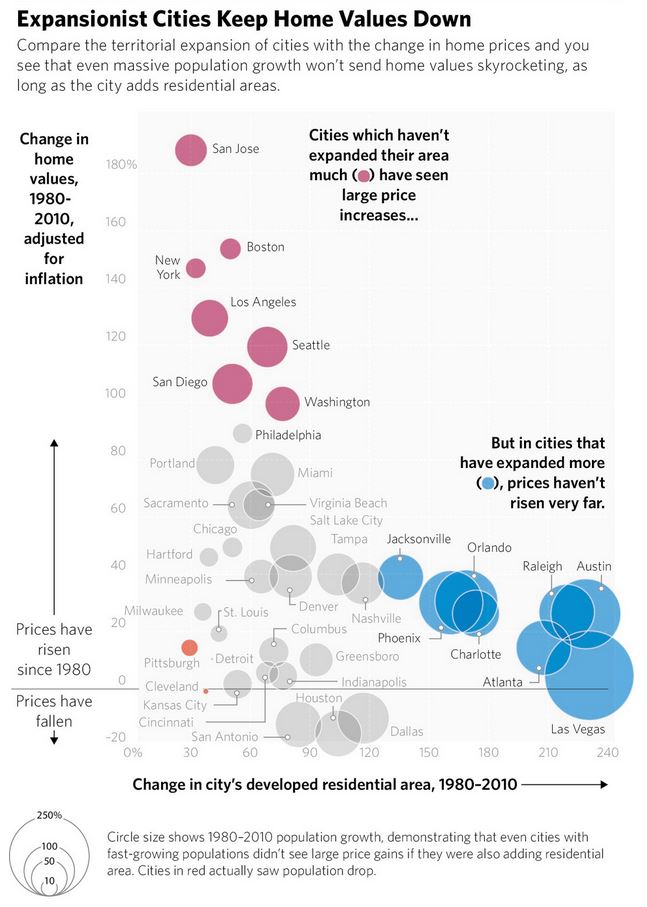

Millienials – or anyone feeling priced out – really should support permissive housing policy to help keep a throttle on prices. Here’s evidence showing that faster-growing cities have more-modest price increases, although this chart is older (prices over last 5 years have been straight up). Thanks Ollie!

Across the country, a divide is emerging between cities that are growing outward and remaining affordable and ones that are hemmed in by geography and onerous zoning codes and are becoming more and more expensive.

As a whole, U.S. cities are expanding as rapidly as they have throughout the last half-century. From the 1950s until the 2000s they have added about 10,000 square miles per decade, or an area roughly the size of Massachusetts, according to research by Issi Romem, chief economist at real-estate site BuildZoom, to be released Monday. But beneath the surface a divide is deepening.

On the one side are cities such as San Francisco, Boston, New York and Miami that have slowed their pace of expansion dramatically since the 1970s, in part as they have added layer upon layer of building regulations. On the other side are cities concentrated in the southeast and Texas, which have grown outward and seen much slower price growth.

The developed residential area in Atlanta, for example, grew by 208% from 1980 to 2010 and real home values grew by 14%. In contrast, in the San Francisco-San Jose area, developed residential land grew by just 30%, while homes values grew by 188%.

The developed residential area in Raleigh, N.C., grew by 219% in the same period, while home values grew by 27%. In Seattle, the developed area grew by 69%, while home values grew by 119%.

Mr. Romem draws the distinction succinctly: expansive cities versus expensive cities.

“If you don’t let the city grow, you’re going to get prices going upward…and see the middle class being pushed out,” Mr. Romem said.

Read full article here:

Here’s a quick tour of the new Davidson models at The Oaks Farms in SJC:

The balance is shifting from human interaction to mobile-device addiction if these floor plans are an indicator:

People suggest that if you want more value, just go out to the ‘burbs. But how far out do you have to go to buy a new one-story house on a 1/2 acre lot with good schools in the $700,000s and $800,000s?

Pulte, California West, Shea Homes, Pardee, and Davidson all have new-home communities being built, or coming soon to the 76 corridor area between North Vista and Fallbrook:

A story with great examples of golf courses being closed across the country, and many being turned into real estate developments.

From the nytimes.com:

BOCA RATON, Fla. — Weeds, crabgrass and fallen palm fronds cover the wildly overgrown greens of what was once the Mizner Trail Golf Club, its decrepit state emblematic of the fate of hundreds of golf courses around the country, many of them derisively known as “rabbit patches” or “goat farms.”

A short drive away, however, perspiring construction workers in yellow vests swarmed on a recent afternoon over the emerging structure of a 150,000-square-foot activities center, part of a $50 million renovation of the 44-year-old Boca West Country Club, home to some 6,000 residents, where fairways are newly planted and houses sell for as much as $5 million.

With the winter golf season beginning in Florida — the nation’s leader in golf courses with more than 1,000 — the extremes of failure and success point to a nationwide upheaval in the sport. It was booming when players like Tiger Woods reigned, but has since been roiled by changing tastes and economics, an aging population of players, and the vagaries of the millennial generation’s evolving pastimes.

There are about four million fewer players in the United States than there were a decade ago, according to the National Golf Foundation. Almost 650 18-hole golf courses have closed since 2006, the group says. In 2013 alone, 158 golf courses closed and just 14 opened, the eighth consecutive year that closures outpaced openings. Between 130 and 160 courses are closing every 12 months, a trend that the foundation predicts will continue “for the next few years.”

Dozens of private and public golf courses here in South Florida, and hundreds around the country, are in transition. Some courses have sought bankruptcy protection, while others have slipped into foreclosure. Many are under construction, with single-family homes and condominiums going up on land once dotted only with pin flags, sand traps and water hazards. Others have gone to seed as they await resolution of legal and zoning disputes.

Read full article here:

New homes and resales used to offer about the same median price and affordability in San Diego. But over the last few years, new-home pricing has jumped up substantially, eliminating some of the quality choices for buyers and delivering more demand to the resale market.

Read full report on the SD home-building market here: bit.ly/1SdBKnG

Click on the link below for the complete NSDCC active-inventory data:

We know that we’re running out of land in San Diego County – here’s a story from the VOSD about Americans going to Tijuana for real estate development.

An excerpt:

“What is really misunderstood is that Tijuana is very important to San Diego. It’s actually where our affordable housing is,” said Shannon.

That is, working-class residents have already realized they can escape San Diego’s high housing costs by crossing the border.

More than 36 million people came through the San Ysidro border crossing in 2014, according to data from the U.S. Customs and Border Patrol. And the San Ysidro trolley station is also the second-most active on San Diego’s network, with about 17,955 riders daily. Given that San Ysidro is home to only 20,000 people between 20 and 60 years old, it’s a safe assumption that many of those riders come from Tijuana.

It’s an international version of what real estate agents call “drive until you qualify.” Facing unaffordability, residents fan out ever farther, trading cheaper housing for longer commutes.

In a lot of housing markets, increases in housing prices force wage increases, but that hasn’t happened in San Diego, said Erik Bruvold, president of the National University System Institute for Policy Research.

That’s partly because people can instead live in Tijuana and Temecula and work in San Diego, he said.

“Sometimes the figures for housing and housing prices in San Diego County can be a bit misleading,” Bruvold said. “They don’t help us understand how housing prices in Temecula and Baja are and how they interact with the San Diego economy.”

Much of Murrieta and Temecula were built because housing costs in San Diego pushed lower-wage residents to the area, said Greg Strangman, a developer working on a hotel project in Tijuana.

“That’s how that Inland Empire came about,” Strangman said. “And in the same way, you could have the same situation in Tijuana. It’s a shorter commute coming from Tijuana to San Diego than Temecula to San Diego.”

Read full article here:

Today is the first day of sales at this new tract next to Black Mountain Park – take your favorite realtor with you!

The middle plan: