by Jim the Realtor | Oct 20, 2023 | Forecasts |

Morgan Stanley analysts previously expected national home prices to fall 4% in 2023, as the housing market continued to crater, and reaffirmed their pessimistic forecast in April of this year. But the analysts recently changed their tune in a big way: They now say housing prices could rise up to 5% for the year.

The reversal, made in a research note earlier this week, comes as mortgage rates continue to rise, hitting 8%, the highest level since 2000. The increase has had a profound impact on the housing market, but not necessarily as many people had expected.

For one thing, it’s keeping the supply of homes for sale tight largely due to the lock-in effect, which prevents homeowners that have lower mortgage rates from selling because it would require buying a new home at a much higher interest rate. That’s helping to prop up the market by creating big demand for the relatively few houses for sale, further deteriorating affordability.

Morgan Stanley isn’t the only financial institution to suggest home prices will likely increase. Roger Ashworth, a managing director at Goldman Sachs, recently wrote that despite affordability being worse than in the 2008 housing crash, housing itself is in a much stronger position, largely due to a low supply of homes for sale.

“Absent any negative shocks to the broader economy that would either boost excess supply of homes on the market or fuel an uptick in unemployment, we continue to expect home prices to rise at a slow pace,” he wrote. And he predicts that by the end of this year, home prices will rise 1.8%, with a 3.5% increase by the end of 2024.

https://fortune.com/2023/10/19/high-housing-prices-home-market-affordability-morgan-stanley-forecast-2023/

by Jim the Realtor | Oct 16, 2023 | Forecasts, Inventory, Jim's Take on the Market |

Recently the president of the local association of realtors was asked what the real estate market will do in the future. His response: “Nobody knows what the market is going to do in the future”. Of course, immediately after that comment he said, “Interest rates have to drop to 5.5%. Then you’ll see everyone get excited and say, ‘Hey, let’s sell our house and get another one.'”

Even if mortgage rates to go back to 5.5%, people are living in their forever home. The difficulty of finding a better home for a decent price will overwhelm any minor inconvenience at their existing home.

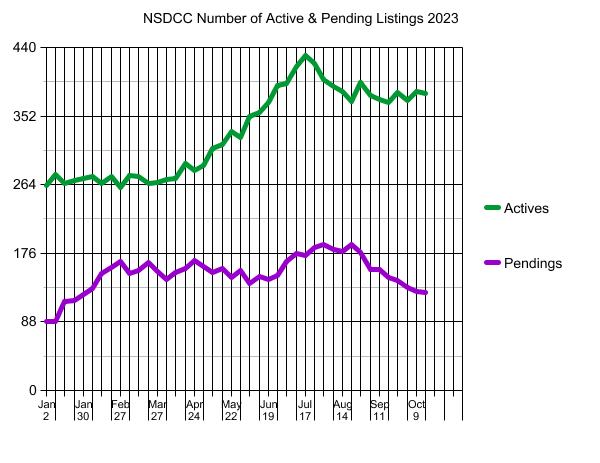

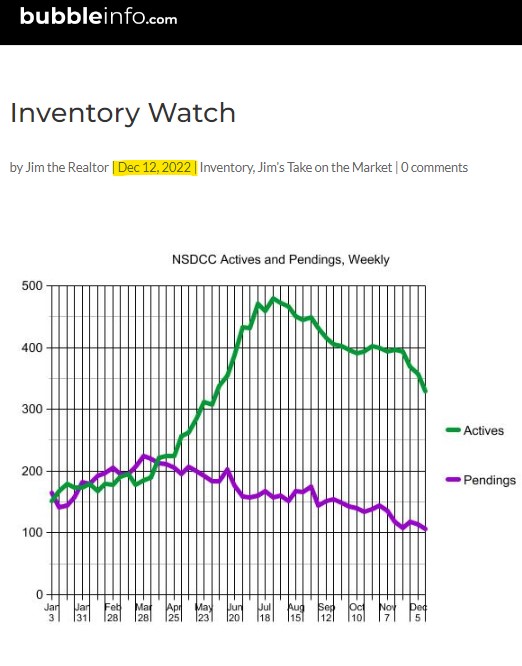

I don’t mind predicting the future. The rest of 2023 is going to look a lot like it did last year:

Next year, the inventory should grow quickly in the April-July time frame. Price will fix everything else!

(more…)

by Jim the Realtor | Sep 29, 2023 | Forecasts, Jim's Take on the Market

The local real estate market between La Jolla and Carlsbad has been fairly healthy lately, and feels in better shape than it did last year at this time when we were still getting over the initial shock or higher rates.

How will the rest of this year turn out?

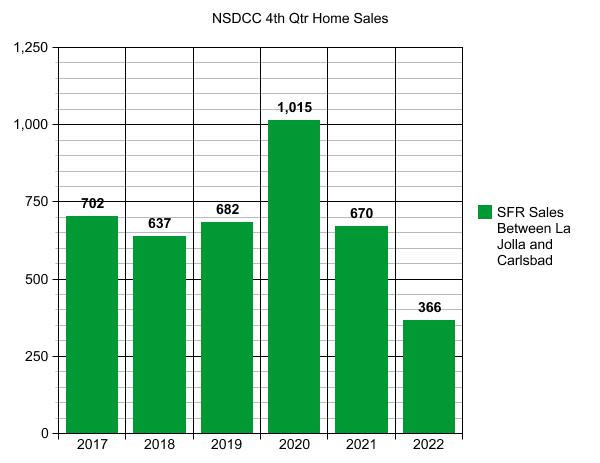

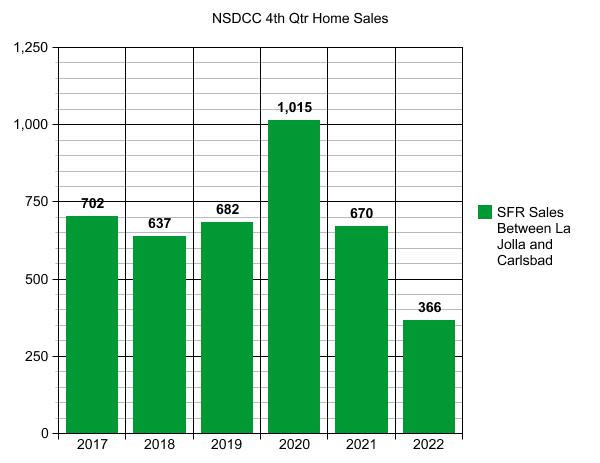

The recent burst that pushed up mortgage rates – now near 8% – will cause most people to sit out the rest of the year. Heck, it’s the holidays! Sales in the fourth quarter of 2023 will plunge and probably set the all-time low. I’m hoping we have 300 sales!

Want to know the history?

In 2007, we had 460 closings in the fourth quarter, and in 2008 we had 461 closings. By 2009 the market was already on the upswing, and there were 671 4Q houses sold between La Jolla and Carlsbad.

Last year, we saw some successful fourth-quarter lowballing where sellers dumped 10% or more on price to get out, and we’ll see more this year! But only for those buyers and agents who cause it to happen.

Stay in the game and Get Good Help!

by Jim the Realtor | Sep 26, 2023 | Forecasts, Realtor Post-Frenzy Playbook, Same-House Sales

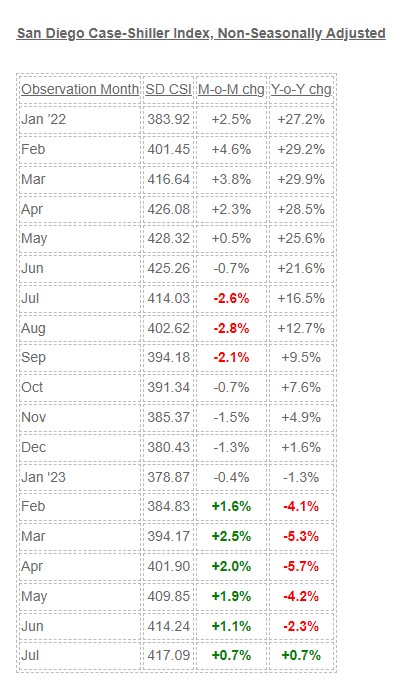

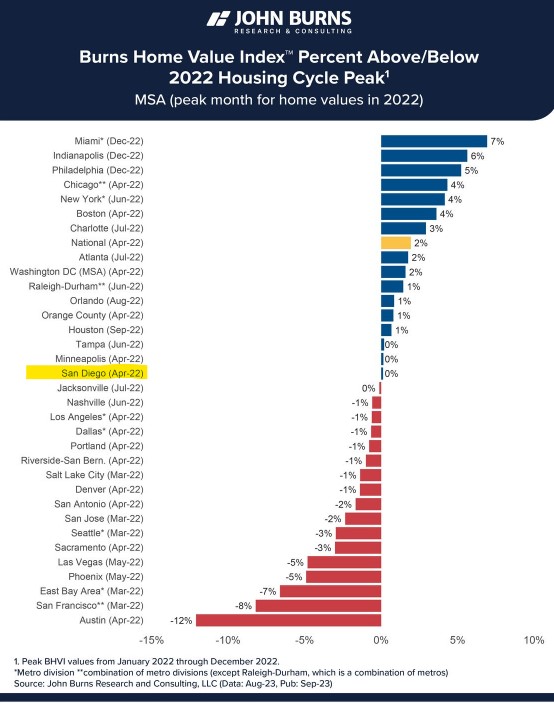

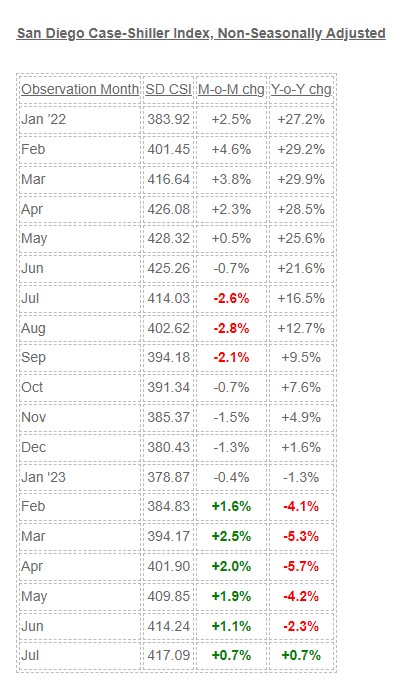

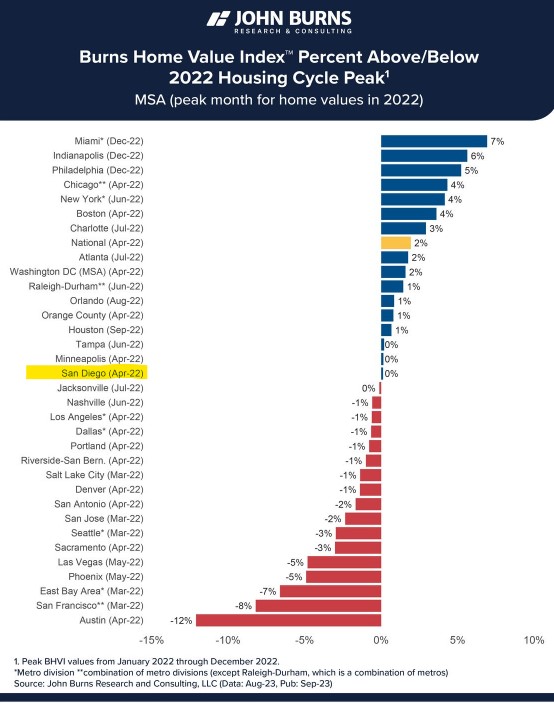

The local index is about where it was last month AND last year at this time.

It is 3% below the peak of last May, and +9.6% year-to-date.

It wouldn’t surprise me if it slides downward ~3% the rest of 2023, then up ~3% in the first half of 2024, then down ~3% in the second half of 2024….recession or not.

Because rates won’t be going down until 2025 (at least), pricing should stay rangebound. Without wild swings in pricing, the buyers can focus on finding the perfect home without compromise.

When there are bidding wars and rapidly-rising prices, buyers are prone to just grabbing something and paying whatever it takes. Without those, sellers and agents have to be really good at selling homes – which hasn’t been required over the last several years.

by Jim the Realtor | Sep 21, 2023 | Forecasts, Interest Rates/Loan Limits |

The Fed paused alright – Jerome just talks up the rates now!

Rates moved only moderately higher on Wednesday after the Fed rocked the bond market with its updated rate forecasts. To reiterate yesterday’s analysis, it’s not that the market is expecting the Fed to be accurate in those forecasts. Rather, the forecasts help investors understand how the Fed’s approach will be calibrated going forward.

In simpler terms, the Fed doesn’t think rates are too high right now. If anything, they might need to go higher. Moreover, they won’t go lower until economic data really starts to deteriorate in a compelling way.

Unfortunately, this morning’s most relevant economic report didn’t deteriorate at all (weekly jobless claims were 201k versus a median forecast of 225k). Actually, it’s fortunate for the economy, but unfortunate for interest rates.

Between the data and the overnight momentum in overseas markets, bonds are at their weakest levels in years. Mortgage-backed securities (the bonds that dictate mortgage rates) didn’t swoon quite as much as Treasuries, but as of today, it was just enough to push the average mortgage lender almost perfectly back in line with the highest 30yr fixed rate of the past 23 years.

https://www.mortgagenewsdaily.com/markets/mortgage-rates-09212023

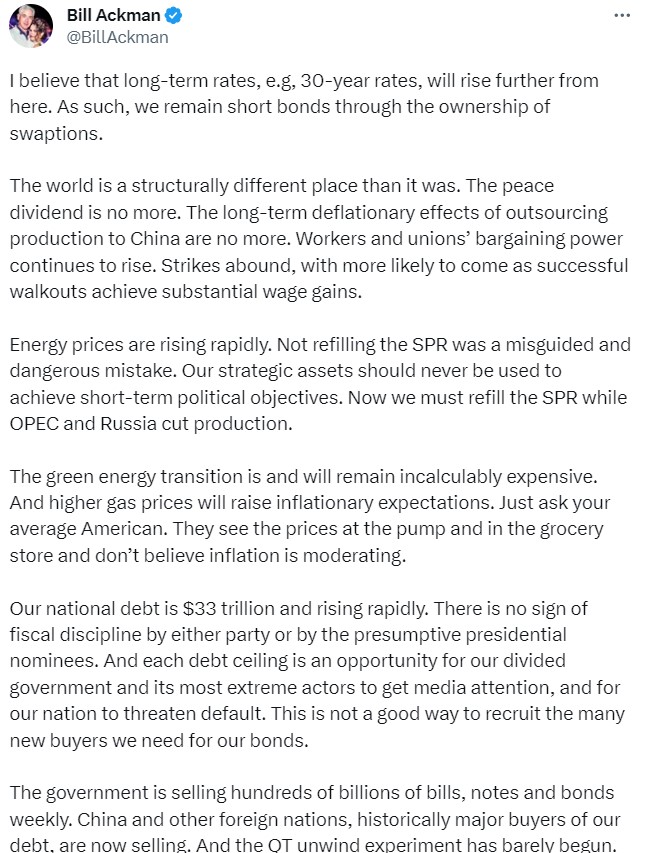

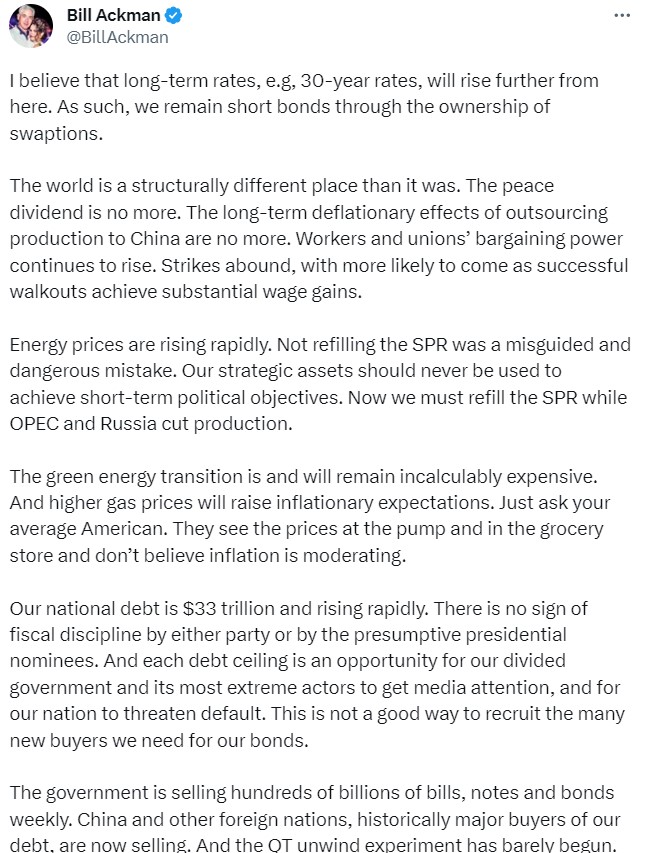

Need a reason to sell now, instead of waiting for next year? It doesn’t matter what you think of Peter or the content. It’s how many people who read this in the first half-day that matters – and this kind of doom spreads like wildfire:

by Jim the Realtor | Sep 18, 2023 | Forecasts, Jim's Take on the Market, Why You Should List With Jim |

We are back to peak pricing!

But it sure doesn’t seem like a good time to sell your house, and as a result, most potential sellers will pack it in and wait until The Home-Selling Season of 2024.

Is there anything wrong with waiting until next year?

- Mortgage rates could go higher. The Fed meets three more times this year, and unfortunately they will be tempted to bump their rate at least once or twice. It doesn’t mean that mortgage rates will definitely go higher, but lenders are like gas stations and use any reason to pinch extra profit.

- Flood of Inventory. By a ‘flood’ , I mean two or three other homes go up for sale nearby.

- Bad Comps. If you have any 4Q sales nearby, they are likely to be lower than you’d like.

Who will be the 2024 home sellers?

There has to be a load of realtors and mortgage brokers who had their worst year ever in 2023, and had already been thinking of moving down and/or out. Or what about those sellers who sat out during covid? How about those who saw the market collapse after rates doubled in the second half of 2022 and they gave up their hopes of selling in 2023? They thought it would take years before we got back to peak pricing. Well, here we are!

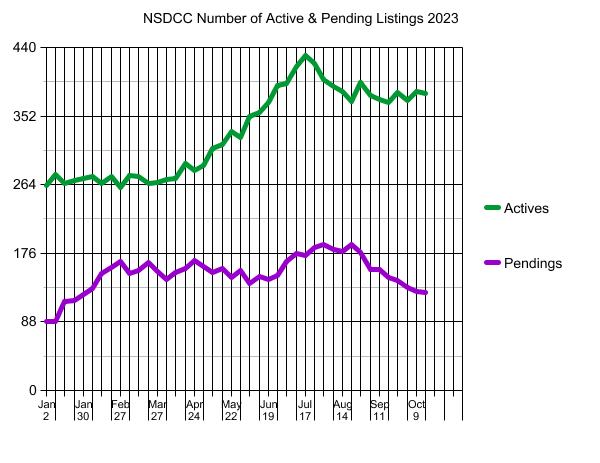

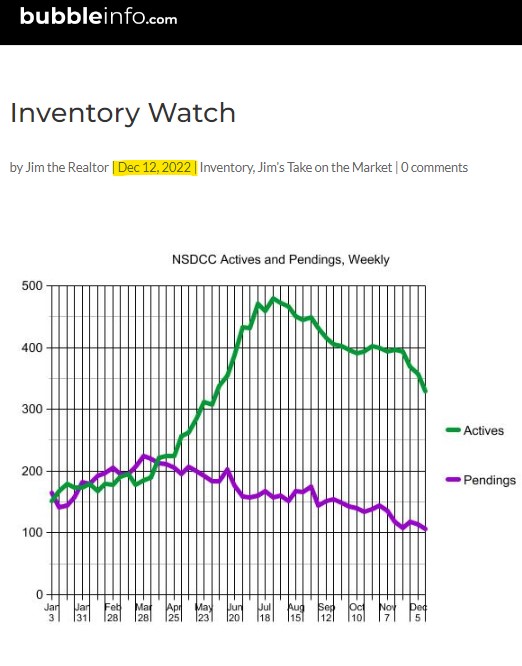

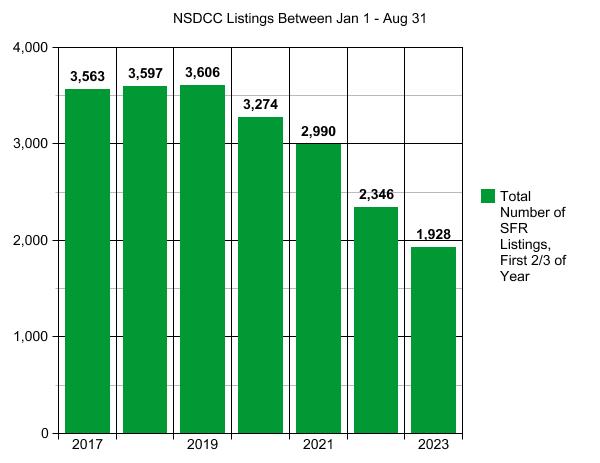

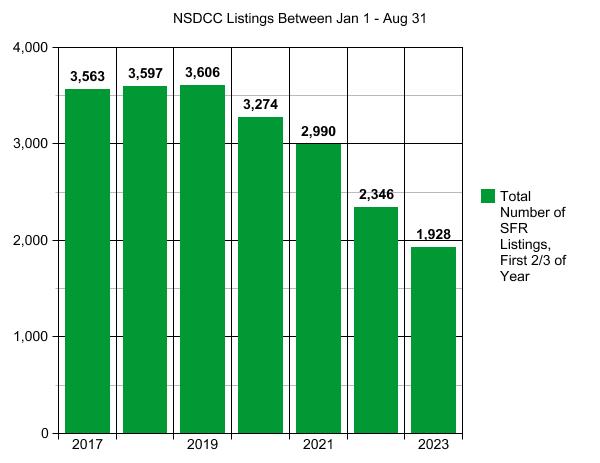

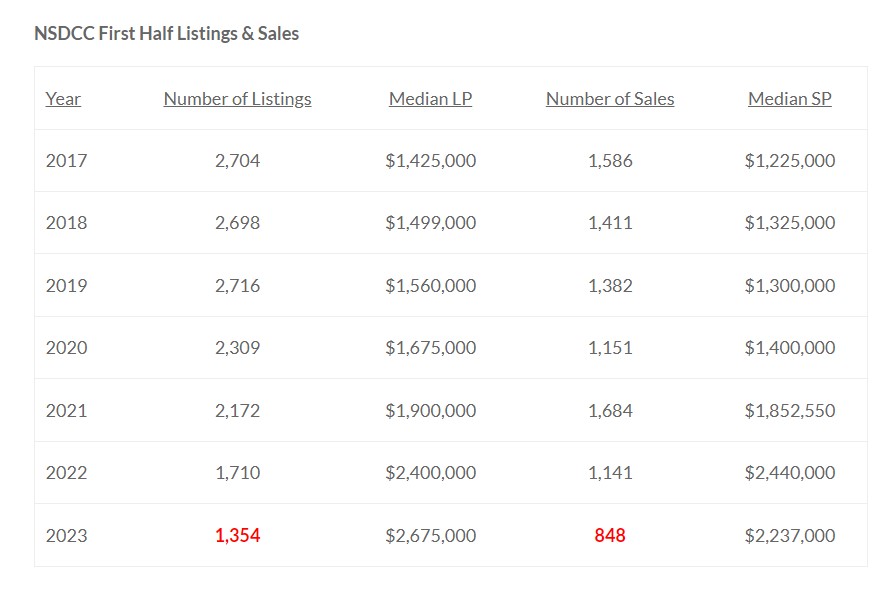

We are so overdue for more listings. Look at the recent history:

Remember the 10% covid drop in 2020 and we thought the world was going to end?

I’ll go out on a limb and guess that we’ll have 2,500 next year, and it will feel like a flood!

I checked my stats for the last two years. I’ve had 29 listings sell that averaged nine days on the market, with a median of 4 days. I’ll get you down the road before Thanksgiving!

by Jim the Realtor | Sep 12, 2023 | Forecasts

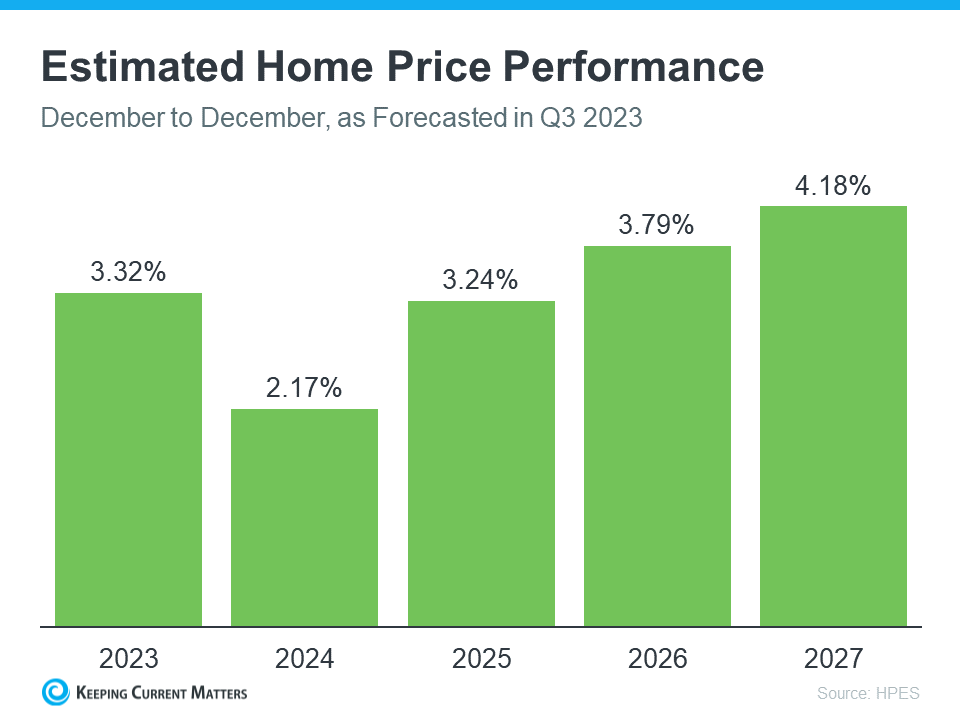

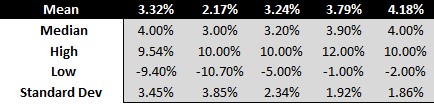

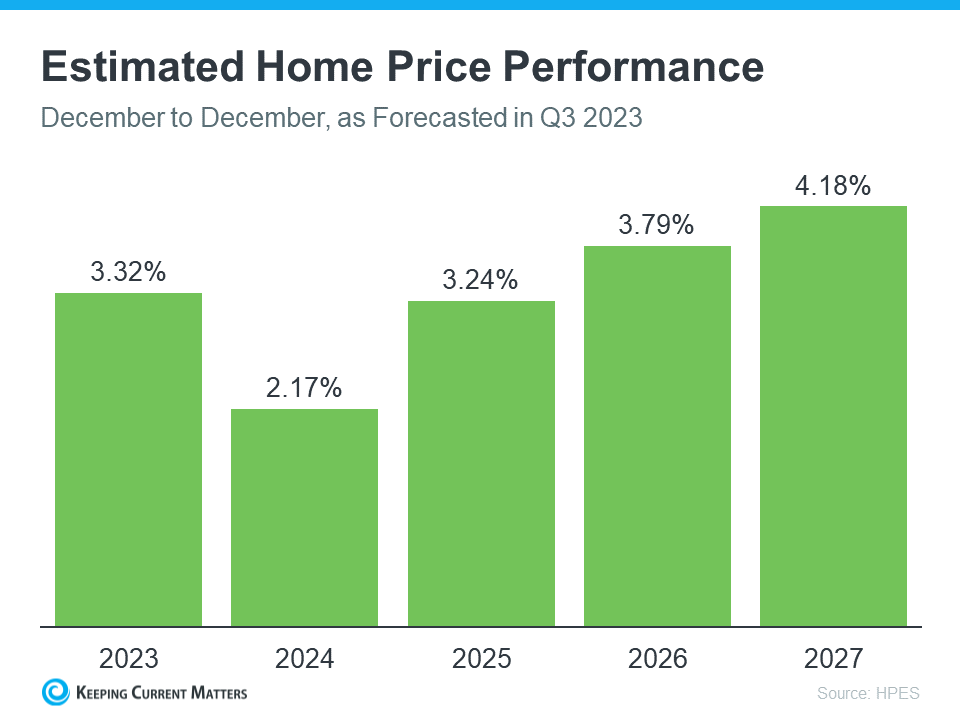

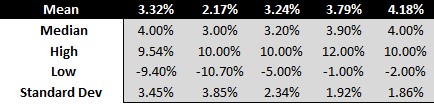

Now that’s more like it – 100 economists were surveyed last month and the average guess of annual home appreciation was back in the comfortable 3% zone. But I dug a little deeper to find the list of economists and their individual guesses, and there was more variance than I expected. Here is the list:

Q3_2023_Summary_Table

Their guesses for next year range from -10% (from Pimco and Auction.com) to +10% from Gerd-Ulf Krueger, who is the only guy on the list who calls me regularly.

Gerd, I said +10% for San Diego, not the whole country! 🙂

by Jim the Realtor | Sep 6, 2023 | Forecasts, Jim's Take on the Market, Market Conditions, The Future |

An article published yesterday included some guesses about the future of the real estate market over the next five years. For those who thought it would be the usual expert opinions touting 3% appreciation per year, you won’t be disappointed, though Larry did throw in a possible 10% decline in California:

Yun foresees no major changes in purchase price tags on a nationwide level next year, with fluctuations of only about 5 percent one way or the other. The only exception is California, he says, where the market could see 10 percent declines: “Because it’s so expensive, California is always the most vulnerable to changes in interest rates.” This scenario is already playing out in the priciest areas in the state: For example, San Francisco median home prices are down 9.71 percent since last year, according to Redfin data. Overall, in five years, Yun expects prices to have appreciated a total of 15–25 percent.

McBride predicts home prices will average low- to mid-single-digit annual appreciation over the next five years. This rate of appreciation, he says, is consistent with the long-term average of home prices increasing by a rate that hovers a percentage point above the inflation rate.

https://finance.yahoo.com/news/housing-market-predictions-forecast-next-175441472.html

I think the North San Diego County coastal region will perform much better for the following reasons:

- Baby boomers aren’t dying fast enough. The capital-gains tax for long-time homeowners is so burdensome that heirs to the estate will insist on their elders aging-in-place, or renting out the home if their elder goes into a senior facility. This will prevent any concentrations of boomer liquidations, and sprinkle them over the next 20-25 years – keeping inventories low. (Half of boomers are still working!)

- The dollar continues to devalue – money isn’t worth what it used to be.

- San Diego is a premier destination spot for rich people. The affluent who tire of deteriorating conditions in their current town will be happy to join us – and pay whatever it takes.

The demand will stay strong and the inventory extremely tight. The realtor and lender populations will get cut in half (at least) and the fascinations about the real estate market will continue – but for almost everybody it will be from the sidelines.

The local Case-Shiller Index has risen 54% since March 2020.

I think we will see another +50% in the next five years, and in 2028 there won’t be a month when we have 100+ sales of detached homes between La Jolla and Carlsbad.

What do you think?

by Jim the Realtor | Jul 24, 2023 | Forecasts

Bob was like all the others and predicted a 10% drop in prices because of higher rates. Now he’s joined us on the seasonal bandwagon. An excerpt from this article:

Fast-forward to 2023, and Shiller is once again closely watching the U.S. housing market after its period of exuberance during the pandemic, which included a 43% jump in U.S. home prices measured by the Case-Shiller National Home Price Index—a single-family index that Shiller helped to build many decades ago.

Only this time around Shiller isn’t predicting a national home price crash—or a sustained boom. Instead, Shiller went on CNBC last week and seemed to suggest that national house prices would go sideways for a bit.

“The housing market is different than the stock market, it’s normally forecastable. It has been growing since 2012, it has been about 10 years of steady growth in home prices. But it may be coming to an end with this interest rate rising cycle,” Shiller said.

“I think the fear of interest rate increases has influenced people’s thinking. It is not just the homeowners, it’s new buyers who wanted to get in before the interest rates went up even more. They wanted to lock in, so that’s been a positive influence on the market, but it’s coming to an end,” Shiller said.

Throughout the course of the boom, Shiller thinks some exuberance entered into the housing market as homebuyers rushed to lock in 2% and 3% mortgage rates, which they knew wouldn’t last long.

Last summer, Shiller suggested to CNBC that the Pandemic Housing Boom could be replaced by a period of declining house prices. In August 2022, he said: “The Chicago Mercantile Exchange has a futures market for home prices… That’s in backwardation now; [home] prices are expected to fall by something a little over 10% by 2024 or 2025.”

While national house prices as measured by Case-Shiller did fall 5.1% between June 2022 and January 2023, they’ve since rebounded 2.8% through April.

However, last week Shiller hinted that recent national house price gains might just be a seasonal blimp.

“Part of what’s happening in the increase in home prices is just seasonal, it’s the summer and it’s typically going up in the summer,” Shiller said.

If Shiller is right and national house price gains this spring and summer are just “seasonal,” it could mean month-over-month price declines return later this year as the housing market enters into the seasonally slower fall and winter months.

“We’ll see, whether we get a soft landing [of the U.S. economy]. But it’s a possibility. I’m not panicking one way or another,” Shiller said.

by Jim the Realtor | Jul 5, 2023 | Forecasts, Jim's Take on the Market, North County Coastal |

This article gets into the usual topics for those trying to forecast the future:

https://www.investopedia.com/what-housing-experts-anticipate-for-the-last-half-of-2023-7555067

Their experts think that mortgage rates will ease for the rest of the year, which will cause the inventory of homes for sale to increase. Apparently they are stuck on the whole golden handcuffs theory of why inventory is ultra-low, and when rates drop, then everything will be fine.

Here are their two quotes on the direction of home pricing:

Weak home prices are expected over the summer months, when they are typically at their peak, according to Realtor.com’s Hale.

“Specifically, while June is expected to be the seasonal peak for home prices in 2023, like it is most years, we won’t see as big of a month to month climb as we did in 2022, which will mean ongoing mild declines when we’re comparing home sale prices to one year ago,” Hale said.

The declines are expected to run through the early fall, depending on the Federal Reserve.

“By the time we get to the fourth quarter, mortgage rate and seasonal home price relief could be enough to stanch the declines” Hale added. “On net, we expect average home prices in 2023 to fall 0.6% compared to 2022.”

As supply boosts and mortgage rates and home prices fall, sales are expected to rise through the end of the year, according to NAR’s Yun.

“We’re likely approaching the bottom in home sales with steady improving home sales in the second half of the year and into 2024,” Yun said.

None of their experts (including Robert) offer any data to support their cases, and are just guessing.

Let’s dig a little deeper into the topic, shall we?

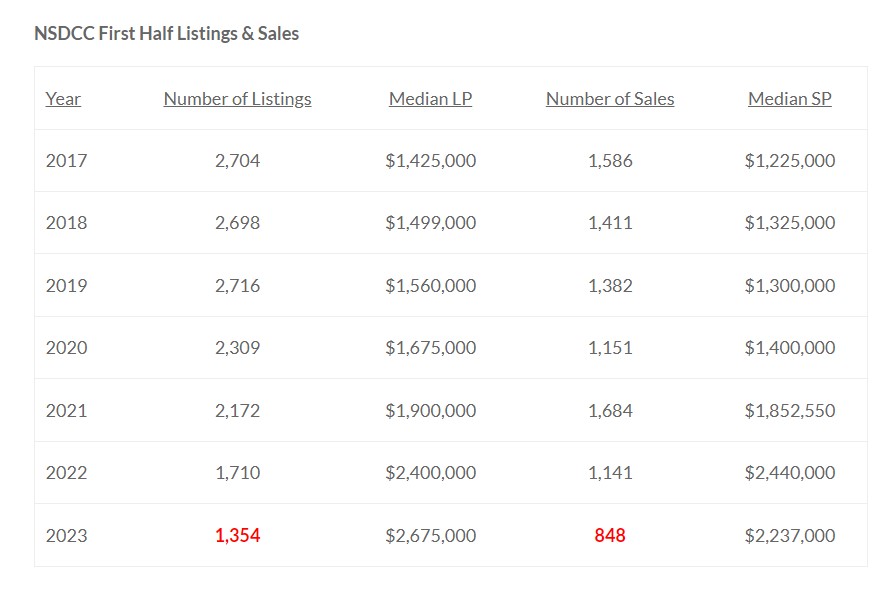

To say that the current market conditions are unprecedented is putting it lightly.

NOBODY HAS EVER IMAGINED LISTINGS AND SALES BEING HALF OF WHAT THEY USED TO BE!

But that’s where we are.

The huge gap between the 2023 MLP and MSP suggests that buyers are unwilling to pay the higher prices, but pricing was sluggish in the first two months of the year so there was some lag – just like in 2020 when we had a couple of months of pandemic trouble.

Buyers should really be picky in the off-season, so any thoughts of sales increasing are optimistic. With only the creampuffs selling, pricing should keep rising, except in areas where the only homes for sale are the scratch-and-dent/fixers and where unscrupulous agents doing their dirty work (this is more of a problem for pricing than you might think).

Fewer comps means that one or two sales in either direction will impact the prices for the rest of 2023.

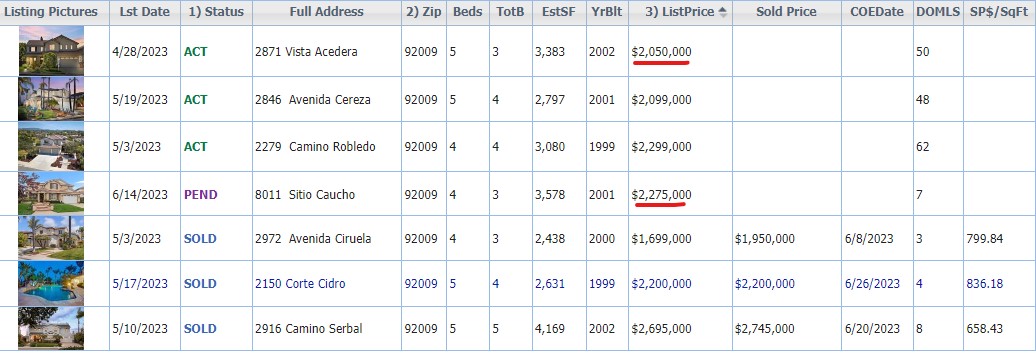

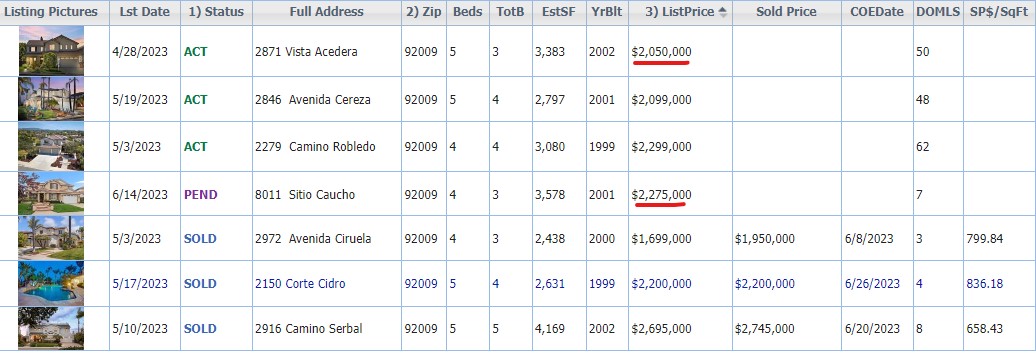

Here’s an example – our La Costa Valley Six had a listing on Sitio Caucho hit the market on June 14th, and it promptly went pending within seven days:

At first, you might think that the new pending sale should close above $2,200,000 and that trend would be bolstered. But Vista Acedera has gotten tired of being left behind, and on Monday they lowered their price from $2,125,000 to $2,050,000.

What’s the trend now?

Lowering their price was smart because they have been on the market since the end of April and summer will be over before you know it. They really want to be the next home to sell – but what will that do to the others left for sale, and the other new listings to come between now and the 2024 Selling Season?

Get Good Help!