by Jim the Realtor | Jan 26, 2022 | Interest Rates/Loan Limits

Today’s conforming rate with no points

From MND:

Fed policy is critically important to interest rates and January has marked a shift in the Fed policy outlook. In not so many words, the Fed sees itself hiking rates and decreasing its bond purchased more quickly than previously expected. It has conveyed this in various ways since the beginning of the month. Today’s policy announcement and press conference were just the latest iterations. They were also arguably the least equivocal.

Despite the relatively clear communication from the Fed in recent weeks, financial markets were increasingly laboring under the misapprehension that the Fed would take a softer tone in light of recent market drama. In other words, stocks have dropped significantly and rates spiked to 2 year highs as the Fed began its communication push this month, so perhaps they would “communicate” in a more market-friendly way today.

While it’s not uncommon for some market participants to hope for such things, it was never very likely in this case (one of the reasons I reiterated that the Fed is not tasked with babysitting the market in yesterday’s commentary). True to form, the Fed paid zero attention to recent market movement. In their view, rates are still low, and asset prices are elevated. If anything, they feel they need to hustle when it comes to hiking rates and decreasing bond purchases.

Bottom line, the market was a bit flat-footed heading into today’s Fed events. When the Fed stuck to the tightening script rather religiously, rates were forced to snap back to the reality they’d previously done a good job of understanding. Case in point, Treasury yields and mortgage rates are both very close to levels seen last Monday. Mortgage rates just happen to have edged slightly higher, thus earning the dubious distinction of “highest in 2 years.”

What will happen to our local real estate market now?

Speaking of misapprehension, the potential buyers who think home prices will come down will be disappointed. Not only will sellers ignore such frivolity, there will be enough motivated buyers who don’t care either. If they don’t mind paying $300,000 over list price, then they’re not going to care about a silly rate hike.

The coming Fed rate hike in March appears to be already priced in. Mortgage rates have gone up 1/2% this month, and the Fed will probably only raise their rate by 1/4% next month. We could see slightly better mortgage rates 60 days from now.

In the past, homebuyers have rushed to purchase before rates went up, and I think that will be the case this time too…..if there is only something to buy! We have had 150 NSDCC listings this month so far, which is dreadful. Last January we had 288 listings! Link to contest.

by Jim the Realtor | Jan 12, 2022 | Interest Rates/Loan Limits |

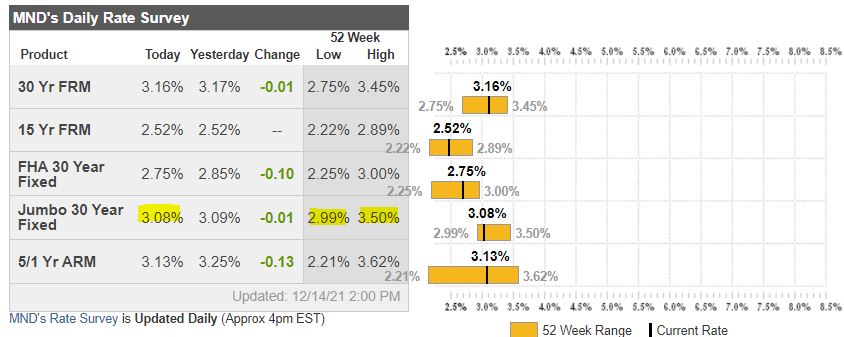

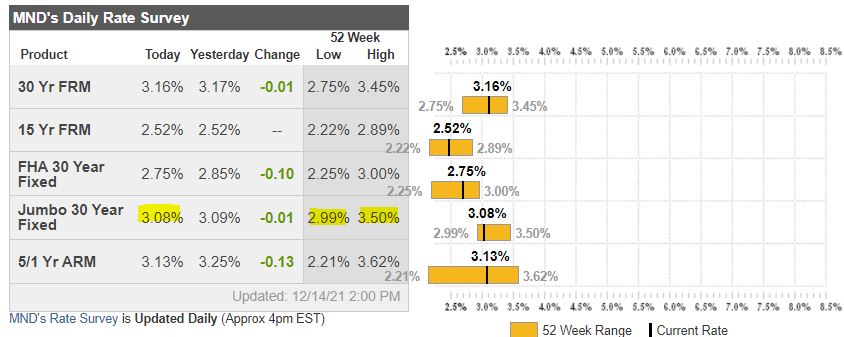

Mortgage rates have been rising steadily:

2022 has gotten off to a bad start for the bond market and consequently, mortgage rates. The pace has been on the aggressive side with the average lender seeing an increase of more than a quarter of a point in a week and 3/8ths of a point in 2 weeks. The most prevalent 30yr fixed quotes are now in the 3.625% range, up from 3.25% at the end of December.

How many guessers had rates in the mid-3s in the first half of January?

Lawrence Yun, chief economist for the National Association of Realtors, projects that mortgage rates will increase to 3.7 percent in 2022, pushed up by persistently higher inflation.

Danielle Hale, chief economist for Realtor.com, expects the 30-year fixed mortgage rate to average 3.3 percent for most of the year and be at 3.6 percent by the end of the year.

Daryl Fairweather, economist for Redfin, expects rates to rise slowly from around 3% to around 3.6% by the end of 2022, thanks to the pandemic subsiding and lingering inflation. That would mean about $100 more per month in mortgage payments for the median home.

MBA economists predict that the 30-year fixed-rate mortgage will rise to 4 percent by the end of 2022.

Bankrate.com predicts that the 30-year fixed mortgage rate will peak at 3.75 percent during the year and fall back to 3.5 percent by the end of the year. “Long-term rates will move higher in the first half of the year, but by the close of 2022, concerns about slowing economic growth will be unwinding that and bringing them back down,” he said. “This will be higher than where mortgage rates started the year but ending at levels previously unseen before the pandemic began in 2020.

Lending Tree predicts that the 30-year fixed mortgage rate will rise to near 4 percent by the end of the year.

If their predictions are right, then rates should flatline for the rest of the year and be a non-issue.

https://www.mortgagenewsdaily.com/markets/mortgage-rates-01112022

by Jim the Realtor | Jan 6, 2022 | Interest Rates/Loan Limits, Mortgage News |

Mortgage rates in the mid-3s in January should put some pep in the buyers’ step. From MND:

Regular readers know that we’re fond of setting the weekly record straight in cases where day-to-day rate movements paint a drastically different picture than weekly surveys. When it comes to the latter, there’s really only one game in town.

Freddie Mac’s Primary Mortgage Market Survey is not only the longest running weekly survey. It’s also by far and away the most widely cited in financial media. It’s even relied upon by the mortgage industry for certain calculations that affect borrower eligibility.

Unfortunately, the rate that Freddie published today (3.22% for a 30yr fixed) is a drastic departure from reality. 3.375% would be an aggressive rate quote this afternoon, and the average lender is closer to 3.50%! A gap of just over 0.25% might not seem like a lot, but consider that it held inside a range roughly half as big for the entirety of the 4th quarter of 2021! It can take months for rates to rise a quarter of a point and we just did it in a few days.

(more…)

by Jim the Realtor | Dec 15, 2021 | 2022, Frenzy, Interest Rates/Loan Limits, Market Conditions |

A reader on Twitter wondered how rising rates will affect the 2022 frenzy.

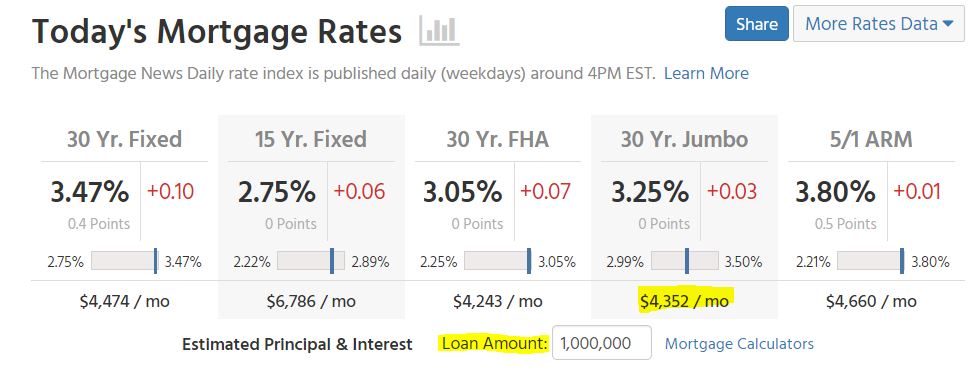

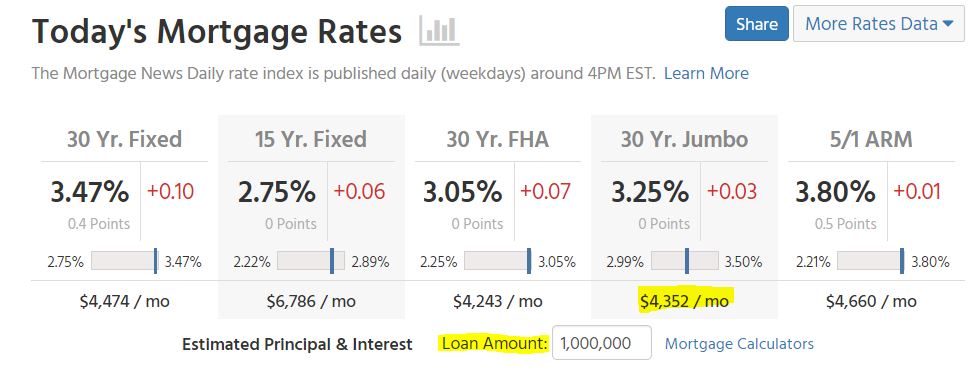

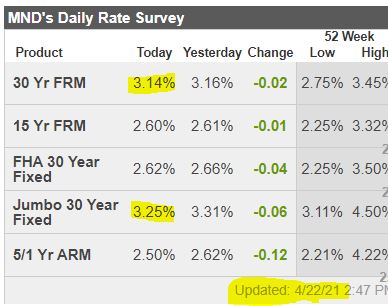

Here’s what is expected today:

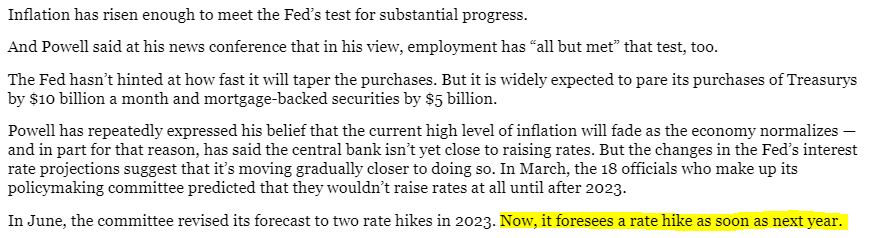

Under Chair Jerome Powell, the Federal Reserve is poised this week to execute a sharp turn toward tighter interest-rate policies with inflation accelerating and unemployment falling faster than expected.

The Fed today will likely announce that it will reduce its monthly bond purchases at twice the rate that Powell had outlined just six weeks ago. Those bond purchases are intended to lower longer-term rates, so winding them down more quickly — likely by early spring — will lessen some of the economic aid the Fed supplied after the pandemic erupted last year.

Fed officials are also expected to forecast that they will raise their benchmark short-term rate, which has been pegged near zero since March 2020, two or three times next year. Rate hikes would, in turn, increase a wide range of borrowing costs, including for mortgages, credit cards and some business loans. Just three months ago, the Fed had penciled in barely one rate increase in 2022.

Let’s note where the mortgage rates are today:

Some of the Fed hike might already be priced in, but these rates are still very attractive. I think that any rate starting with a 3 will be attractive to buyers.

But let’s consider the history. Any time rates threaten to go up, or actually do start to rise, it causes buyers to hurry up and find a house – just to be able to lock in a lower rate. It means that we could be heading for the Ultra-Peak Frenzy, where rising rates actually create MORE frenzy!

Buyers who think sellers should lower their price to compensate for higher rates will be in for a long wait. Sellers won’t believe it, and unless they are desperate (which very few are), they will blame the market/rates/agent before considering a lower price. Many will try over and over again, and it might take them 2-3 selling seasons before they succumb.

Would rising rates cause more sellers to hurry up? Doubtful, but I hope so! It would be great just to get back to normal inventory (which is about double where it has been during the last half of 2021).

by Jim the Realtor | Nov 9, 2021 | 2022, Forecasts, Interest Rates/Loan Limits |

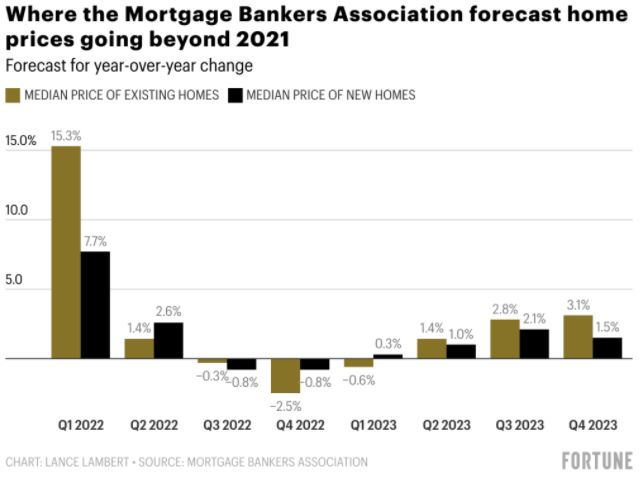

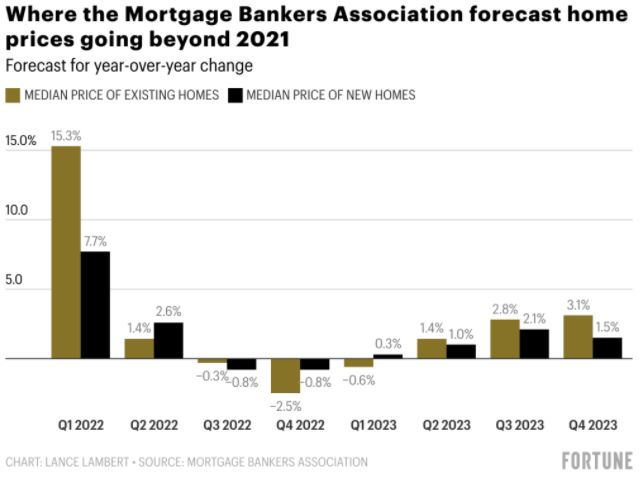

This forecast suggests that prices would still be cooking in 1Q22, but once the spring selling season gets rolling, the median prices will level off? It would take a flood of inventory to pull that off. They blame rising rates, but when that happens it usually causes buyers to hurry up and buy. As long as mortgage rates are in the 3s, we’ll be fine.

It was inevitable that the housing market would slow down a bit. After all, home prices can’t continue to outpace income growth by a 4-to-1 ratio forever, right?

However, even as the market has seen some softening so far, price hikes and bidding wars are still ongoing across the U.S. And the industry consensus is that whatever cooling comes next year, it will slow—but not stop—the continuing rise in home prices.

However, that assessment isn’t shared by the Mortgage Bankers Association, an industry trade group based in Washington, D.C., which recently published its 2022 forecast. While the Mortgage Bankers Association foresees the median price of existing homes posting a 15.3% year-over-year gain to $362,000 in the first quarter of 2022, it sees prices beginning to fall as the year progresses. The group expects the median price of existing homes to end 2022 at $352,000. That would represent a 2.5% year-over-year drop in home prices.

What’s going on? A lot of it boils down to inflation—or what higher inflation means for the market.

The latest reading of the consumer price index in October made it clear that stubbornly high inflation could be around longer than economists were assuming. That has increased the odds that the Federal Reserve will raise interest rates, and thus mortgage rates, as a means of reining in inflation. A rise in mortgage rates—which have dropped to near record lows as the Fed kept money cheap to ease the economic effects of the pandemic—would lock some buyers out of the market altogether and put downward pressure on prices.

The Mortgage Bankers Association is forecasting that the average 30-year fixed mortgage rate will hit 3.7% by the third quarter of 2022, and 4% by the end of 2022. That would be a big increase from the current 3.09% rate, and is well above the 3.4% rate that Fannie Mae projects by the end of 2022.

Link to Article

by Jim the Realtor | Sep 22, 2021 | Interest Rates/Loan Limits, Mortgage News |

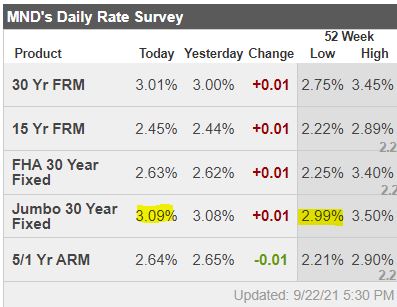

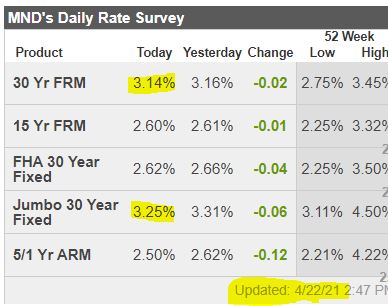

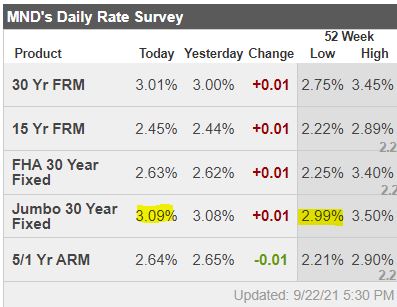

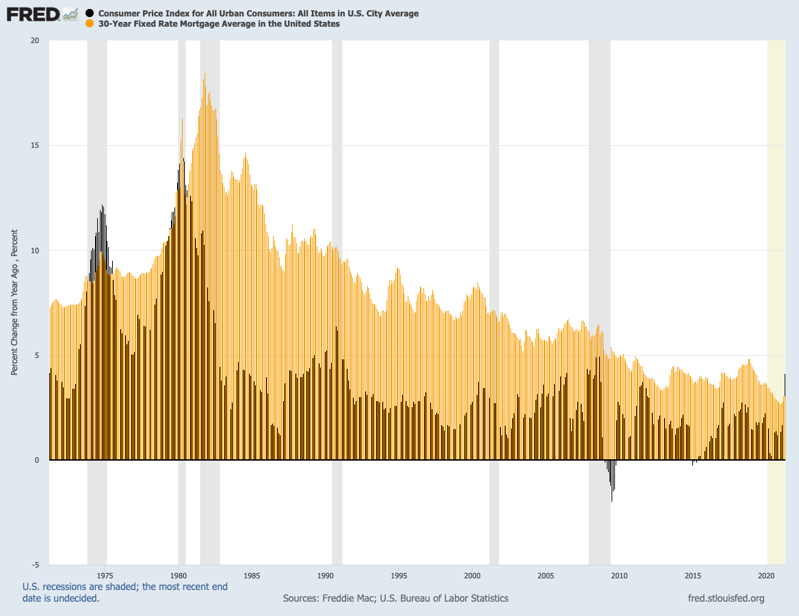

The jumbo rate was 3.25% on April 22nd

From Mortgage News Daily – thank you:

Mortgage rates were surprisingly steady today as the bond market reacted to a new policy announcement from the Fed. Perhaps “reacted” is the wrong word considering the market’s response. Specifically, the bond market (which dictates interest rates on mortgages and beyond) was hard to distinguish from most any other random trading day. That’s nothing short of impressive given what transpired.

So what transpired? That requires a bit of background, but let’s make it quick.

- The Fed is currently buying $120 bln / month in new Treasuries and MBS. These purchases greatly contribute to the low rate environment for mortgages.

- The Fed has done this, off and on in the past since 2009.

- 2013 was the first major example of the Fed “tapering” its monthly bond purchases after an extended period of accommodation. Markets freaked out and rates spiked at the fastest pace in years.

- Late 2021 is well understood to be the second major example of Fed tapering and markets have been speculating as to when it would become official.

Today’s announcement advanced the verbiage that suggests the Fed will begin tapering at the next policy meeting in November. Then, in the post-meeting press conference, Fed Chair Powell bluntly and explicitly confirmed the Fed is indeed planning on announcing the tapering plan at the next meeting unless the next jobs report is surprisingly bad.

Bonds definitely experienced some volatility during today’s Fed events, but again, that volatility existed within a perfectly normal range. The absence of a bigger market reaction is a testament to the Fed’s transparency efforts.

In short, they ended up saying almost exactly what they’ve been telegraphing in the past month of speeches, and markets revealed themselves to be positioned for an “as-expected” result. So not only was the Fed transparent, but markets were also fully betting on that transparency. Relative to some of the drama in 2013, today amounted to a perfectly threaded needle of epic proportions.

What does it mean for mortgage rates? Today? Nothing really. Lenders barely budged from yesterday.

All of the above having been said, sometimes it takes a few days for post-Fed rate momentum to truly kick in. Additionally, we’d expect some of today’s potential impact to instead be seen in the wake of the next jobs report on October 8th.

http://www.mortgagenewsdaily.com/consumer_rates/986363.aspx

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

by Jim the Realtor | May 18, 2021 | Interest Rates/Loan Limits

Add this to the list of reasons why demand is so hot…..

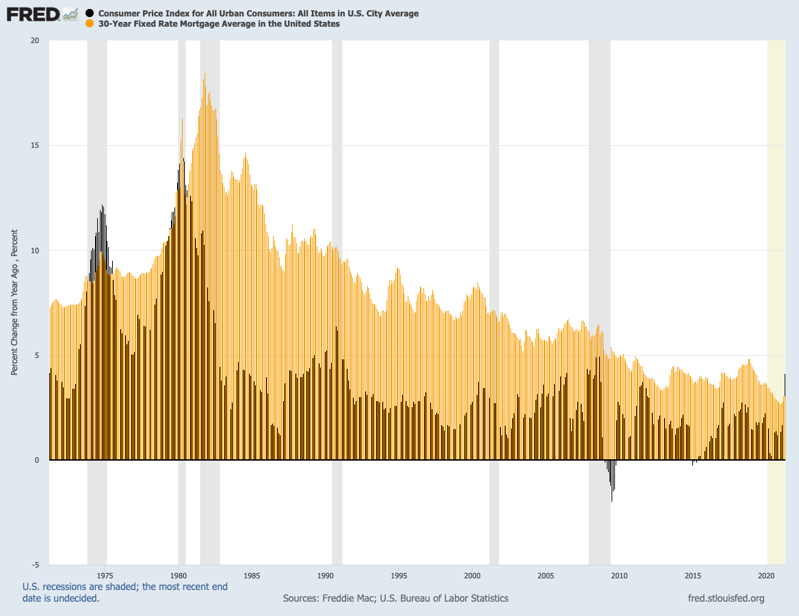

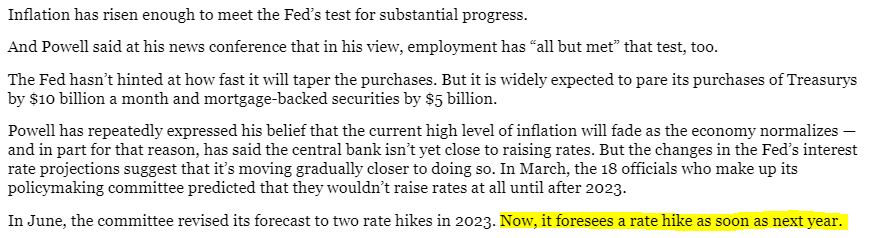

For the first time since 1980, the cost of living is rising faster than the average mortgage rate.

The Consumer Price Index for April tells us U.S. inflation is growing at a 4.2% annual pace, the largest jump since the bubble days of 2008. Meanwhile, Freddie Mac’s rate for a 30-year mortgage averaged 3.1% in the same month, a smidgen above record lows.

That puts the cost of home loans at 1.1 percentage points below inflation. Let my trusty spreadsheet tell you how topsy-turvy that really is: Over the past half-century, mortgages were an average 4 percentage points above the inflation rate — though that gap’s been halved in the past decade.

Inflation rates topping mortgage rates have happened in just 34 of the 601 months — that’s 50 years — since this loan index started in 1971. That’s just 6% of the time. The last occurrence was August 1980, when inflation was an ugly 12.9% and mortgage rates were 12.6%.

Link to Article

by Jim the Realtor | Apr 22, 2021 | Frenzy, Interest Rates/Loan Limits, Market Buzz

Mortgage rates have settled down nicely, and are back in the high-2s for those home buyers who don’t mind paying a half-point or so (those quoted above are with zero points paid).

Not sure that it matters. Not sure that anything matters any more.

I had a great conversation with a top Compass agent today discussing the market conditions.

Specifically, what do you tell buyers?

Thankfully, the market is so hot that we have more sales to rely on. Even with the prices going up, at least there are a few recent sales nearby that help to substantiate the trend.

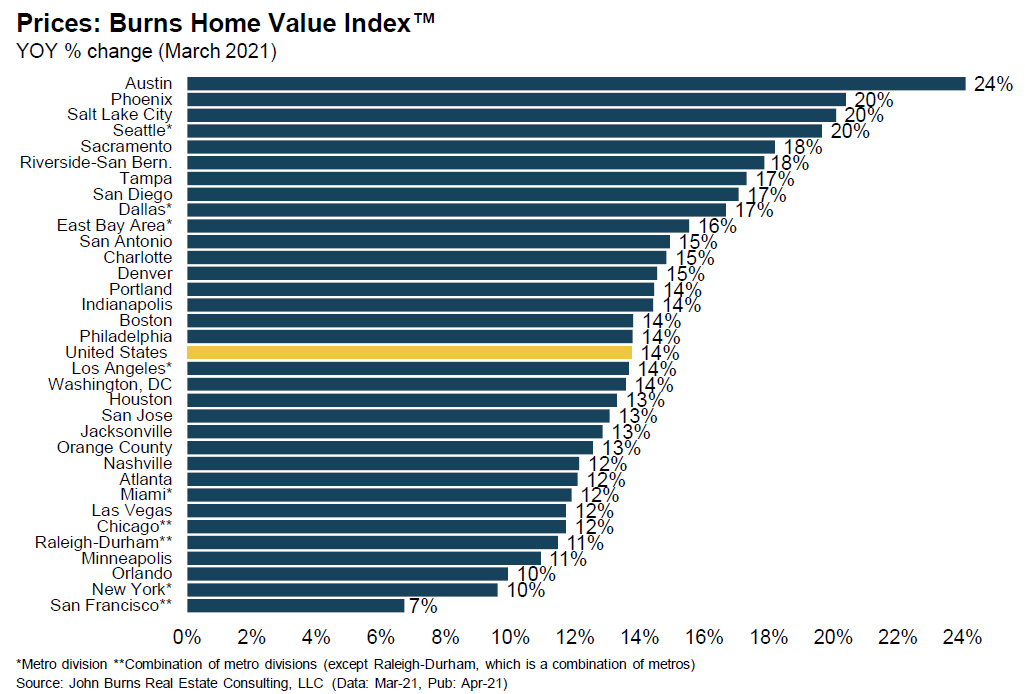

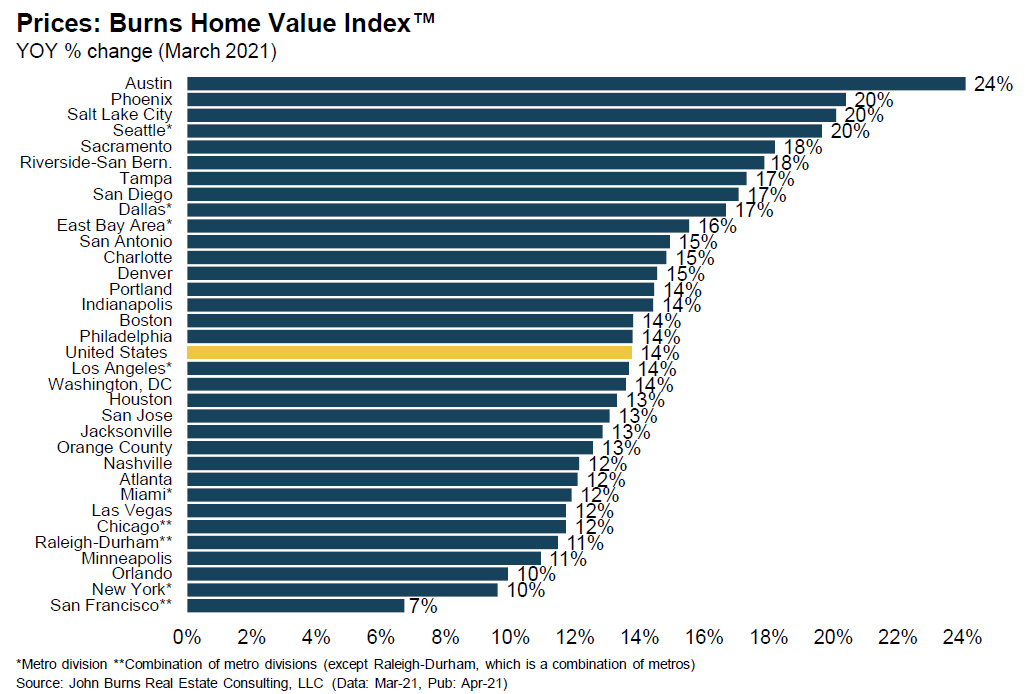

Is adding 1% per month to pricing enough to keep up with the actual? 1.5%?

Or how about 2.0% per month in the quality mid-range markets, both local and national?

by Jim the Realtor | Apr 3, 2021 | 2021, Interest Rates/Loan Limits |

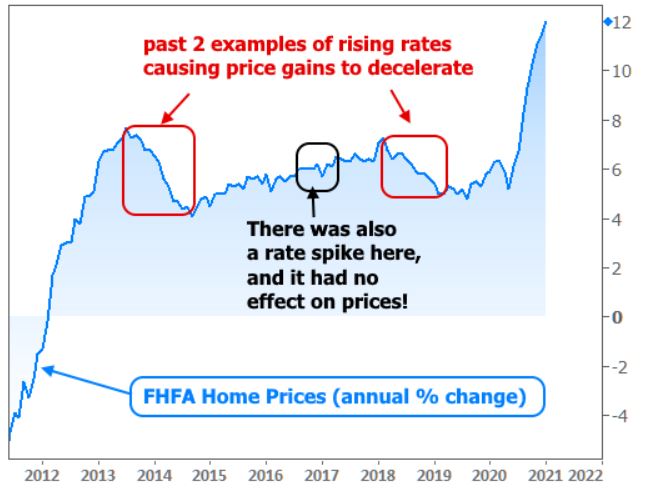

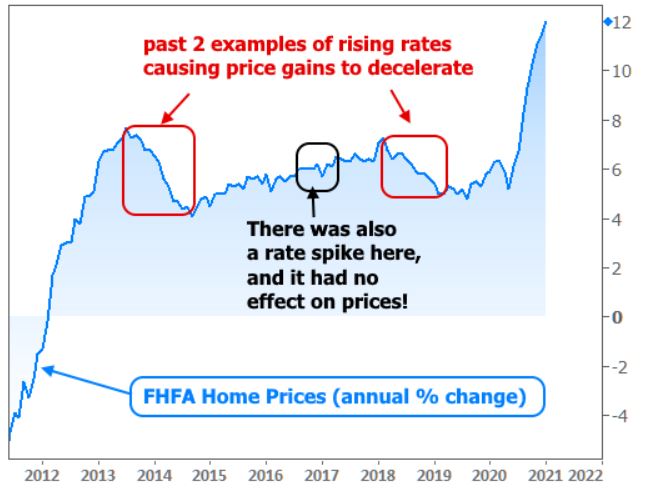

Matthew makes the case here that the current uptick in mortgage rates may not affect home prices:

There was a big rate spike at the end of 2016 that had no discernible effect on prices. This is notable because that rate spike was fueled by economic optimism as opposed to 2013’s rate spike which happened after the Fed said they would begin decreasing their rate-friendly bond buying program. 2018 was somewhat similar as the Fed was continuing to tighten monetary policy and raise short term interest rates.

A case could be made that the current rate spike shares some similarities with 2016. The path of 10yr Treasury yields (a benchmark for longer term rates like mortgages) has largely traced pandemic progress and economic recovery hopes. Yields (aka rates) began rising late last summer as vaccine trials showed promising results and economic data began to improve.

Rates spiked more quickly in the new year as vaccine logistics ramped up and covid-relief legislation was passed. Fiscal spending hurts rates both due to both its positive implications for the economy (a stronger economy supports higher rates) and the implication of more US Treasury issuance (more Treasury supply = lower bond prices = higher bond yields = higher rates).

But it is predicated on mortgage rates staying about where they are today, which is around 3.0% – 3.25%. The demand has been strong enough that rates in the low-3s should be acceptable and that the bidding wars will sort out the rest of what happens to pricing.

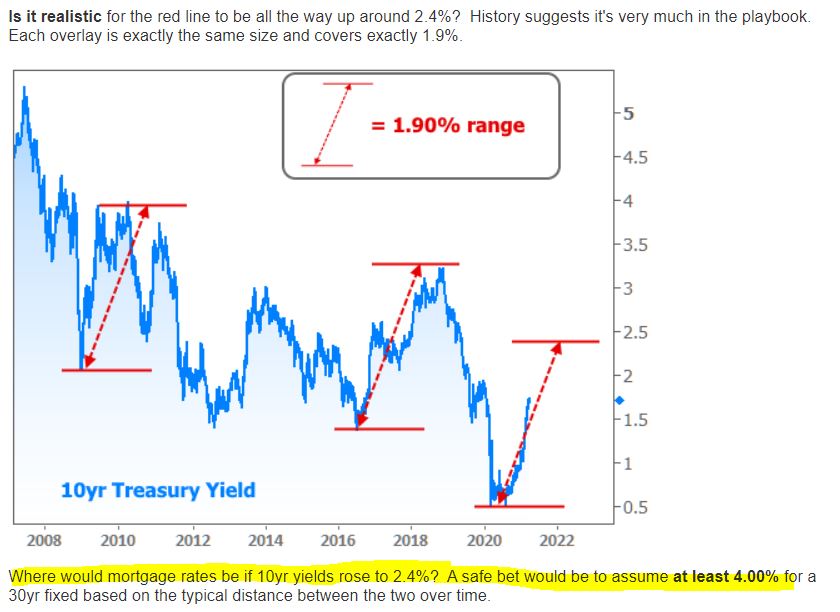

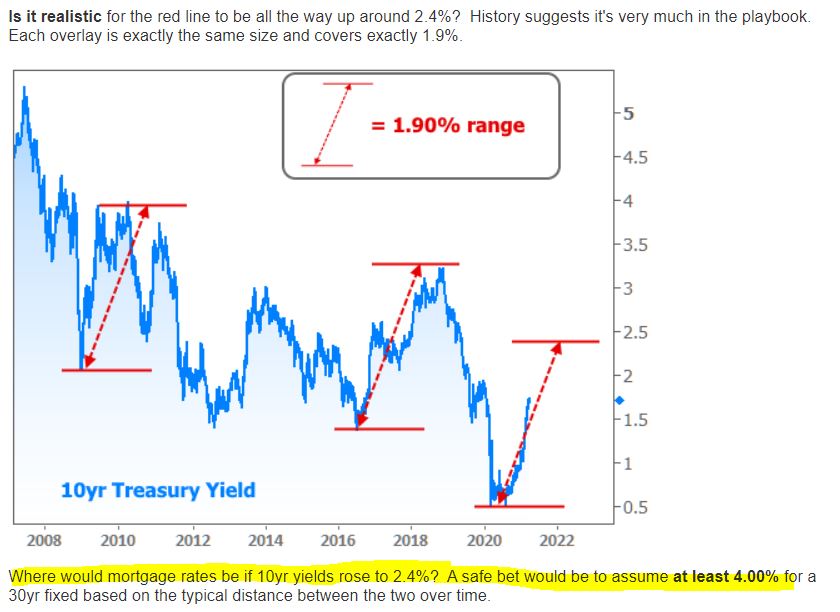

He also makes the case that the 10-year bond yield and mortgage rates have re-connected. The 10-year closed at 1.71% yesterday, and if things go right, it will stay in that ballpark.

But there has been times when the 10-year has kept rising. If that happens again, we might see 4% rates:

If mortgage rates get back to 4%, we should see pricing flatten out. Let’s keep an eye on the 10-year yield!

Read full article here:

http://www.mortgagenewsdaily.com/consumer_rates/971650.aspx

by Jim the Realtor | Mar 23, 2021 | 2021, Interest Rates/Loan Limits, Jim's Take on the Market, Mortgage Qualifying, Virus |

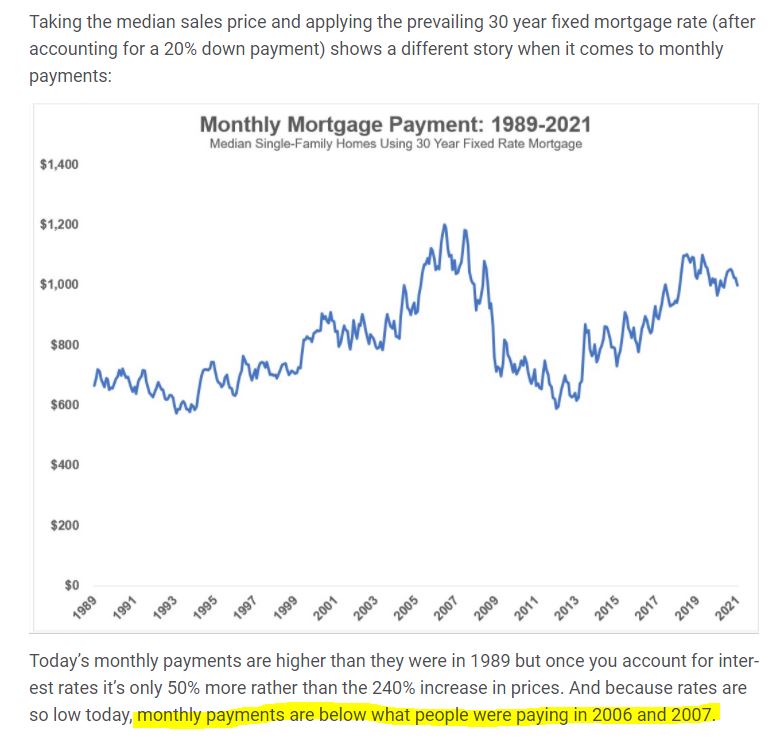

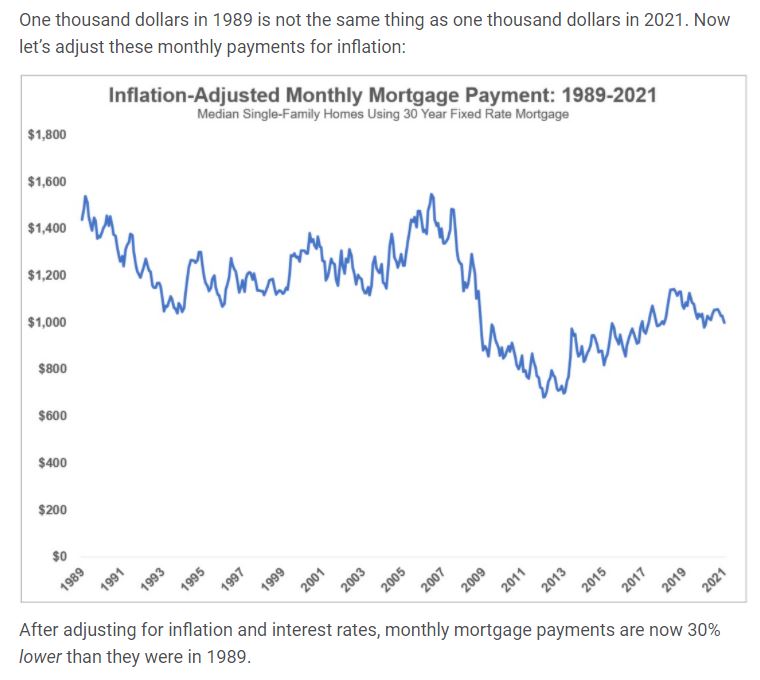

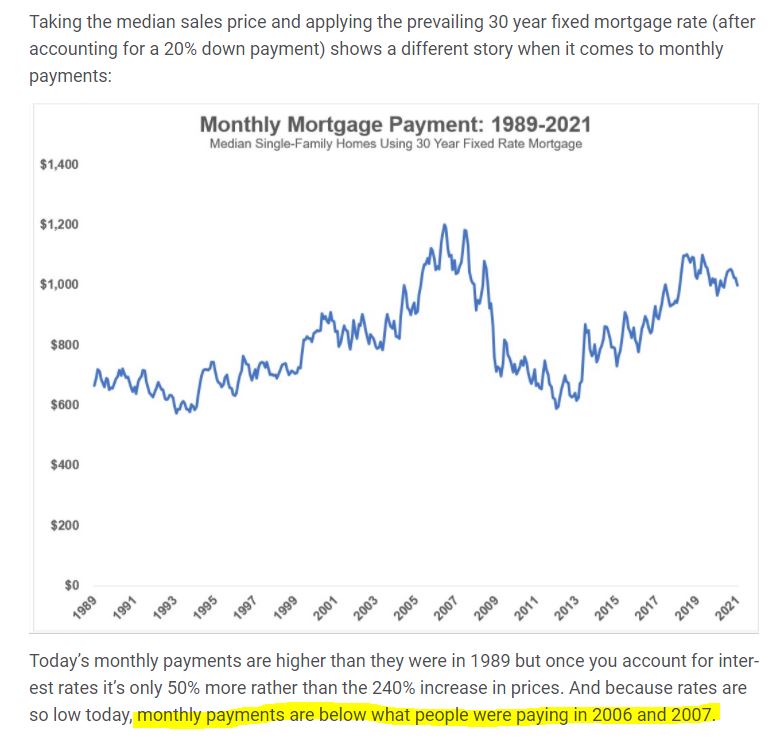

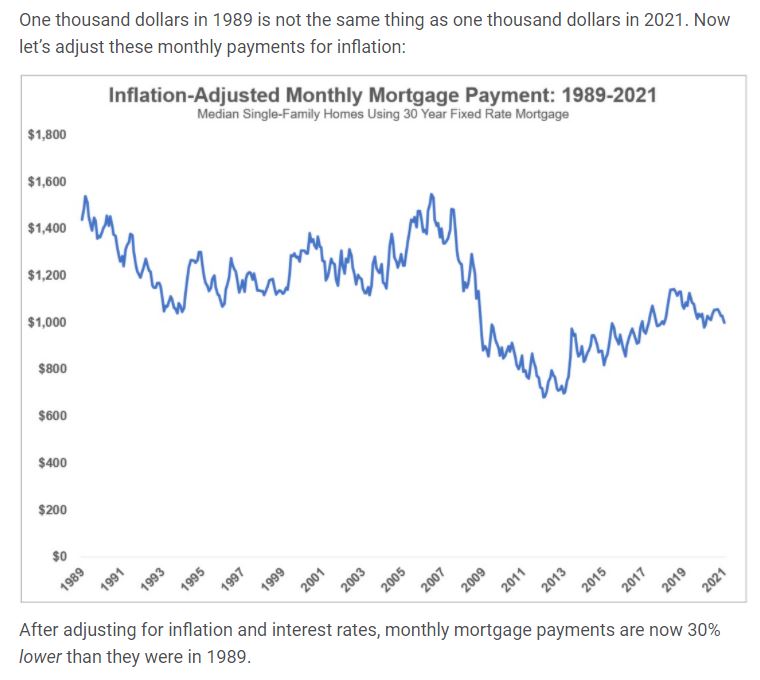

Thanks to just some guy’ for sending in this article comparing prices, rates, and inflation:

https://awealthofcommonsense.com/2021/03/what-if-housing-prices-arent-as-high-as-they-appear/

It’s a feel-good idea that inflation and lower rates can ease the pain of higher prices. But recent pricing has been really painful for buyers! Let’s apply the data to our local action (using 80% of MSP):

NSDCC Detached-Home Sales, February

| Year |

# of Sales |

Median SP |

Mortgage Rate |

Monthly Pmt |

| 2006 |

137 |

$833,000 |

6.25% |

$4,103 |

| 2015 |

171 |

$1,110,000 |

3.71% |

$4,092 |

| 2018 |

166 |

$1,289,005 |

4.33% |

$5,121 |

| 2021 |

226 |

$1,736,000 |

2.81% |

$5,714 |

It’s a nice idea, and higher rates did cool things down a bit in 2018. But today’s market is so explosive that we are blowing through all the usual stop signs – look at the number of sales!

My guess is that there will be additional sellers pulled forward from future years, just like with buyers – it’s too lucrative and tempting to find a way to sell now. Might it mirror the covid-recovery trend line?