Juan Loves San Diego

The Chamber of Commerce is loving this:

If Soto re-signs because of his neighbors bringing him homegrown grapes, give them lifetime season tickets. pic.twitter.com/CW24Clu6FR

— Michael Shin (@MichaelUCSD) July 10, 2023

The Chamber of Commerce is loving this:

If Soto re-signs because of his neighbors bringing him homegrown grapes, give them lifetime season tickets. pic.twitter.com/CW24Clu6FR

— Michael Shin (@MichaelUCSD) July 10, 2023

This article gets into the usual topics for those trying to forecast the future:

https://www.investopedia.com/what-housing-experts-anticipate-for-the-last-half-of-2023-7555067

Their experts think that mortgage rates will ease for the rest of the year, which will cause the inventory of homes for sale to increase. Apparently they are stuck on the whole golden handcuffs theory of why inventory is ultra-low, and when rates drop, then everything will be fine.

Here are their two quotes on the direction of home pricing:

Weak home prices are expected over the summer months, when they are typically at their peak, according to Realtor.com’s Hale.

“Specifically, while June is expected to be the seasonal peak for home prices in 2023, like it is most years, we won’t see as big of a month to month climb as we did in 2022, which will mean ongoing mild declines when we’re comparing home sale prices to one year ago,” Hale said.

The declines are expected to run through the early fall, depending on the Federal Reserve.

“By the time we get to the fourth quarter, mortgage rate and seasonal home price relief could be enough to stanch the declines” Hale added. “On net, we expect average home prices in 2023 to fall 0.6% compared to 2022.”

As supply boosts and mortgage rates and home prices fall, sales are expected to rise through the end of the year, according to NAR’s Yun.

“We’re likely approaching the bottom in home sales with steady improving home sales in the second half of the year and into 2024,” Yun said.

None of their experts (including Robert) offer any data to support their cases, and are just guessing.

Let’s dig a little deeper into the topic, shall we?

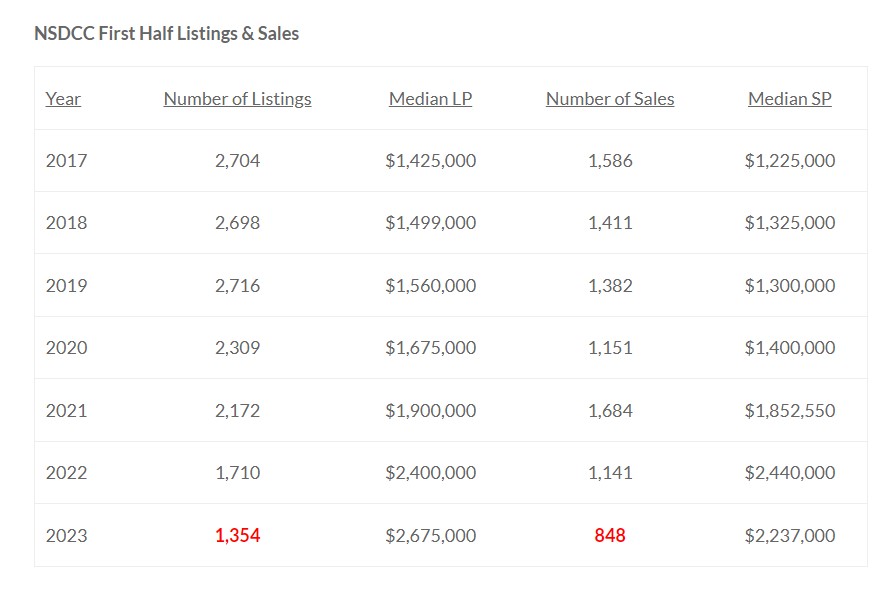

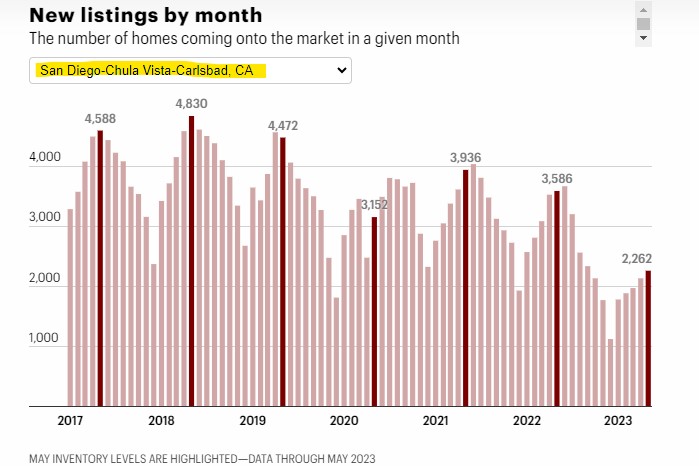

To say that the current market conditions are unprecedented is putting it lightly.

NOBODY HAS EVER IMAGINED LISTINGS AND SALES BEING HALF OF WHAT THEY USED TO BE!

But that’s where we are.

The huge gap between the 2023 MLP and MSP suggests that buyers are unwilling to pay the higher prices, but pricing was sluggish in the first two months of the year so there was some lag – just like in 2020 when we had a couple of months of pandemic trouble.

Buyers should really be picky in the off-season, so any thoughts of sales increasing are optimistic. With only the creampuffs selling, pricing should keep rising, except in areas where the only homes for sale are the scratch-and-dent/fixers and where unscrupulous agents doing their dirty work (this is more of a problem for pricing than you might think).

Fewer comps means that one or two sales in either direction will impact the prices for the rest of 2023.

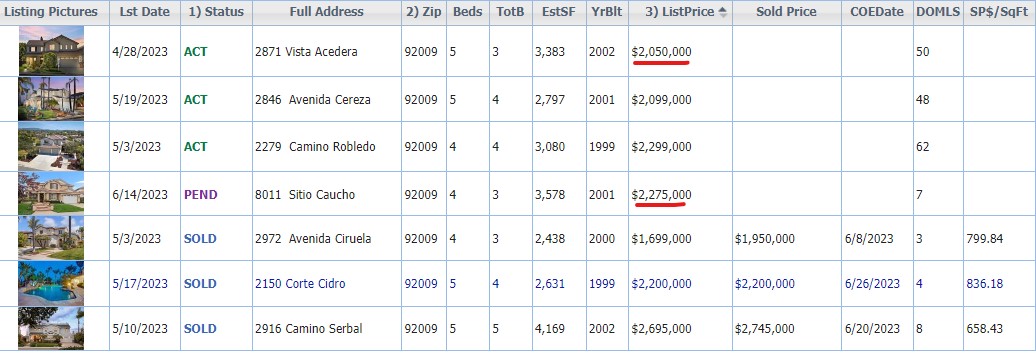

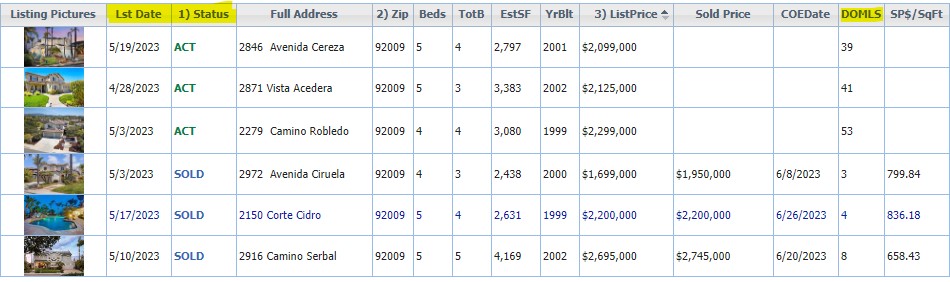

Here’s an example – our La Costa Valley Six had a listing on Sitio Caucho hit the market on June 14th, and it promptly went pending within seven days:

At first, you might think that the new pending sale should close above $2,200,000 and that trend would be bolstered. But Vista Acedera has gotten tired of being left behind, and on Monday they lowered their price from $2,125,000 to $2,050,000.

What’s the trend now?

Lowering their price was smart because they have been on the market since the end of April and summer will be over before you know it. They really want to be the next home to sell – but what will that do to the others left for sale, and the other new listings to come between now and the 2024 Selling Season?

Get Good Help!

My guys have done three of these – but I think you should move instead!

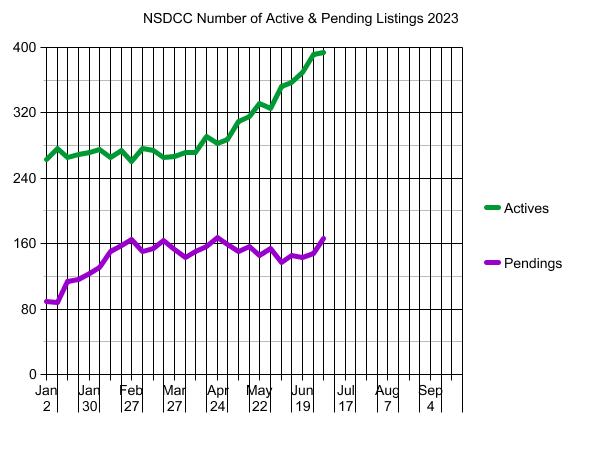

The number of pendings surged with the largest weekly gain of the year – 48 detached-home sales between La Jolla and Carlsbad opened escrow since last Monday! This year’s previous weekly high was 39.

There should be another 2-3 weeks of heightened activity as buyers scramble to secure a home and get comfortable before school starts. We have three new listings coming – stay tuned!

When I listed 2949 Avenida Castana on March 31st, it was the only house for sale in La Costa Valley. Well, besides this one, which we thought would never sell while priced at $2,400,000 (the model-match comp had just closed under list at $2,175,000 on March 27th).

We listed Castana for $1,900,000, and took a $2,000,000 offer on April 8th after my slow-motion auction gave all five bidders a chance to win.

But the $2.4 listing did go pending on April 16th, shocking everyone. Two weeks later, their cash buyer closed for $2,375,000, which set off a cascading surge of new listings.

Above are the six La Costa Valley listings that hit the open market between April 28 and May 19th, with their initial list prices.

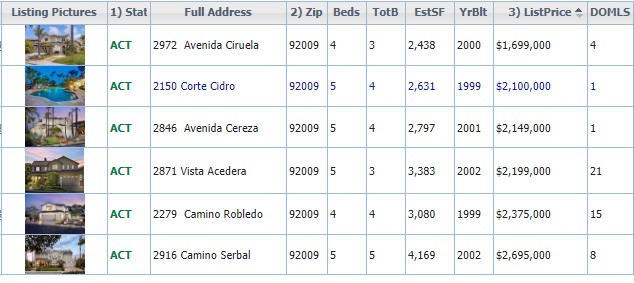

Here are today’s results for the same six listings:

Everyone – sellers, buyers, and agents – were working with the most-recent $2,175,000 comp until the $2,375,000 closed on May 1st. Vista Acedera had already gone on the open market, but the other five listings had a chance to adjust their price before hitting the MLS in May.

COULD ONE HIGH COMP GIVE EVERYONE ELSE A 10% BUMP?

The other three listings are still active, and have only adjusted their prices modestly. Now that my listing offcially closed yesterday for $2,200,000, there probably won’t be much change in their prices now – heck, two out of three are below mine, and my listing had power lines and a full bath added without permits!

It shows how easy it is to miss in the post-frenzy market. Some homes aren’t going to get their price, and others aren’t going to sell at all. The reading of the market conditions, and the strategy employed by the listing agent is what makes the difference.

The experts say that the majority of homeowners are locked into their homes by their low mortgage rate, and if/when today’s high rates come down, then the inventory of homes for sale will bounce back.

Boy, are they going to be disappointed.

For the last 10-12 years, San Diegans have been buying their ‘forever home’, whether they knew it or not. They are locked into their home all right, and their low rate is only one of the reasons – with two other facts being more of a burden:

If mortgage rates magically came back to the 3% to 4% range, would it make sellers shrug off the first two? If rates came down to the 2% to 3% range? They would still need a very good reason to move, and endure the first two problems.

The low-inventory environment is here to stay.

From realtor.com:

To find the most affordable beach towns for homebuyers in 2023, we started by using a federal listing of beaches and their locations. We aggregated Realtor.com listing data for every home put on the market in the past year located within a one-mile radius of each beach. We then selected the most affordable beach towns by price per square foot. Only locations with at least 50 properties within a mile of the water in the past year were included.

We limited our list to just one beach town per state to ensure geographical diversity. And although we did favor places on the ocean, we also included a few bayside locales.

Despite what you may have assumed, in some places, a home by the beach can cost about the same as an average U.S. home—or less. So let’s dive in.

Powell’s goal was to crush the real estate market…..

In June 2022, Powell told reporters that spiked mortgage rates would help to “reset” the U.S. housing market, and that “we need to get back to a place where supply and demand are back together and where inflation is down low again, and mortgage rates are low again.”

Then in September 2022, Powell told reporters that we had officially entered into a “difficult correction” that would restore “balance” to the housing market. At the end of November 2022, Powell went a step further, and said a “housing bubble” had formed during the Pandemic Housing Boom.

Last week, Powell said, “The housing market is bottoming and may already be improving.” He made the comment after the central bank kept benchmark rates steady but indicated more hikes may be needed later this year.

“Activity in the housing sector remains weak, largely reflecting higher mortgage rates,” Powell told reporters after the rate announcement. “Certainly, housing is very interest rate-sensitive, and it’s the first place, really, or one of the first places, that’s either helped by lower rates or is held back by higher rates. And we certainly saw that over the course of the last year. We now see housing putting in a bottom and maybe moving up a little bit. We’re watching that situation carefully.”

In his prepared statement yesterday, he said, “Although growth in consumer spending has picked up this year, activity in the housing sector remains weak, largely reflecting higher mortgage rates.”

Then he said,“We think housing inflation will be coming down significantly over the course of the rest of this year and next year. Consumer inflation has eased since last summer due mainly to falling energy and core good prices. In contrast, rents and other housing inflation has been moving higher.”

What he doesn’t see…..

Powell’s comments get turned into headlines, like this:

Potential home sellers take one glance and – even though they aren’t quite sure what he means – they decide the market is no good and that it’s smarter for them to wait for better times. It would take a flood of supply to effectively reset the real estate market, yet his policy is doing the opposite. Plus, his higher rates are pricing out the marginal buyers (the regular people), which creates less competition for those who can withstand higher rates – the affluent buyers.

The end result is affluent people chasing the few sellers who really need to move – just the type of buyer who can, and will, pay more to get what they want now….which will help to keep prices elevated.

What’s likely to happen:

The off-season will commence shortly and there will be fewer sales than ever, with an occasional deal here and there. The trendline will look softer than during the selling season, which will cause Powell and others to abandon the bottom talk and instead declare that their ‘housing inflation’ – code for rising prices – is coming down. Everyone will take it as a sign that the recession is finally here!

Then the 2024 selling season will get rolling in February, confounding the experts even more.

It might take a couple more years before they start believing that home sales are seasonal – if they ever do.

How did the local home prices go up 40% in two years?

The low rates helped buyers lose their minds, but it was more attributable to how we price homes.

When there was a sale that was 10% or more above comps, it became the new standard – and made the next seller so giddy that they started from there. Prices were leapfrogging higher!

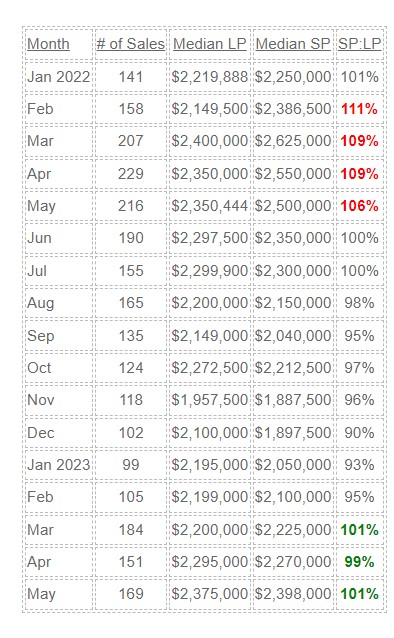

Look at how hot the uber-frenzy was in early 2022:

It was a result of most buyers paying crazy amounts just to win something:

The big difference now? While many are still paying over the list price, they’re not going WAY over. The latest 41% Over List (above) sounds like the market is on fire but the SP:LP ratio of around 100% reflects how it only takes a few bucks over the list price to win these days.

It’s a whole new world of home pricing….just when we were getting comfortable with the last new one!

With these two graphs showing more reluctance to overpaying – even when more are doing it – future sellers need to be smart about pricing their home.

If there happens to be a wild sale that went 10% over the logical comps nearby, it was probably a fluke with no guarantee that another buyer will go for it again. You see it regularly now where listings are stacking up unsold because they relied on a single hyped-up sale nearby.

What to do when pricing the next home near a sale that wildly overpaid?

Use the list price of the comparable sale, not the sales price, and ignore the one-offs.

Their list price was the logical conclusion of value last time, and what the seller was willing to take then. Any extra money paid above list was a gift to him, and not a reflection of the actual value.

Then hire an agent who is an expert at causing prices to go up, not down!

It is common to see the same words or phrases in the MLS descriptions.

A few years ago, the fancy new buzz word was ‘boasts’; a word realtors would use to describe the home’s best features. The word got overused, and eventually we would read that a home “boasts three bedrooms, and two baths”, as if that was something special.

There are two buzz-phrases you hear regularly these days.

Watch how many times you see, ‘this one checks all the boxes’ and ‘this is the one you’ve been waiting for’.

For those who have access to the confidential remarks, you will see a third phrase currently that is very curious: “Reviewing Offers As Received”

Isn’t that what you are supposed to do? Isn’t that required by law? I think so!

The phrase is probably a response to inquiries from buyer-agents wondering about their full-price offer they just sent in. Sometimes the listing agent will tell you that they have a specific date in mind to review offers with the sellers, or they are reviewing them as received, one by one.

What the buyer-agents really want to know is….when are you going to respond? How long will my buyers and I have to sit on pins and needles while you dink around with no strategy or game plan and instead just play around with the process?

The reason buyer-agents don’t like asking that question is because they cringe at the thought of having to hear one more time the same answer given by listing agents in almost all cases: ‘I don’t know’.

You get a very specific answer from me: “Should we have multiple offers, everyone will receive a highest-and-best counter-offer from us on Monday, and we hope to select a winner by Tuesday night”. It gives buyers and agents alike a specific idea of what to expect, and they can start planning their response.

It’s part of the slow-motion auction – full transparency includes an clear outline of the process, and how to win the game. Our counter-offer will level the playing field by balancing out the other terms, and ensure that everyone knows the winner will be determined by price.

It may sound simple and obvious, but I haven’t seen any other agents embracing full transparency.

I have another example happening now. The listing agent said they have already received one offer and expect a couple of more. When I asked how they will handle it, I got the usual uncomfortable laugh and a vague, joking response of doing something about it next week.

Sellers deserve better. Buyers deserve better. Agents deserve better.

But no one ever says or does anything about it, and so it continues.