by Jim the Realtor | Oct 11, 2023 | Jim's Take on the Market |

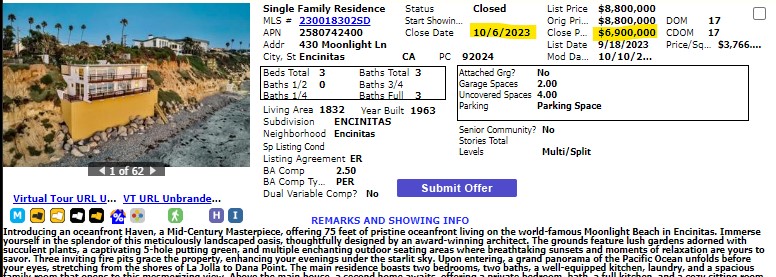

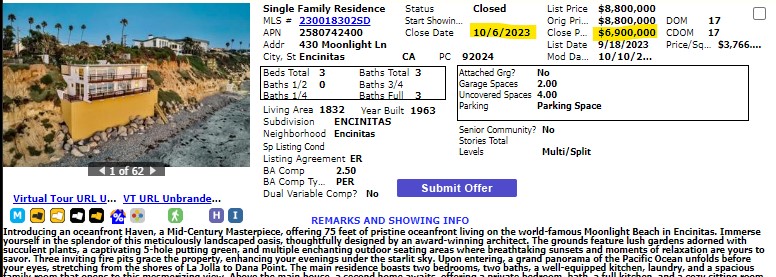

The incredible part about this sale is that it was listed with a Compass agent previously for $9,800,000.

The seller dumped $1,000,000 and listed with a new agent for $8,800,000 and then about a week later dumped again and sold for $6,900,000 cash. He dropped $2,900,000 in less than a month!

Deals are out there, but you have to earn them! Make offers!

by Jim the Realtor | Oct 11, 2023 | 1-story, Boomer Liquidations, Boomers, Jim's Take on the Market

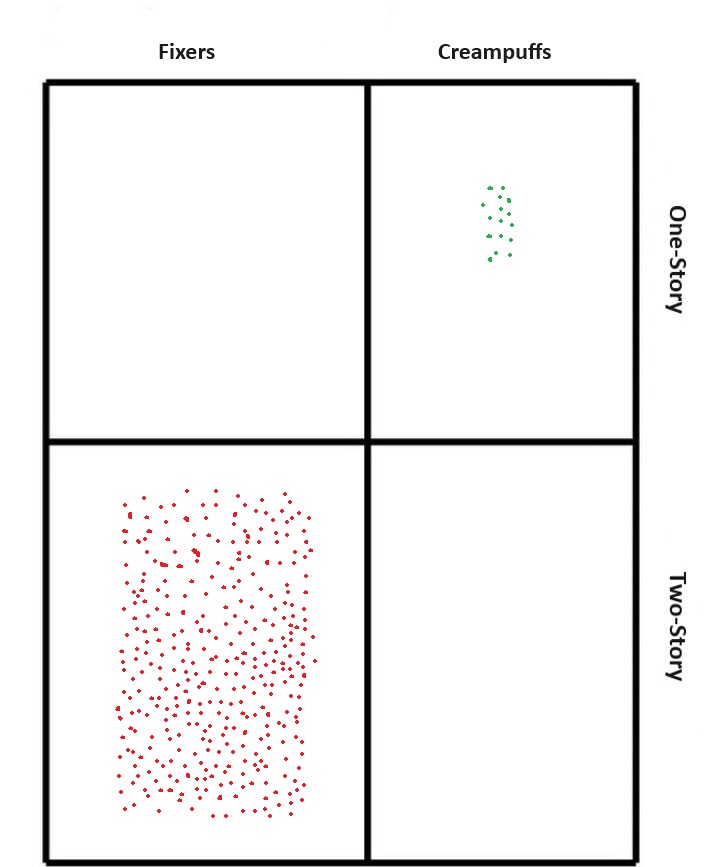

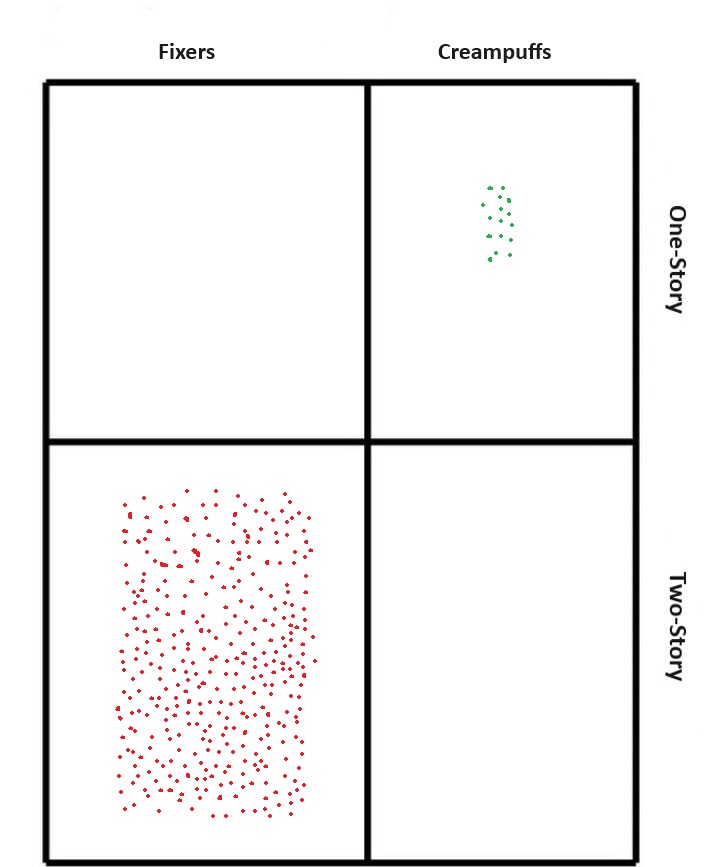

The author has been writing about housing for 3+ years, and has already identified the key topic. Even though the houses owned by boomers might be in superior locations, they are dated and in need of repairs and improvements. While she thinks fixers will become popular again, it will only be those that are appropriately discounted. During the frenzy, no discount was needed, now it’s around 10%, and soon it will be 20% or more as the group of two-story fixers grows faster. The market is dividing into four quadrants; one-story, two-story, creampuffs, and fixers.

The number of people 80 years of age or older is expected to more than double between 2022 and 2040, increasing from 13 million to 28 million. As the baby boomer generation ages into their 80s, starting slowly in the late 2020s and picking up speed in the 2030s, they will likely begin downsizing and selling their homes, putting more housing supply on the market.

However, many of the homes being sold by baby boomers will need some work. Approximately 942,000 single-family homes owned by a head of household that is over the age of 60 are considered “inadequate” dwellings, according to the 2021 American Housing Survey (AHS). The AHS definition for an “inadequate” dwelling includes units with severe defects such as a lack of electricity or hot water, insufficient heating during the winter, or water leaks. That still leaves approximately 32 million single-family homes considered “adequate” in 2021. Of those, approximately 11 million were in the top 25 U.S. metropolitan areas, including 1.5 million units in New York, 852,000 in Los Angeles, and 490,000 in Washington, D.C.

Even so, many of the structures considered adequate would still likely need updating and remodeling to be brought up to date and be attractive to potential buyers. Given the highly sought-after locations of these housing units, there will likely be buyers willing to spend the money needed for updating and remodeling. Somewhat by default, the fixer-upper will be popular again.

The demographics for home buying will remain very favorable in the coming years. Today, the housing market suffers from a shortage of housing inventory—a deficit of approximately 2 million housing units in early 2023—due to a combination of decade-long underbuilding and a demographic wave of demand from millennial home buyers. However, the generation behind the millennials, Generation Z, is smaller in size and will likely require fewer housing units. Over the next decade, as baby boomers age out of homeownership, the housing shortage may narrow and eventually disappear. Demographic trends dictate long-run demand and supply in the housing market and, though they may move slowly, they are hard to outrun.

https://blog.firstam.com/economics/when-boomers-and-millennials-collide-tectonic-shifts-in-demographics-are-coming

by Jim the Realtor | Oct 10, 2023 | Boomers, Jim's Take on the Market |

For virtually everyone – and especially for the long-time homeowners – moving is a life-changing event.

People are already having a life-changing event, and that’s what is causing them to move. Just getting older is life-changing! Selling the house and moving is the SECOND life-changing event, and the double whammy is a lot to digest for those who have settled into their comfortable lifestyle for the last 10, 20, or 30+ years.

Things to Handle (all of which can be a monster by themselves):

- Leaving the comfort of home and move to a new neighborhood….and maybe a new state.

- Having to go through “the stuff”.

- Getting comfortable with the huge numbers.

- Surrendering to paying six-figures in capital-gains taxes.

- Finding a realtor who adds value.

- Finding a suitable house.

If you already live in a house that will be suitable for the rest of your life (i.e., one-story in a good area that doesn’t need much work), then enjoy! But if you know you have another move to make, don’t wait too long.

Moving is mentally, emotionally, and physically demanding…..and you want to do it when you still have your wits about you. Generally-speaking, you want to be settled by the time you are 75 years old. Because it could take years to handle the six things above, you want to get started by the time you are 70 years old.

It means that if you were born in 1953 or before, and you know you have another move coming, then you should call me today and we’ll get started! Let’s do it!

Don’t wait too long!

by Jim the Realtor | Oct 9, 2023 | Bubble Talk, Jim's Take on the Market |

How prepared is the real estate market for unpredictable black swan events?

The 2008 financial crisis gets thrown onto the list, but it was a gray swan that was predictable – and widely discussed for 2-3 years in advance. Things could have been done to avert that crisis – like stopping Angelo from talking up Countrywide’s neg-am loans while he was quietly dumping $300,000,000+ in stocks.

The Hamas uprising in Israel will be considered a black swan event, and will likely capture the attention of everyone world-wide for the foreseeable future. It will be a distraction like the Persian Gulf War when watching rockets and missles was a major event on TV, or like the OJ trial.

Both of those events happened during some of the most difficult real estate markets, and that’s probably not a coincidence – major distractions can impact the market. But at least they were both of those were helped by being in a declining interest-rate environment.

In the low-inventory/unaffordability era, will the Israeli conflict be the last straw?

I think we can expect the rest of this year to be dormant – both buyers and sellers have to be looking for any reason to take a breather, and the Hamas massacre will provide a good reason to sit out the next three months. After 9/11, the local market rested for a few weeks but the conditions had been so red hot in 2001 that it got back on track quickly. But in 2001, the NSDCC median sales price was $570,000 and ez-qual mortgages were everywhere. This year, the MSP is $2,180,000 and getting a mortgage is miracle work.

I was hoping for 300+ NSDCC sales in 4Q2023, but now I think the count will be closer to 200 sales.

There will be buyers who really need to move, and/or they find the perfect house at the perfect price – which is no small feat. There will be sellers who need to sell and can’t wait until 2024 – or don’t want to take the chance on the market getting worse.

Will there be discounts?

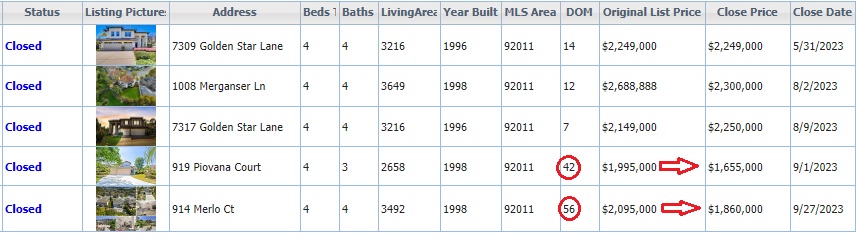

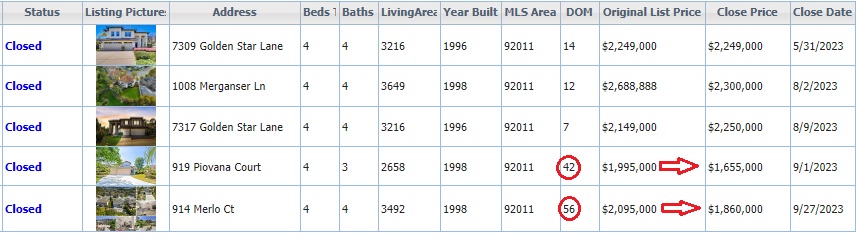

They have been in the works already. Here’s an example in the south end of Aviara:

The two on Golden Star were built by Davidson, but I’m not sure that will carry any gravitas with today’s buyers. As recently as last month, sales were closing for list price or higher, but look at the two that closed this month. I represented the buyers of Merlo Ct., and after the discount slide that started on Piovana – a house that was completely original and no effort was made to dress it up – we were able to continue at Merlo because it was the original owners who had paid $395,500 in 1998. They could afford a discount, and wanted to get on their way to the east coast.

There will probably be 5% to 10% discounts (or more) being negotiated – especially on the high-end. Any sellers still on the open market over the next 2-3 months must be motivated, and buyers are going to take advantage.

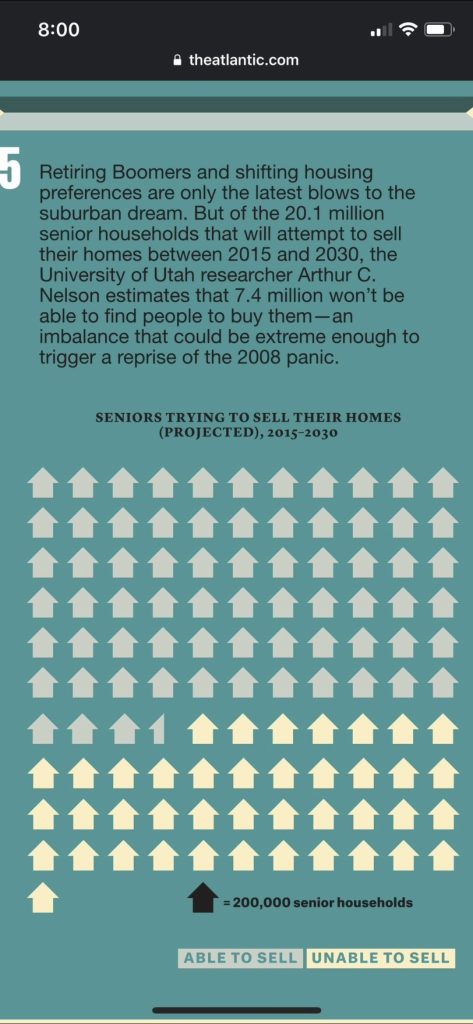

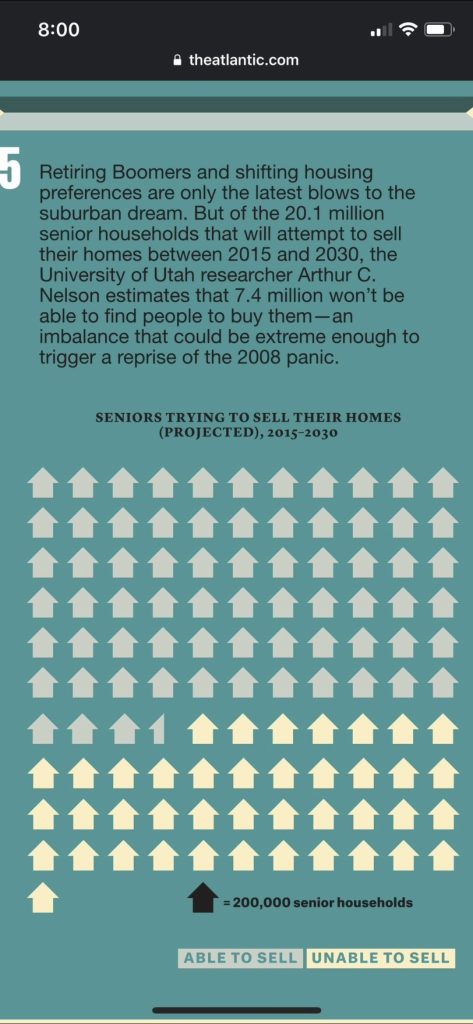

The social media won’t be helping either. This is another visual being sent around, but nobody mentions that the guy wrote it in 2013, and a lot has changed since then:

I suggested for years that boomer liquidations were inevitable, but I’ve given up hope. Seniors want to age in place, mostly due to the excessive cost of senior facilities. Between reverse mortgages and in-home care, more people can live out their life where they are most comfortable – at their long-time home.

Expect fewer homes for sale – and even fewer quality buys available. More buyers will be looking for a discount, but will have to lowball to get one. Just the fact that a home is on the market now is evidence enough that the sellers must be motivated – but they probably won’t reflect it much in their list price.

by Jim the Realtor | Oct 5, 2023 | Jim's Take on the Market, Why You Should List With Jim

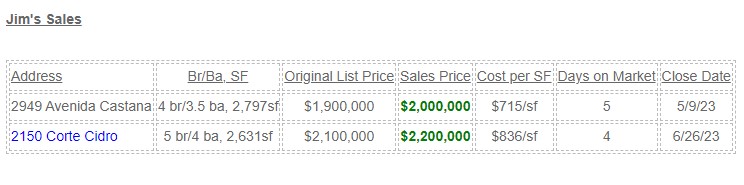

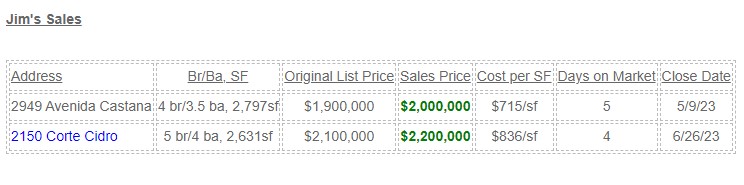

I have sold two LCV listings this year – here are my results:

Both of mine sold in the first week on the market for $100,000 over their list prices.

The addresses highlighted in blue here are the group I named the La Costa Valley 6 – the comps that would have given other sellers confidence that their values were in the low-$2,000,000s….at least in June, 2023. Here is a link to the last update (dated June 27th):

http://bubbleinfo.s020.wptstaging.space/2023/06/27/la-costa-valley-6-update/

What has happened since to the LCV Six?

Two of the six are still for sale. My sale on Corte Cidro and three others closed escrow.

But look at the other new action too:

The addresses in bold:

Unbelievably, the model match to my Corte Cidro sale, 2185 Corte Arboles, hit the market at $1,799,500, three weeks after mine closed for $2,200,000! Hard to understand why they didn’t try for more – the house was described as ‘beautifully renovated’, and in the photos it looked a lot like my listing did. There was probably some street noise from Olivenhain Road, but $400,000 worth?

Corte Cicuta had been the first sale that set the tone for the 2023 Spring Selling Season, selling for $714/sf in March. But to demonstrate how thin the demand can be, only one buyer looked at that house, and bought it right away.

Sitio Caucho was a large 3,578sf house on a culdesac with westerly view, so no surprise that it sold right away too. At $622/sf, it looked like a good value.

2305 Camino Robledo was the wild card, because at the time, the only comp was Corte Cicuta at $714/sf so I didn’t think it had much chance of selling. The model match next door is still for sale, now listed for $714/sf, and when the 2305 buyer walked into that open house, he said ‘Oh s***, what have I done?’ – realizing that he paid too much.

The two sales on Camino Serbal were Davidson-built homes, and superior in quality.

Bottom line in the new era: You never know when a neighbor will dump on price, and it affects everyone else. The four active listings are now hung out to dry by the Corte Arboles sale, and at this point, they don’t have much chance of selling for $2,000,000+ when in May/June they could have gotten it easily.

by Jim the Realtor | Oct 5, 2023 | Jim's Take on the Market, Realtors Talking Shop |

PLEASE DO NOT CONTACT ME FOR OPEN HOUSES. Title and Escrow to be seller’s choice. Deposit to be in escrow within 48 hours of acceptance and seller has the right to cancel without providing a notice to perform, if the deposit isn’t received by escrow within 48hrs.

**NO MORE SHOWINGS, MULTIPLE OFFERS OVER ASKING PRICE IN HAND**

For offers full price and above, seller is offering a full commission of 3%

Offers do by Wednesday 5pm

Views are not guaranteed and can be abstracted at any time.

24 HOUR NOTICE FOR QUALIFIED BUYERS ONLY! DO NOT WALK PROPERTY, PLEASE! SKIDDISH TENANTS.

Seller is not open to making repairs or offering buyers a credit for repairs.

Paint is fire proof

Please, no blind offers. Please do not call to ask if I have offers, email your highest and best.

Please do not submit any narratives or photos of your buyers regardless of how cute they may be- only the actual offer will be submitted. The super cuddly dogs do not convey with the house. Seller is NOT contingent on purchase. Please do not play the harps (I know it is soooo tempting).

Buyer must have inspection completed by certified ASHI, CREIA, NACHI, or NAHI Inspection Company.

Possible noise from traffic, aircraft and watercraft activities, appliances, and neighbors etc. Buyers are recommended to investigate neighborhood safety by contacting the local police department.

Owner is a fragile, elderly lady with a bad back. Don’t make it weird, thanks.

by Jim the Realtor | Oct 4, 2023 | 2023, Carmel Valley, Jim's Take on the Market, Why You Should List With Jim |

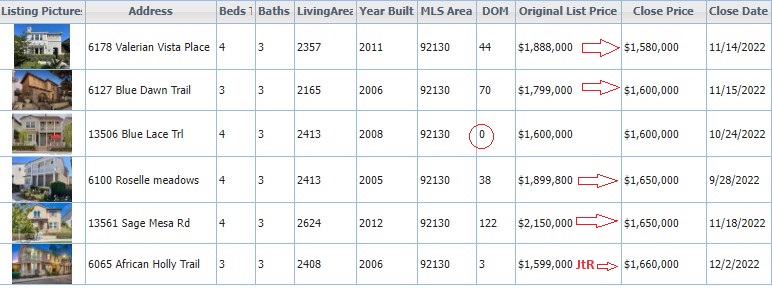

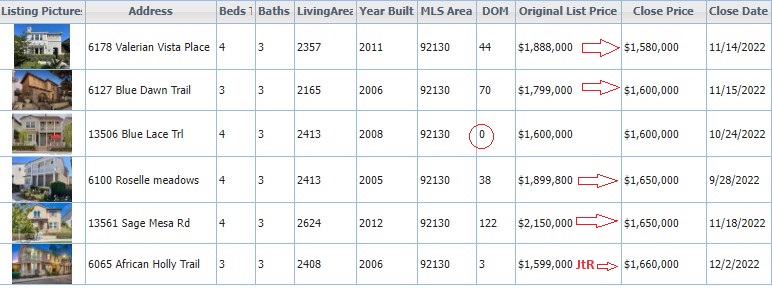

As we roll into the Lowball Season, we’re reminded of what happened in Carmel Valley at the end of 2022. Everyone’s home equity was built up fast and easy over the last 3.5 years, and the more desperate sellers might give it back in big chunks if they had to….and with 8% mortgage rates, they might have to.

How did it turn out last year?

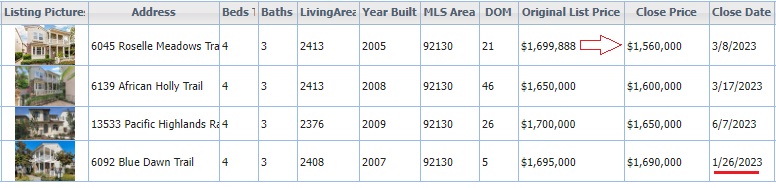

The fourth quarter of 2022 was brutal for the entry-level homes in Pacific Highlands Ranch:

The list pricing was fairly optimistic, and after 30+ days on the market, the lowballers came out. By the time my listing hit the market (the last on the list), our list price was revised down to $1,599,000 to ensure we would sell right away – and hopefully for more, which we did, and stop the trend.

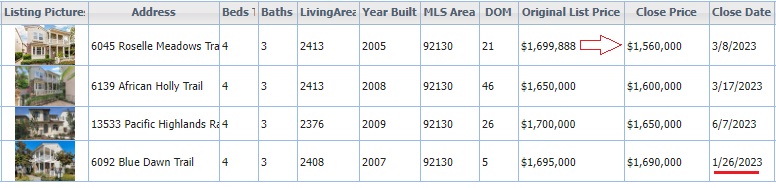

Did the pricing bounce back this year?

The first sale of 2023 closed right away for $1,690,000, and it seemed like the comeback was underway. But then the next sale was $1,560,000 – and it has hampered the pricing ever since:

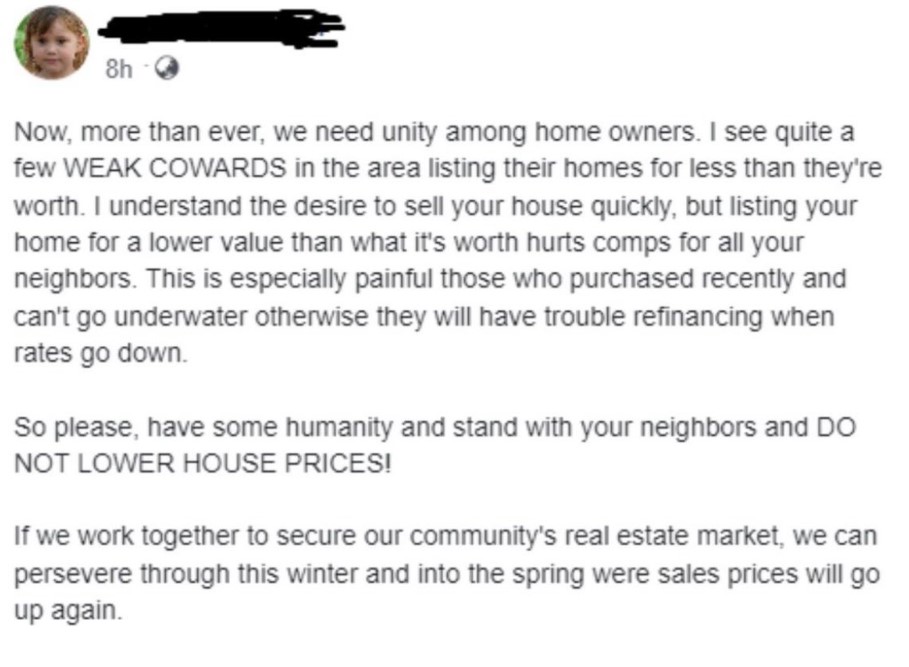

The big threat isn’t going to be foreclosures. It will be the equity-rich sellers who dump on price to get out – and they will impact future sales. A couple of lowballs can turn into a trend!

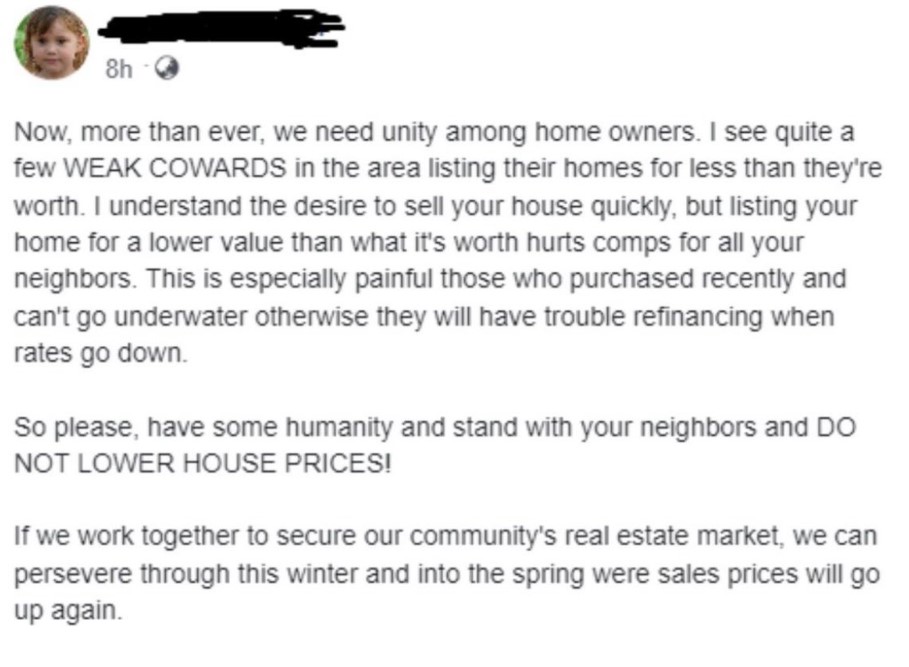

Letters like these probably won’t help either:

by Jim the Realtor | Oct 1, 2023 | Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, Realtor Training, Realtors Talking Shop |

I have mentioned repeatedly that the buyer-agent is a dead man walking. All forces within the industry are combining to push the buyer-agent out of the equation, and home buyers will be worse off because they will only have faux representation when buying directly from the listing agents.

Everything is negotiable……well, except the buyer-agent commission. From the Code of Ethics:

The Code of Ethics Standard of Practice 16-16 prohibits buyer-brokers from “using the terms of an offer to purchase to attempt to modify the listing broker’s offer of compensation.” Thus, the buyer-broker cannot attempt to condition the purchase of a home on the seller-broker’s agreement to adjust the amount of compensation offered to the buyer-broker.

Second, the Code of Ethics’s Standard of Practice 3-2 requires that any modification in the compensation offered to the buyer-broker “must be communicated to the [buyer-broker] prior to the time that [buyer-broker] submits an offer to purchase the property. And once a buyer-broker “has submitted an offer to purchase the property, the listing broker may not attempt to unilaterally modify the offered compensation.”

Third, Case Interpretation #16-15 advises that any negotiations regarding the buyer-broker’s commission “should be completed prior to the showing of the property.”

The buyer-agent is NOT allowed to negotiate their commission during the offer process!

What’s worse is that any negotiation of the commission must happen BEFORE the home is shown to the buyer. How many listing agents will agree to pay more commission before the buyer sees the home? The answer is zero.

The pending lawsuits against realtors are all about the seller being required to pay the buyer-agent’s commission. Miraculously, ReMax and Anywhere have already settled, and the whole thing could get resolved shortly. But it has been univeral among observers that the end result will be that home sellers will not be required to pay ANY commission to the buyer-agents. It will be optional instead.

Two things will happen:

- The buyer-agents will be even more likely to steer their clients to where they can get a commission.

- There will be even more shenanigans by listing agents.

Rob lays it out here, starting around the 26-minute mark:

https://www.vendoralley.com/2023/09/28/industry-relations-podcast-the-re-max-settlement-and-what-happens-next/

It means that the buyer-agents will have to either live with the commission that the seller is offering (if any) and steer their buyers to those homes, or have an agreement with their buyer to be paid directly by them. While that sounds nice, it is a complete change to the business and most agents won’t be able to justify being paid for their services. When buyers can just go direct to the listing agent for free – which the listing agents will be advertising – they will be very reluctant to be contractually obligated to pay a buyer-agent.

by Jim the Realtor | Sep 29, 2023 | Forecasts, Jim's Take on the Market

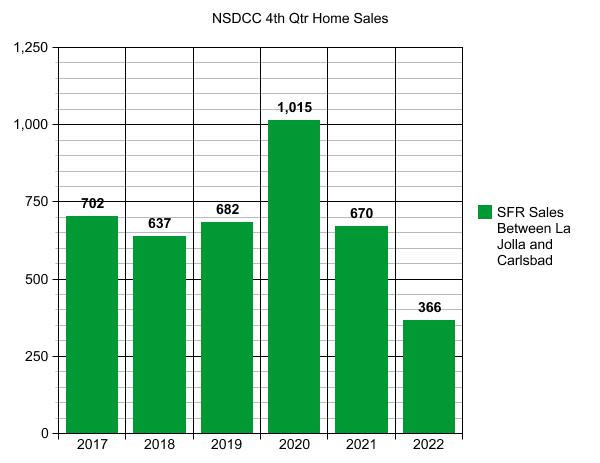

The local real estate market between La Jolla and Carlsbad has been fairly healthy lately, and feels in better shape than it did last year at this time when we were still getting over the initial shock or higher rates.

How will the rest of this year turn out?

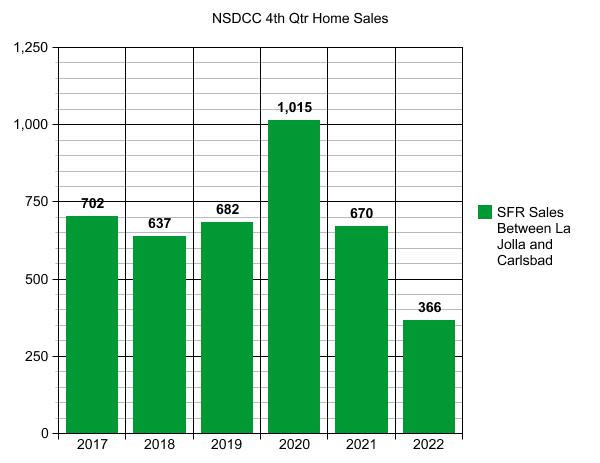

The recent burst that pushed up mortgage rates – now near 8% – will cause most people to sit out the rest of the year. Heck, it’s the holidays! Sales in the fourth quarter of 2023 will plunge and probably set the all-time low. I’m hoping we have 300 sales!

Want to know the history?

In 2007, we had 460 closings in the fourth quarter, and in 2008 we had 461 closings. By 2009 the market was already on the upswing, and there were 671 4Q houses sold between La Jolla and Carlsbad.

Last year, we saw some successful fourth-quarter lowballing where sellers dumped 10% or more on price to get out, and we’ll see more this year! But only for those buyers and agents who cause it to happen.

Stay in the game and Get Good Help!

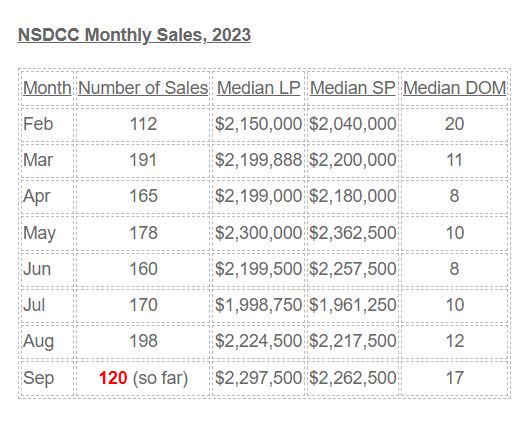

by Jim the Realtor | Sep 27, 2023 | Jim's Take on the Market, North County Coastal, Sales and Price Check

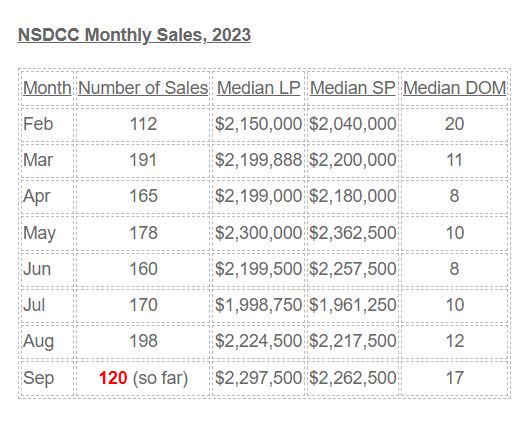

We’re having another amazing month, and should get close to 150 sales!

The pricing appears to be holding up nicely too (and more evidence that July’s collection of lower-priced sales was an anomaly).