by Jim the Realtor | Sep 19, 2023 | Jim's Take on the Market

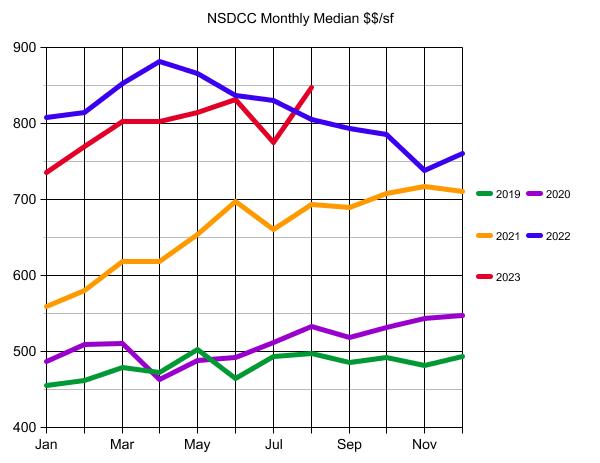

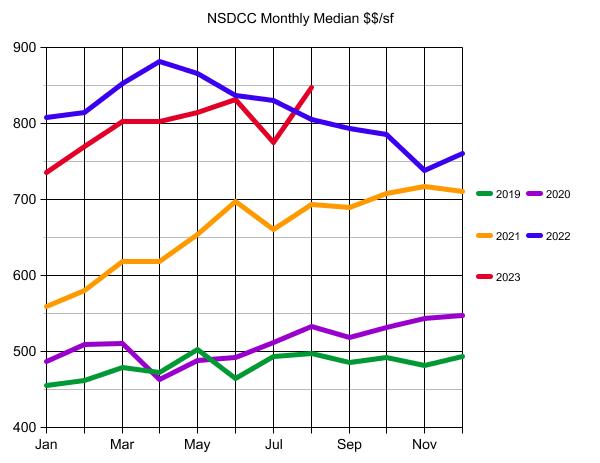

The graph above is another way to identify the local pricing trend.

If it weren’t for the surge of lower-end sales in July, the trend line this year would look all positive. It should mellow out over the rest of the year, and even if it flatlines, the market will be fine entering 2024. It would actually be more exciting if it dropped a bit!

How can it be explained?

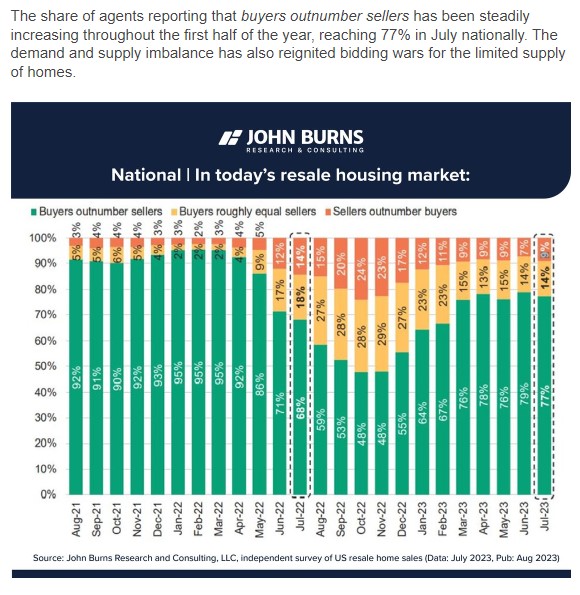

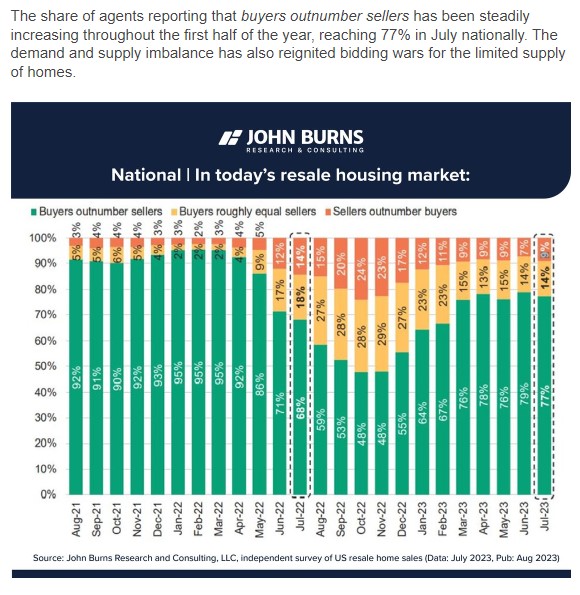

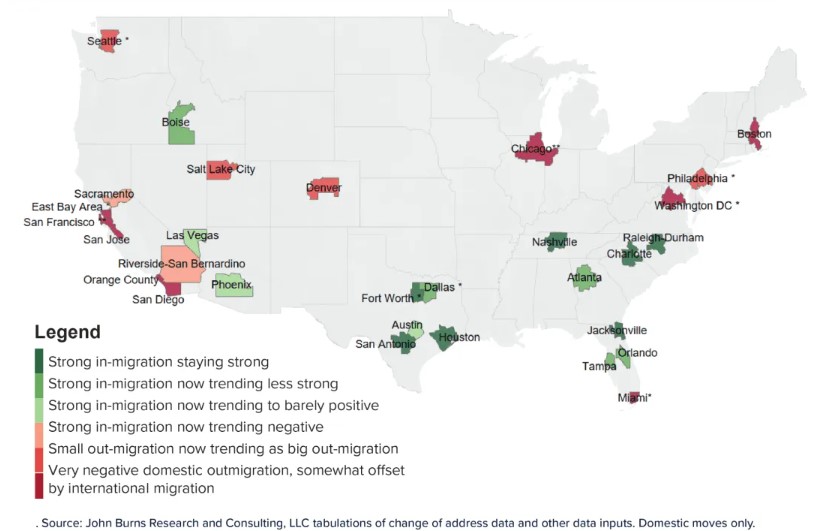

The demand is solid and buyers have been willing to endure the double whammy of higher rates and prices. Here is a graphic to help demonstrate the demand nationally (thanks JB!):

The demand is hot enough that 90% of agents say that the number of buyers are equal or greater than the number of sellers! While there are obviously fewer sellers, it can’t be that bad because the existing-home sales nationally will only be down 20% this year.

What will keep it going is the $70 TRILLION of older generational wealth that will be redistributed over the coming 2 decades!

by Jim the Realtor | Sep 18, 2023 | Forecasts, Jim's Take on the Market, Why You Should List With Jim |

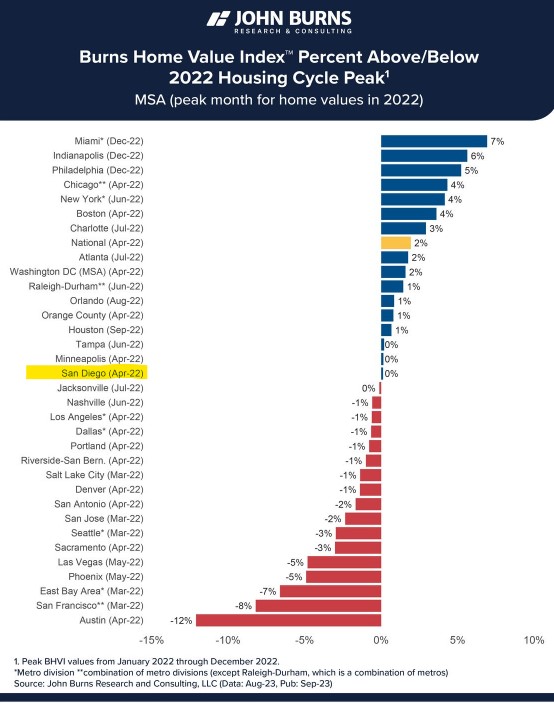

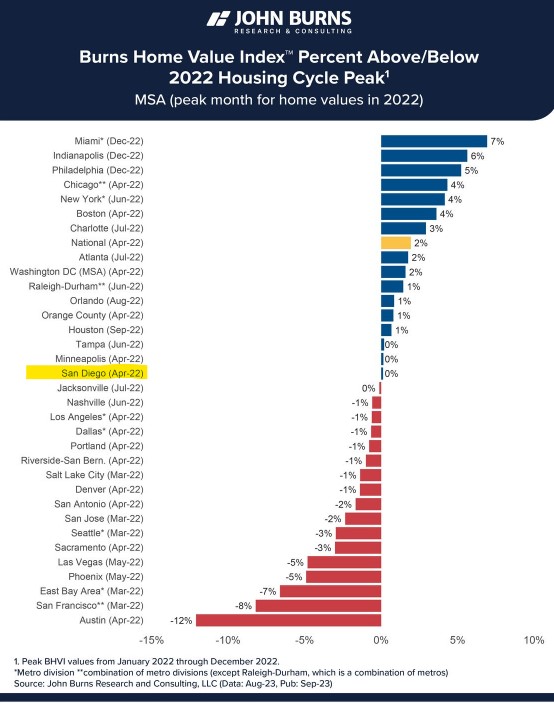

We are back to peak pricing!

But it sure doesn’t seem like a good time to sell your house, and as a result, most potential sellers will pack it in and wait until The Home-Selling Season of 2024.

Is there anything wrong with waiting until next year?

- Mortgage rates could go higher. The Fed meets three more times this year, and unfortunately they will be tempted to bump their rate at least once or twice. It doesn’t mean that mortgage rates will definitely go higher, but lenders are like gas stations and use any reason to pinch extra profit.

- Flood of Inventory. By a ‘flood’ , I mean two or three other homes go up for sale nearby.

- Bad Comps. If you have any 4Q sales nearby, they are likely to be lower than you’d like.

Who will be the 2024 home sellers?

There has to be a load of realtors and mortgage brokers who had their worst year ever in 2023, and had already been thinking of moving down and/or out. Or what about those sellers who sat out during covid? How about those who saw the market collapse after rates doubled in the second half of 2022 and they gave up their hopes of selling in 2023? They thought it would take years before we got back to peak pricing. Well, here we are!

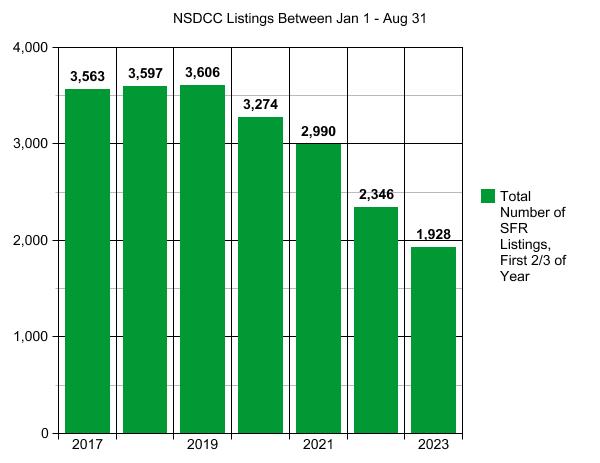

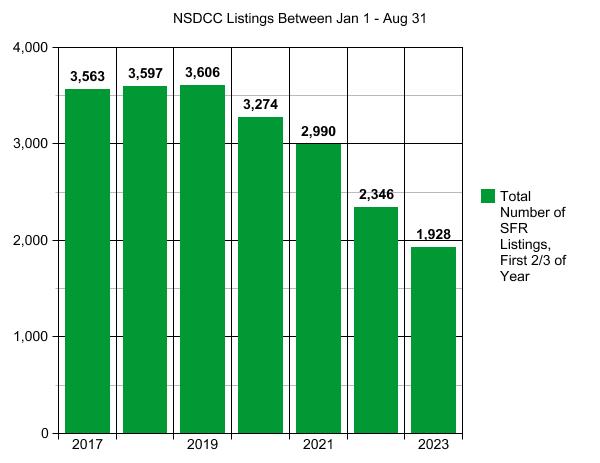

We are so overdue for more listings. Look at the recent history:

Remember the 10% covid drop in 2020 and we thought the world was going to end?

I’ll go out on a limb and guess that we’ll have 2,500 next year, and it will feel like a flood!

I checked my stats for the last two years. I’ve had 29 listings sell that averaged nine days on the market, with a median of 4 days. I’ll get you down the road before Thanksgiving!

by Jim the Realtor | Sep 6, 2023 | Forecasts, Jim's Take on the Market, Market Conditions, The Future |

An article published yesterday included some guesses about the future of the real estate market over the next five years. For those who thought it would be the usual expert opinions touting 3% appreciation per year, you won’t be disappointed, though Larry did throw in a possible 10% decline in California:

Yun foresees no major changes in purchase price tags on a nationwide level next year, with fluctuations of only about 5 percent one way or the other. The only exception is California, he says, where the market could see 10 percent declines: “Because it’s so expensive, California is always the most vulnerable to changes in interest rates.” This scenario is already playing out in the priciest areas in the state: For example, San Francisco median home prices are down 9.71 percent since last year, according to Redfin data. Overall, in five years, Yun expects prices to have appreciated a total of 15–25 percent.

McBride predicts home prices will average low- to mid-single-digit annual appreciation over the next five years. This rate of appreciation, he says, is consistent with the long-term average of home prices increasing by a rate that hovers a percentage point above the inflation rate.

https://finance.yahoo.com/news/housing-market-predictions-forecast-next-175441472.html

I think the North San Diego County coastal region will perform much better for the following reasons:

- Baby boomers aren’t dying fast enough. The capital-gains tax for long-time homeowners is so burdensome that heirs to the estate will insist on their elders aging-in-place, or renting out the home if their elder goes into a senior facility. This will prevent any concentrations of boomer liquidations, and sprinkle them over the next 20-25 years – keeping inventories low. (Half of boomers are still working!)

- The dollar continues to devalue – money isn’t worth what it used to be.

- San Diego is a premier destination spot for rich people. The affluent who tire of deteriorating conditions in their current town will be happy to join us – and pay whatever it takes.

The demand will stay strong and the inventory extremely tight. The realtor and lender populations will get cut in half (at least) and the fascinations about the real estate market will continue – but for almost everybody it will be from the sidelines.

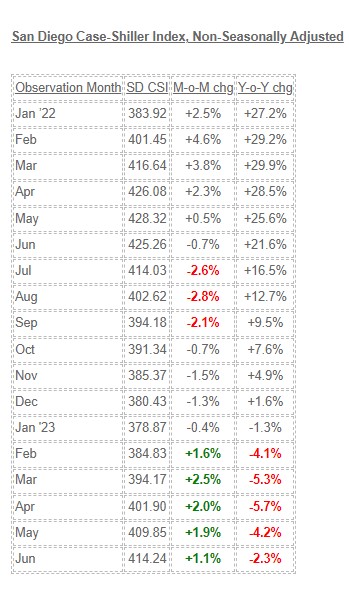

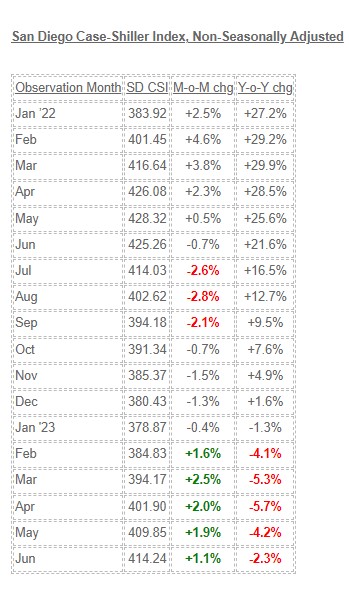

The local Case-Shiller Index has risen 54% since March 2020.

I think we will see another +50% in the next five years, and in 2028 there won’t be a month when we have 100+ sales of detached homes between La Jolla and Carlsbad.

What do you think?

by Jim the Realtor | Sep 5, 2023 | Jim's Take on the Market, North County Coastal, Sales and Price Check |

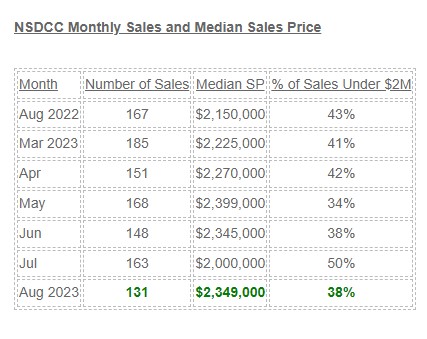

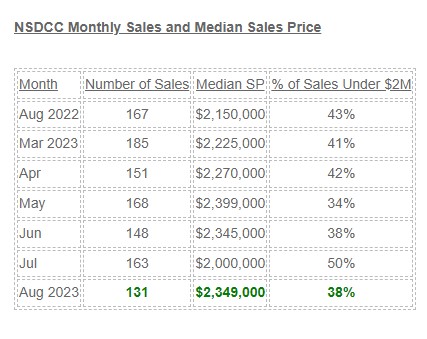

This is what it feels like in Plateau City. It’s a little bumpy but the pricing looks range-bound.

Sales cool off towards the end of the year – even during the frenzy. Surprisingly, last month might end up being the best of the year for sales, and the market should settle down for the rest of 2023….shouldn’t it?

There are only 157 NSDCC pendings today, so it’s likely that in the 4th quarter of 2023, the monthly sales will slip under 100 per month, which is fine. Everyone will be anticipating the spring selling season!

by Jim the Realtor | Aug 29, 2023 | Jim's Take on the Market, Same-House Sales

Higher mortgage rates caused the San Diego Case-Shiller index to take a tumble last summer. The decline moderated towards the end of the year and bottomed in January.

Since then, it went up 9.3%, which is pretty good appreciation for five months!

July and August will be hot too, but we are overdue for a break. It should mellow out for the rest of 2023.

Be prepared for a fast start in 2024. The market should be at full speed in February, which is contrary to the wait-and-see approach I expected as the frenzy was winding down. The frenzy conditions are still around – I sold my listing in Oceanside for $200,000 over list!

by Jim the Realtor | Aug 26, 2023 | Jim's Take on the Market, Where to Move |

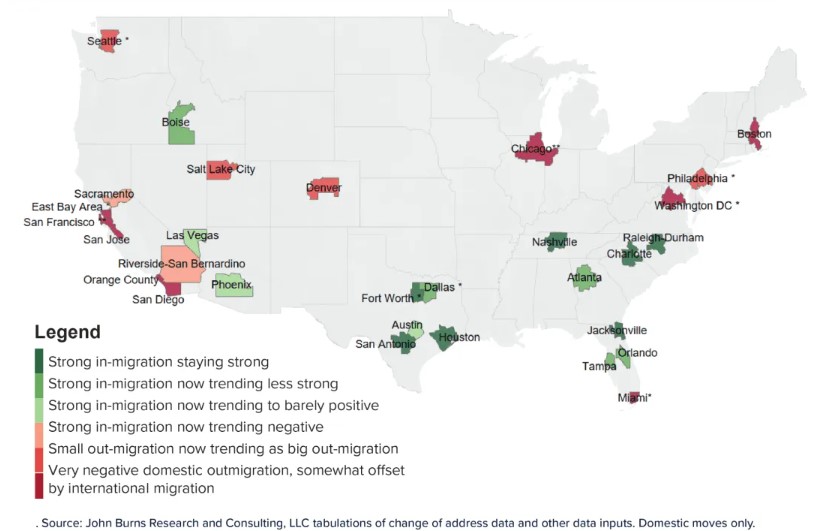

From jbrec.com:

We now monitor domestic migration trends in near real time, using postal address change forms that are current within a few months. This data has given us far more conviction in expressing a positive demand outlook on 15 markets and a more cautious outlook on another 15 markets, as shown below. This data excludes international migration.

by Jim the Realtor | Aug 25, 2023 | Jim's Take on the Market, Sales and Price Check

My thoughts:

- Sales are holding up nicely here at the end of August – a time when the buyer pool could have, and should have been completely exhausted. With five business days to go plus late-reporters, we should see this month’s closed sales get up to 160 or so and be near the MoM and YoY numbers – with a higher median sales price.

- Of today’s 155 pending listings, 62 of them went into escrow prior to August. All of those 62 should have their contingencies released by now and are just waiting to close. If 40 of those close this month, and the final August sales count gets to 170+ it would be phenomenal. Compare to April, May, and June!

- Last month’s drop in the median sales price was a one-off.

There are no comparisons to pre-covid August counts. There were 262 sales in August, 2019, but that was way back when the NSDCC median sales price was $1,354,500 – ancient history!

Given where prices and rates are today, I’ll take 170 August sales though!

by Jim the Realtor | Aug 16, 2023 | Jim's Take on the Market |

From Leonard Steinberg at Compass:

If you thought the $7 trillion Covid-linked stimulus was big, think again.

It is pittance compared to the biggest stimulus that has started and will continue for the next 2 decades amounting to over $80 trillion! Reduced – and eliminated – estate taxes (that many view as double taxation, although many unrealized gains passed to heirs remain untaxed) have helped fuel this to record levels. Yes, the great wealth transfer has already begun and even Ray Dalio thinks it is contributing to the continued resilience of the US economy.

Here are some additional thoughts on the GREAT WEALTH TRANSFER:

1. As many wealthier people live longer, some wealth transfer will be delayed.

2. Some wealth transfer will be diluted to help pay for increasingly costly healthcare.

3. Lots of wealth transfer will happen prior to death, for tax reasons and because practical parents and grandparents don’t want to be given the evil eye at the Thanksgiving table…..

4. We always think of 20-year-old heirs, but in reality most wealth is transferred to those in their 40’s, 50’s and 60’s. The kid of an 80 year old is not 20….mostly!

5. Not all those passing on wealth are billionaires or even millionaires. The vast, vast majority have significantly less wealth. But an inheritance of even $50-100,000 can change the entire trajectory of someone willing to buy a home who has struggled saving for a downpayment. 21% of millionaires received some inheritance, but only 3% received an inheritance of $1 million or above. 79% of millionaires did not receive any inheritance from their family or relatives.

6. While kids mostly inherit and are gifted, often grandkids are too, so this transfer does not apply exclusively to one demographic.

7. Often the very wealthiest families have started wealth transfer well before death (mostly to minimize federal estate taxes that kick in above $13 million), often decades, so those heirs may not be as reliant on inheritance to buy a home. Fewer than 1% of Americans have this net worth or more…..

The best news about wealth transfer: often wills, estates and trusts require and/or encourage inherited wealth to be used on education and……housing.

This may also impose the biggest demand-fuel for more expensive homes and add fuel to rising prices, not to mention overall home inflation…..if the ‘other’s stimulus did, why wouldn’t this one? Stimulus – of all kinds – usually fuels demand…..and pricing.

by Jim the Realtor | Aug 4, 2023 | 2023, Jim's Take on the Market, Realtor

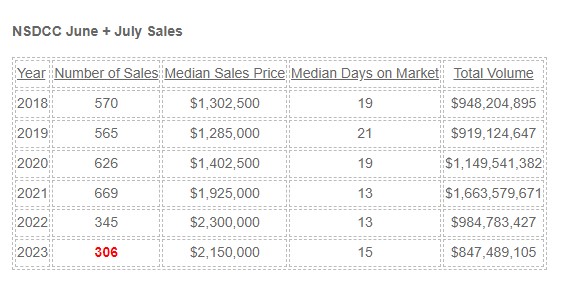

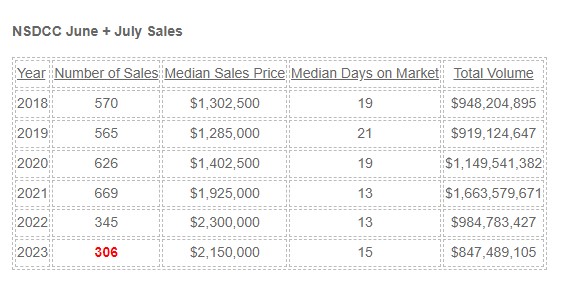

It’s good to see that last month had more sales (159 vs 147) than in June – which also had two more business days! Let’s combine the two months to soften the July drop median sales price and compare to previous years.

The plunge in sales has to be discouraging to potential buyers who can now only expect 2-3 chances per year to buy a desirable home in their preferred area of choice – and you can count on being beat out by a crazier buyer on at least one of those, and be victim to realtor shenanigans on at least one other. It happened again this week when the listing agent grabbed the first offer within 24 hours even while allowing other showings to motivated buyers, but then denied them a chance to submit an offer.

With that much frustration in the air, the pricing will likely stay elevated.

by Jim the Realtor | Aug 3, 2023 | 2023, Jim's Take on the Market, Sales and Price Check |

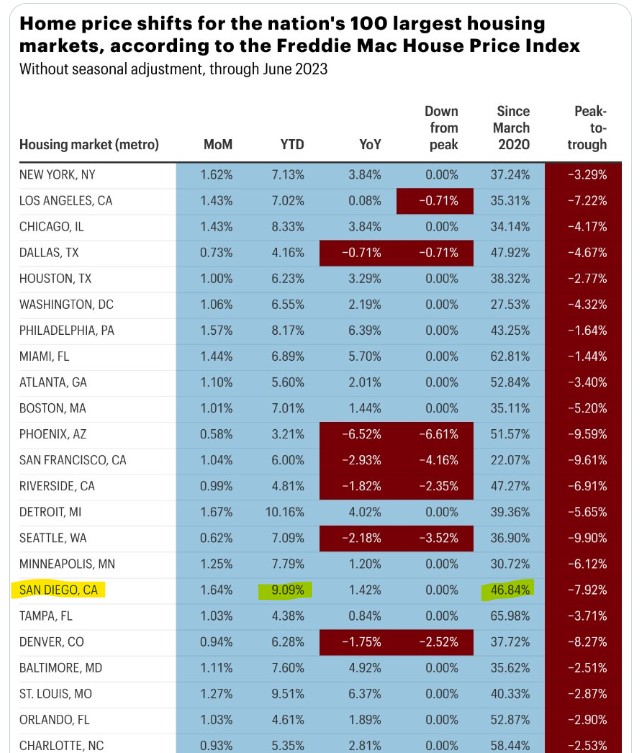

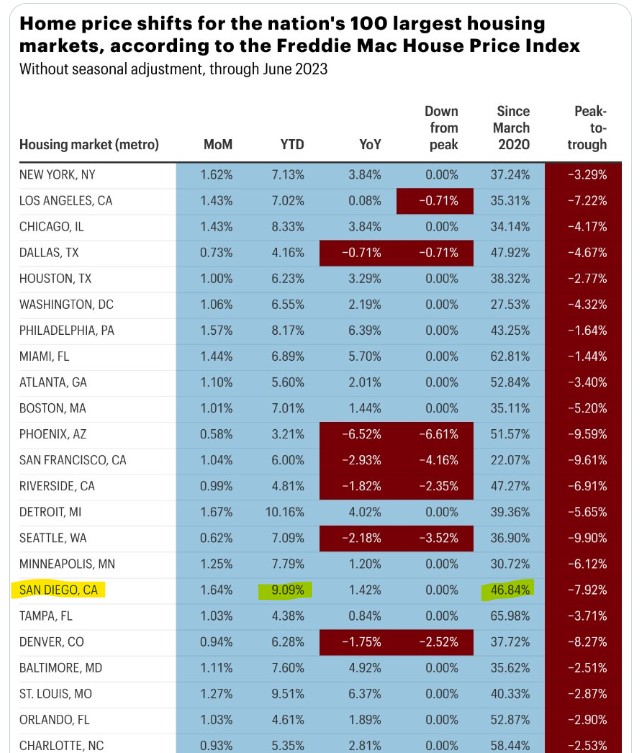

Of all the higher-end metros, San Diego is doing the best this year!

To see the rest of the Top 100 markets, click here:

https://twitter.com/NewsLambert/status/1686805363557888023