Big-Timers

From the wsj.com:

Andrew Viterbi, co-founder of wireless giant Qualcomm, has listed his sculptural home for $60 million:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

From the latimes.com:

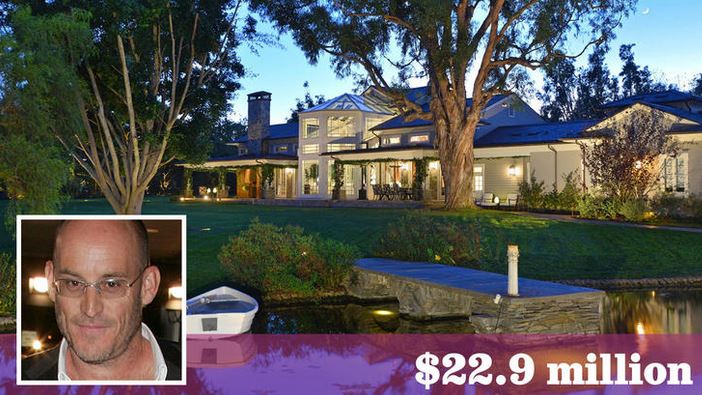

Billionaire philanthropist Ted Waitt, who in recent months has bought a house in Beverly Hills and listed another for sale in Hollywood Hills West, has put his estate in La Jolla on the market for $22.9 million.

Around La Jolla

I said I’d do another tour of La Jolla, but there’s a lot to see.

Let’s call this the first half:

Pi in the Sky

This closed for $12 million today:

La Jolla Video

Here is a video introduction to La Jolla by www.sandiego.org – I’m probably due for another video tour myself:

Mid-Summer $1M Market

The OC Register is reporting that million-dollar sales in Orange County are down 12% this mid-summer. We’re watching the sales counts closely, because we know that is the leading indicator for the market.

How about our north county coastal region?

The OCR only looked at zip codes that had a $1,000,000 median sales price, which in our case, excludes all four zips in Carlsbad.

Here are the stats on the Encinitas-to-La Jolla sales over $1,000,000 (where 91% of the active listings today are over $1M) between July 13th and August 11th:

| Year | |||||

| 2013 | |||||

| 2014 | |||||

| 2015 |

Our $1M sales count was up 9% YoY, instead of down – yippee! But nobody in this market should get giddy about pricing in general – it is flat, at best.

Sexy La Jolla

Sharper Pricing?

How is the fourth quarter rolling out?

Are sellers feeling pressured to lower their price? Are buyers stepping up?

Here are the pricing trends in our local areas:

SE Carlsbad – List and sales pricing converging should cause an active 4th quarter – unless buyers decide to wait-and-see where this is going:

Encinitas – An example of what can happen when pricing converges here, where buyers backed off starting in April. But sellers are proud, and heck, it’s only money:

Rancho Santa Fe – This is how they roll in the Ranch – put a price on it, and wait for someone to come along. It results in a meandering trend:

Carmel Valley – Stunning to see average list pricing in decline since April – but it’s been working. It keeps the sales momentum rolling:

La Jolla – List pricing took off in the beginning of 2013, but buyers cooled off for a full year before coming back around in 2014, price-wise:

Drone + Paragliding

The drone got a look at the paragliders around Black’s Beach today:

Here is a link to other paragliding videos that show some of the homes too:

http://bubbleinfo.s020.wptstaging.space/?s=paraglid&x=0&y=0

Thanks Murph!

La Jolla by Drone

The drone said hello to the seals at the cove, and then went for a spin around the park: