by Jim the Realtor | Dec 18, 2017 | Jim's Take on the Market, Local Government, Mortgage News, Tax Reform |

Here we have three different real-estate-industry opinions on the effects of the final tax reform. 1) The demand will increase due to more spendable income, pushing home prices higher; 2) The demand will drop, due to less spendable income because middle-class families will have higher taxes, and 3) Congress did the right thing and should be applauded:

LINK

The Republican party’s self-imposed Christmas deadline for the widely debated tax bill is fast approaching. Last week, Republican lawmakers announced they had the votes necessary to pass the converged Tax Cuts and Jobs Act bill. As the process moves forward, details are changing quickly, and, now, a couple of steadfast voters may not cast their ballots.

(more…)

by Jim the Realtor | Dec 15, 2017 | Frenzy, Jim's Take on the Market, Local Government, Market Conditions, Tax Reform |

We knew these were coming:

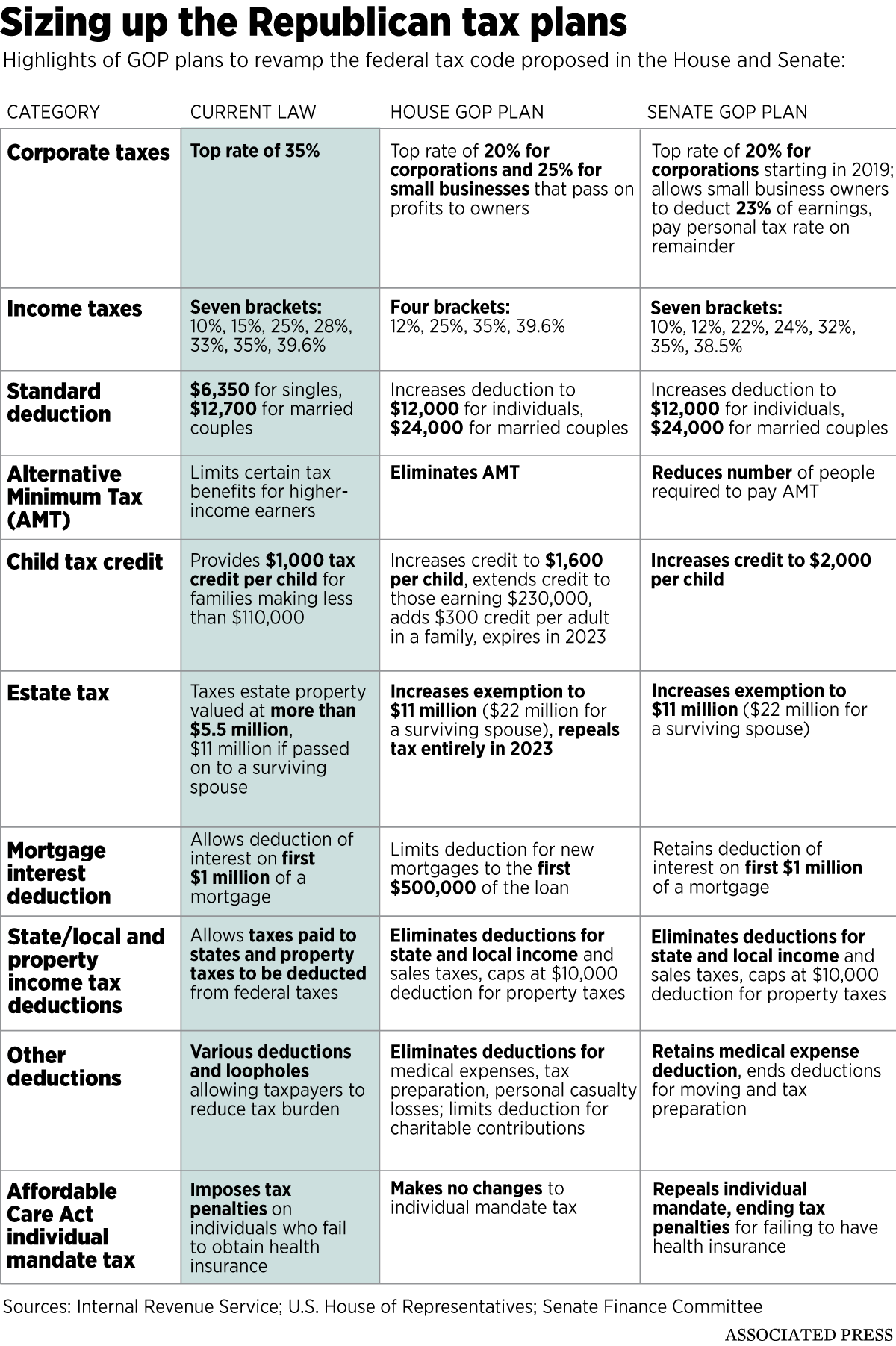

The legislation preserves the deductions for mortgage interest and charitable giving, though it lowers the cap on the mortgage deduction from $1 million to $750,000.

Seeking to win over House Republicans from high-tax states, the conference committee legislation caps the state and local tax deduction at $10,000, with filers allowed to deduct property taxes and state and local income and sales taxes.

Those aren’t quite as generous as before, but a happy compromise.

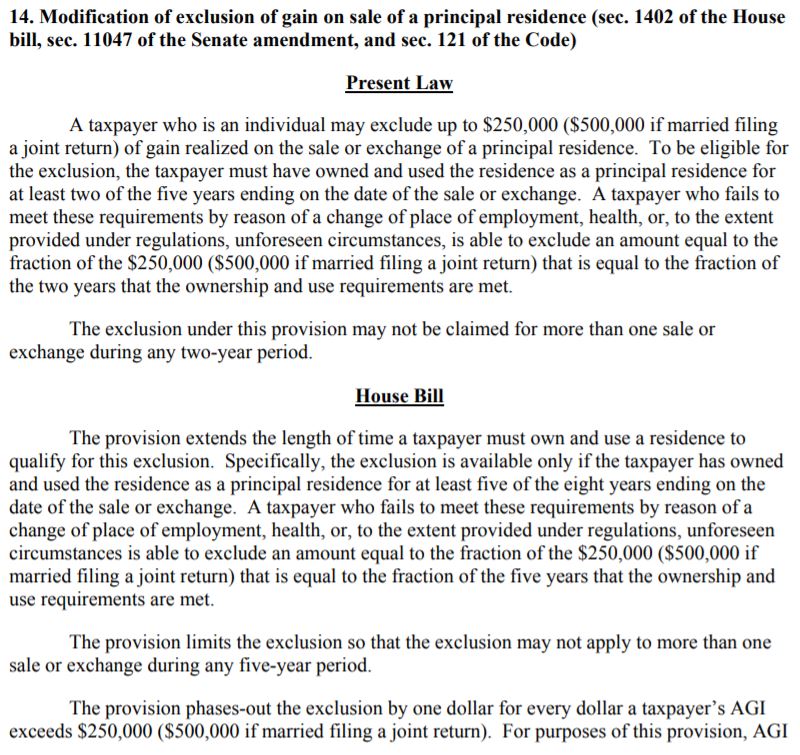

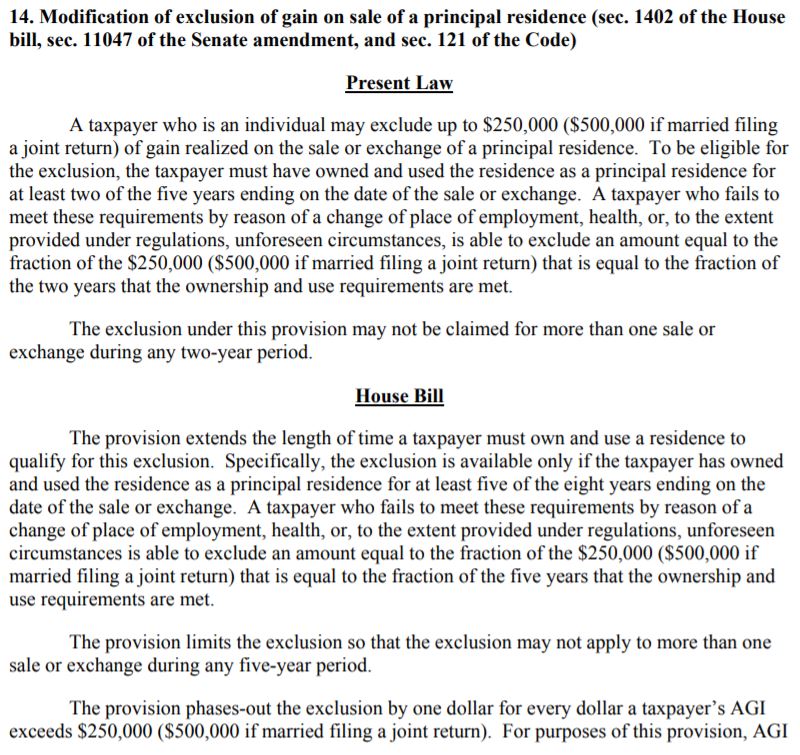

What about the change from owning your home for two out of the last five years to get up to $500,000 tax-free profits? Both the House and the Senate wanted to change the time period to owning five out of the last eight years.

I found this on page 663 of 1101 here:

http://docs.house.gov/billsthisweek/20171218/CRPT-115HRPT-%20466.pdf

I’m not a lawyer, and could be a little woozy after scrolling 600+ pages, but I think they threw it out altogether! Before I get too excited, can an attorney tell us that ‘No provision’ means nothing was included in the final bill?

If the two-out-of-five-years is still the law, then the realtor spokespeople better be running to the microphone to declare total victory, and assuring everyone that property values won’t be going down 5% to 15% now!

by Jim the Realtor | Dec 15, 2017 | Builders, Jim's Take on the Market, Local Government, Market Conditions |

We see these stories regularly now, but nothing is changing. Even if we had another housing crash and prices retreated by 10% or 20%, homes would still not be affordable for most. Hat tip to Richard!

LINK

For all of its claims of being an economic paradise, California is a failure when it comes to housing.

Not just low-income, affordable housing, but middle-income, working-class housing for teachers, firemen and long-time residents hoping to live anywhere near work.

“California has a housing crisis. We can’t provide housing to our citizens,” said Rita Brandin, with San Diego developer Newland Communities. “In Georgia, Texas and Florida, it can take a year and a half from concept to permits. In California, just the process from concept to approvals, is five years – that does not include the environmental lawsuits faced by 90 percent of projects.”

Numbers tell the story of California’s housing crisis.

* 75 percent of Southern Californians can’t afford to buy a home, according to the state realtors association.

* 16 of the 25 least affordable communities in the US are in California, according to 24/7 Wall Street.

* Officials this year declared a homeless emergency in San Francisco, Los Angeles, San Diego and Orange counties.

* 56 percent of state voters say they may have to move because of a lack of affordable housing. One in four say they will relocate out of state, according to University of California Berkeley’s Institute of Governmental Studies.

* A median price home in the Golden State is $561,000, according to the realtors association. A household would need to earn $115,000 a year to reasonably afford a home at that price, assuming a 20 percent down payment. Yet, two thirds of Californians earns less $80,000, according to the U.S. Census Bureau.

* The household income needed to afford a median-priced home in the Silicon Valley town of Palo Alto is $450,000.

* In San Francisco, a median priced home is $1.5 million, according to the Paragon Real Estate Group.

* Home prices in California are twice the national average, and 70 percent can’t afford to buy a home, according to state figures.

* Median household income in L.A. is $64,000. That’s half what is necessary to buy a home.

*1 in 10 residents are considering leaving because they can’t afford a place to live, according to a state legislative study, while US Census figures show 2 million residents, 25 and older, have already left the state since 2010.

* In 2016, 30 percent of California tenants put more than 50 percent of their income toward rent and utilities, according to the California Budget & Policy Center. Economists consider 30 percent the limit.

* California needs to double the number of homes built each year to keep prices from rising faster than the national average, according to the Legislative Analyst’s Office.

“The biggest tragedy of California is we have stopped building houses for the middle class,” said Borre Winkle with the Building Industry Association of San Diego. “Think of California’s housing market as a martini class. We’re building some affordable housing at the low end. Absolutely nothing in the middle and the top end is high-income housing, which subsidizes low-income housing. So that is a broken system.”

In 2016, the cities of Houston and Dallas built more homes, 63,000, than the entire Golden State, which built 50,000, according to US Census Bureau figures.

“Supply and demands works,” said USC real estate professor Richard Green. “People want to be here and we’re not accommodating them with new housing and so the cost of the housing goes up.”

Read full article here (blaming building fees and NIMBYs):

LINK

by Jim the Realtor | Dec 4, 2017 | Jim's Take on the Market, Local Government, Realtor, Realtors Talking Shop, Tax Reform |

As long as the House and Senate can agree, it appears that the tax reform bill will include the existing tax incentives for home buyers (M.I.D. and property-tax deduction up to $10,000). The N.A.R. and C.A.R. aren’t happy though, and are still fighting the fight.

Today, the C.A.R. issued this explanation:

We must reverse the decline in California’s homeownership rate. For over 100 years Congress has incentivized homeownership with the tax code; currently through the mortgage interest deduction. Any effort at reforming the tax code should maintain and prioritize this incentive. The current proposal only pays lip service to incentivizing homeownership. The proposed changes will result in only top earners itemizing their deductions. Therefore, the vast majority of people will no longer receive any tax incentive to purchase a home. So, while the proposal keeps the mortgage interest deduction, the incentive effect of the deduction for Americans to become homeowners disappears.

If you don’t earn enough money to itemize your deductions, you’re probably not buying a house around the coast. It would be nice if they included their math so we could see who they claim as the ‘vast majority’ of buyers.

The M.I.D. and the property-tax deduction are the two primary incentives for home buyers – and they should make it into the final version of the bill.

What about the five-out-of-eight years rule? It is a concern for recent purchasers only. The long-timers who make up about half of our sales already qualify for the new rule too.

As you can see in the chart above, on average about 22% of our sellers are recent purchasers. But the actual number of potential delayers is lower.

Today’s stats are from the 116 NSDCC sales we’ve had since November 15th. The 24% equals 28 sales, but five of those were flips, and five others had bought in 2012, and happened to sell right after their fifth anniversary. There were also a couple who sold in less than two years, so they paid the capital-gains tax anyway.

In summary, there were 16 sellers who sold between their two-year and five-year anniversary, or 14% of the total.

It suggests that roughly 14% of the potential sellers over the next 2-3 years might delay their plans to sell, in order to qualify for the tax-free profits. Great, even less inventory – hopefully the estate sales will increase!

The year-over-year sales were already lower in October by 5%, and November isn’t looking any better – and the tax reform hasn’t happened yet. I think we can expect 5% to 10% fewer sales in 2018!

This change to a five-out-of-eight benefit doesn’t really affect today’s buyers – most are planning to stay long-term. The average length of homeownership is already eleven years, and likely to go longer.

The homeowners who will suffer are those who have several houses and planned to move into each for two years to qualify – like Rob Dawg. But if it means you only get to take advantage of the rule once or twice instead of three or four times, at least some benefit came your way – sorry they changed the rules on you. Maybe you can run for president, and fix it? Lower the capital-gains tax while you’re at it!

by Jim the Realtor | Dec 3, 2017 | Jim's Take on the Market, Local Government, Tax Reform |

Real estate spokespeople from N.A.R., C.A.R., Zillow, etc. keep saying that if tax reform removes the incentives for homeownership, prices would fall at least 10%. Then the Senate leaves the mortgage-interest deduction untouched, and adds back in the property-tax deduction for most – and our N.A.R. president is still claiming prices will go down?

Now she’s talking about the national debt and grandchildren. It appears that she has gone from fighting for tax incentives for homeownership to fighting for the everyman – that’s not your job! Do that on your own time.

Send our lobbyists back up to the Hill with donuts and payola and have them convince the House to agree with the Senate – quick! And stop saying prices will go down 10% or more – you have no hard evidence of that!!!!

WASHINGTON (December 2, 2017) – The U.S. Senate today passed tax reform legislation that the National Association of Realtors® believes puts home values at risk and dramatically undercuts the incentive to own a home.

NAR President Elizabeth Mendenhall, a sixth-generation Realtor® from Columbia, Missouri and CEO of RE/MAX Boone Realty, offered strong concerns over the bill and said Realtors® will continue to work with members of the House and Senate as the process moves forward into a conference committee.

“The tax incentives to own a home are baked into the overall value of homes in every state and territory across the country. When those incentives are nullified in the way this bill provides, our estimates show that home values stand to fall by an average of more than 10 percent, and even greater in high-cost areas.

“Realtors® support tax cuts when done in a fiscally responsible way; while there are some winners in this legislation, millions of middle-class homeowners would see very limited benefits, and many will even see a tax increase. In exchange for that, they’ll also see much or all of their home equity evaporate as $1.5 trillion is added to the national debt and piled onto the backs of their children and grandchildren.

“That’s a poor foot to put forward, but this isn’t the end of the road. Realtors® will continue to advocate for homeownership and hope members of the House and Senate will listen to the concerns of America’s 75 million homeowners as the tax reform discussion continues.”

The National Association of Realtors®, “The Voice for Real Estate,” is America’s largest trade association, representing 1.3 million members involved in all aspects of the residential and commercial real estate industries.

LINK

by Jim the Realtor | Dec 2, 2017 | Jim's Take on the Market, Local Government, Market Buzz, Tax Reform |

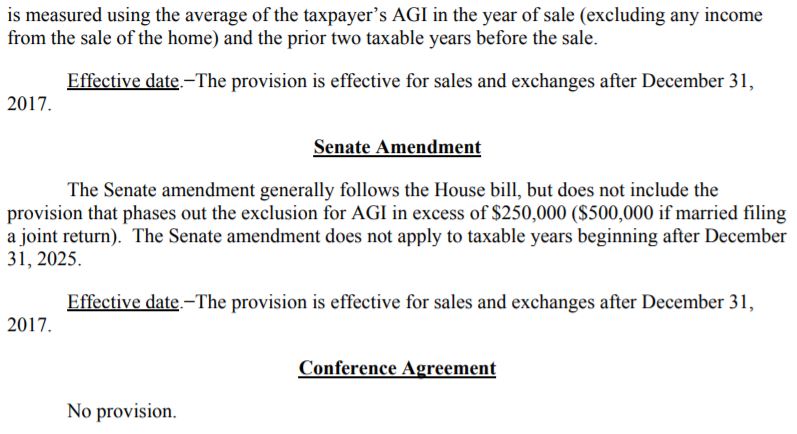

The Senate’s version of the tax reform bill didn’t include any changes to the mortgage-interest deduction, which keeps the limit at mortgages under $1,000,000. But the House limit was $500,000, and they still have to reconcile the two versions, so it’s not done yet.

The ability to deduct property taxes up to $10,000 was included at the last minute by the senators.

The 2-out-of-5 year residence requirement to avoid taxes on profits from selling your home will be changing to 5-out-of-8 years, but the effective date isn’t exactly clear yet. The Senate version included any sales contract signed in 2017 would qualify, even if they close in 2018, but we’ll see about the final reconciled version – which should come in the next couple of days.

The N.A.R. should declare victory, and assure us that our property values won’t be going down 10% to 15% now.

by Jim the Realtor | Nov 24, 2017 | Jim's Take on the Market, Local Government, Realtor |

The California Association of Realtors is pushing a new proposal:

C.A.R.’s Portability Initiative would allow homeowners 55 years of age or older to transfer some of their Proposition 13 property tax base to a home of any price, located anywhere in the state, any number of times.

This measure is important because seniors, who are often on a fixed income, fear they will not be able to afford a big property tax increase if they sell their existing home and buy another one, discouraging them from ever moving. As a result of this “moving penalty” almost three-quarters of homeowners 55 and older haven’t moved since 2000.

The measure, if approved by voters, will let thousands of seniors, currently “locked into” their homes by low property tax rates purchase a home that will better suit their needs freeing up housing inventory for young families seeking to buy a home. According to the Legislative Analyst’s Office almost 43,000 additional transactions will occur annually.

The cost to circulate the initiative for signature gathering is $3 million, with the cost of the subsequent campaign ranging between $30 million and perhaps upward of $50 million, if the initiative is heavily contested. Funding would come from C.A.R. political action committees, reserves, NAR funds and a C.A.R. member assessment.

They conveniently ignore the fact that Prop 60 and 90 have already allowed homeowners 55 years of age and older to transfer their property-tax basis to a lower-priced home in these counties:

- Alameda

- El Dorado

- Los Angeles

- Orange

- Riverside

- San Diego

- San Mateo

- Santa Clara

- Tuolumne

- Ventura

So the ‘almost 43,000 additional transactions’ that will occur annually will be by those seniors who want/need a more-expensive home, or those tired of living at the coast who have been dying to move to places like El Centro!

The C.A.R. is also asking each realtor to join in:

The best way to help promote the initiative right now is to sign it, collect 4 additional signatures from family, friends, and clients, and return the petition. Anyone who signs the petition must be a registered voter and reside in the same county as the other signers on that petition. More petitions are available at your local association of REALTORS® office and REALTORS® are encouraged to gather signatures from their clients and while walking their farms.

Access instructions for signature gathering and a helpful script and walking piece HERE.

Agents don’t have to worry too much about gathering their own signatures, because C.A.R. is assessing us an extra fee to pay for a campaign company.

by Jim the Realtor | Nov 16, 2017 | Jim's Take on the Market, Local Government, Mortgage News, Tax Reform

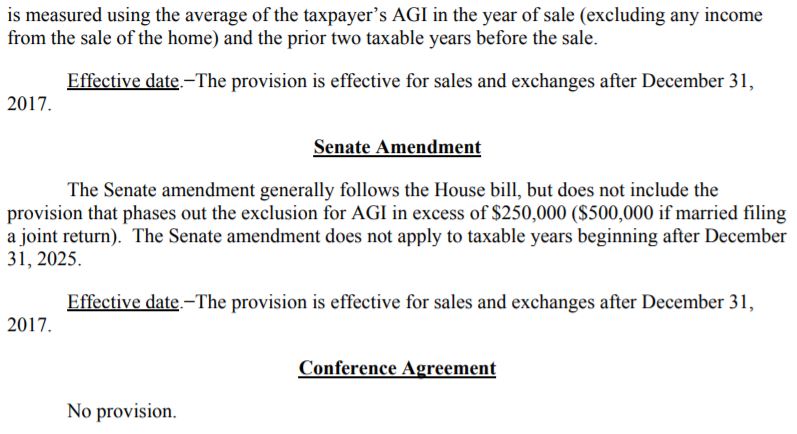

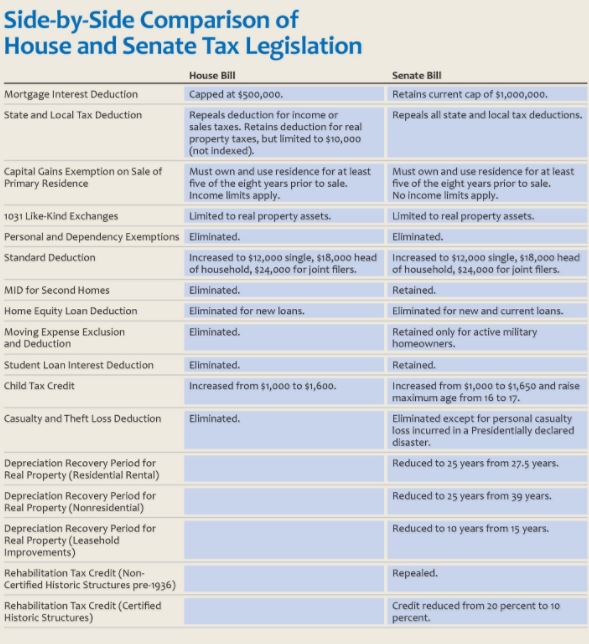

For tax reform to be implemented, our politicians will need to negotiate and compromise on the existing terms:

by Jim the Realtor | Nov 15, 2017 | Jim's Take on the Market, Local Flavor, Local Government, Mortgage News, Tax Reform |

If I were a local politician, I’d like to preserve either the M.I.D. or the state and local taxes – or at least include the property-tax deduction up to $10,000 – and compromise on the other changes

Use the slogan, “If California tanks, the whole country tanks!

by Jim the Realtor | Nov 7, 2017 | Boomer Liquidations, Boomers, Jim's Take on the Market, Local Government, Market Buzz, Market Conditions, Tax Reform |

In September, I touched on the Big Stagnation:

http://bubbleinfo.s020.wptstaging.space/2017/09/02/the-big-stagnation/

Just talking about the GOP tax changes could slow down the market. Because the N.A.R. and others are suggesting publicly that home values could drop 5% to 10%, won’t potential home buyers wait to see if it happens?

The demand will still be there; it will just be more picky than it is today.

The move-up market is where we could see real impact from the proposed tax changes. If potential move-uppers don’t move, they would keep their mortgage-interest deduction and lower property taxes. If they do move and get a loan over $500,000, they’ll enjoy paying on a new mortgage for 30 years with no MID, and pay higher property taxes.

They won’t calculate the exact cost of losing the MID (it’s not that much) – and instead, it will be the last straw and they will just quit thinking about moving because they’re disgusted with politicians.

We will also lose a few who need to stick around longer to qualify for the tax-free gain on the sale of their house, due to the change of having to own/occupy the house for five out of the last eight years to qualify.

End result: Fewer people willing to move up, which would have a significant impact on the higher end market. True, the move-up buyers won’t be listing their lower-priced house for sale either, which would create a net-zero change, and potentially make the inventory tighter, which would be better for the remaining sellers.

But there hasn’t been a shortage of homes for sale listed over $1,000,000 (there are 1,395 homes for sale today in San Diego County priced over $1,000,000, and 327 sold in October).

Higher-end sellers will have to wait even longer for the trickle of buyers to reach them. Plus, if a neighboring seller or two dumps on price to unload theirs, the lower comps could add another six months to the selling timeline, or longer. The sellers who claim to be in no rush will be tested!

The environment will be compounded by the lack of experience in dealing with this type of market by everyone involved. For the last seven years, if you wanted to buy a house, you had to pay the sellers’ price….or more. Will that continue? Yes, for those selling a perfect house at the perfect price. But it will be too easy for buyers to pass on the clunkers or OPTs.

S-t-a-g-n-a-n-t C-i-t-y.

The lower end should stay red hot, but it won’t be trickling up as much.

And that’s not considering the possibilities of higher interest rates, earthquake or other natural disaster, nuclear war, or recession!