by Jim the Realtor | Jan 23, 2019 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying, Neg-Am |

Hat tip to both Rick and Richard sent in this article from the WSJ on alternative underwriting for mortgages, which is on the rise:

https://www.wsj.com/articles/no-pay-stub-no-problem-unconventional-mortgages-make-a-comeback-11548239400

Excerpted – bold added:

Aryanna Hering didn’t have pay stubs or tax forms to document her income when she shopped around for a mortgage last year—a problem that made it tough for her to get a loan.

But the nursing student who works part time providing home care for children and the elderly eventually hit pay dirt: For a roughly $610,000 home loan, a mortgage company let her verify her earnings with 12 months of bank statements and letters from clients.

Ms. Hering’s case highlights how a flavor of mortgage once panned for its role in the housing meltdown a decade ago is making a comeback. These loans, aimed at buyers with unusual circumstances such as those who can’t provide the standard proofs of income, are growing rapidly even as rising interest rates and higher home prices crimp demand for mortgages.

Lenders issued $34 billion of these unconventional mortgages in the first three quarters of 2018, a 24% increase from the same period a year earlier, according to Inside Mortgage Finance, an industry research group. While that makes up less than 3% of the $1.3 trillion of mortgage originations over that period, the growth is notable because it came as traditional home loans declined. Those originations fell 1.2% over the same period and were on track for a second down year in 2018.

Tom Jessop, the loan consultant at New American Funding who handled Ms. Hering’s loan, said he has seen demand for unconventional loans double over the past 18 months and they currently makes up more than one-third of his business. “I think it’s just catering to an audience that’s been neglected for years,” Mr. Jessop said. “Now they have an opportunity to get financing finally.”

At the same time, Wall Street investors who buy home loans are scooping up unconventional mortgages that have been packaged into bonds, edging back into a corner of the market that is riskier but provides higher returns. There were $12.3 billion of such residential-mortgage-backed securities sold in 2018, nearly quadruple from a year earlier, according to credit-rating firm DBRS Inc.

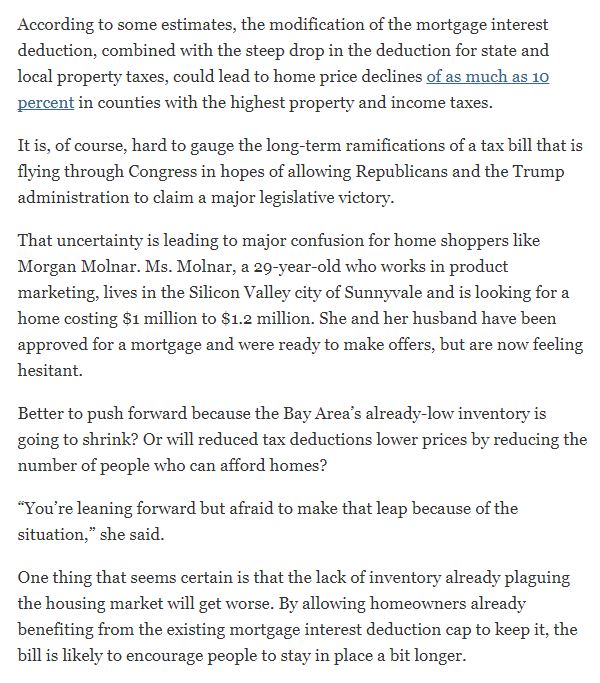

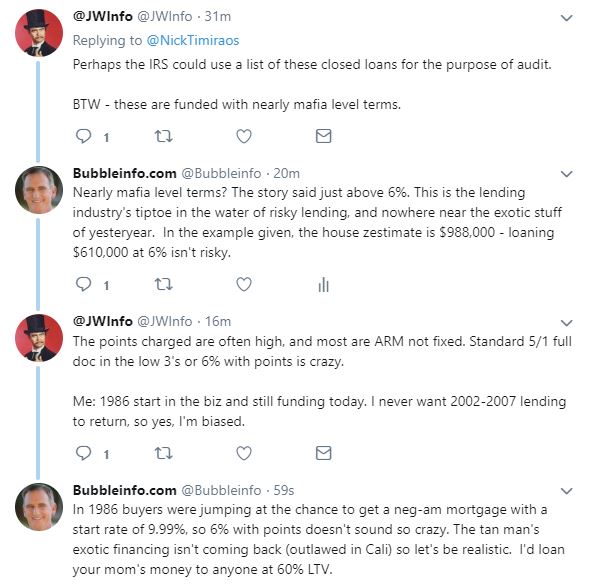

Nick also put it on twitter, where I responded:

Back in 2006-2007, Countrywide was funding neg-am mortgages up to $1,500,000 with no money down and just a decent credit score – the example given is far from that.

The mortgage industry needs to find a balance in between – it’s not out of line to finance a borrower who can show income via bank statements and has substantial equity/skin in the game.

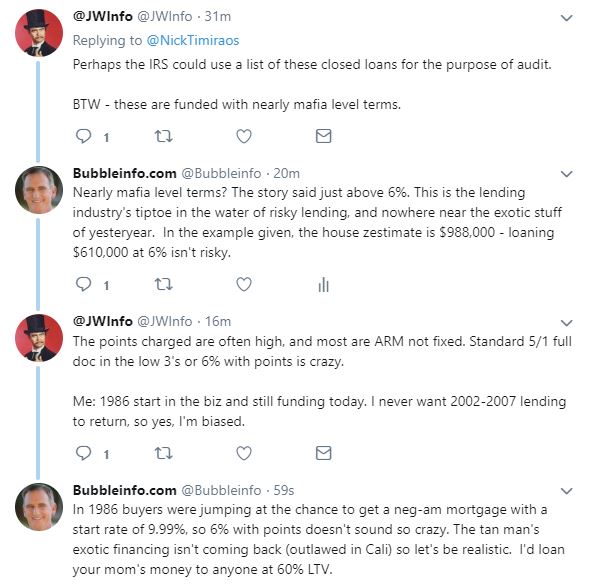

by Jim the Realtor | Oct 5, 2018 | Interest Rates/Loan Limits, Jim's Take on the Market, Mortgage News |

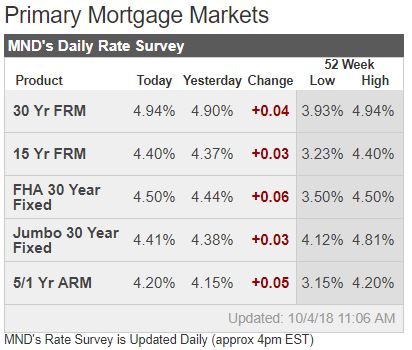

After today’s NFP report, we can say that 5% mortgage rates (no points) have arrived – sellers can offer to buy down the rate to help ease the pain for buyers. Yesterday’s thoughts from MND:

So is it possible for bonds to see such a reversal? Yes, but it’s equally possible that the pain continues. Either way, it will likely be up to the market’s reaction to the big jobs report in the morning. Traders aren’t necessarily as interested in the payroll count and unemployment rate as they are in the average hourly earnings data–the ingredient that lit the match on September’s rising rate powder keg.

Loan Originator Perspective:

Bonds’ “truly terrible, traumatic week” continued today with further losses ahead of September’s NFP report. If that report shows strong job/wage growth, there’s no telling how much more rates will rise. Conversely, it would take a staggeringly disappointing report to dissuade bond buyers. It truly requires a pronounced penchant for risk to float here, and I, for one, don’t have that. Lock now or relinquish your right to complain about high rates later if you don’t. –Ted Rood, Senior Originator

Today’s Most Prevalent Rates

30YR FIXED – 4.875-5.0%

FHA/VA – 4.5%

15 YEAR FIXED – 4.375-4.5%

5 YEAR ARMS – 4.25%-4.75% depending on the lender

(more…)

by Jim the Realtor | Sep 21, 2018 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

Higher prices, higher rates, slowing sales, and now easing loan guidelines? On non-owner-occupied properties? Buying a rental property with 5% down is unheard of, and even with higher rents they are likely to negative cash flow:

Freddie Mac is consolidating its Home Possible program with its Home Possible Advantage Mortgages program. These programs offer greater flexibility and higher loan-to-value ratios (LTVs) than traditional mortgage programs.

The combined product will be called Home Possible Mortgages, and will closely align with the purpose and requirements of the previously-named Home Possible Advantage program, with some changes.

Beginning October 29, 2018, lenders will be able to offer Home Possible Mortgages to buyers with limited down payment funds. Under the consolidated program, eligible homebuyers will include:

- non-occupant buyers for mortgages secured by one-unit properties with LTVs no higher than:

- 95% for Loan Product Advisor Mortgages; or

- 90% for manually underwritten mortgages (non-occupant buyers were previously excluded from the programs);

- those who own other properties (buyers who own other properties were previously limited);

- buyers with super conforming mortgages (mortgages with high maximum mortgage limits for homes located in high-cost areas) when the mortgage:

- is submitted and receives an “Accept Risk” classification through the Loan Product Advisor; and

- has an LTV no higher than 95% (super conforming mortgages were previously not permitted);

- buyers with secondary financing, including home equity lines of credit (HELOCs), for most cases when the mortgage’s LTV is no higher than 97% (secondary financing was previously limited to 95% LTV);

- buyers using adjustable rate mortgages (ARMs), when the LTV is no higher than 75% (ARMs were previously not permitted); and

- buyers with a maximum 45% DTI for manually underwritten mortgages.

These changes are meant to both widen the pool of qualified homebuyers, and streamline programs for lenders’ ease of use.

Housing market risks broaden

By loosening the requirements for its Home Possible Mortgage programs, Freddie Mac’s hope is to encourage lenders to qualify more applicants, thereby increasing homeownership opportunities nationwide.

However, loosening requirements by allowing high LTVs, DTIs and ARMs makes lending — and by extension the housing market — riskier. For veteran real estate professionals, a growing presence of dangerous mortgage products and loose lending restrictions will sound familiar, as they all increased during the Millennium Boom and ultimately played a big part in the cause of the housing crash and 2008 recession.

Link to Article

by Jim the Realtor | Sep 14, 2018 | Jim's Take on the Market, Mortgage News |

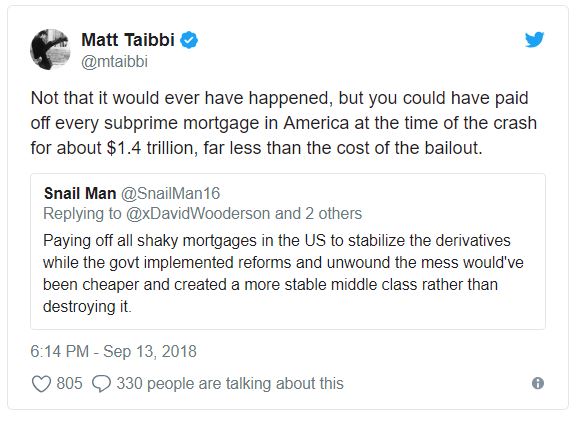

Matt Taibbi has a good summary of the mortgage crisis here:

https://www.rollingstone.com/politics/politics-features/financial-crisis-ten-year-anniversary-723798/

An excerpt:

Restoring compensation levels was one of the first and most urgent priorities of the bailout. Bonuses on the street were back to normal within six months. Goldman, which needed billions in public funds, paid an astonishing $16.9 billion in compensation just a year after the crash, a company record.

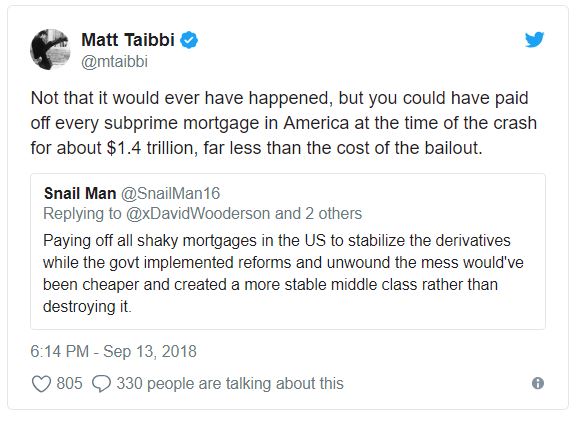

Even better is the on-going discussion of particular details on twitter:

Click here for more:

https://twitter.com/mtaibbi

by Jim the Realtor | Jul 15, 2018 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying

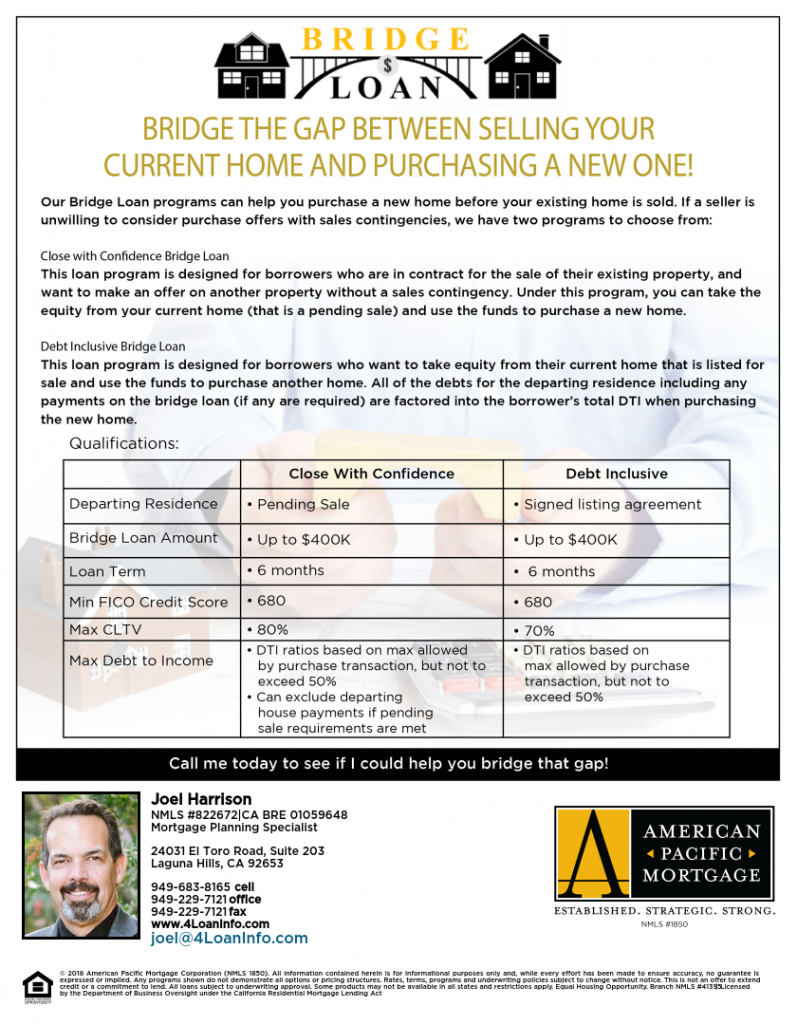

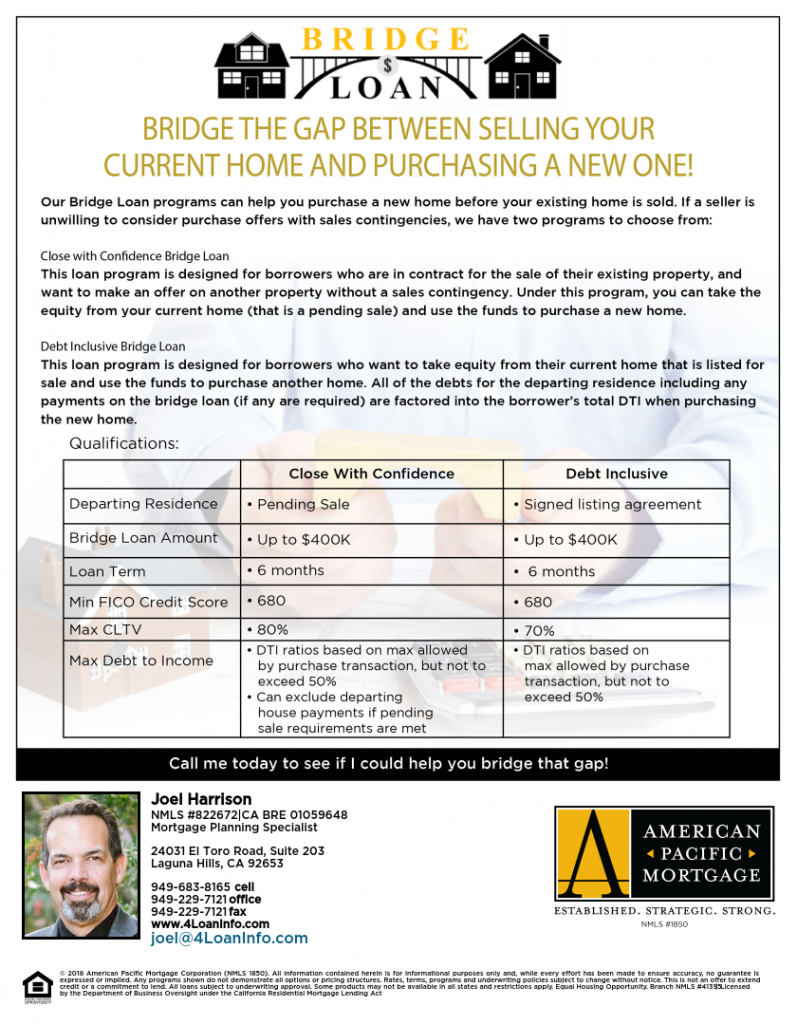

Are you turned off by the e-buyer who wants to lowball your home’s value, and then knock off another 7% to 9%? But you like the idea of having your equity available for the next purchase?

How about an old-fashioned bridge loan?

Joel arranged financing for a recent buyer of ours who changed jobs during the week of escrow closing – Joel re-verified employment and still closed on time. This was on 97% financing of a converted-apartment condo built in 1979.

Thanks Joel!

by Jim the Realtor | Jun 18, 2018 | Fraud, Jim's Take on the Market, Mortgage News |

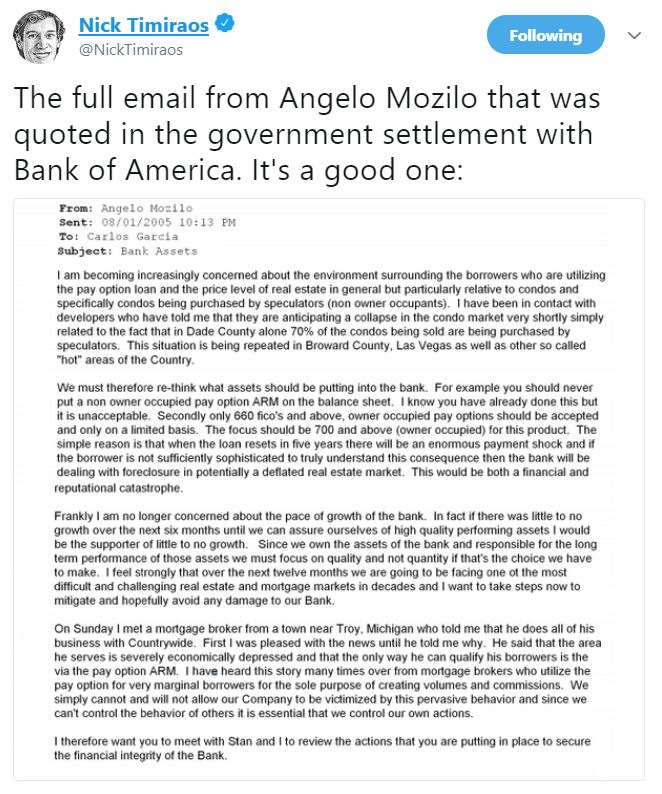

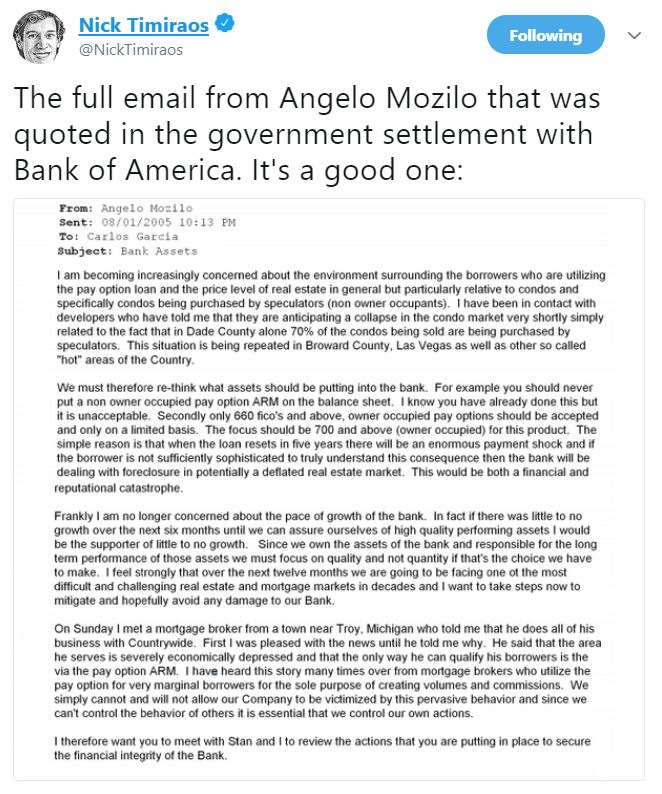

Nick at the WSJ has a good piece on the Tan Man – with one of Angelo’s emails from three years prior to the Countrywide failure and fire-sale to BofA:

An excerpt from an old article:

Mister Mozilo, a mortgage industry maverick who co-founded Countrywide in 1969, and nearly 30 years later co-founded the dramatically collapsed IndyMac Bank (now OneWest Bank), is widely regarded as one of the more Machiavellian sub-mortgage-men who helped march the U.S. (and global) economy straight off the cliff in the mid-Noughts.

While Mister Mozilo and his mortgage-making army pushed and pedaled sub-prime home loans, he talked up the then-flourishing company’s stock price, earned hundreds of millions in compensation, and cashed out more than $400,000,000 worth of Countrywide stock, a large portion of it during the last couple of years of his tattered tenure as the king of Countrywide.

Alas, the sub-primed fueled real estate bubble burst sometime around 2007 and Mister Mozilo left Countrywide in 2008 after the crippled company was sold for $4.1 billion to Bank of America.

In June 2009 the Securities and Exchange Commission (SEC) charged Mister Mozilo with insider trading and securities fraud and in September 2010, Mister Mozilo settled with the SEC and agreed to pay $67,500,000 in fines, $45,000,000 of which was paid by Bank of America. Despite the sizable payout, settlement terms allow Mister Mozilo to circumvent acknowledgement of any misconduct. We can’t vouch for or confirm it but online idle chatter says he has a net worth well in excess of half a billion dollars.

Link to Full Article

Mozilo, in his deposition, continues his long standing defense of his former company. “I have no regrets about how Countrywide was run,” Mozilo said. “We were a world-class company in every respect.“

“We never made a loan knowingly — and it would be stupid to do so — that we knew the borrower could not pay. Never,” Mozilo said. “All our loans had that one standard from 1968 to the end of my rein at Countrywide.”

by Jim the Realtor | Apr 27, 2018 | Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

Freddie Mac’s underwriting also allows self-employed buyers to submit tax returns for one year only, instead of the customary two years’ tax returns. I’m not sure if they will do that on this new program?

It’s been more than three years since Freddie Mac rolled out a conventional mortgage that only required a 3% down payment for certain borrowers.

But now, Freddie Mac is about to supercharge its 3% down program and launch a widespread expansion of the offering.

Freddie Mac announced Thursday that it is rolling out a new conventional 3% down payment option for qualified first-time homebuyers. What makes this program different is that there are no geographic or income restrictions.

The new program, which is called HomeOne, puts Freddie Mac in direct competition for mortgage business with the Federal Housing Administration, which also only requires 3% down on some mortgages.

(more…)

by Jim the Realtor | Dec 19, 2017 | Jim's Take on the Market, Mortgage News, Realtor, Realtors Talking Shop |

There was a snafu in the rush to sign the tax reform bill:

“The Senate parliamentarian determined two minor provisions do not have budgetary impacts and had to be removed from the bill,” the representative told Business Insider. “The Senate will still vote tonight, and the House will vote tomorrow to send the final bill to the president’s desk.”

Republicans are using a process known as budget reconciliation to pass the bill without being subject to a Democratic filibuster. But that also means the legislation must comply with the Byrd rule, which stipulates that it must not be projected to add to the federal debt outside of 10 years and that all its provisions must deal with the budget.

The parliamentarian, a sort of umpire for Senate rules, determined that three elements of the bill violated the Byrd rule:

The name. The short name of the bill, the Tax Cuts and Jobs Act, appears to be placed incorrectly in the legislation.

Changes to the so-called 529 savings plan. The bill would have allowed money in the college-savings accounts to be used for homeschooling supplies.

The exemption for small colleges from a new excise tax. The bill had proposed a tax on college and university endowments exceeding $500,000 for every student enrolled, but it included a provision that would have exempted those with fewer than 500 tuition-paying students. The parliamentarian struck only the words “tuition-paying,” the Ways and Means representative said.

Even with the delay, the bill is expected to make it to President Donald Trump’s desk before the GOP’s self-imposed Christmas deadline.

We will wait patiently for Congress, and in the meantime find some good news in the Sandicor resolution, published today. This isn’t much progress, but at least they are agreeing to something.

The two renegade associations will join the vastly superior CRMLS, and concede Sandicor to the only people who want it, the Greater San Diego Assocition of Realtors.

(more…)

by Jim the Realtor | Dec 18, 2017 | Jim's Take on the Market, Local Government, Mortgage News, Tax Reform |

Here we have three different real-estate-industry opinions on the effects of the final tax reform. 1) The demand will increase due to more spendable income, pushing home prices higher; 2) The demand will drop, due to less spendable income because middle-class families will have higher taxes, and 3) Congress did the right thing and should be applauded:

LINK

The Republican party’s self-imposed Christmas deadline for the widely debated tax bill is fast approaching. Last week, Republican lawmakers announced they had the votes necessary to pass the converged Tax Cuts and Jobs Act bill. As the process moves forward, details are changing quickly, and, now, a couple of steadfast voters may not cast their ballots.

(more…)

by Jim the Realtor | Dec 17, 2017 | Jim's Take on the Market, Mortgage News, Tax Reform |

It’s now been widely reported – and Rob Dawg agrees – that Congress did not change the two-out-of-five-year requirement for home sellers to receive up to $500,000 in net proceeds, tax-free.

The only two changes in the final tax reform bill are 1) Lowering the mortgage cap from $1,000,000 to $750,000 for future buyers, and 2) capping the state, local, and property taxes deductions to a max of $10,000.

This is a win for the real estate industry, yes? After all, they were considering lowering the cap to $500,000, no SALT deductions, and changing the capital-gains exemption to five-out-of-eight years.

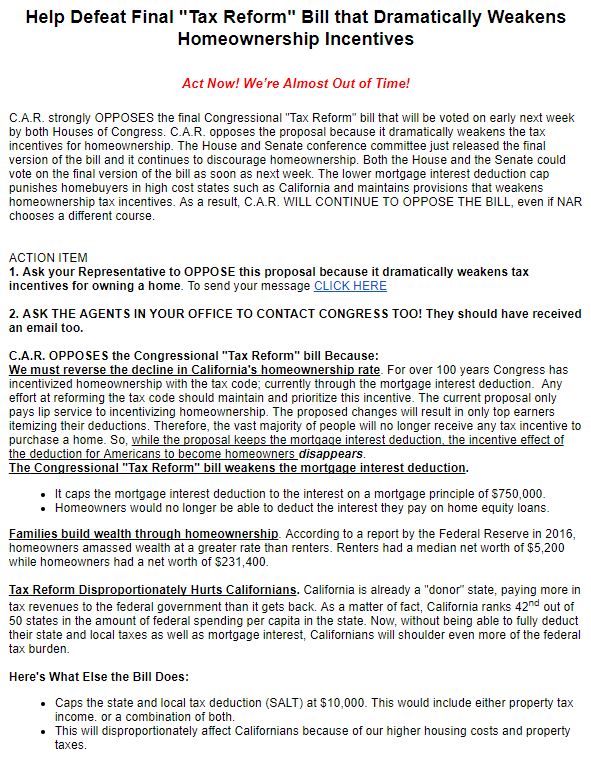

Yet, last night the California Association of Realtors sent out their second email since Friday’s final bill was published, and declared that it ‘Dramatically Weakens Homeownership Incentives’.

Why aren’t realtors forming victory parades, instead of complaining?

Should I just be happy that they stopped including the scare tactic of home values declining if the bill passes?

P.S. It is mortgage principal, not principle.

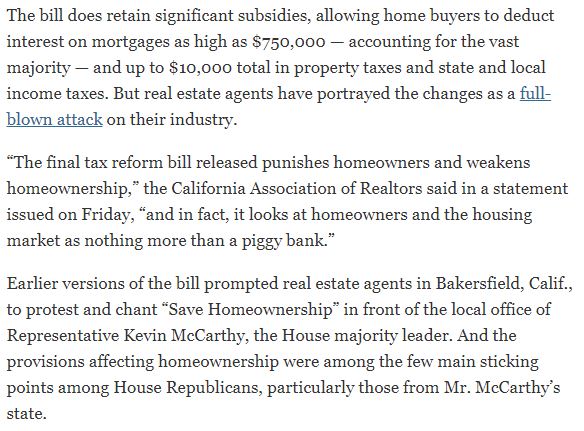

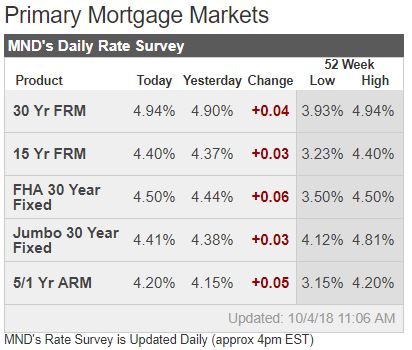

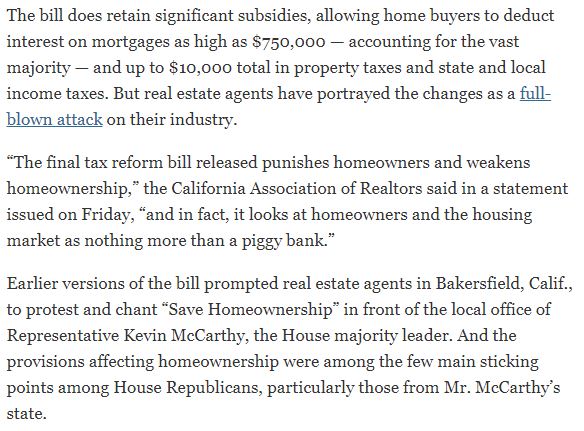

Now that N.A.R. and C.A.R. have been saying for weeks that home values will be plunging, here’s an example of how it is being reported (H/T to Susie for sending this in from the NYT):