by Jim the Realtor | Dec 14, 2017 | Jim's Take on the Market, Mortgage News, Tax Reform |

Congress is expected to vote on the final version of the Tax Reform Bill next week. The terms being bandied about:

- The mortgage-interest deduction will remain, but only for loans up to $750,000 for future buyers, instead of $1,000,000.

- State and local income and property taxes can be deducted, up to $10K.

- Home sellers who have lived in their home for five out of the last eight years can exclude up to $500,000 in profits, tax-free.

What I haven’t seen is the date when the five-out-of-eight requirement begins – the House and Senate each had different versions. If you see or hear how they decided to resolve it, let us know!

Republican lawmakers are trying to release the text of a compromise bill by Friday in order to hold votes in the House and Senate early next week, said Senator John Thune, the chamber’s third-ranking Republican.

by Jim the Realtor | Dec 13, 2017 | Interest Rates/Loan Limits, Jim's Take on the Market, Mortgage News

With the new Fed transparency, these rate hikes are telegraphed well in advance now and priced in by the market. Free enterprise is working – the competition between Chase, Wells Fargo, and Bank of America is keeping rates in check. BofA is quoting 3.875% and no points for 30-year jumbos today – and we’ve had three Fed hikes this year (doubling from 0.75% to 1.5% today)!

From MND:

Mortgage rates fell fairly quickly this afternoon following the Federal Reserves updated economic projections. While it is indeed true that the Fed “raised rates” this afternoon, there are two reasons that doesn’t matter.

First of all, the rate the Fed adjusts (aptly named, the Fed Funds Rate), governs only the shortest-time frames (overnight loans among big banks). Although its effects radiate to longer-term debt like mortgages, the two are far from joined at the hip. Short term rates often move one direction while long term rates move another.

More importantly, EVERYONE responsible for trading the bonds that govern interest rates (and I do mean every last person without a single exception) was well aware that the Fed would be hiking rates today. No Fed rate hike has been better telegraphed during this cycle.

When bond traders know what’s going to happen in the future, they’ll trade accordingly as soon as possible. That means rates had long since adjusted to today’s rate hike–so much so that the hike itself was a non-event. Again, it was the update economic projections that helped rates move lower this afternoon. Fed Chair Yellen’s press conference played a major role as well.

Even before the Fed news came out, a weaker reading on an important inflation report helped bond markets get into positive territory on the day. The net effect of the Fed and the economic data was a moderately quick move back to last week’s low rates.

Loan Originator Perspective:

Bonds are rallying following the Fed announcement today and weaker inflation data. As of 4pm eastern, only a few lenders have passed along any of the gains. So, I favor floating overnight and evaluate pricing tomorrow. Hopefully this rally can continue.

LINK

by Jim the Realtor | Nov 16, 2017 | Jim's Take on the Market, Local Government, Mortgage News, Tax Reform

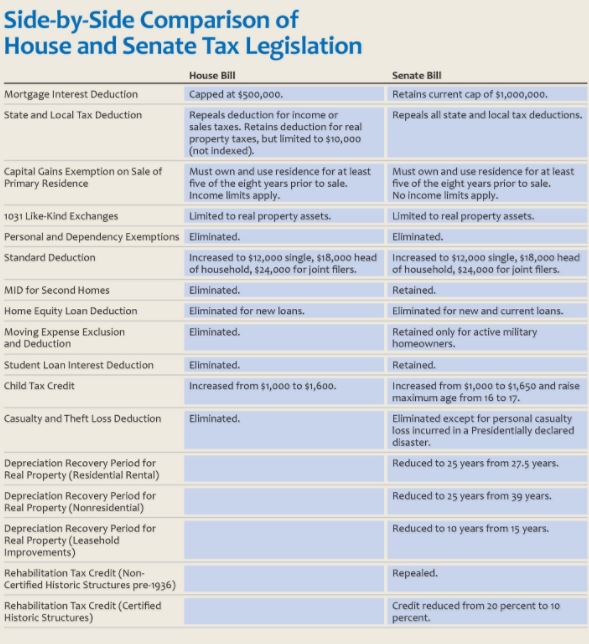

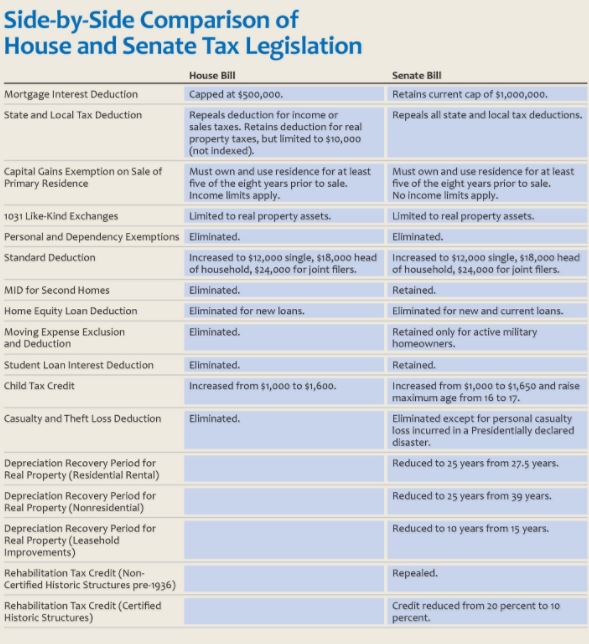

For tax reform to be implemented, our politicians will need to negotiate and compromise on the existing terms:

by Jim the Realtor | Nov 15, 2017 | Jim's Take on the Market, Local Flavor, Local Government, Mortgage News, Tax Reform |

If I were a local politician, I’d like to preserve either the M.I.D. or the state and local taxes – or at least include the property-tax deduction up to $10,000 – and compromise on the other changes

Use the slogan, “If California tanks, the whole country tanks!

by Jim the Realtor | Nov 10, 2017 | Jim's Take on the Market, Local Flavor, Mortgage News |

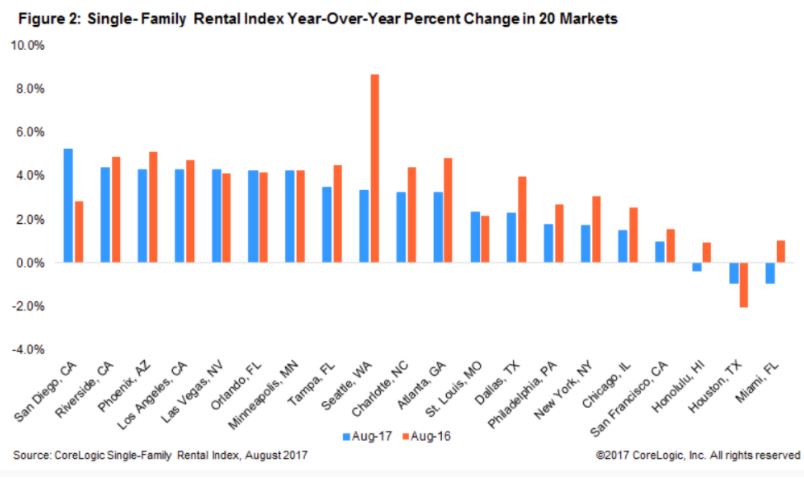

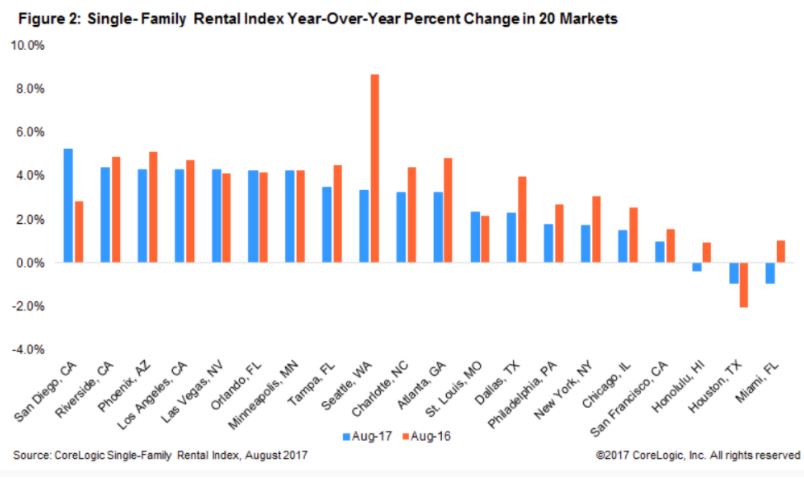

Even if the tax reform includes fewer incentives for buying, the rising rents should still help to power sales – and San Diego was #1 in the country for our 5% increase year-over-year!

http://www.mortgagenewsdaily.com/11082017_housing_affordability.asp

An excerpt:

Most of the 20 largest core-based statistical areas had rent increases, but those with limited new construction and strong local economies tend to have low rental vacancy rates and stronger rent growth.

The largest rate of growth was in San Diego, while Phoenix experienced 4.3 percent year-over-year rent growth, driven by employment growth more than double the national growth at 2.8 percent year over year. In contrast, Houston, which has been hit with energy-related job losses since early 2015, saw rents decline by 0.9 percent year-over-year (pre-hurricane) and Miami was also down. Seattle’s skyrocketing rents, and rents in other cities that experienced strong but less exuberant gains, saw growth moderating significantly.

But at first glance, renters are getting off easy when compared to those shopping for new homes and loans. Andrew LePage says that while home prices have risen about 6 percent over the past year, recent homebuyers have taken on mortgage payments that have risen closer to 10 percent.

(more…)

by Jim the Realtor | Nov 9, 2017 | Jim's Take on the Market, Mortgage News, Tax Reform |

We’re breathing again – the Senate’s version of tax reform doesn’t change the mortgage-interest deduction, leaving the cap at $1,000,000:

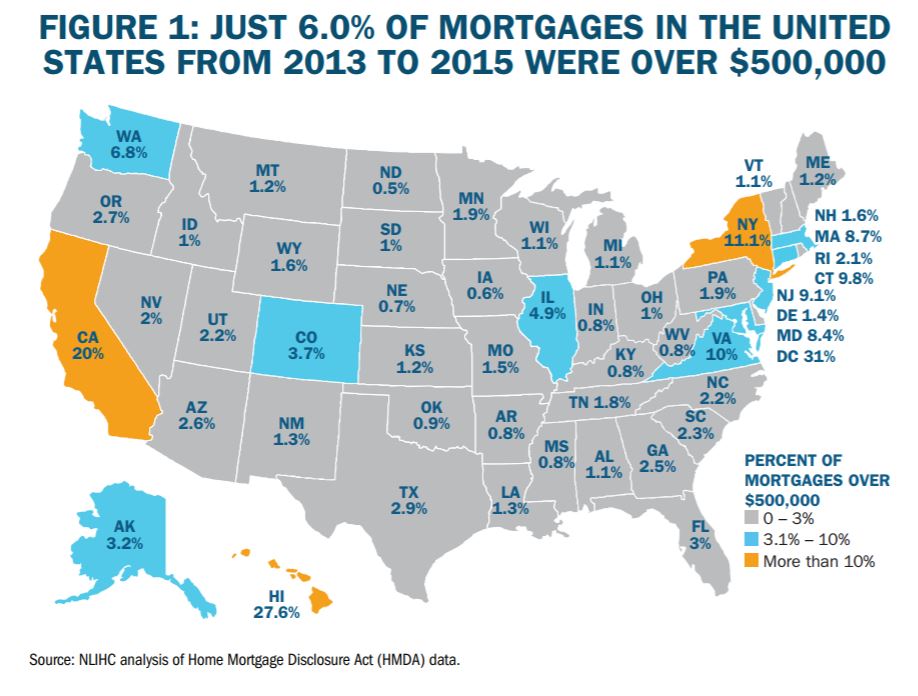

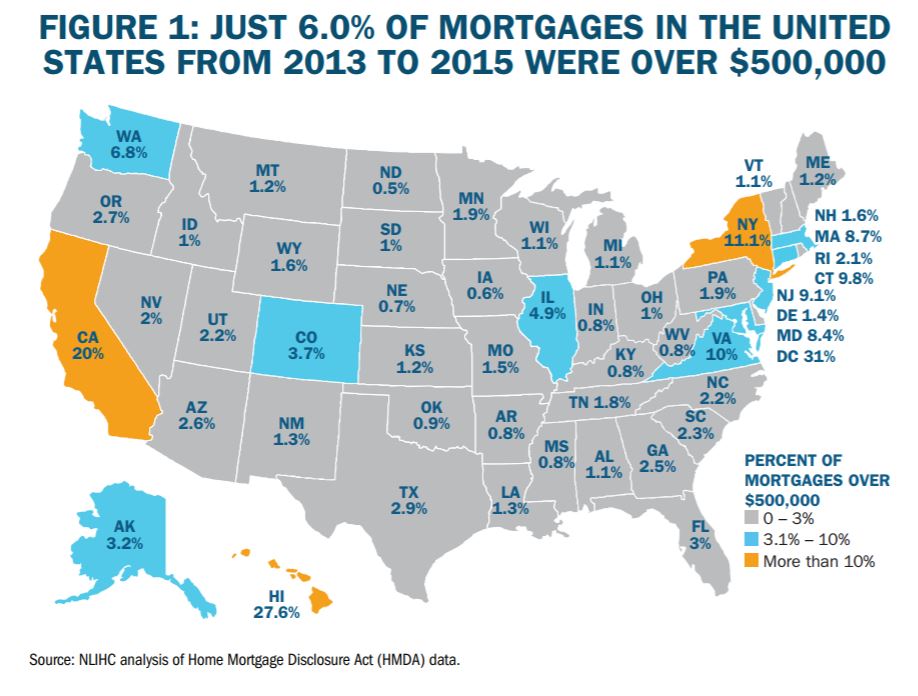

The mortgage interest deduction stays. The current mortgage interest deduction rules remain intact in the Senate plan: Americans would still be able to deduct the interest they pay on the first $1 million of mortgage debt. The House plan reduced that threshold for new mortgages to $500,000, causing outcry from some real estate agents and builders as well as congressmen who represent areas with extremely hefty real estate costs. While there was pushback on the House plan, the reality is only about 6 percent of new mortgages are valued at more than $500,000, according to a report by the United for Homes campaign.

So far this year, 37% of the mortgages funded in San Diego were over $500,000, so there is a significant impact upon our area:

In the San Francisco metro area, 60% of new loans were for more than $500,000, while in Los Angeles and San Diego, the figures were 44% and 37%, respectively.

While there is still more wrangling to come for the House and Senate to agree on a bill to send to the President, at least this might be enough to stop the NAR from declaring that the sky is falling.

by Jim the Realtor | Nov 3, 2017 | Jim's Take on the Market, Mortgage News, Tax Reform |

From HW:

The Republican tax plan is in, and an investigation reveals one place stands to lose far more than any other under the new plan.

To recap – the Tax Cuts and Jobs Act will slash the mortgage interest deduction in half from $1 million to $500,000, double the standard deduction and reducing the capital gains exemption, allowing homeowners to deduct profits from a home sale only once every five years, instead of two. Read a full analysis of the new plan here.

The GSEs Fannie Mae and Freddie Mac also say it could trigger yet another bailout for them, so there’s that. But the lower corporate tax rate could also allow them to quickly pay back the draw – read all about that here.

But the mortgage interest deduction debate has been going on for a while. A quick search on HousingWire shows articles debating the mortgage interest rate going back seven years.

Before the Republicans announced their intent to slash the mortgage interest rate deduction, the National Association of Realtors argued that even an increase in the standard deduction could be detrimental to the MID as it would make it irrelevant for all but the wealthiest Americans.

However, in one state, the effects of the cut could be much more far-reaching.

You guessed it – California.

Using the IRS statements of income data from 2015 and filed in 2016 compiled LendingTree, these are the top metro areas where homeowners utilize the mortgage interest deduction, all of which are located in California:

1. San Francisco – with 24% of tax filers claiming mortgage deduction of an average $16,167

2. Samford-Norwalk – with 32% of tax filers claiming mortgage deduction of an average $15,237

3. San Jose – with 28% of tax filers claiming mortgage deduction of an average $14,815

4. Orange County – with 27% of tax filers claiming mortgage deduction of an average $13,938

5. Santa Cruz-Watsonville – with 27% of tax filers claiming mortgage deduction of an average $13,496

6. Oakland – with 30% of tax filers claiming mortgage deduction of an average $13,406

7. Ventura – with 29% of tax filers claiming mortgage deduction of an average $13,257

At this point, another state comes into the picture, taking the eighth spot with Honolulu, Hawaii, with 22% of tax filers claiming an average $13,092 in mortgage deduction. However, the list then continues on with more metros from California.

9. Santa Barba-Santa Maria-Lompoc – with 22% of tax filers claiming mortgage deduction of an average $13,053

10. Los Angeles-Long Beach – with 21% of tax filers claiming mortgage deduction of an average $12,904

11. San Diego – with 26% of tax filers claiming mortgage deduction of an average $12,727

12. Salinas – with 20% of tax filers claiming mortgage deduction of an average $12,279

13. Santa Rosa – with 28% of tax filers claiming mortgage deduction of an average $12,067

14. San Luis Obispo-Atascadero-Paso Robles – with 28% of tax filers claiming mortgage deduction of an average $11,825

Needless to say, Californians could see a hard hit if the new tax bill passes. Experts point out that only about 5% of U.S. mortgages are more than $500,000, but the map above, produced by the National Low Income Housing Coalition, shows the majority of these homes are either in California or in the Northeast.

by Jim the Realtor | Oct 29, 2017 | Jim's Take on the Market, Mortgage News, Tax Reform, Thinking of Buying?, Why You Should Hire Jim as your Buyer's Agent |

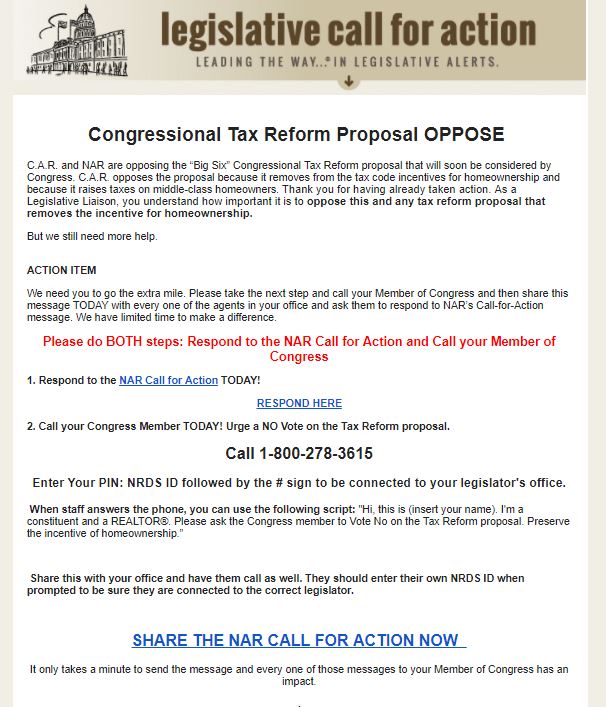

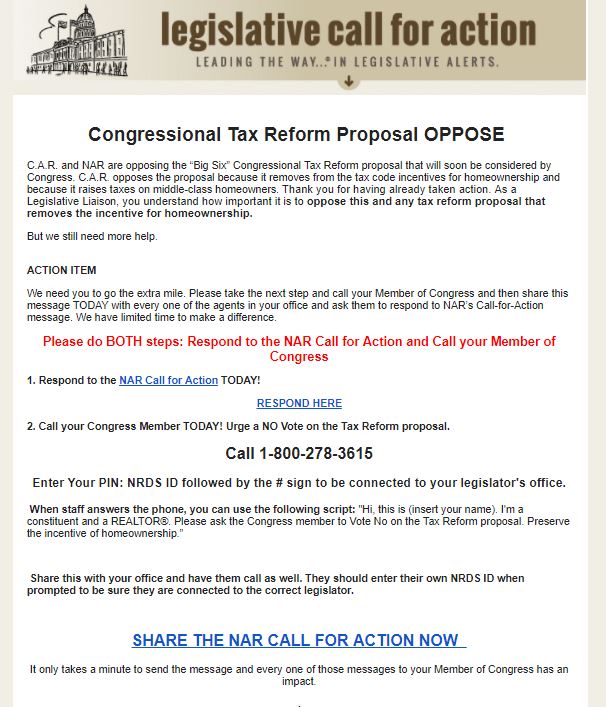

The California Association of Realtors is pushing realtors to object to the Big Six tax reform. Here are the reasons why:

C.A.R. OPPOSES the Tax Reform Proposal Because:

We must reverse the decline in California’s homeownership rate. For over 100 years Congress has incentivized homeownership with the tax code; currently through the mortgage interest deduction. Any effort at reforming the tax code should maintain and prioritize this incentive. The current proposal only pays lip service to incentivizing homeownership. The proposed changes will result in only five-percent of taxpayers itemizing their deductions. Therefore, the vast majority of people will no longer receive any tax incentive to purchase a home. So, while the proposal keeps the mortgage interest deduction, the incentive effect of the deduction for Americans to become homeowners disappears.

This is a tax increase on California homebuyers and homeowners. Congress needs to protect taxpayers from double-taxation and maintain the deduction for state and local taxes, including property taxes. Not allowing the average homeowner in California to deduct their property, state and local taxes would effectively raise their taxes $3,000 a year! The Federal government would tax families on money paid to the state and to local governments they never used.

That’s all you got?

Tax reforms will come and go. Buy a house to lock down your living expenses, and provide housing stability for generations to come.

by Jim the Realtor | Oct 14, 2017 | Flips, Jim's Take on the Market, Mortgage News

Add house-flippers to Goldman Sachs’ ever-expanding roster of potential clients as the Wall Street firm hunts for new ways to make money.

Lending has taken an increasingly higher profile at Goldman, where once-prominent trading desks have had their wings clipped by automation and regulation. The bank started out last year with small loans up to $30,000 for regular people with good credit through an online business it calls Marcus.

This summer it opened its doors to investors by giving financial advisors a way to arrange loans of up to $25 million for clients backed by their investment portfolios.

Goldman is even trying to find a way to occupy its traders’ time, exploring possibilities in the realm of bitcoin and other digital currencies after picking up on client interest in the area.

In September, the bank’s president, Harvey Schwartz, said lending activities are projected to shake out $2 billion in additional revenue. Now Goldman is getting into lending for real estate pros through its acquisition of Genesis Capital.

The deal, for undisclosed terms, gives Goldman a business that makes loans of $100,000 to $10 million at rates of 7 percent to 12 percent. It won’t lend to occupants, so that leaves real estate professionals who are renovating and looking to sell fairly quickly. Genesis made $1 billion of loans last year.

https://www.cnbc.com/2017/10/12/goldman-wants-to-help-flip-that-house.html

Save

by Jim the Realtor | Oct 5, 2017 | Down Payments, Jim's Take on the Market, Mortgage News, Mortgage Qualifying |

If Fannie/Freddie is willing to allow this, how much longer will they require a down payment? From cnbc.com:

https://www.cnbc.com/2017/10/05/a-new-way-to-buy-a-home-crowdfunding-the-down-payment.html

An excerpt:

Most business crowdfunding platforms offer returns on the investment, but this has none — it is simply a gift. George said the individual gifts will be small, in the $50 to $250 range. The platform can be linked to wedding and baby registries.

“You’re going to spend $250 on a coffee making machine? If that $250 goes to a down payment of your home, at the very least, I improve your quality of life and the second thing I do is I give you some, today, some tax deductibility,” George added.

As an incentive for encouraging prospective homeowners to attend credit education courses and counseling, borrowers can also receive grants of up to $2,500 once they’ve completed the free classes. After that, the platform will match donations at $2 for every $1 raised, up to $2,500.

“Folks that go to counseling tend to be more informed, and they also tend to be better borrowers,” George said. “We’ve looked at this as advertising dollars and have said, listen we think this promotes homeownership, we think it’s something that we would otherwise spend either through the internet or through social media. We’ve put our money here where we think it has its best use.”

On the other side, contributors are also assured that the money will in fact go to fund the home purchase and can make their gift conditional on that.

The idea is not just to raise money for the down payment but to add to the borrower’s existing funds. This can help eliminate the need for mortgage insurance, which is required on very low down payment loans. Fannie Mae is calling it a “pilot project,” and will be watching the results closely.

“What we’re doing today is we’re trying to test and learn a variety of solutions because the preferences for today’s homebuyers have changed significantly, and there is no silver bullet to solving a problem that’s as hard as how do you find a down payment,” said Jonathan Lawless at Fannie Mae. “What we prefer to do is source ideas from all sorts of different places. Our customers are a major one, lenders who are dealing every day with people trying to buy homes, and instead of trying to take those ideas and spend three years trying to roll out a major change, we’d rather test and learn.”

Crowdfunding your way into home ownership. Here’s how from CNBC.