Jim and Rob on Buyer Agency & Auctions

Rob Hahn and I had a conversation about the state of buyer agency – which might only interest realtors, if anybody – but we also got into the idea of home auctions too:

Rob Hahn and I had a conversation about the state of buyer agency – which might only interest realtors, if anybody – but we also got into the idea of home auctions too:

One more thought about the extinction of buyer-agents.

There are many variables that point to the demise of the two-agent system that has prevailed for 100+ years. The coming changes should roll out over the next 12 months too – how exciting!

What’s already happened:

What’s coming:

The traditional buyer-agents get cut out of the loop, which then also means the MLS isn’t needed either. Then today’s search portals break down because they aren’t getting the listing feeds from the 600+ MLS companies around the country.

Because it is dual agency when buyers go direct to the listing agent, there will be a semblance of buyer representation, so commission rates won’t change much – even though buyers will mostly be on their own. Whether the consumers recognize the benefits of having their own representation won’t matter. They just want to buy a house, so the companies that spend the most money on advertising with win their business.

Any disrupter could win the game if they spend enough money. Zillow was spending more than $100 million per year in advertising to become #1, and it worked.

In the link below, Joe says that CoStar is going to spend a couple of hundred million dollars on consumer advertising to compete with Zillow. You can imagine their advertising:

Want to know about a property? Click here to contact the listing agent directly!

Joe lays it all out here, starting at the 17-minute mark:

https://www.rismedia.com/2022/01/03/be-ready-when-music-stops-how-focus-today-but-prep-for-tomorrow/

Throw in an auction platform somewhere along the way, and homes sales will be transformed forever.

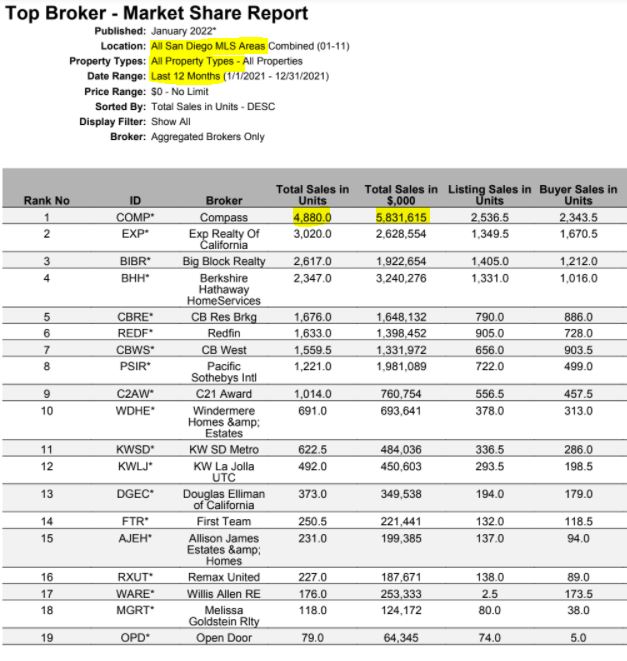

I screwed up the national rankings the other day. Donna sent me that clip but it was the 2020 list, not from last year. Anyway, who cares about the national – real estate is local!

In just 3+ years, Compass has become the dominant real estate brokerage in San Diego County, and it’s not close. Even if you add the two CBs together, our volume last year was almost double any other brokerage.

How will this affect consumers in the future?

As buyer-agents are phased out over the next 1-2 years (and it could happen sooner), there won’t be a need for the MLS. Inputting our listings onto Zillow will become voluntary, and only used if the homes can’t be sold in-house.

It will be just like the commercial side of real estate, where all the good deals are kept in-house, and only when they don’t sell, are the listings inputted onto LoopNet.

The best thing about 2021 for Kayla? Her new boyfriend Frank, who is a great guy and quite a golfer too!

Natalie signed with a new talent agent and has high hopes for next-level work in the new year. Dancing on a concert tour would be ideal, all while being our marketing director!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I said that pricing will likely seem a lot higher this year.

With few recent sales to guide them, sellers and listing agents will wonder how much can they get away with on price. There are tales of a old blogger guy being wildly successful with his transparent open bidding, but other agents aren’t experienced in conducting a slow-motion auction and don’t have the guts.

Instead, the list prices will be getting packed.

When sellers wonder how high, it will be easier to lump 10%, or more, on top of the initial guess (which was probably +5% optimistic already). The zestimate, or other automated valuation, that is higher and supports the dream will be collected as proof!

But it’s the METHOD of selling that makes the +10% possible.

Bidders are turned against one another and compete for the prize. Their ego takes over and directs the bidding……and the contest is on, with no ceiling.

Will a list price that starts at 10% to 15% higher than comps produce the same results as my slow-motion auctions? Maybe, but only with the homes that are highly upgraded with all the bells & whistles and have a superior location. The real creampuffs.

The early buyers will have to tolerate such sloppy pricing, but for those who are already frustrated from not buying a house in 2020/2021, it won’t matter and they will grab whatever they can. It virtually guarantees that the first 1-3 months of the season will be scorching hot.

But there will come a day when we run out of those buyers, and the frenzy conditions will be over.

I’m sticking with my +15% appreciation, and it all happens in the first half of 2022.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

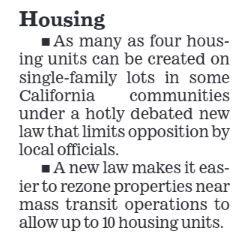

Two new laws that address the housing crisis begin today (above).

Baby boomers are another year older, and more will need help with living. The multi-gen home buyers will grow in numbers, and granny flats will be an ideal solution. Many will buy a suitable property with grandma’s money, and take care of her until the end.

Some multi-gen home buyers will cope with finding an existing single-family home and adding their own granny flat. But the real opportunity will be for those sellers of properties that already have an ADU. Because the supply is low and the need is very high (and because grandma’s money came a little too easily), the prices paid for homes with existing granny flats will be excessive. There will be a separate category of comps too – those with ADUs, and those without, with a pricing differential of 10% minimum.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

This could be the year that buyers have to pay for their own agent.

I don’t think many agents can make a case of why they are worth it – or at least demonstrate why they are worth as much as 2% to 3%. It would be cool to develop buyer-agent squads who are experts in their field and are worthy of compensation – and can prove it. But most will just fade away, or open up a shop of discount door-openers who don’t offer much, but get paid up front.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Another political season starts in 2022, which means an increase in the vitriol and hate. The perceived volatility will cause a few people to move to areas which are better suited for their political leanings, especially if there are riots – which is what it would take to get laid-back San Diegans to reconsider a move. It may not cause a surge of additional sellers here, but it could create more demand for homes in those politically-friendly destinations.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The difficulty of buying homes out-of-state is already tough enough, and now they are more expensive – with some now 30% to 40% higher. It could be the game-changer for potential sellers and even be the reason why the inventory has been so tight recently.

We don’t know what it will take to get more homeowners to sell.

In the past, record-high prices did the trick, but today’s prices are setting new records every month – and inventory is in decline. How many current homeowners in San Diego wouldn’t sell at any price? 80%? 90%? That’s a problem, and I’ll say that it’s something we’ve never faced before until the last few months.

At the same time, the number of San Diego County detached-home sales in 2021 will probably rank as the #2 of all-time, behind only those in 2003. There were 28,319 detached-home listings last year, and 25,029 sales, which is incredibly efficient. Virtually everything is selling!

But only 12,936 of those listings came in the second half of 2021, and if we continue at that pace or lower, it will be excruciating for buyers – and send prices to the moon.

The optimum number of listings will probably be in the 30,000 to 35,000 range. Having a small surge in listings will drive the market crazy with activity…..and force sellers and buyers to Get Good Help!

Brian and Yunnie got together for a preview of 2022. Yun touted his usual vagueness and Brian touched on a sensitive subject that long-time blog reader Chris and I discussed yesterday.

The shuffle of older agents leaving the business and being replaced by new-age realtors who only know automated order-taking will make the end of the frenzy somewhat predictable. Because the agents who have gotten into the business over the last 12 years have never experienced a ‘downturn’, it won’t be detected by most until the market has softened considerably. Agents will carry on, and the last thing sellers will do is lower their price enough to sell. Plateau City should arrive by next summer, where sellers and listing agents unwittingly let listings sit for months while waiting for someone to bail them out. Sales drop, and prices stay about the same. It will be excruciating.

“People rushed to buy homes during the pandemic, so two straight years of spectacular performance,” Yun said, pointing to a 7% increase in home sales from 2020 to 2021—from 5.7 million to 6 million, respectively.

While home sales have shined over the past two years since the start of the pandemic, Yun said 2022 is poised to be slightly different.

“I think the sales activity will be shaved modestly,” Yun said, suggesting a 2% reduction in sales next year as mortgage rates increase.

A silver lining on the horizon will be improvements in inventory, with the industry “turning the corner” on the dire shortage of housing supply for sale, according to Yun.

“New construction of single-family homes has been moving steadily higher,” he said, indicating that the market may see more inventory in the spring market next year than in 2021.

Yun also indicated that more people are likely to list their homes now that federal support and mortgage forbearance programs are either ended or are slated to end next year.

Even with a much-needed injection of inventory, Yun noted that agents should prepare for the rising mortgage rates to push activity forward next year as buyers try to secure the lowest rates possible before they climb to 3.7% by the end of 2022.

Buffini’s general advice to agents was to focus on the fundamentals and take advantage of the upcoming business in the winter and summer.

“I know people are working as hard as they can, but there is an old phrase that even a turkey can fly in a hurricane,” Buffini said. “When the wind starts to slow down, if you’re a turkey up at 200 feet, you’re going to be Thanksgiving dinner.

“There are going to be a bunch of people getting out of the business, and we are going to be left with even less experience in the industry,” he concluded.

https://www.rismedia.com/2021/12/15/buffini-bold-predictions-2022-challenges-inexperienced-agents/

This report should be the last dagger for buyer-agents.

Won’t buyers who are empowered by searching for homes on the internet themselves just go direct to the listing agent, rather than paying extra for their own representation? They don’t think they need representation – they can find houses on their own!

Listing agents will encourage this program too – and just charge 4%-5% and keep the whole fee (which this report didn’t see coming). In addition, without buyer-agents there will be no need for the MLS. The search portals will become an option, rather than a requirement, for listing agents to advertise their listings if they feel like it.

Also, realtors will be extremely reluctant to advertise their true rates and services. How do we know that? How many realtor blogs do you see today? Instead, the braggadocious fluff will prevail.

Bold added:

Washington, D.C. – A new report by the Consumer Federation of America (CFA) on residential real estate commissions – The Relationship of Residential Real Estate Commission Rates to Industry Structure and Culture – shows that buyer agent commissions are highly uniform. This rate uniformity is strongly supported by the industry’s compensation system in which home sellers pay the commissions of both the listing agent and the buyer agent. Uncoupling (or untying) seller and buyer agent compensation would spur price competition that would substantially reduce the some $100 billion in commissions paid annually by consumers.

“The current commission system is designed to thwart price competition among agents,” said Stephen Brobeck, a CFA senior fellow and the report’s author. “If home buyers were allowed to negotiate their agent’s commission, agents would be encouraged to compete on price and service,” he added.

CFA’s analysis of more than 10,000 home sales this year, in 21 cities from the eastern half of the U.S., shows that buyer agent rates were highly uniform. As the appended table shows:

The report’s analysis of these buyer agent rates and their relationship to listing agent rates reveals that the typical total commission in these cities ranged between five and six percent. The report also explains why the most widely-quoted estimate of a national average rate – by industry-related Real Trends and now below five percent – is misleading and probably inaccurate.

In a price-competitive marketplace, rates would vary greatly because of several factors:

The report shows that the above factors, which should result in highly variable commission rates and agent compensation, are minimized by the structure and culture of the industry.

The report notes that there appears to have been some recent erosion of rates and their uniformity. Over several decades, typical rates in urban areas have declined from six to seven percent to five to six percent (with no loss of agent incomes because of rising housing prices). In some cities, there are now a large number of sales at both 2.5 percent and at 3.0 percent. And in Brooklyn, where expensive homes generate substantial fees, typical buyer agent rates are well below 2.5 percent.

The report suggests that the one measure which could spur rate competition is uncoupling buyer and listing agent commissions so that buyers can negotiate compensation with their agents. Buyer agent commissions, now baked into listed prices, would instead be negotiated by buyers. That would lower home sale prices, and both the mortgage and real estate industries would ensure that these commissions could be included in mortgages whose amount financed would not need to increase.

The uncoupling of rates would also free listing agent discounters from the shackles of current industry rules that force them to charge typical buyer agent rates. Over time, there would be a much wider variation in rates (and service options) reflecting agent experience, work, effort, representation, and willingness to compete on rates.

There is a broad and increasing consensus that commission rates should be uncoupled.

Studies published on both the Right (Cato Institute) and Left (Brookings Institute) argue strongly for this untying. Lawsuits filed by major class action firms seek to uncouple commissions. The U.S. Department of Justice is pursuing antitrust issues beyond improved disclosures. The Biden administration’s antitrust agenda targets tied commissions. Even some voices from the industry have suggested the consideration of changes in current rate compensation practices.

A week ago, the National Association of Realtors (NAR) announced changes that would allow agents, firms, and portals to publish buyer agent rates. In an analysis of these changes, CFA noted that they would discourage agents from steering consumers to higher-commission properties, but would not permit significant rate competition because buyers would still not pay, or be able to effectively negotiate, compensation of their agents.

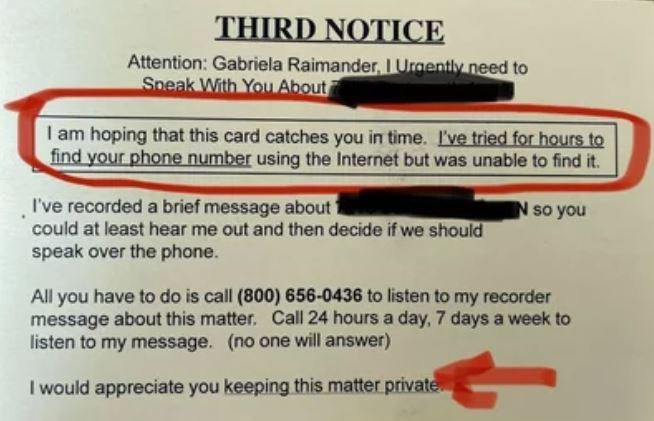

Excerpts from this article about real estate soliciting – it’s going to get crazier! Hat tip to just some guy:

Jennifer Folden-Nissen’s three-bedroom, Victorian-style house in Duluth, Ga., isn’t for sale. But that hasn’t stopped a guy calling himself Henry from phoning her at least once a week. She says the pitch is always the same: “I want to buy your house. I’m willing to pay cash. Today.”

She says it’s sort of like having to deal with an insistent car salesman. “I just let him leave voicemails,” she says. But even those are pushy. “Call me back, call me back, call me back, call me right now — I’m out front of your house.”

Folden-Nissen works at the local fire department, and she’d call home and ask her husband to see if the guy was outside. But nobody ever was. Then she started to get postcards from the same guy — with no stamp, so apparently hand-delivered — with photos of her own home on them.

“It was a little freaky because some of it was just like, OK, is the guy really outside?” she says. “And why is he taking pictures of my house if I haven’t given him the time of day?”

“They have just gotten increasingly worse in the past six months, six or seven calls every day,” says Lauren Barber, who lives in Columbus, Ohio.

“If you know anything about Columbus, it’s growing and it’s hot,” she says. “People want to live here.” Barber bought her house about 10 years ago for $155,000. She says now it’s worth more than twice that.

Investors can go on the internet and buy lists of phone numbers for people whose homes have risen in value, maybe more than the owners’ realize.

Barber works in human resources, so she says she has to answer her phone. “It could be one of our employees calling me with a question.” She says she tries to block the homebuyer calls, but they always seem to somehow call from a different local-looking number.

She says one of them even called her mother’s house, on purpose, to ask if Barber would sell.

“Like, really, you’re going to call my mom and ask her if I’m going to sell my house to you? It was just the most absurd and amazing thing,” she says. “But I told you no. Stop calling me. Don’t bother my mom.”

For those who are thinking of selling next year and plan to do some improvements, don’t wait to begin.

In fact, start today!

Yesterday, I contacted three different flooring contractors, and all were booked into December. Our GC is currently booked for two months, our pool-repair guy has work scheduled for the next FIVE MONTHS, and our plumber gave up and suggested that we find someone else.

If you want us to provide an initial consultation and give opinions of what repairs/improvements would be smart to complete prior to selling, feel free to contact us – now. We can call in favors if needed – the pool guy got started within two weeks!

It made me wonder how many homeowners were in the hunt for a new house over the last 1-2 years, and have since given up on moving and decided to remodel instead.

No matter how small the percentage, it means the demand for homes for sale will be increasingly more dependent upon the out-of-towners who don’t have a house here yet. Their desperation level is higher than our current homeowners here who are comparing to what they already own……and who are finding it more difficult every day to justify a move.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

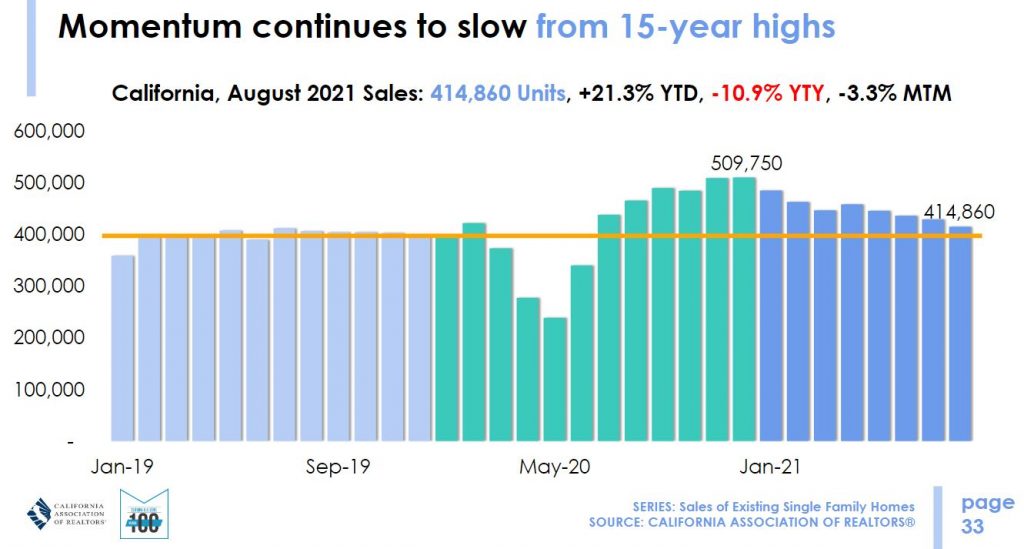

More slides from the C.A.R. forecast:

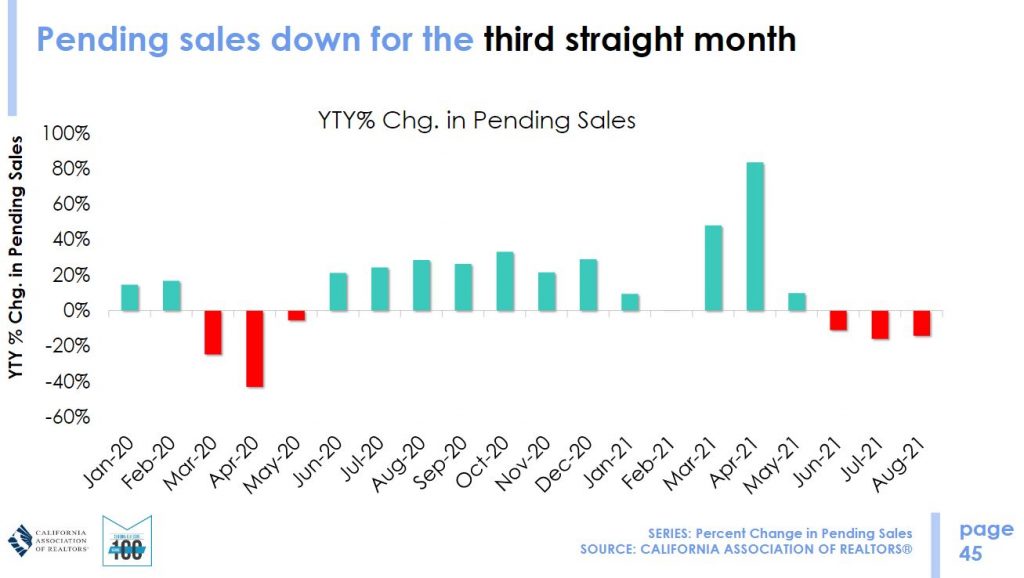

They are forecasting a 5.2% YoY drop in sales in 2022, after we will likely set the all-time record for sales here in 2021. They are probably considering the slowdown in pending sales:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

They also showed how 70% of the business is done by 30% of the realtors….and the rest of the agents are barely in business with less than two sales per year:

Get Good Help!

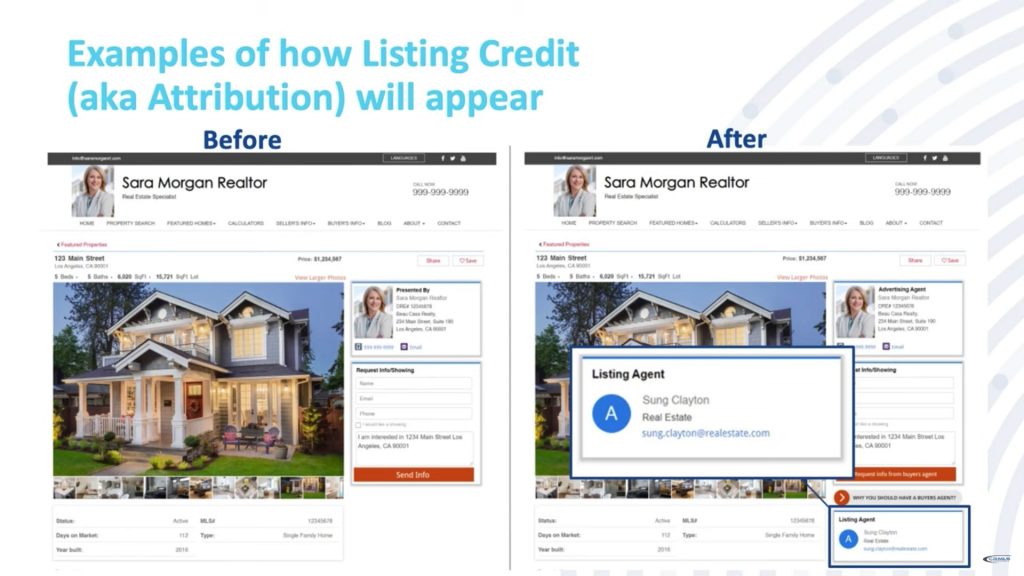

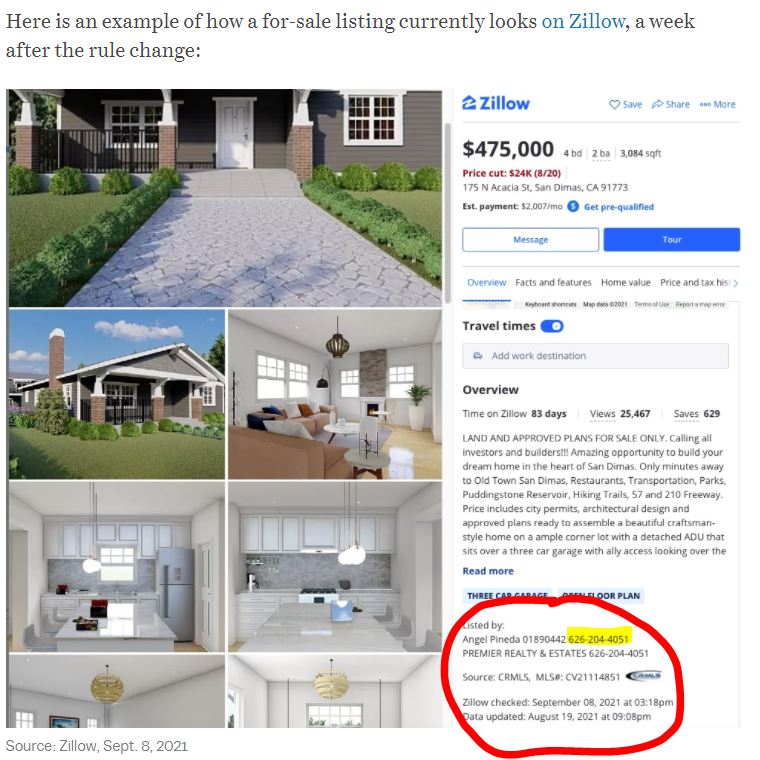

The old rule was that any agent could advertise any MLS listing via the IDX, as long as the listing agent’s name and brokerage was displayed. But now you have to include their contact information too. He sounds confident because this is clearly a shot at Zillow but the unintended consequences from directing the consumer to the listing agent is promoting single agency which will eventually eliminate broker cooperation as we know it.

The discouragement of buyers getting their own representation from a buyer-agent is part of the dumbing-down of the business. Sellers and listing agents prefer buyers who just pay whatever it takes and don’t ask questions, and when the History of the 2020-2021 Frenzy is written, it should include that it was fueled in part by crazy buyers getting no good help.

In an emailed statement, a Zillow spokesperson said, “As part of our switch to IDX feeds and becoming CRMLS participants earlier this year, we agreed to comply with all CRMLS rules and regulations, which includes adhering to listing credit and display rules — such as the updates that went into effect this month.

“One of our core values is to empower consumers and increase transparency in real estate, which includes efforts to give shoppers the information they need to connect with listing agents. For more than a decade, our philosophy of ‘turning on the lights’ for consumers has meant that we’ve consistently displayed listing agents’ names and contact information, something not done on all IDX sites today.”