by Jim the Realtor | Mar 18, 2023 | Realtor Training, Realtors Talking Shop |

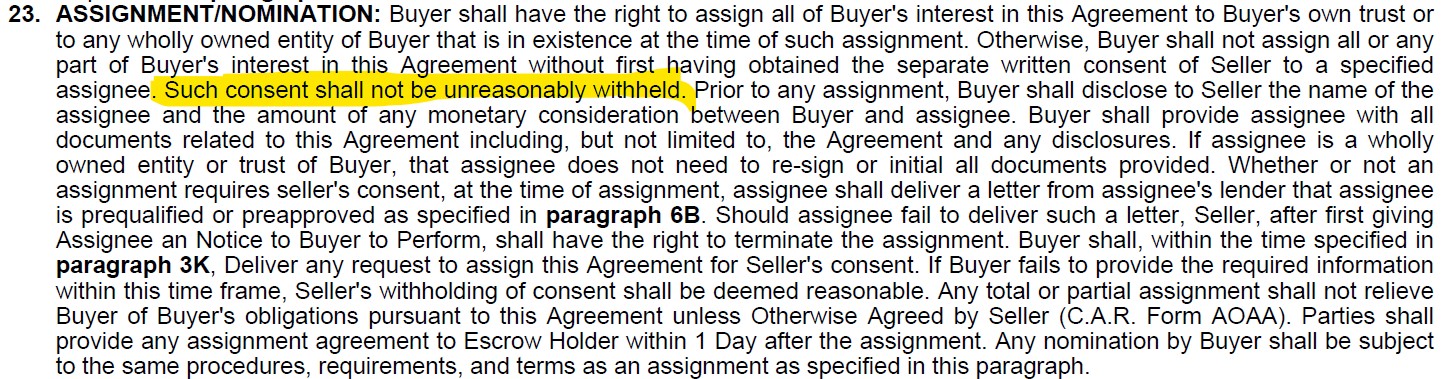

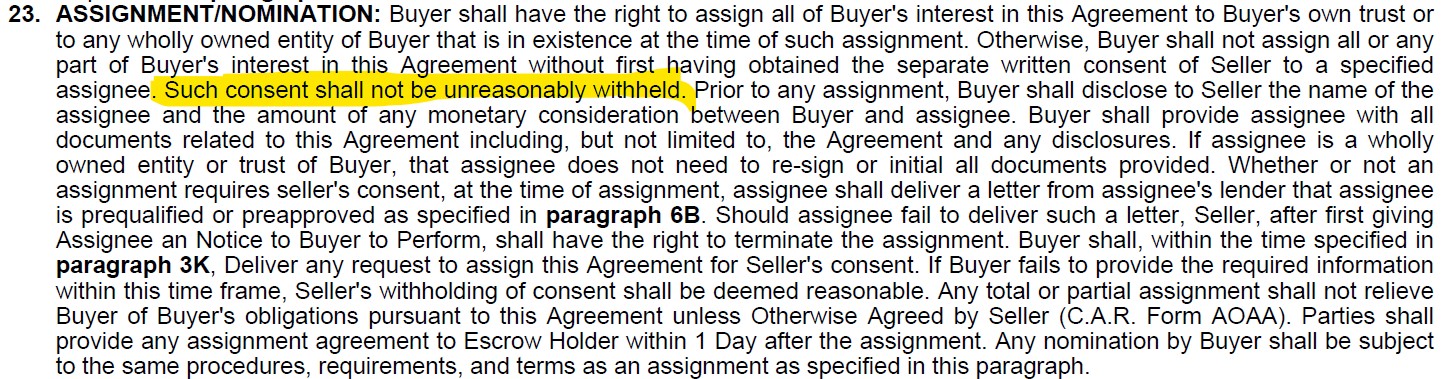

Agents are supposed to maintain a good working knowledge of the purchase contract, and every year we go to the C.A.R. review to keep up with the changes. But I don’t remember discussing this paragraph that was added in 2021, and expanded in the most recent version of the contract.

We had an interesting test case on it recently.

The buyer wanted to cancel their purchase, but they knew someone who was also interested in buying the property too. They claimed that Paragraph 23 gives them permission to plug in the new buyer, and the seller can’t ‘unreasonably’ withhold consent.

The way that paragrah reads, they might have a case. If they were able to provide a pre-qual letter and properly notify the seller and listing agent, it looks like they would have complied with the criteria expressed in this paragraph.

Do I want to get into a battle over it?

Luckily, they did not produce the documentation, and instead bowed out gracefully. But for a minute, I thought we might be stuck with the assignee, who had said that he flipped homes in the past. I cringed at the thought of the usual discount that flippers demand after their home inspection.

From now on, we’re going to counter out #23 before we enter into an agreement.

by Jim the Realtor | Mar 3, 2023 | Realtor, Realtors Talking Shop |

Between the lawsuits that will decouple commissions and homes.com that funnels all inquiries back to the listing agent, the buyer-agents are cooked. It’s just a matter of time.

Hat tip to RE News – an excerpt:

Florance also detailed his vision for Homes.com, which he believes can serve the interests of consumers and agents in ways that other residential listings sites do not.

“I’ve used some of these competing sites myself and submitted leads on properties I’m interested in. The experience is remarkably awful,” Florance said. “The moment you submit a lead and for months afterwards, you’re bombarded with cold calls from countless agents who have questionable qualifications.”

He said the agent experience is also lacking. “The competing models use all the agents’ listings in a market to funnel monetize leads to just a very small percentage of agents.”

Florance also made the case that there is plenty of opportunity to provide a more seamless online set of tools for agents while cultivating a residential real estate space for consumers serious about buying and selling homes. “While other sites are injecting their agents into the homebuyers’ search experience somewhat awkwardly, we offer a friction-free environment connecting buyers directly to the listing agents,” he told investors.

Consumers can collaborate with their agent directly using the Homes.com platform. “Our agent collaboration tools are up and running. We’ve had tremendous feedback from both agents and consumers,” Florance said.

“We’re presenting consumers with hundreds of thousands of highly qualified potential buyer agents for free based upon those buyer agent skills and experiences rather based on how much the buyer agent is willing to give up in commission to the portal,” Florance said. He predicted that the company will start monetizing the site later this year.

“Not only do we believe we offer a superior consumer experience for buyers, we also believe we are much better aligned with real estate agents,” Florance said.

Link to Full Article about Homes.com

by Jim the Realtor | Feb 7, 2023 | Realtor, Realtor Post-Frenzy Playbook, Realtors Talking Shop, Why You Should List With Jim

We’ve covered the ways that buyers and buyer-agents are getting battered by listing agents.

Making homes tough to show, no transparency about offers and bidding-war process (if any), below-market commissions, sandbagging listings in-house for days or weeks before exposing to general public, etc.

Some can be chalked up to inexperience or clerical errors, but most are a deliberate attempt by the listing agents to box out other agents, and limit the number of offers.

Here’s another one: MyStateMLS.com.

Agents input their listings onto this website only, which gets the property onto Zillow and Realtor.com where waiting buyers might see it. Typically, the buyer-agents are using their local MLS to track the new listings, so they’re not watching Zillow or Realtor.com (and certainly not some unknown MLS website).

It has to be a deliberate attempt by the listing agents to limit the exposure to fellow agents, with the intent to reach buyers directly and double-end the commission.

by Jim the Realtor | Jan 26, 2023 | Commission Lawsuit, Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, Realtors Talking Shop

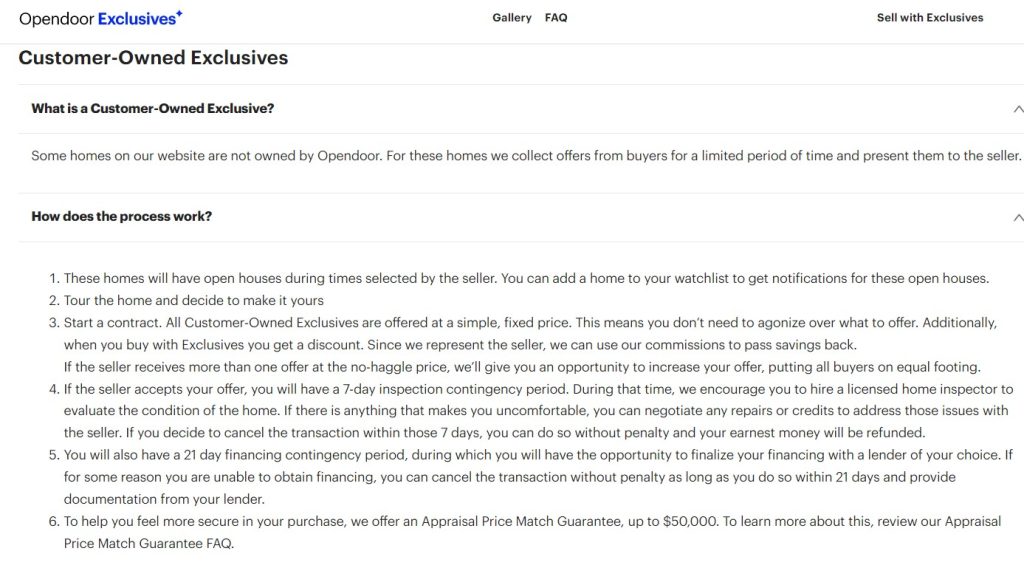

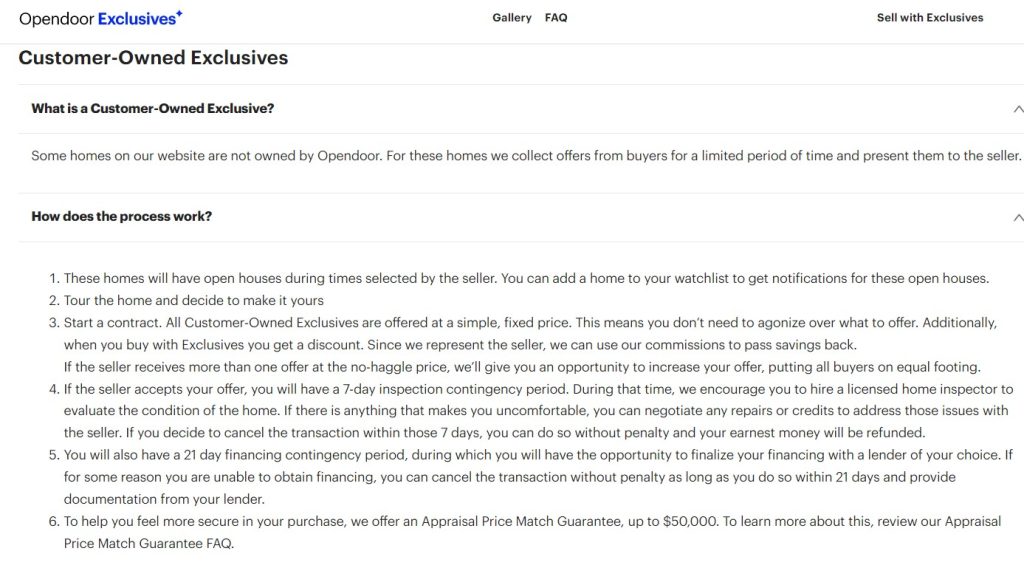

Won’t somebody just produce an all-encompassing (pardon the pun) website to facilitate homes sales? There is a new disruptor every month with their unique solution, and it’s ALWAYS born out of their frustration with buying a home recently so they are happy to bash agents and the current process.

But consumers have become more adept at searching online, and because there are so few quality homes for sale in 2023, their standards will probably relax further as their frustration mounts. Pretty soon, they will accept just about any risk, just to get their home search over with.

If a bigger company with some brand recognition put together the right website at the perfect moment when the consumers’ frustration is mounting and agents are flailing, it might catch fire. Something like this:

https://www.opendoor.com/exclusives/faq

I’d prefer an auction company because it would be more effective at selling homes fairly, and for top dollar. But the winner will be the company that advertises the most.

by Jim the Realtor | Jan 26, 2023 | Commission Lawsuit, Jim's Take on the Market, Pocket Listings, Realtor, Realtor Post-Frenzy Playbook, Realtors Talking Shop, The Future |

Seen on social media

I spoke to a few agents on the broker preview yesterday about business this year, and the common theme was that agents are have big trouble finding people who want to sell their home. It suggests that the inventory of quality homes will be extremely low this year.

What happens, when that happens?

It means that when listing agents get a hot new property to sell, they will be tempted to find their own buyer first, and/or spoon it to a select few of their agent friends, and then maybe expose it to their office mates before putting it on the MLS/open market.

The extinction of buyer-agents is well underway.

As the market tightens further, more listing agents will be tempted to sandbag their listing and not put it on the open market. Look what happened to the agent this week who received 20+ offers (they told me the final count was 30 offers). After the listing was put on the open market, the flood of offers caused regrets about the workload, so they just grabbed one and shut it down.

Last night I popped off in the comment section about how the business gets shadier every year.

Here’s proof – not every listing with zero days on market was sandbagged, but let’s face it. If you mark your listing pending within a few hours of it going live on the MLS, you didn’t get full exposure.

NSDCC Annual Closed Sales With Zero Days On Market

| Year |

Annual Detached-Home Sales, Total |

# With Zero Days on Market |

Percentage |

| 2016 |

3,107 |

84 |

2.6% |

| 2017 |

3,084 |

99 |

3.2% |

| 2018 |

2,799 |

84 |

3.0% |

| 2019 |

2,834 |

100 |

3.5% |

| 2020 |

3,190 |

116 |

3.6% |

| 2021 |

3,184 |

173 |

5.4% |

| 2022 |

1,939 |

124 |

6.4% |

When agents see other agents touting their off-market business, they think it must be ok, so they do it too. It feeds on itself, especially when the allure of double-ending the commission is so strong in a tight-inventory environment.

This disease among agents is everywhere. You will notice it at every open house you attend – the agents conducting the open house can’t wait to tell you about their off-market opportunities to get you to sign up. You’ll see it mentioned on social media daily – agents don’t think there is anything wrong with promoting off-market deals. Heck, everyone is doing it!

I regularly ask the agents who have a quality home for sale how they will handle multiple offers, and the answer is always the same: “I don’t know”, before they stumble and mumble something about the seller will decide (oh, thanks for that!) so the agents don’t get blamed for the end result. It’s embarrassing that they don’t have any strategy, and want to leave the door open for shenanigans later. No wonder they want to do an off-market deal, with no scrutiny.

Because no one is doing anything to intervene, the off-market deals will continue to be an accepted practice, and exacerbate the trend towards single agency (and the extinction of buyer-agents). Within the next year or two, every buyer will just go to the listing agent and take their beating.

by Jim the Realtor | Jan 25, 2023 | Commission Lawsuit, Jim's Take on the Market, Realtor, Realtor Post-Frenzy Playbook, Realtors Talking Shop |

I don’t think anyone in the realtor industry recognizes the harm being done to the consumers by squeezing out the buyer-agents. The good ones offer a valuable service by assisting homebuyers with the complexities of purchasing a home; a challenge that is tougher than ever in 2023.

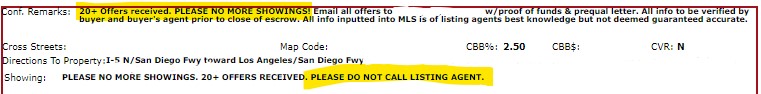

For example, let’s say you come across a good buy – what do you do with this?

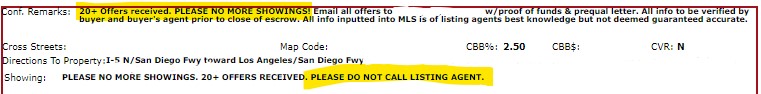

This weekend, the listing agent got 20+ offers and shut it down. Then he just accepted one. Game over.

None of the other buyers got a chance to win. But at least they had a chance to offer.

If buyers were directed to the listing agent, do you think the realtor teams would have 20+ buyer-agents ready to serve everyone who wants to make an offer? Or would they just write offers with the first couple of buyers and shut it down?

I can’t tell you how many times we see in the confidential remarks, “PLEASE NO MORE SHOWINGS”. We already have an environment where listing agents believe there is no incentive to keep taking offers – especially if/when they already wrote an offer with their own buyer and will double-end the commission.

It’s only going to get worse. Forces within the industry are conspiring to eliminate buyer-agents altogether, and are conspiring to create a system that makes it even harder for buyers to get a fair chance. The local MLS companies are launching a new search portal that directs all inquiries back to the listing agent.

Do you think an outside buyer-agent will have any chance of selling that listing now? If multiple buyers contact the listing agent, then what happens?

Here is the article:

https://www.realestatenews.com/2023/01/24/leading-mlss-come-together-to-launch-consumer-home-search-portal

An excerpt:

With the goal to “promote a more competitive marketplace,” three of the largest multiple listing services announced plans to launch a new consumer home search portal this spring.

Called Nestfully, the website will be owned and operated by California Regional MLS (CRMLS) and Bright MLS, under a joint venture, and REColorado has signed on as a participant. The founding MLSs designed the site and its features, and real estate tech company Constellation1 is providing technology services.

Key points:

- Nestfully is expected to debut by April 1 with listings from a pool of 240,000 agents and brokerages that are MLS subscribers.

- Agents will get leads at no cost, and consumers will have direct access to the property’s listing agent.

- “With Nestfully, we believe we are in the best position to deliver what agents want and need in this changing market,” said Brian Donnellan, CEO and president of Bright MLS.

With the goal to “promote a more competitive marketplace,” three of the largest multiple listing services announced plans to launch a new consumer home search portal this spring.

Called Nestfully, the website will be owned and operated by California Regional MLS (CRMLS) and Bright MLS, under a joint venture, and REColorado has signed on as a participant. The founding MLSs designed the site and its features, and real estate tech company Constellation1 is providing technology services.

“Nestfully is run by MLSs whose primary goal is to promote an open, clear, and competitive marketplace,” Art Carter, CEO at CRMLS, told Real Estate News. “We are a neutral source working in the best interests of consumers, brokers and their agents.”

For agents, Nestfully offers a financial advantage over advertising-powered portals. The site will not have ads, and leads will be delivered directly to agents and their brokerages at no cost, “taking a significantly escalating cost out of the existing system,” Carter said.

Agents and brokerages companies will also have access to a lead management platform on Nestfully with lead tracking, analytics and metrics that gauge success.

“We believe we are in the best position to deliver what agents want and need in this changing market,” said Brian Donnellan, CEO and president of Bright MLS, adding that the new search engine will “serve as an extension of the agents’ marketing initiatives to promote listings, attract qualified lead prospects and forward these opportunities directly to the agent at no cost.”

The goal is not to monetize the consumer search, he said, but to help answer consumer questions about properties for sale and connect potential buyers with property listing agents or with a local agent or broker in their communities.

Asked in an interview if MLSs will be compensated for the initiative, a company spokesperson said that “financial arrangements are not being disclosed.”

https://www.realestatenews.com/2023/01/24/leading-mlss-come-together-to-launch-consumer-home-search-portal

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Will they advertise enough to compete with the established search portals? They will need to promote some new whiz-bang feature…..which will be that buyers should go direct to the listing agent, and use their fancy new portal to do so.

I don’t think they have a clue – or they are flat out ignoring – how they will be putting buyers at a bigger disadvantage, and destroying our business as we’ve known it for the last 100 years.

An auction company would fix everything though!

by Jim the Realtor | Jan 23, 2023 | Realtor, Realtor Post-Frenzy Playbook, Realtors Talking Shop, Why You Should List With Jim |

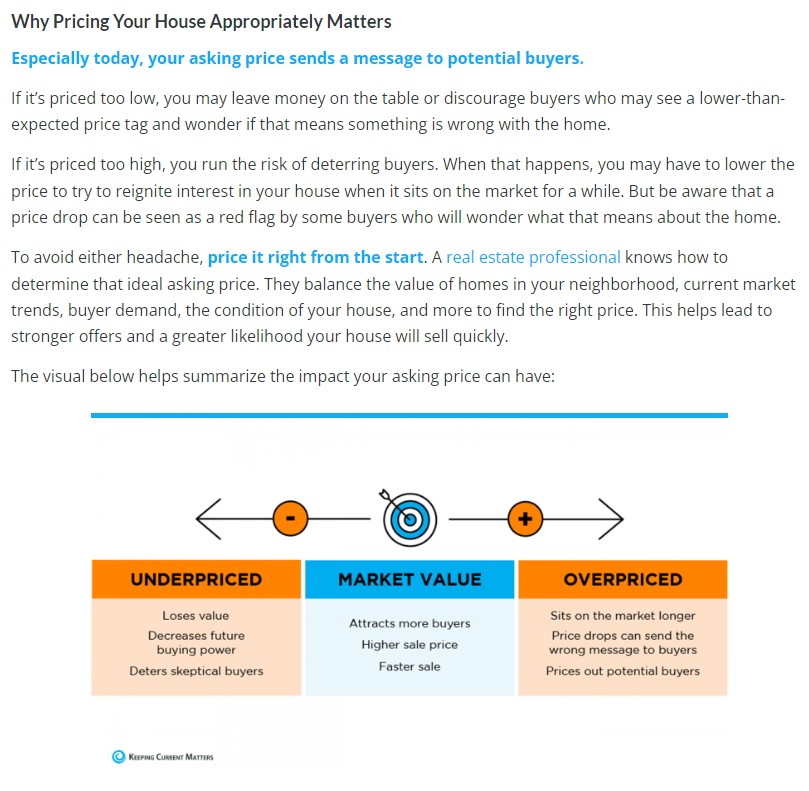

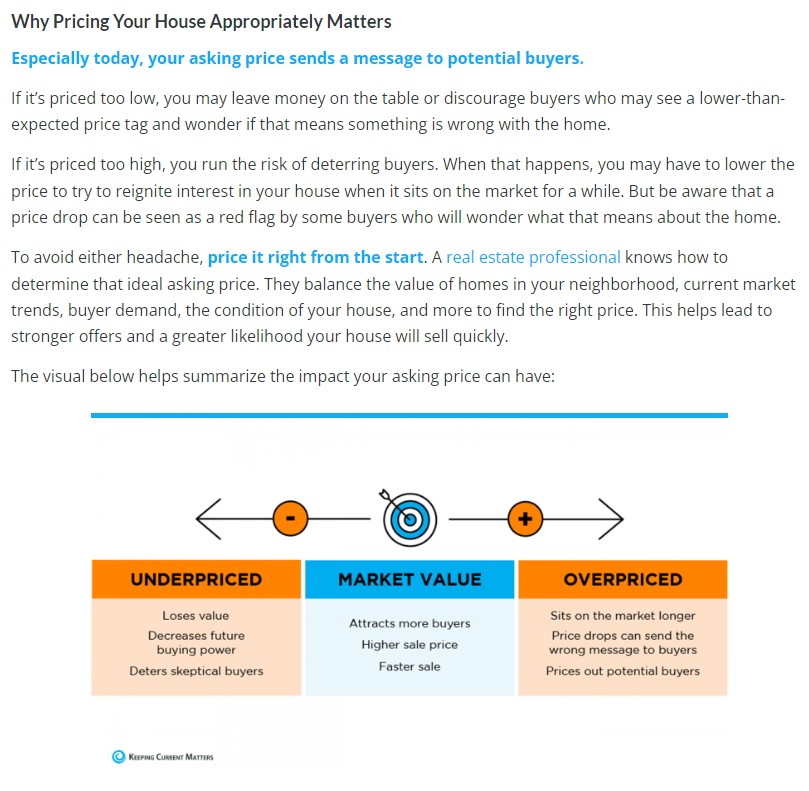

KCM is a fine group of people who supply realtors with content for them to publish in their newsletters, social media, etc. They provide an invaluable service for the agents who’d rather just pay for content than create it themselves. It tends to be a softer version of what I do here at bubbleinfo.com because most realtors aren’t interested in a deep dive – they are fine with the lightweight stuff.

But because I said last week that “price it right” is code for listing your home for the realtor’s price, I thought I should comment on the above.

UNDERPRICED – The fear of underpricing your home and leaving money on the table is real….if you list with an agent who just wants to take the first offer and go back to sleep. When you list your home with an agent like me and the market responds favorably, I will let EVERY buyer compete for your home and then pit them against one another to drive the price up.

OVERPRICED – Realtors want to be the hero and are just as likely to overprice a home as a seller. This is especially true when several agents are competing for the listing – it is irresistible for sellers to strongly consider, and end up hiring, the agent who quotes the highest price.

The worst part about overpricing is not reacting quick enough. Once a home is on the open market, both the sellers and the listing agent wants to believe that if they just wait a little longer, the magical perfect couple with 2.2 kids will come along. But today’s buyers are watching the market time of each listing very closely, and making up things in their head about what it means – and none of that is good for sellers.

MARKET VALUE – It would be a miracle if a seller or agent could guess the market value. The conditions are changing every day in every area – and NOBODY knows what a buyer will pay until a home is on the open market. Besides, there is a slush factor of 5% on every house, based on it’s unique location, upgrades and condition, ease of showing, and the competence of the listing agent.

The best thing any seller could do is to hire a listing agent who is an expert in handling what to do if the market conditions cause the home to be underpriced OR overpriced – because every agent can handle a listing that gets lucky and miraculously happens to be perfectly priced.

by Jim the Realtor | Dec 22, 2022 | Realtor, Realtors Talking Shop

As you may know, there are multiple lawsuits pending that accuse realtors of price fixing, and it ain’t looking good for us. Here is evidence provided in court – thanks Rob:

The Franchisor Defendants provided training to brokers which directed them to offer a 6% commission rate, to be split equally among the Seller-Broker and the Buyer-Broker. The Franchisor Defendants used this 6% commission rate split in educational transaction models.

For example, Re/Max training documents instructed brokers to develop their “Economic Model” and “define the ‘average’ commission that will come from each of their closings,” including an example of a 6% commission rate per transaction, split 50/50 between the Seller-Broker and Buyer-Broker.

Similarly, Keller Williams trained its brokers to develop an “economic model” which provided a “standard 6% commission” rate per transaction, split 50/50 between the Seller-Broker and Buyer-Broker.

Additionally, the HomeServices Defendants circulated training materials from Intero, a California subsidiary, that instructed brokers to “always have 6% written in on ALL listing agreements” and, if they “have to give something,” to “remember they always have to pay [the Buyer-Broker] a minimum of 2.5%.”

Further, the Franchisor Defendants trained brokers to never lower their rates. For example, Re/Max trained brokers to “have the commission typed into the listing agreement” before speaking to Sellers, and to tell Sellers “‘This is what my company charges.’”

Re/Max franchises must “maintain . . . quality,” including avoiding “discounting rates,” or the franchise may be sold.

Keller Williams provided brokers with scripted responses to requests to lower commissions, stating that brokers “require a full 6 percent” to “do the advertising that they do” and that a “discount rate will not provide you with enough exposure to get you top dollar.”

Realogy acknowledged that its franchisees compete with one another, and instructs franchisees to “avoid any action or discussion intended to eliminate or restrict competition” including discussions of “commission structures.” However, Realogy provided training to its franchisees and subsidiaries regarding commissions and trains its agent to tell clients they cannot cut commissions. [Citations removed, and edited for legibility and clarity.]

This probably didn’t help much:

The next court date isn’t until October, and undoubtedly there will be an appeal, so it will be a year or two before the case is done. The likely results will be that sellers won’t be obligated to pay the buyer-agent commissions. Not sure if that will reduce them, or eliminate them, but this will likely be the big commission disruption that has been expected by outsiders.

by Jim the Realtor | Dec 21, 2022 | 2023, Boomer Liquidations, Boomers, Jim's Take on the Market, Realtor, Realtors Talking Shop |

The #1 reason that the real estate market has been in the doldrums over the last few months is because of the inept response from realtors on how to handle it. There hasn’t been ANY real guidance or advice coming from NAR and other industry leaders on what to do, which gives the appearance that they probably don’t have a clue.

But the least they can do is respond to doomers leaving unsubstantiated teasers on your twitter account. This guy is begging you to respond, and you just let it go? Have some guts and reply with something that forwards the conversation…..please!

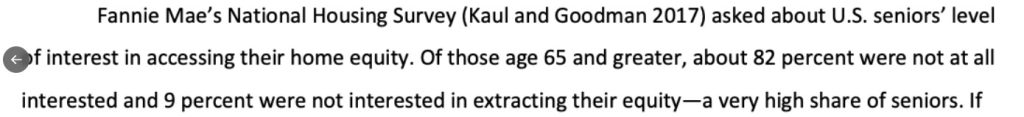

I’d respond with this:

The baby boomers own most of the homes, and 91% of them aren’t interested in accessing their equity, let alone moving! There isn’t going to be a flood of boomer liquidations, though I hope it comes some day. While there might be some minor outbreaks in 2023, for the most part, seniors are going to age in place and chuckle at the real estate mailers that promise instant riches.

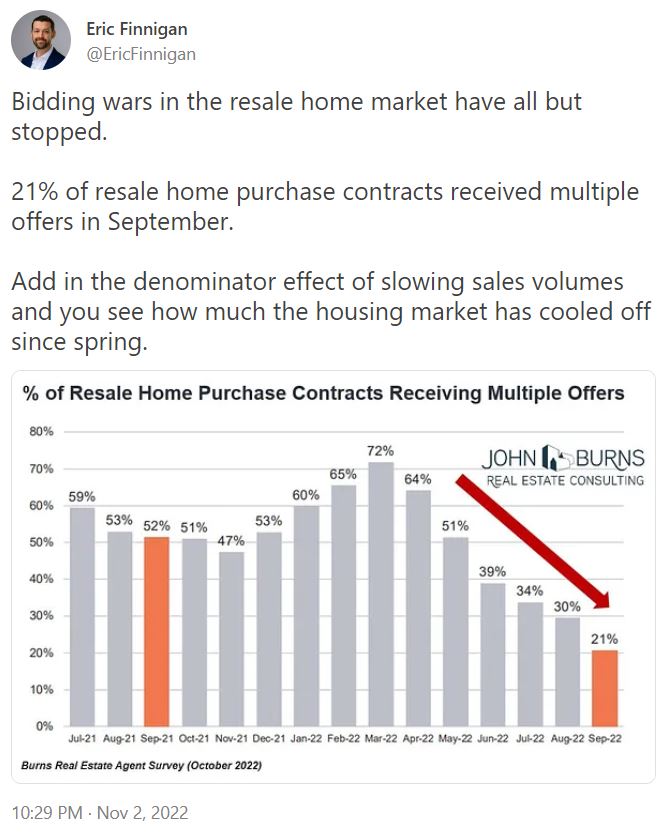

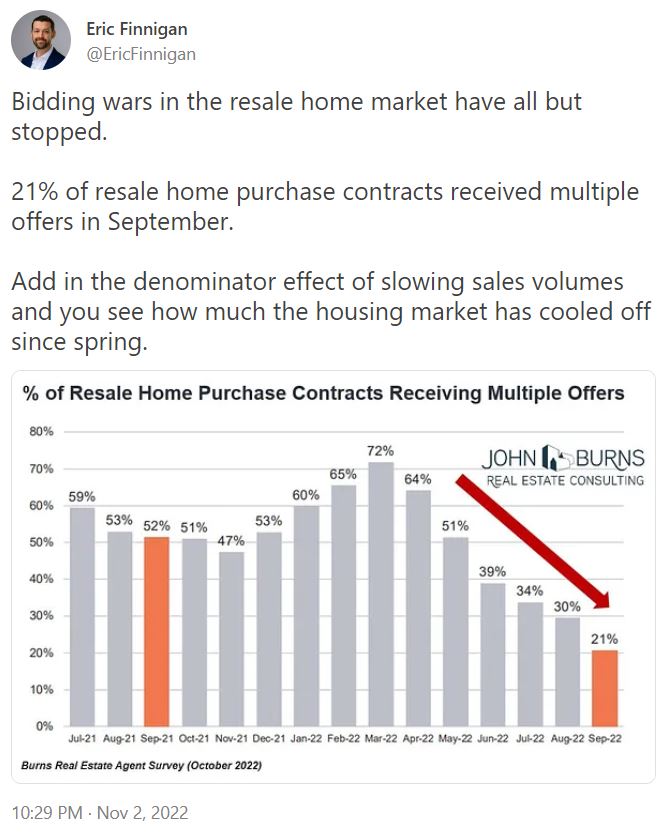

by Jim the Realtor | Nov 3, 2022 | Market Buzz, Market Conditions, Realtors Talking Shop |

Of course the current conditions look worse when comparing to the hottest real estate market ever. Having bidding wars on 21% of homes for sale sounds great to me.

The discouraging part about Bill’s post today is how the realtors have bought into the negativity.

This is the first downturn to be affected by amateurs on social media, and realtors can either price ’em high and repeat these same negative talking points seen everywhere now, or they can get better at their craft, price their listings attractively, and be part of the solution:

#Houston, TX: “Home prices have most first-time home buyers priced out of home ownership. It’s even worse with the higher interest rates decreasing what the buyers can qualify for.”

#Denver, CO: “Cost of living [and] interest rate [increases] are keeping most buyers from buying.”

#Baltimore, MD: “The market is transitioning. Inventory is still low and the number of buyers looking is less due to rising interest rates. Buyers are qualifying for less, so they are pulling back. [I am] seeing less as-is sales, more home inspections, and negotiations overall.”

#Sarasota, FL: “I’ve had numerous buyers looking but the prices are much higher than they want to spend. Many pulled back waiting for the market to go down.”

#LosAngeles, CA: “Skyrocketing interest rates are pushing buyers out of the market (they can no longer afford homes that were in their price range just a few months ago) and making homes more difficult to sell for sellers and their agents.”

#Phoenix, AZ: “Buyers are very nervous about making a decision.”

#NewYork: “Open house attendance is weaker than usual, and sales take longer.”

#Minnesota, MN: “Still seeing a fair number of cash sales as competition to financed sales.”

#StLouis, MO: “Things are slowing down slightly, but I have found that the good properties are still moving quickly with multiple offers and going above ask.”

#Barre, VT: “Our local market in Lamoille County is very flat and challenging. Local working families are outpriced by the prices and interest rates. The neighboring resort town has slowed but there are still cash buyers for the million plus market.”

#OrangeCounty, CA: “Interest rates have put the brakes on the market.”

I did sign up to be on their realtor-comments list!

https://open.substack.com/pub/calculatedrisk/p/interest-rates-have-put-the-brakes