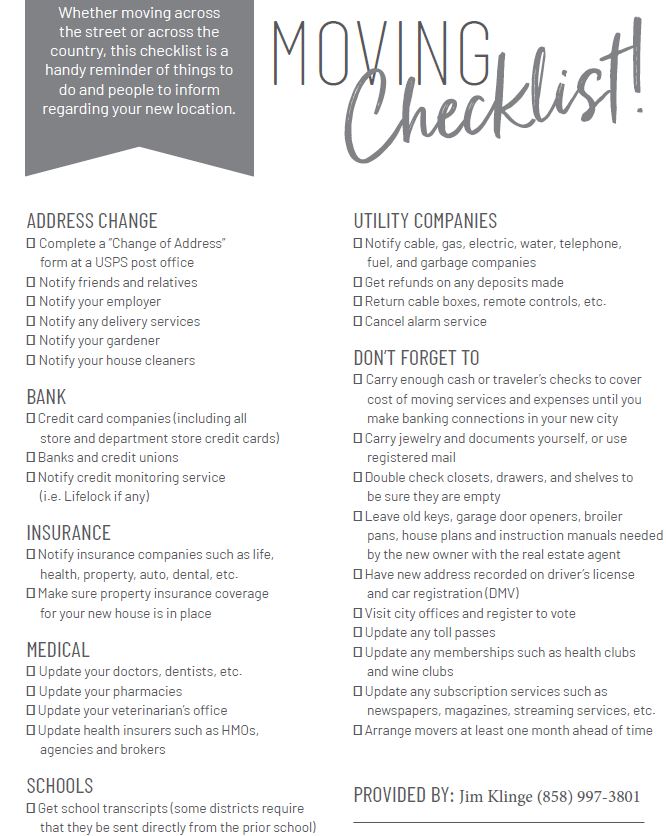

Moving Checklist

Their most popular markets are suburban areas that are 30 minutes from the nearest city center? Sounds like Carlsbad/Encinitas! From Zillow:

Zillow’s most popular market of early 2022 is Woodinville, Washington, leading a list of fast-growing suburbs as the most in-demand places of the first three months of the year. Following close behind were Burke, Virginia, in the Washington, D.C. area; Highlands Ranch, Colorado, outside of Denver; Westchase, Florida, near Tampa; and Edmonds, Washington, also in the Seattle metro.

The most popular markets so far this year paint a picture of how remote work has changed the U.S. housing landscape. Demand for suburban homes found an extra gear last summer, causing suburban home values to grow faster than home values in urban areas, a reversal from previous norms and from the first 15 months of the pandemic. Remote work is a driving force behind this shift, prompting home buyers to prioritize affordability and space over a short commute.

The suburbs that beat out all others to make the top 10 of Zillow’s most popular markets of Q1 are seeing home values grow faster on a quarterly basis than the principal city in their metro area, indicating stronger demand. Most of them have more expensive homes than their nearest major city, and several are significantly more expensive. Eight of the top 10 have a typical home value higher than their nearby principal city, and seven of those have a typical home value more than $150,000 higher.

Regionally, Havertown, Penn. outside of Philadelphia is Zillow’s most popular market in the Northeast, edging out four Boston suburbs: Billerica, Framingham, Waltham and Arlington. In the central region, Ballwin, Missouri,. is joined in the top five by Grand Rapids, Michigan, and three pricey Dallas suburbs: Coppell, Plano and Prosper. Denver suburbs dominated the mountain region, taking the top eight spots in Zillow’s rankings.

Yuma beat out every town in San Diego County?

Less expensive cities with strong local economies climbed The Wall Street Journal/Realtor.com Emerging Housing Markets Index in the first quarter, another sign that many home buyers are giving priority to affordability.

Fast-rising housing prices have pushed buyers from expensive coastal cities into cheaper housing markets in recent years. Expanded remote-work opportunities and a search for different lifestyles during the Covid-19 pandemic have accelerated the trend.

“People are chasing affordability,” said Sam Khater, chief economist at mortgage-finance giant Freddie Mac. In response to high housing prices and increased remote-work flexibility, he said, “people are reordering where they live.”

The Wall Street Journal/Realtor.com Emerging Housing Markets Index identifies the top metro areas for home buyers seeking an appreciating housing market and lifestyle amenities.

The top-ranked markets in the first quarter had faster home sales, higher wages and shorter commute times than the market as a whole, said George Ratiu, manager of economic research at Realtor.com. News Corp, parent of the Journal, operates Realtor.com.

The Wall Street Journal/Realtor.com Emerging Housing Markets Index ranks the 300 biggest metro areas in the U.S. In addition to housing-market indicators, the index incorporates economic and lifestyle data, including real estate taxes, unemployment, wages, commute time and small-business loans.

If you’re worried about wildfires and earthquakes…..you can always move to Detroit!

Millions of Americans are living in communities with precarious climate conditions, in houses that feel overpriced. There is a solution for many of these people, though:

Move to one of the so-called climate havens.

Climate havens or climate destinations are situated in places that avoid the worst effects of natural disasters and have the infrastructure to support a larger population. Many of these legacy cities are located in the Northeast.

Jesse Keenan, associate professor of real estate at Tulane University, named the following cities as possible climate havens:

Anna Marandi, who served as the program manager of climate resilience and sustainability at the National League of Cities, added two other places to the safe haven list: Ann Arbor, Michigan and perhaps surprisingly, Orlando, Florida.

Orlando makes the cut, Marandi said, because the city has introduced measures to decarbonize. While the natural environment, such as being a noncoastal city, is an advantage, cities can “earn” the designation by working to provide benefits like affordable housing and being committed to economic sustainability.

“I see climate migration as an opportunity for these cities to avoid the mistakes of urban sprawl,” Marandi said. “They often have a vibrant, walkable downtown that might just need a little bit of revitalization.”

Keenan also stressed that climate haven cities need to help their own residents, which in turn will attract more climate migrants.

“This isn’t we’re going to build a community for tomorrow,” he said. “We’re going to build a community for today. And that’s going to be the foundation for the building of a community for tomorrow.”

Here are the best California cities in which to buy a home – Carlsbad is #8!

All of the demographics plus hundreds of reviews of each town too:

https://www.niche.com/places-to-live/search/best-cities-to-buy-a-house/s/california/

While it is understandable why nobody wants to leave San Diego, some might!

Here are more ideas on where to go:

https://www.realtor.com/news/trends/the-cheapest-metros-for-u-s-homebuyers/

https://edition.thrillist.com/s/underappreciated-american-cities-efff2ad8275f4c84

https://edition.thestreet.com/s/coolest-towns-retire-ef8d340b4d3f4d2c

https://www.travelandleisure.com/trip-ideas/best-small-towns-in-america

https://www.farandwide.com/s/best-small-towns-united-states-e6a21b7c07fb4035

Or just check my history of suggestions here:

http://bubbleinfo.s020.wptstaging.space/category/where-to-move/

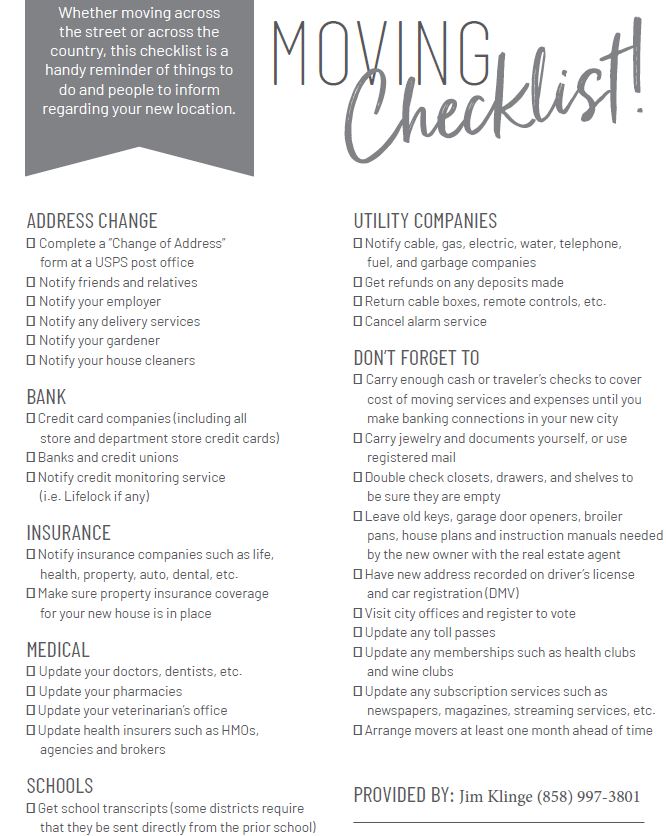

I’ve been hoping to promote the best areas in nearby states for readers to consider for relocations, and have wanted to feature lower-priced homes in order to make the move really worth it.

Yesterday I spoke with Bill Ims, a former Carlsbad realtor and probably the nicest guy in the business. He and his wife moved to Green Valley, Arizona, and love it!

He has been selling homes there, and his latest listing is on the golf course for only $370,000!

https://www.coldwellbanker.com/property/1324-N-Paseo-de-Golf-Green-Valley-AZ-85614/120312733/detail

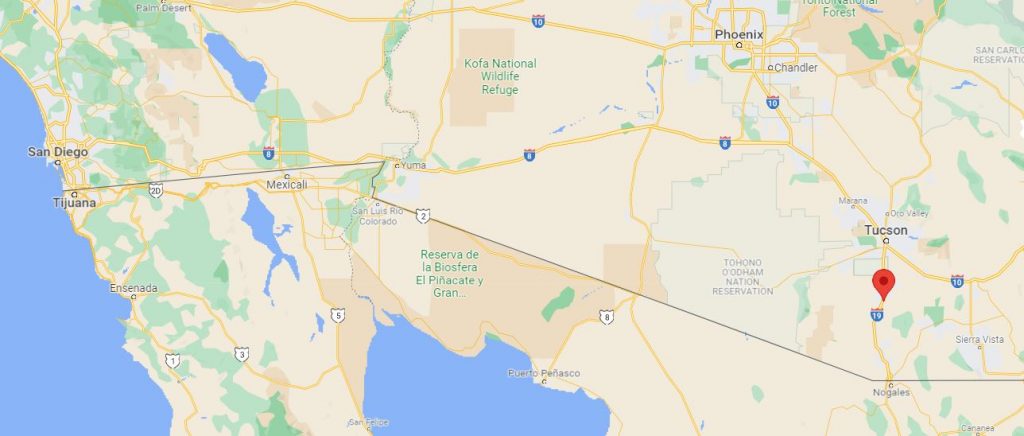

Green Valley is 20 miles south of Tucson and an easy drive from San Diego – tell him I sent you:

https://en.wikipedia.org/wiki/Green_Valley,_Arizona

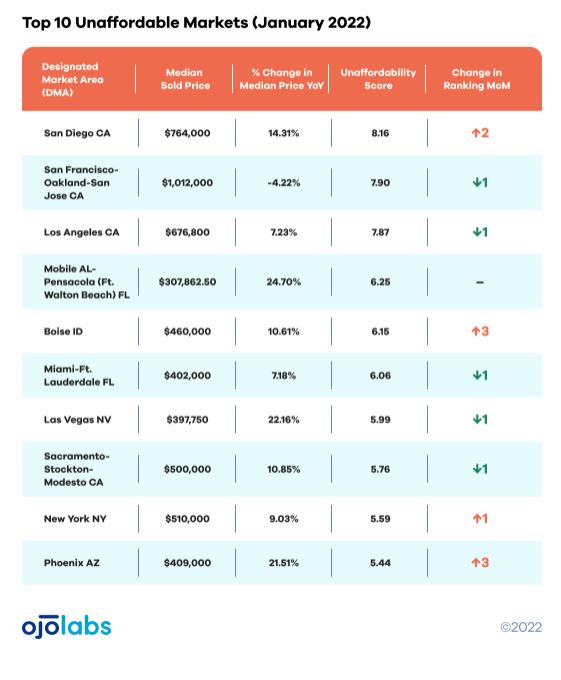

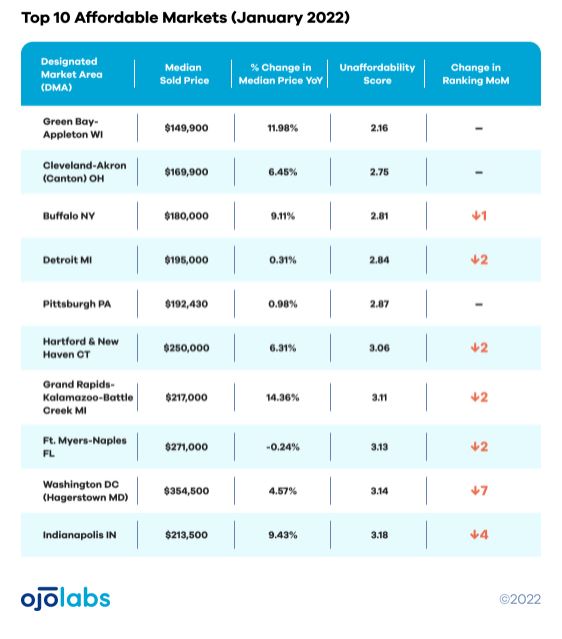

San Francisco is no longer the nation’s least affordable metro area, being surpassed by San Diego, it’s neighborhood to the south. The latest OJO Labs unaffordability report saw San Diego bypass both San Francisco and Los Angeles to become the nation’s least affordable metro by comparing median home price to local incomes.

The median home sold price in San Diego climbed 14.3% in January to $764,000, bringing the city’s unaffordability score — a ratio of home sold price to median household income — to 8.1.

And despite San Francisco still boasting the most expensive housing stock of any metro in the U.S., a 4.2% home sold price decrease in January on an annual basis actually drove San Francisco’s unaffordability score below 8 for the first time since OJO Labs began tracking the data in July 2021. In January, San Francisco’s unaffordability score fell to 7.9, down from 9.2 last month.

Los Angeles; Mobile, Alabama; Pensacola, Florida; and Boise, Idaho metro areas rounded out the top five least affordable metro areas in the U.S.

Unaffordability score is a ratio that’s derived from monthly median housing prices and median household income. The higher the score, the more unaffordable a metro area is for a household making the median income. Median home price data is drawn from local multiple listing service sold data and median household income is derived from 2016-19 census data.

https://email.ojo.com/san-diego-passes-san-francisco-as-nations-least-affordable-metro

When homeowners are asked about selling, there is a universal response: “Where am I going to go?”

To help those who are searching, here is the Compass collection of luxury homes for sale by region:

https://www.luxuryatcompass.com/regions

These look like the towns to which people from New York and California are moving. Excerpts:

The boomer tide in the for-sale housing market is expected to continue to rise for at least the next 8 years; younger millennials will be hitting first-time home buying age at about the same time, meaning the 2020’s will be a period of sustained underlying demand in the housing market.

Year by year, these effects will be felt differently across markets.

In 2022, the market with the most demographic lift in the for-sale market is Austin, with a trend suggesting the formation of 3.4% more owning households (assuming there are homes available for them to buy). Orlando follows at 2.8%, and then Tampa at 2.7%. Of the largest 50 markets, 29 have natural owner household growth exceeding 1% in one year, the rule-of-thumb rate at which the housing stock increases nationally. The markets with the least demographic pressure for growth are Pittsburgh, Hartford and Buffalo.

There are two large known risk factors for housing markets in 2022. First, mortgage interest rates are expected to rise in 2022, making home loans more expensive for aspiring buyers. At the margin, this would restrict the inventory accessible in the most expensive markets, potentially driving up competition for the lowest-priced homes in those markets or removing them from consideration altogether.

Historically, home value appreciation in the following markets has strong negative correlation with interest rates — so if interest rates go up, these markets are likely to slow the most: San Diego, New Orleans, Washington DC, Los Angeles, San Jose and San Francisco.

Second, forecasts on the performance of stocks are incredibly wide, with analysts’ 2022 year-end targets ranging from -7% to +13%, slower growth in any case than what we’ve seen in the last 2 years if not declines. A slower stock market would mean buyers are bringing relatively less to the table for a down payment in 2022.

This would most affect markets where there are a lot of first time buyers or where more buyers are entering from lower cost areas, bringing less equity from their previous home. (Or if housing is treated as an asset it could mean a substitution to housing in the next few months. What follows addresses only the downside risk.)

In the following markets, growth has strong positive correlation with stock market returns — so if the stock market falters next year, we’d expect home value growth in these places to slow disproportionately: Phoenix, Las Vegas, Cincinnati, Hartford, St. Louis, Miami, Cleveland, Los Angeles and San Jose.

https://www.zillow.com/research/zillow-2022-hottest-markets-tampa-30413/