by Jim the Realtor | Apr 16, 2018 | ibuyer, Jim's Take on the Market, Market Conditions, The Future, Zillow |

Zillow is setting up their home-flipping business in Phoenix and Las Vegas, which are two very safe towns for taking a risk.

The vast majority of houses there are easy-to-value tract homes, and relatively inexpensive compared to the coasts. But Zillow’s stock price has plunged 10% since they announced their new venture.

In this cnbc article, Mahaney makes a good point. Having skin in the game will assist Zillow to better gauge and predict market conditions. When we still hear the typical market nonsense from N.A.R., Zillow could become the voice of real estate – if they’re not already:

Link to CNBC article

In May 2017, Zillow announced the launch of Instant Offers, which enables home sellers in the Las Vegas and Orlando test markets to get cash offers from potential investors on Zillow’s platform. The company said homeowners prefer the process, and that most of them who requested an Instant Offer ended up selling their home with an agent.

“Home sellers welcome a hassle-free experience selling your home without decluttering your garage or taking the kids out of the house,” Rascoff said.

Rascoff said the company will take on collateralized debt to purchase the homes, and hopes to have between 300 and 1,000 homes held for sale by year’s end. He called the move “industry friendly,” benefiting buyers, investors and agents. He also said it could help stimulate the real estate market and open up new inventory for prospective buyers.

“There are people that are basically stuck in their home that would love to go buy another home, but can’t sell,” Rascoff said. “This could provide the ability to unstick people from their homes.”

Mahaney said that it will help Zillow test how much the real estate market is turning.

“This is an interesting experiment on the company’s part,” Mahaney said. “They’ve reached the point of scale with both real estate agents and with consumers. There are data points in the market that suggest this way of buying and selling homes is really starting to gain traction.”

The program will start this year in Phoenix and Las Vegas. Zillow didn’t say when it will expand into other markets.

I doubt any of the corporate flippers will ever come to the high-priced California coastal markets – with fewer tract homes and high cost, it’s too risky.

by Jim the Realtor | Apr 12, 2018 | ibuyer, Jim's Take on the Market, Listing Agent Practices, Zillow |

Whoever spends the most money on advertising will win, and Zillow spends around $100,000,000 per year. Who can keep up? In the video he says that 90% of the home sellers chose to hire an agent, rather than sell to Zillow:

Nearly one year ago, Zillow shook up the real estate industry when it announced that it was getting into the home selling business by launching “Zillow Instant Offers.”

In the program, homeowners looking to sell their home in the test markets of Las Vegas and Orlando are able to get cash offers for their home from selected investors interested in buying it, all within Zillow’s platform.

As it turns out, that was just the beginning.

Zillow announced Thursday that it will begin buying and selling homes directly to and from homeowners.

To repeat, Zillow itself will soon be buying homes directly from sellers, then turning around and reselling them.

According to Zillow, the program will start small and test in two markets, Las Vegas and Phoenix.

But the program represents a huge change in the business model for Zillow. Back in 2015, Zillow CEO Spencer Rascoff said that the company views itself as a media company, not a real estate company.

“We sell ads, not houses,” Rascoff said at the time. “We’re all about providing consumers with access to information and then connecting them with local professionals. And we do a great job of giving those local professional high-quality lead, they’ll covert those leads to at a high rate and then want more media impressions from us. So we’re not actually in the transaction, we’re in the media business.”

But that’s not the case anymore.

Now, Zillow sells ads and houses.

According to Zillow, its homebuying program will roll out “this spring” in Phoenix and Las Vegas.

The company said that home sellers in those markets will be able to compare an agent’s comparative market analysis to offers directly from Zillow or from other investors.

Zillow says that it when it buys a home, it will make the “necessary repairs and updates” and list the home “as quickly as possible.”

Now, what appears to make Zillow’s direct buying program different from companies like Opendoor and OfferPad is that it does not cut real estate agents out of the process.

According to Zillow, a local agent will represent Zillow in the purchase and sale of each home, which will enable agents to earn commission on the purchase and sale.

Link to Article

Zillow interview from Mo Moghari on Vimeo.

by Jim the Realtor | Apr 9, 2018 | Jim's Take on the Market, Thinking of Selling?, Why You Should List With Jim, Zillow |

Hat tip to SM for sending in Zillow’s latest version on the best dates to put your home on the market. San Diego is the only town in America that gets started this early – let’s go!

https://www.zillow.com/research/best-time-to-list-2018-19215/

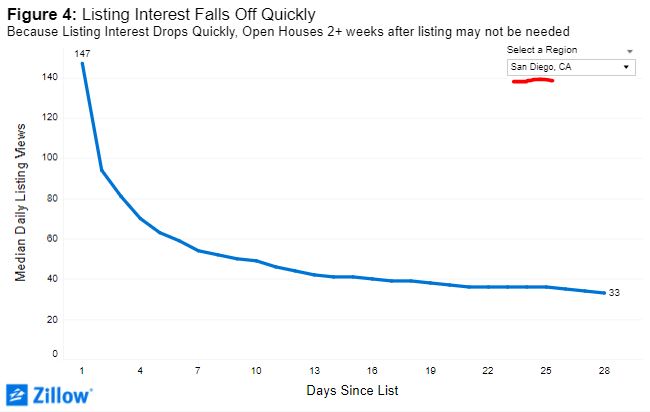

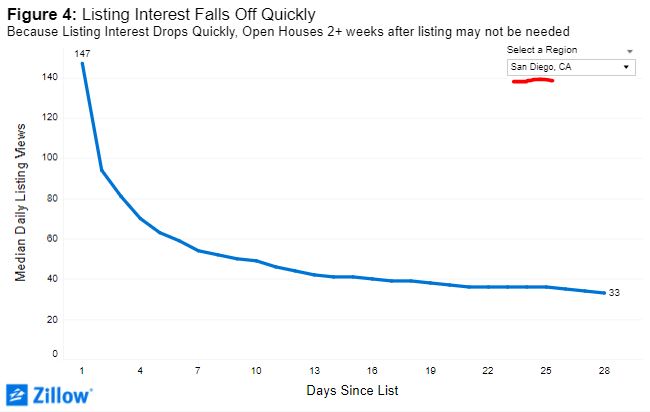

Not only is now the best time to hit the market, their research shows it is ideal to sell early in the listing period:

According to earlier research, the largest number of home shoppers will see a given listing within its first week on the market, and it’s important to capture that early interest as quickly as possible in order to boost the chances of a quicker sale.

by Jim the Realtor | Mar 13, 2018 | Jim's Take on the Market, Listing Agent Practices, Why You Should List With Jim, Zillow |

Zillow started their ‘Coming Soon’ feature in the summer of 2014, so by now the gimmick is maturing. Agents have worked every angle of it, and consumers have seen it all too. Everybody comes to their own conclusions.

Here’s how one consumer described it to me yesterday:

Interesting tactic. Post a ‘Coming Soon’ sign for two weeks and then drop it on to the MLS when it doesn’t sell.

Makes me immediately think the price is too high. Couldn’t get it sold as a “Coming Soon”, so now trying the traditional way.

It looks over priced especially after the pictures.

The listing agent could have been playing it straight and was really holding back all buyers until the house was ready, but who would know? The consumer’s conclusion is that it must be over-priced – is that in the seller’s best interest?

Consumers have never been so skeptical of agent tricks, and are jumping to their own conclusions. Because agents don’t define their Coming Soon strategy, the rest of us just assume there is none, or the agent is just shopping for his own buyers before MLS input.

A tactic like this burns up any urgency there might be for the home – the necessary ingredient for it to sell for top dollar. Buyers don’t feel the need to step up because the house isn’t on the open market. Then once the listing is inputed onto the MLS, those who saw the failed Coming Soon campaign are rewarded for their patience – and will likely wait longer.

The ‘Coming Soon’ campaigns are good for one thing:

The listing agent occasionally pocketing both sides of the commission, while ignoring their fiduciary duty to their sellers.

by Jim the Realtor | Mar 12, 2018 | Jim's Take on the Market, Zillow |

This post was generally positive about Zillow’s future, but a commenter left this remark about Zillow puffing their counts:

Interesting that you repeatedly quote ‘according to management’ – did it cross your mind that Zillow management exaggerate performance with over stated Average Monthly Unique Users?, or how they use EBITDA instead of GAAP for earnings so that $114M of share based compensation is excluded?

The 152M ‘Average Unique Users’ in Q4 reported by Zillow is substantially overstated compared to 83.2M MUU’s reported by Comscore (http://bit.ly/2G7Zc6V). Even Zillow admits they duplicate MUU’s with the following statement buried in the SEC Form 10-Q Filing:

“Measuring unique users is important to us because our marketplace revenue depends in part on our ability to enable real estate, rental and mortgage professionals to connect with our users, and our display revenue depends in part on the number of impressions delivered to our users. Growth in consumer traffic to our mobile applications and websites increases the number of impressions and clicks we can monetize in our marketplace and display revenue categories. In addition, our community of users improves the quality of our living database of homes with their contributions, which in turn attracts more users.”

“We count a unique user the first time an individual accesses one of our mobile applications using a mobile device during a calendar month and the first time an individual accesses one of our websites using a web browser during a calendar month. If an individual accesses our mobile applications using different mobile devices within a given month, the first instance of access by each such mobile device is counted as a separate unique user.”

“If an individual accesses more than one of our mobile applications within a given month, the first access to each mobile application is counted as a separate unique user. If an individual accesses our websites using different web browsers within a given month, the first access by each such web browser is counted as a separate unique user. If an individual accesses more than one of our websites in a single month, the first access to each website is counted as a separate unique user since unique users are tracked separately for each domain. Zillow, StreetEasy, HotPads, Naked Apartments and RealEstate.com (as of June 2017) measure unique users with Google Analytics, and Trulia measures unique users with Adobe Analytics (formerly called Omniture analytical tools)”.

Another interesting aspect of Zillow is how a handful of Investors control 60% of the shares and even when Executives dump huge amounts of shares the share price goes up. Are these investors acting in concert with the executives? so that there are buyers in the market knowing that executives are bailing out? Take a look at the major institutional investors and consider how easy a stock like Zillow can be manipulated by relatively small purchases in the market.

Finally, Zillow is a consistently Loss Making business with $443M in accumulated Losses in the 6 years since its IPO and losses of $149M in 2015, $107M in 2016 and $94M in 2017. Put that in context of Facebook making a massive investment in Real estate and Redfins growth substantially higher than Zillows and you have to question the long term viability of Zillow whose business model is to incrementally increase costs greater than the additional revenue generated.

Full Disclosure: I am a Zillow cynic who takes issue with Zillow imposing inaccurate Zestimates on millions of homes and refusing all reasonable requests to correct the erroneous valuation despite fundamental flaws in the proprietary Zestimate algorithm.

Link to Article

I also remain skeptical about anything Zillow says, or any other disrupter.

by Jim the Realtor | Mar 6, 2018 | Forecasts, Jim's Take on the Market, Sales and Price Check, Zillow |

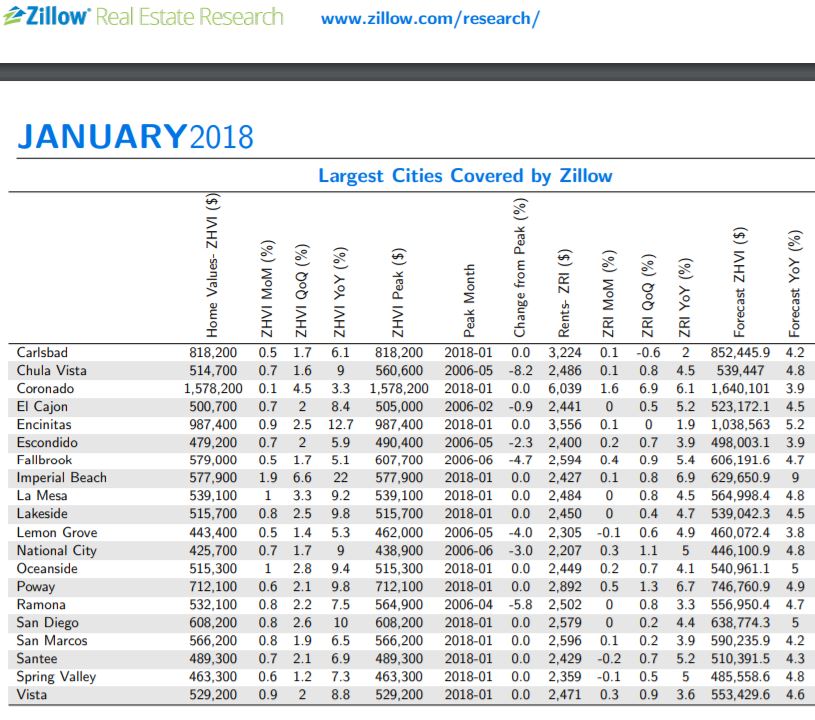

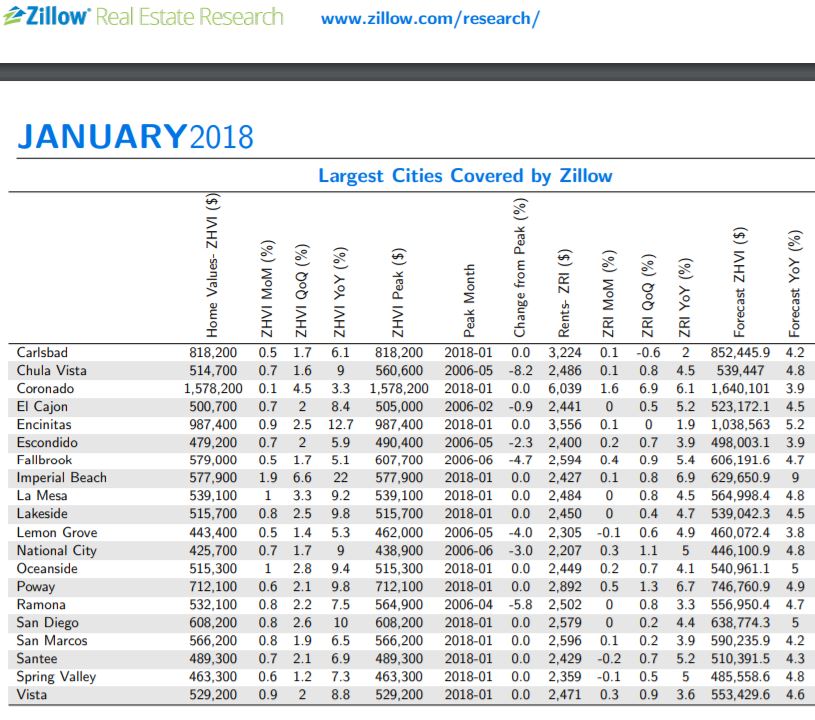

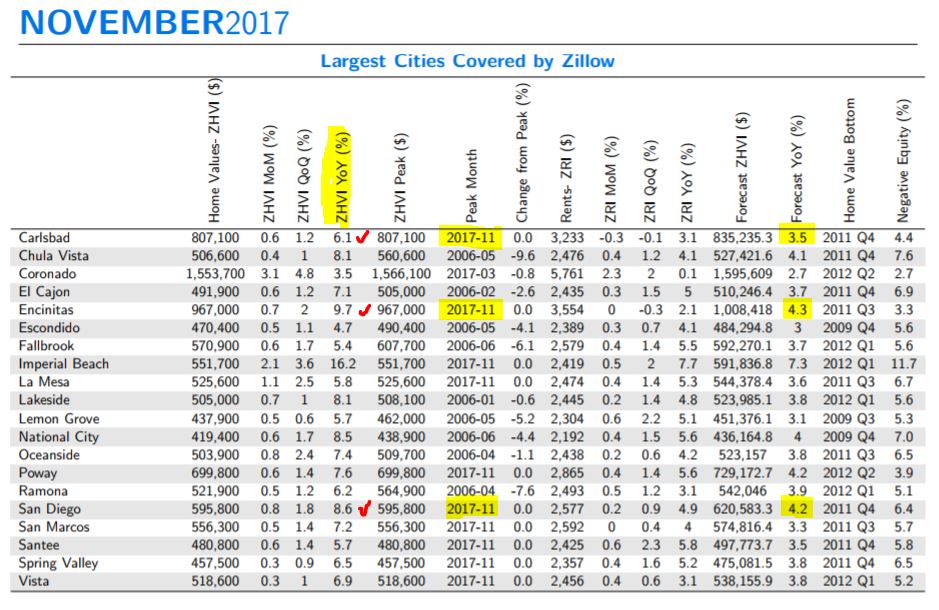

Five years ago, Zillow predicted that the ZHVI would increase 22% by 4Q17. At the time, it seemed a bit optimistic.

Since then, the national index rose 32%, and the San Diego index rose 45%!

Currently, thirteen of the 20 cities followed in SD County are at all-time peaks!

by Jim the Realtor | Dec 27, 2017 | Forecasts, Market Conditions, North County Coastal, Zillow |

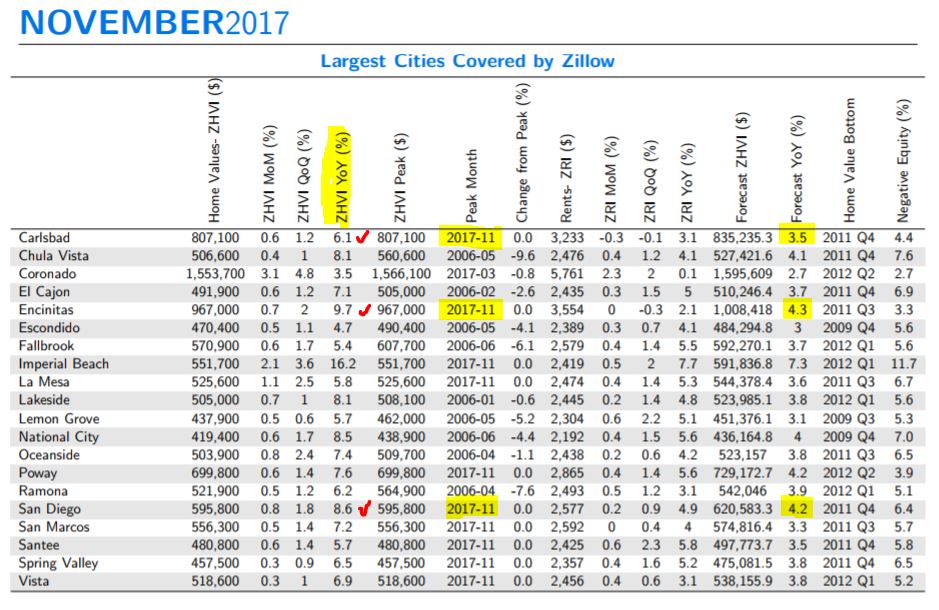

For those who are putting the finishing touches on their own 2018 forecast, here’s how close the Zillow Group guesses have been:

Local ZHVI-Appreciation Forecasts

| Town |

2015 Forecast |

Actual |

2016 Forecast |

Actual |

2017 Forecast |

Actual |

2018 Forecast |

| Carlsbad |

+2.7% |

+4.8% |

+1.9% |

+3.8% |

+1.3% |

+6.1% |

+3.5% |

| Carmel Valley |

+0.3% |

+5.4% |

+1.4% |

+1.9% |

+0.9% |

+12.1% |

+5.2% |

| Del Mar |

+5.5% |

+1.1% |

+1.4% |

+2.6% |

+1.1% |

+0.3% |

+3.2% |

| Encinitas |

+0.6% |

+8.3% |

+2.4% |

+6.3% |

+2.2% |

+9.7% |

+4.3% |

| La Jolla |

+2.7% |

+6.6% |

+2.3% |

+6.1% |

+2.1% |

+7.0% |

+3.9% |

| RSF |

+0.4% |

+11.1% |

+3.7% |

-0.5% |

+1.9% |

+4.1% |

+2.9% |

| San Diego |

+1.7% |

+6.4% |

+2.1% |

+4.0% |

+1.7% |

+8.6% |

+4.2% |

| Solana Beach |

+2.7% |

+6.4% |

+2.2% |

+2.6% |

+1.4% |

+8.3% |

+3.6% |

Their guesses have been conservative, and for their 2018 forecasts, they pretty much just halved the appreciation gained in 2017.

The Zillow data changes slightly, depending on where you look on their website, and whether you use town names or zip codes. Here is the LINK to find others.

by Jim the Realtor | Nov 8, 2017 | Jim's Take on the Market, Zillow |

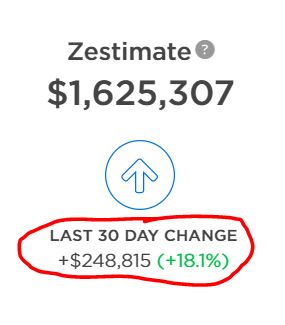

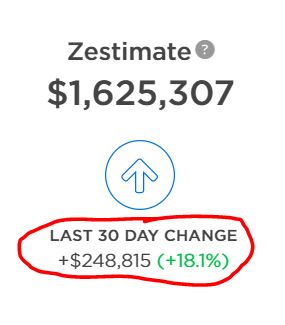

Dough sent in this change in his zestimate of his Carlsbad Aviara tract house – almost a quarter-million increase in the last 30 days! The accuracy of the zestimates haven’t been getting any better, but think of the influence this could have on sellers and buyers!

The one-year forecast is exciting too:

https://www.zillow.com/homedetails/7224-Calidris-Ln-Carlsbad-CA-92011/52507038_zpid/

by Jim the Realtor | Sep 27, 2017 | Jim's Take on the Market, Market Conditions, Zillow |

There’s a wealth of data on home buyers, sellers and renters in this year’s Zillow Group Report on Consumer Housing Trends – a self-administered study that gathered information between May 17 and June 5, 2017 from a total of 13,125 key household decision-makers.

Zillow’s 15 favorites:

Homeowners

- Thirty-nine percent of Baby Boomer and 25 percent of Silent Generation homeowners* still live in the first home they bought. There are likely several million homes that will hit the market over the next two decades for the first time since the 1950s or 1960s. What state will they be in? This is potentially a pool of “affordable” entry-level homes.

- Forty percent of U.S. homeowners share their home with a pet. The data on Americans and their pets is so sparse, it’s a socio-economic research black hole. It was great to finally put a number on the phenomenon. And the number is impressive: Four in 10 American homeowners have a pet (mostly dogs).

- Fourteen percent of U.S. homeowners say their home needs serious updating; 61 percent say their home could use “a little updating.” This speaks to the enormous potential demand in the American economy for home improvement labor and materials, and to an often-overlooked cost (both financial and emotional) of homeownership.

Renters

- When renters* decide to relocate, it’s often prefaced by an increase in rent. Seventy-nine percent of renters who moved from a previous rental experienced a rent increase before moving, with more than half (57 percent) indicating that their decision to move was directly influenced by that increase, including 26 percent who state they were greatly affected by a rent increase previously. Only 21 percent experienced no rent increase in their prior home before moving.

- Today’s renters cast a wide net to find a new place, contacting a variety of property managers and landlords, all while hoping for a timely response back. On average, a renter contacts 4.5 landlords or property managers and submits 2.6 applications. Almost a third (32 percent) submit three or more applications, demonstrating that for renters in competitive and fast-moving markets, disappointment and competition are now an unfortunate part of the rental process.

- African-American/black renters submit 3.1 and Hispanic/Latino renters submit 2.9 applications for a rental home, on average, compared with just 2.3 for Caucasian/white renters.

- When renters move, most stay in the same city (53 percent), and 12 percent even stay in the same neighborhood. Only 30 percent move to a different city (but stay in the same state), and 15 percent move to a different state. When it comes down to it, moving can be a heavy lift, and many renters may end up becoming comfortable with their neighborhood and its offerings.

Buyers

- Nearly a third (29 percent) of buyers* go over budget. More than a third of Millennial buyers (37 percent) go over budget, compared with 27 percent of Generation X buyers, 19 percent of Baby Boomers and 25 percent of the Silent Generation. Perhaps due to their inexperience, first-time buyers (many of them Millennials) are more likely to exceed their budget (32 percent) than repeat buyers (27 percent). Blowing the budget could also be tied to the fact that more than half of homes available to buy are valued in the top one-third of all homes. More than 40 percent of home buyers are first-time buyers, compounding the intense competition for less expensive homes.

- Fifty-seven percent of first-time buyers also considered renting, with Millennials most likely to consider that path (62 percent). Given the state of the market for first-time and younger buyers noted above, it’s no wonder. Owning a home can have a lot of financial advantages over the long haul compared to renting, but renting offers flexibility for many would-be buyers who are not quite ready to make a jump.

Sellers

- Millennials make up almost one-third (32 percent) of sellers*. For all the talk about Millennials having trouble saving down payments and getting into their first homes, a fair share of them have both done that and are turning around to sell.

- While 36 percent of sellers attempt to sell their homes on their own, although only 11 percent actually do. Many sellers who attempt to or do sell their homes on their own believe it saves time (36 percent) and money (57 percent). Some feel they’re their own best agents because they know their homes better than any agent could (27 percent), or they’ve had negative experiences with an agent (14 percent). Almost a third of these sellers already have a potential buyer in mind (29 percent), eliminating the need for an agent’s help with marketing.

- One in two sellers (50 percent) sell their home below its list price. Millennial (30 percent) and Generation X sellers (24 percent) are more likely to sell their homes above list price than older generations (11 percent of Baby Boomer and 19 percent of Silent Generation sellers). This trend is attributable in part to location: Younger sellers are more likely to be selling a home in an urban area, where homes sell above their listing prices 29 percent of the time (compared with 20 percent in the suburbs and 13 percent in rural areas).

by Jim the Realtor | Sep 14, 2017 | Jim's Take on the Market, Realtor, Revolution, Zillow |

The guy who started the StopZillow campaign wants to build a new real estate portal which would be controlled by realtors – he discusses the details here:

https://youtu.be/rv2SiGrw870?t=2m47s

An excerpt from the leadership team’s email announcing that the pre-launch of the crowdfunding campaign starts today:

We will use contributions from this crowdfunding campaign to build the best home search portal ever in real estate. This will be a website designed to sell our listings rather than using our listings to take advantage of us. Crowdfunding will also be used to create the national TV, print and Internet advertising we will need to market this website.

Once the website is completed (projected January 2018) you as a campaign leader will have the first opportunity to demo it. You will also be given an insiders preview of the national TV commercials and blitz marketing campaign we develop to attract buyers to the website. After you have approved the website and marketing, it will then be made available to crowdfunding contributors, followed by other agents throughout the country.

Then we will launch a $50,000,000 Regulation A+ securities offering to enable every licensed agent and broker the opportunity to become an owner. This $50,000,000 shouldn’t be difficult to raise… it’s an average of less than $50 per Realtor. I plan to buy at least $100,000 in stock myself. That money will be used for a national blitz marketing campaign to make every buyer aware of our website.

Once we have our buyers back, we will be able to retain our sellers and ensure our future. Recapturing control of our buyers and regaining control of our industry is the #1 goal of this project. Sellers need buyers. If we have the buyers, sellers will need us.

It seems far-fetched that he could get enough realtors on-board and get them to cough up money to build a new portal. But realtors need to do something to save our jobs, and having our own portal would solve everything.

https://stopzillow.com/plan-save-real-estate/